QBT shares are spiking with the volatility of a newly created altcoin. The stock may be an opportunity. Quantum Blockchain Technologies (LON: QBT) shares combine the risk of the AIM market with the risk of cryptocurrency-based investments, to create an investment case that contradictorily— at the face of it — seems apparently not too risky […]

eEnergy Group shares were the top FTSE AIM riser yesterday. Here’s why

eEnergy shares could still be undervalued after their share price rise. An asset sales remains close. eEnergy Group (LON: EAAS) shares shot up by 43.75% to 5.75p yesterday — on a +12 million volume — after announcing that long-time partner Luceco has decided to take the relationship a step further. In a bright spot in […]

The Rise of Sheconomy: A Look at UK Women in Business Statistics for 2023

Women have been playing an increasingly significant role in the UK economy, often referred to as the “Sheconomy”. As of the second quarter of 2023, the employment rate for women aged between 16 and 64 in the United Kingdom was 72.1 percent, signifying an era of female dominance in the corporate world. The rise of […]

Baron Oil: is the next catalyst coming?

Baron Oil shares are rising sharply after months in the doldrums. Several catalysts are approaching concomitantly. I’ve been covering Baron Oil for over a year and been invested for longer than that. The recent rise back to 0.10p reflects the excitement that another catalyst could be coming down the tracks — but this time, the […]

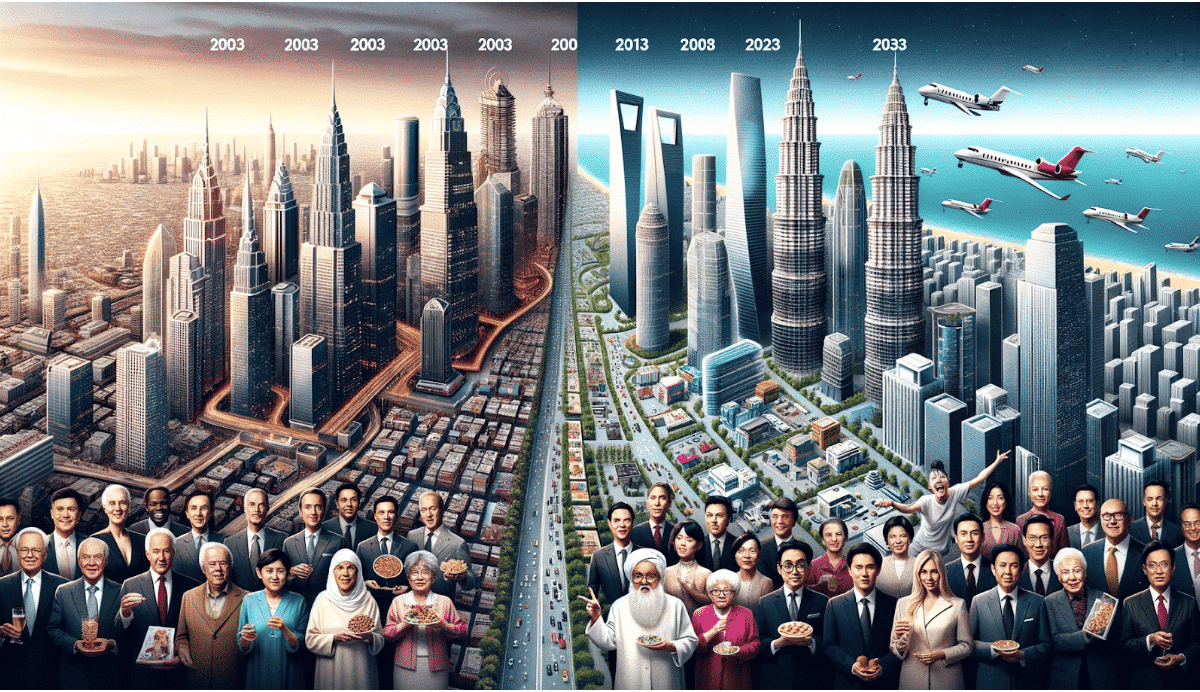

Ranking the Top 10 Venture Capital (VC) Hubs by Growth, Development, and Value

Venture Capital (VC) hubs worldwide have experienced considerable shifts, with 2021 marking a peak in global VC investment at $671 billion. Despite a 53% drop in the first quarter of 2023, sectors like artificial intelligence (Al) have kept the VC landscape vibrant, contributing to a $94 billion investment in the second quarter. As VC hubs […]

Has risk appetite vanished from the face of the earth? Blue chip earnings suggest so

If you think it’s just FTSE AIM where sentiment is collapsing, think again. Alphabet, Barclays and easyJet are all falling — and the only thing they have in common is strong fundamentals and weak sentiment. As your resident small cap analyst here at Investing Strategy, it may seem that most of my work is occupied […]

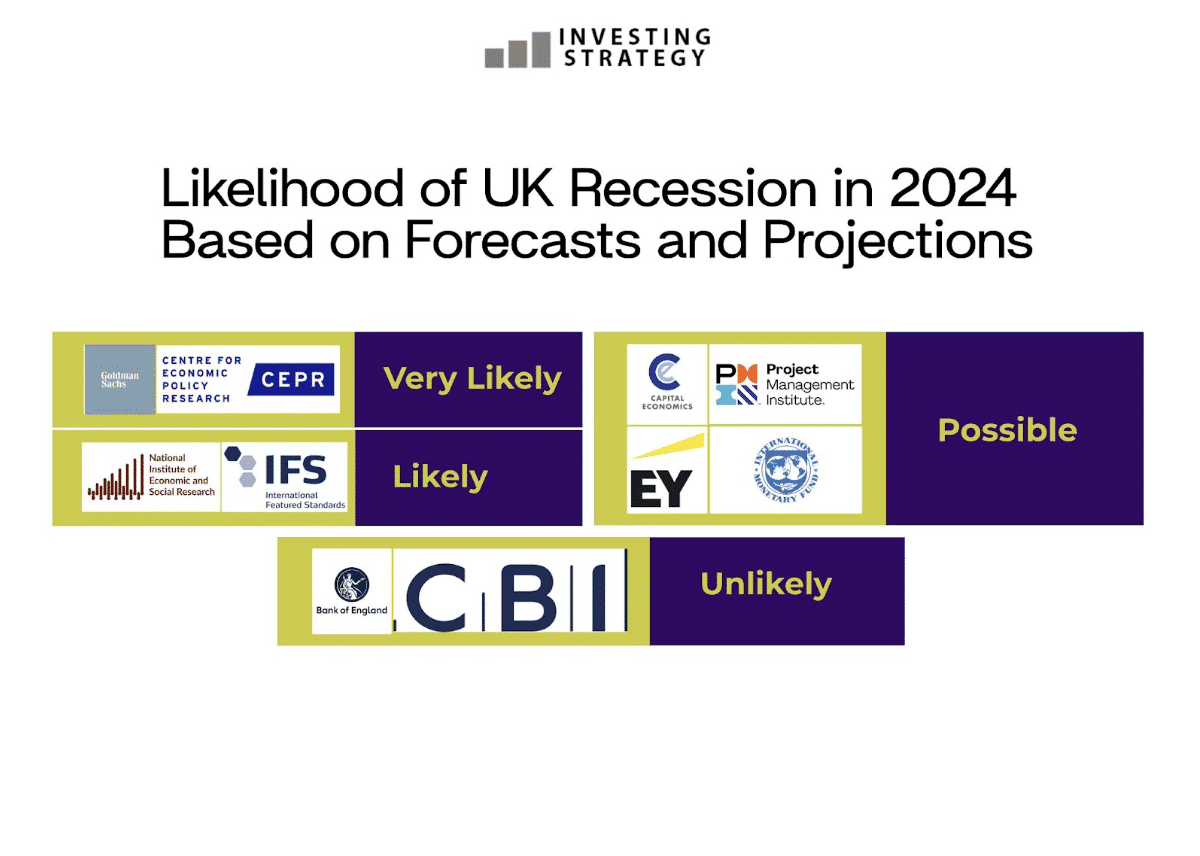

How Likely is a UK Recession in 2024? Here’s What We Know

The possibility of a UK recession in 2024 has been a topic of discussion among economists and policymakers. While some experts predict a recession, others believe that the UK economy will continue to grow. With differing opinions on the likelihood of a UK recession in 2024, it’s important to keep an eye on economic indicators […]

The $100 Million Club: How the Number of Centi-Millionaires Has Doubled in 2023

Centi-millionaires are people who have a net worth of at least $100 million. They are the elite of the elite, the cream of the crop, the top 0.01% of the global population. In 2023, their number and wealth increased dramatically, reaching new heights of prosperity and power. How did they do it? What are the […]

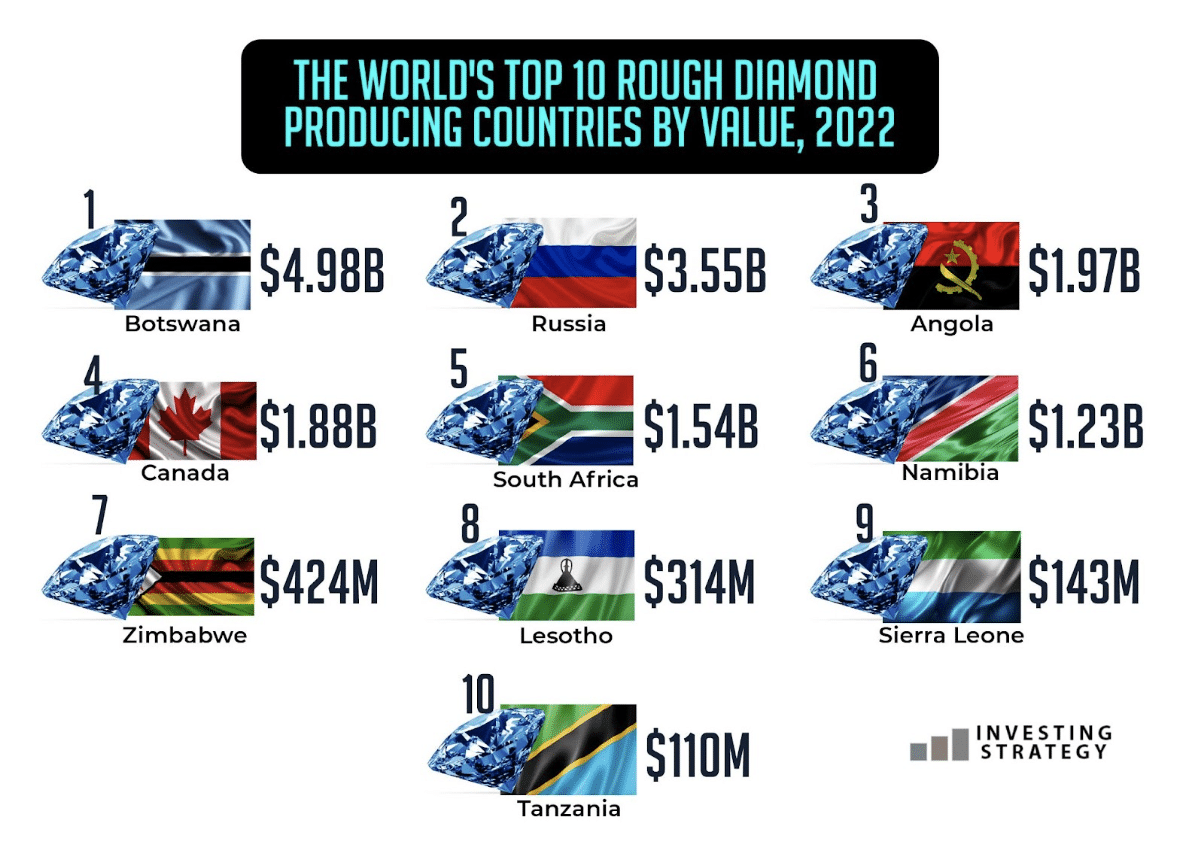

Who Owns the Most Diamonds 2023? Ranking Countries by Their Diamond Production, Reserves, and Trade

Diamonds, like crude oil, are among the most valuable and sought-after in the world. Extreme heat and pressure deep within the earth’s mantle form them, and volcanic eruptions bring them to the surface. But currently who has the most rough diamonds? Which countries produce, own, and trade the most diamonds in the global market today? […]

PREM, AVCT, KOD, ALL, GGP, HZM, GMET, HARL, VAST & BOIL: we’re in the endgame now

The FSTE AIM index has collapsed, investors are panicking, and sentiment is at rock bottom. Everything can change in one quarter. As a long-term FTSE AIM investor and analyst, I do try to stay optimistic when it comes to high risk shares. After all, anyone coming to the small cap market isn’t here for an […]

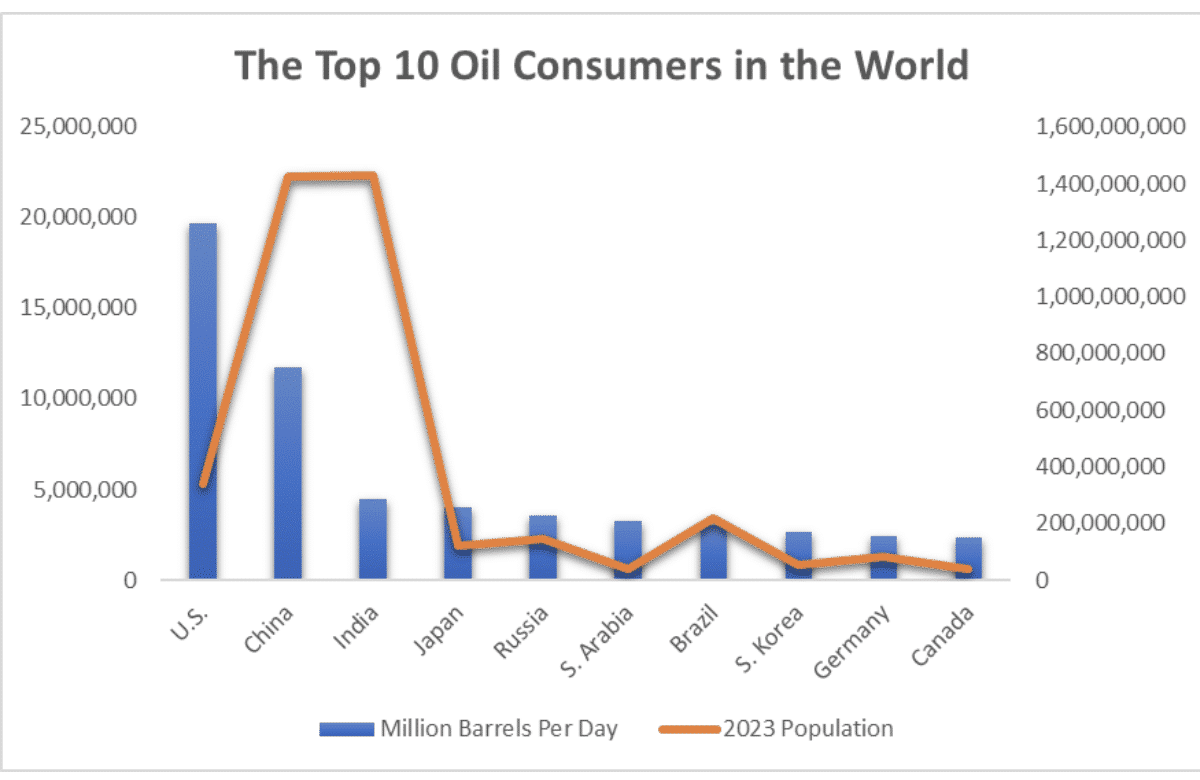

Oil consumption around the world: Top 10 oil consumers, producers, importers, and exporters

Oil is often referred to as ‘black gold’ due to its colour when harvested from the land and how valuable the commodity is. Oil is useful in many industries, and likewise, it’s become a necessity for our daily activities. Most of the finished products we see today are the end results of oil put to […]

Crunching the numbers: How long does it take to double your money?

Just last week, a buddy of mine posed an intriguing question: “How long would it take to double my investment?” It’s a question that many investors ponder. Interestingly, I had recently come across a graphic on LinkedIn, shared by someone I follow, that discussed the timeframes for doubling investments across various assets. However, I was […]

LifeSafe shares: top new tech opportunity of Q4 2023?

LifeSafe has fallen by circa 50% since its IPO last year. Value investors looking for new tech opportunities are watching. Read why below. LifeSafe (LON: LIFS) shares have not enjoyed a particularly pleasant journey since the IPO in July 2022. The company launched at 75p per share, raising gross proceeds of £3 million and leaving […]

Gold vs. Bitcoin: Investment Return and Volatility Comparison

Gold and Bitcoin have historically produced huge returns for investors, although they’ve also had their fair share of volatility and setbacks. Gold, particularly, is known among investors with long-term goals, while Bitcoin is known for its short and long-term returns based on the market’s volatility. While some investors will decide to own assets in one […]

Novo Nordisk A/S (NVO): Equity Research, Stock Forecast & Insights on Wegovy and Ozempic Maker

Company Profile: Novo Nordisk is a global healthcare company founded in Denmark in 1923. The company’s purpose is to drive change to defeat diabetes and other serious chronic diseases. It has over 49,000 employees worldwide and operates in more than 80 countries. Its headquarters is located in Bagsværd, Denmark. Novo Nordisk recently surpassed LVMH to […]

30+ eVTOL and Electric Aircraft Statistics Including Market Size, Trends, and Predictions

Electric aircraft, powered by electricity rather than conventional fuels, offer a more environmentally friendly alternative, aligning with the global push towards sustainable travel. As the world grapples with the challenges of climate change, the importance of electric aviation has become more emphatic. Recently, Hong Kong’s aviation sector highlighted the pressing need for more manpower, indicating […]

Solar Panel Cost UK 2023: Average Prices, ROI & Cost Calculator Guide

In the UK, an increasing number of households are opting for rooftop solar panels, driven by feed-in-tariffs and other attractive incentives. As the interest in solar panels grows among homeowners, businesses, and investors, it’s vital to grasp the associated costs and the potential return on investment (ROI). While the upfront cost of buying and installing […]

Beacon Energy: further to climb?

Beacon Energy shares have shot up over the past few days. Is there further to go, or is this pure speculation? Beacon Energy shares have rocketed since circa 7 August, as investors and traders consider the potential implications of its Schwarzbach-2(2.) drilling operations. The share could still be a buy, but investors are speculating on […]

What is high risk, high reward?

High risk, high reward investing in small cap shares is not for everyone. What does this typical warning actually mean? First up, this is not advice. This is simply an insight into my investing philosophy. Again, for clarity, not advice — DYOR. As I spend much of my time covering FTSE AIM and similar small […]

AMD vs NVIDIA 2023: Which is the Better Chip Stock by Numbers?

Are you interested in investing in the tech industry? If so, we bring you two of the biggest players in the game: AMD and NVIDIA. These two companies have seen, considerably, impressive growth in 2023, but which represents the better chip stock? Looking at numbers can give a better idea of which company is performing […]