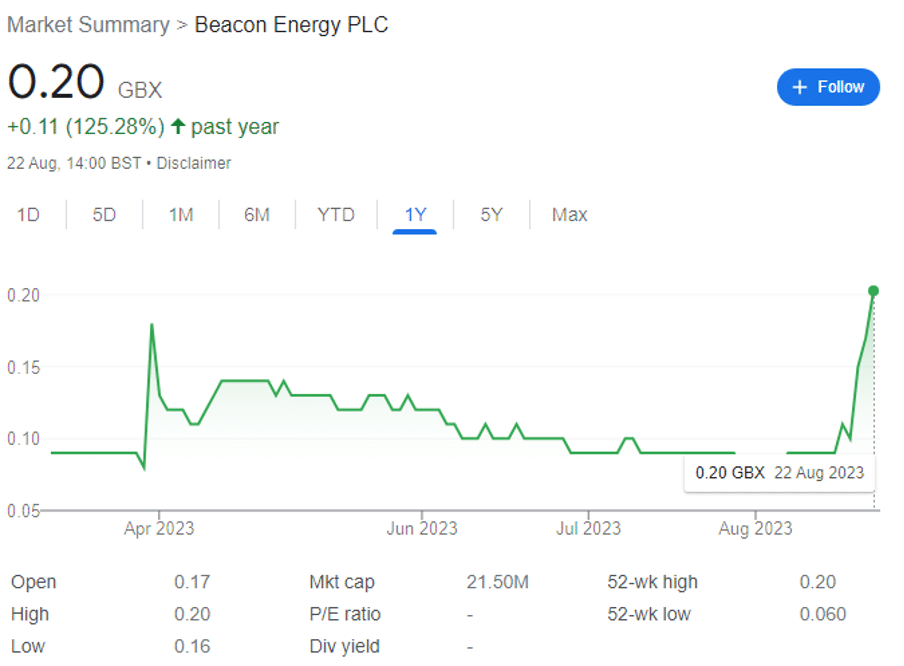

Beacon Energy shares have shot up over the past few days. Is there further to go, or is this pure speculation?

Beacon Energy shares have rocketed since circa 7 August, as investors and traders consider the potential implications of its Schwarzbach-2(2.) drilling operations. The share could still be a buy, but investors are speculating on continued success — and only volatility can be reliably guaranteed.

Let’s dive in.

Beacon Energy updates

On 7 August, Beacon — which owns a portfolio of onshore German assets in varying stages of production, development, or appraisal — gave its first key update on the ongoing Schwarzbach-2(2.) drilling. Or in other words, the first the market paid actual attention to.

- Beacon noted that ‘drilling is currently underway in the deviated mechanical sidetrack. The well is on track to achieve the primary objectives of testing the reservoir targets, and completing this well as a producer as part of the development of the Stockstadt Mitte segment of the Erfelden field.’

The company also promised a further update as appropriate, and this came just nine days later on 16 August with speculation swirling.

It noted ‘the recent movement in the price of the Company’s shares on AIM,’ and took the opportunity to remind investors that its targeted segment was assigned 2P oil reserves of 3.784mmbbls from the CPR report published in December last year.

Beacon also brought investors up to date on the technicals: the well had reached a total drill depth of 2255 metres measured depth, with electric wireline logging ongoing. This is a technical process where drillers use electrical instruments to continuously measure downhole formation attributes using special tools or equipment lowered into the borehole.

Self-evidently, until this process was completed, and results analysed, Beacon could not definitively make any claims over ‘the implications for the future cash generative potential of the Erfelden field’ and it further noted that ‘and the Company’s aspiration to build a self-funding platform for growth will not be known.’

But it did make sure to inform investors that it looked forward to updating the market ‘in due course.’

And investors didn’t have long to wait.

On 18 August, Beacon gave a summary of promising new updates:

- The well encountered good quality oil-bearing reservoirs in the Meletta-Schichten sandstones and the Pechelbronner-Schichten sandstones.

- The electric wireline logging programme had been completed and initial analysis showed good quality oil-bearing reservoirs, with porosity ranges above pre-drill expectations.

- Initial evaluation of the logs over the PBS indicated a 34-metre gross interval containing 28 metres of oil-bearing net reservoir, with porosities averaging 18% and up to 28%.

- These oil-bearing reservoirs were encountered approximately 25 metres higher than prognosis with oil observed on the shale shakers and in the mud pit whilst drilling these intervals.

- No water-bearing sands were encountered in the Meletta or the PBS intervals.

The operating team is now undertaking reservoir clean-up, production testing and installing the production liner to bring the well into production through the existing Schwarzbach facilities, which are already owned and operated by the company. No extra costs is a huge deal.

And most importantly, the company expects that this new production will ‘be brought onstream over the next month’ — with a further update due very soon after the reservoir clean-up and production testing have finished.

CEO Larry Bottomley — who has enjoyed senior stints at Perenco, Hunt Oil, Triton, Chariot, and FTSE 100 oil major BP — enthused that the new well has been ‘safely, effectively and successfully drilled and logged…the well has encountered oil bearing reservoir in the Meletta and PBS sandstones, both shallower than predicted with the PBS being a thicker interval with more sand and of better quality than pre-drill estimates. These results imply significant upside to the reserve range assigned to the Stockstadt Mitte segment in the CPR.’

Unlike the previous RNS, the CEO was prepared to announce that electrical wireline logging analysis shows that the well ‘has the capacity to materially increase the Company’s production and revenue…this is a very important step in the Company’s aspiration to build a self-funding platform for growth.’

But even more encouragingly, this positive result de-risks the 2C contingent resources of 2.4mmbbls assigned to the adjacent Schwarzbach South segment — which is the next company target at the Erfelden field.

Beacon is now focusing on completing the well for production, and an update could come literally at any time. This well was the company-maker, but what the market is missing is that the rest of Erfelden is now a far more prospective resource.

This is Germany — there’s next to no chance of regulatory problems. And with Australian workers striking, the Ukraine War still raging, and winter coming down the track, gas prices will likely continue to rise.

The next RNS could well see another share price jump.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.