Scattering your clothes all over the house is wrong; you should keep them in a closet. Likewise, scattering your investment is wrong, and you need an investment portfolio. This article explains all you need to know about investment portfolios.

Concise Overview

- How do you track your assets as an investor?

- Did you know that rather than just throw money into anything investment you find, you can build a portfolio that helps you manage your investment?

- Learn how to build an investment portfolio in the article below.

If you are a beginner in the investment journey, you must have come across materials that teach how to invest in high, medium, and low-risk assets. Proper knowledge of where to put your money and how much to invest is essential, but very little attention is given to portfolio building.

Portfolio building is essential to track your investments and discern whether or not you are a profitable investor. Gains and losses are intrinsic parts of every investor’s journey, but making more gains than losses gratifies the effort.

Many investors recorded fatal losses because of their inability to build a solid investment portfolio. So in this article, we will discuss the importance, strategies, risks, and other details involved in building a profitable investment portfolio. Let’s read.

What Is an Investment Portfolio, and Why Is It Important?

An investment portfolio is a balanced collection of financial assets, such as stocks, bonds, mutual funds, and other investments. A portfolio may include a variety of investments, which a person can choose based on risk tolerance and goals.

Ideally, investors are in charge of managing their investment portfolios. However, certain situations may require them to entrust their portfolio management to an independent investment manager or firm. Irrespective of whoever is in charge of the portfolio, the assets are usually tailored to match the investor’s risk tolerance and financial goals.

Investment managers use special investment tools to choose the assets in a portfolio by evaluating individual factors like the investor’s age, income, and reason for investment. The performance of each asset is tracked constantly to measure their performance, manage risk, and secure profit for the investor. Hence, copying another investor’s portfolio would be wrong because we have varying needs.

An investor starting in the work industry will have different goals and risk tolerance than another investor who is five years shy of retirement. Two investors close to retirement will also have different goals and risk tolerance if one has enough savings to survive after retirement and the other depends on investment funds for survival after retirement. So, while investment portfolios can contain the same assets, the asset allocation will vary from one investor to another.

Building a diversified investment portfolio is the best way to ensure your money will grow over time. A diversified portfolio can help you achieve the following;

- Protection against market risk.

- Reduce the risk of making poor investment decisions, such as investing too much in a single stock or choosing a broker who charges high commissions.

- Diversify your investments.

- Provide an opportunity to balance your needs for current income and growth over time.

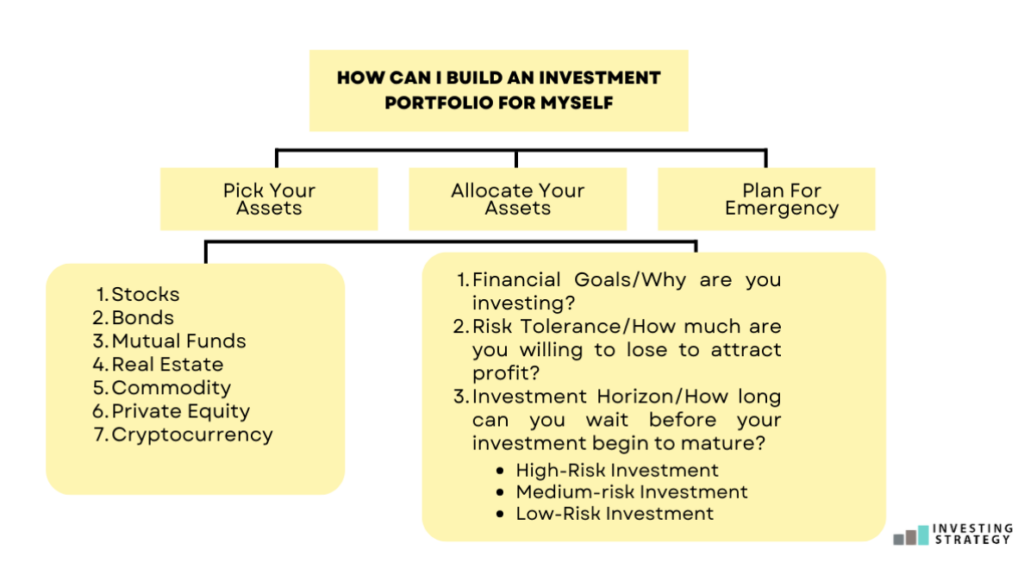

How Can I Build An Investment Portfolio for Myself?

Anyone can have an investment portfolio irrespective of financial situation or expertise. You don’t need to be a Warren Buffet or Wall Street expert before building a portfolio for yourself. The process can be confusing and overwhelming, but we have broken it down into simple steps for easy understanding.

Pick Your Assets

Choosing your assets is the first step in building a portfolio. Diversifying your investment is critical as an investor – you can’t keep all your eggs in one basket. Choosing assets for your portfolio requires understanding the array of options available. A diverse portfolio will help you avoid having too much exposure to any one asset class (like stocks) or sector (like energy). Examples of assets that you can add to your investment portfolio include;

Stocks

Stocks allow you to own a piece of a company and share in its growth. This means that your investment performance is directly dependent on the performance of the company you hold its stocks. Hence, if the company loses value, your portfolio suffers, and vice versa.

Bonds

With bonds, you loan money to a company or government entity for a fixed period and get paid interest until the loan matures, at which point you get your principal back. The higher the risk, the higher the return.

Mutual funds

Mutual funds are baskets of stocks or bonds managed by professional money managers who try to beat the market average while keeping fees low. Mutual funds help you manage your risk and reduce loss.

Real estate

On the one hand, investing in real estate is great because it’s tangible—you’ll own something valuable at the end of your investment period (at least when it comes to rentals). On the other hand, it’s risky because there’s no guarantee that you’ll make enough money off rent payments to cover your initial investment costs and operating expenses.

Commodities

There are many different kinds of commodities, including gold and silver, oil, natural gas, wheat and corn, coffee beans and cocoa beans, and many more. You can invest in commodities through a fund or by purchasing the physical commodity itself.

Private Equity

Private equity is a type of investment usually reserved for institutions and high-net-worth individuals. It’s essentially buying shares in privately held companies that aren’t available to the general public.

Cryptocurrency

Cryptocurrencies are one of the use cases of blockchain technology. They are highly volatile and can be purchased by anyone. There are other closely related assets like DeFi tokens, NFTs, and many more for investors to buy.

Allocate Your Assets

Allocating your assets is the first and most crucial step in building an investment portfolio. It means deciding how much money you want to invest in each of the different types of investments that are available. However, before you start allocation, you need to understand a few things about yourself as an investor.

- Financial Goals/Why are you investing? A crucial first step to building an investment portfolio is figuring out what you’re trying to achieve. Are you saving for retirement? Do you have a child’s education in mind? Are you looking to be able to retire early? Do you want to ensure that your family will be taken care of if something happens to you? Once you know your goals, it’s easier to decide how much risk you’re willing to take to reach them and how long it will take for their returns to compound into the necessary amount of money.

- Risk Tolerance/How much are you willing to lose to attract profit? Once you’ve decided on your financial goals, you must figure out how much risk is involved in achieving them. The amount of risk that works best for one investor might not work for another. So it’s important to know what level of volatility makes sense, given your specific financial situation and investment horizon. For example, if someone is saving up money for their child’s college tuition and has several years until they need it back, they may not need as much money as someone who needs more immediate access.

- Investment Horizon/How long can you wait before your investment begin to mature? The investment horizon is the length of time that the investor plans to hold an investment. It is typically measured in years, months, or even weeks. Investors with a long-term horizon are more likely to invest in stocks and other assets with high volatility because they can ride out the ups and downs of the market over time. However, investors with a short-term horizon will be more conservative because they need their assets to provide income sooner rather than later.

After understanding these concepts, you can efficiently allocate the assets in your portfolio to meet your financial goals. Investment portfolios typically have three categories of investments based on the type of risk, and they help investors allocate assets properly. These categories include;

High-Risk Investment

Investing in high-risk investments can be a great way to make money fast. They present a higher potential for gain (and loss) than any other investment category. High-risk investments are highly volatile and react quickly to market changes. High-risk investments include stocks, futures contracts, commodities, and options.

Medium-risk Investment

Medium-risk investments carry more risk than a guaranteed return investment and less risk than an unsecured bond. They are considered more volatile than low-risk investments and less risky than high-risk investments. This ability to provide more profit with reduced risk makes them a better option for those with a moderate budget and bigger risk tolerance to receiving greater potential returns. They generally involve some financial assets, such as bonds or mutual funds.

Low-Risk Investment

A low-risk investment is unlikely to cause a loss of the original amount invested. Low-risk investments are often considered relatively safe because they have little to no risk of losing money. Investors looking for a steady income with minimal risk often choose low-risk investments, and they have proven to be pretty stable over time. Examples of low-risk investments include savings, certificates of deposit, bonds, etc.

Plan For Emergency

We can’t predict the future; that’s why we prepare for it. As an investor, you want to ensure that your portfolio has a back door that allows you to remove a certain amount of money at any time. This strategy allows you to take care of health insurance and take charge of emergencies. Assuming you are in the middle of an unexpected crisis like a vehicle breakdown or a home appliance malfunction. It will make no sense if you have a rich investment portfolio and cannot bail yourself out of the situation.

You’ll also need this emergency fund if a health crisis arises – whether you are the one involved or a loved one. Your emergency fund will ensure you can navigate the situation without ruining your portfolio.

To create this backdoor to your investment fund, you must ensure that part of your investment portfolio is liquid. Assets like treasury bills (T-bills) and commercial papers are government securities. They are more secure and can be liquidated at any time.

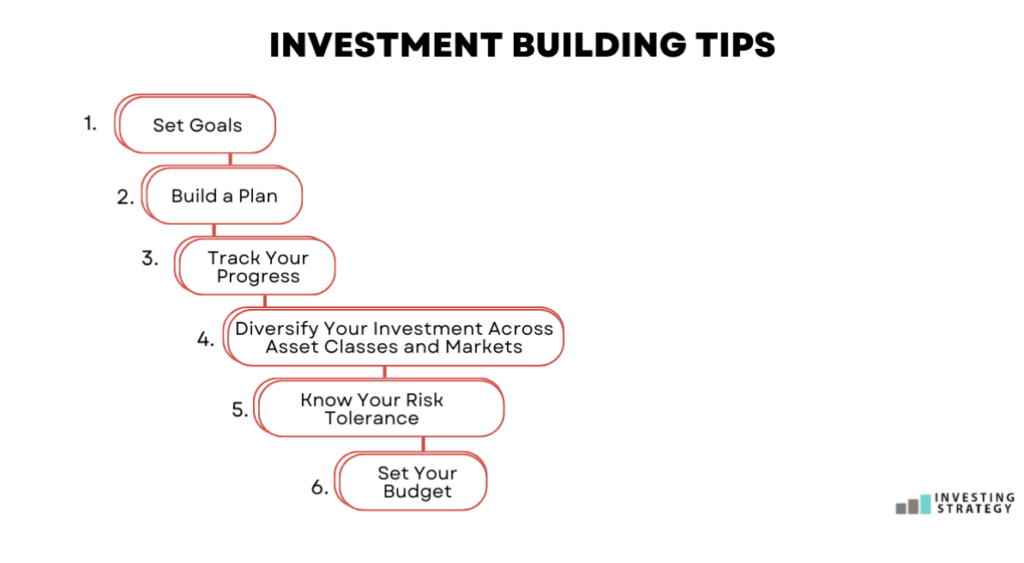

Investment Building Tips

Building an investment portfolio is a process. It’s not something you can do in one day. It would be best if you took the time to understand your risk tolerance, goals, and how different investments fit into your overall strategy. Here are some tips to help you get started:

Set Goals

Before building anything, it’s essential to set goals. Start with the end in mind. Think about how much money you want to make and what risks are acceptable for you—this will help figure out just how risky your business needs to be.

Build a Plan

Once you’ve set your goals, build a plan for reaching them. This will help you determine how much money to invest each year and how much risk is acceptable for you. A good plan will also help you prioritise risks and in what order. For example, you might decide that your priority is to grow the business and use some savings to fund it. Once you’ve done this, you can start investing in more risky ventures.

Track Your Progress

It is essential to track how well your investments are doing so you can make adjustments if necessary. The best way to do this is by using a portfolio tracking tool. This will give you a clear picture of your risks, returns, and overall performance.

Know your Risk Tolerance

An investor’s risk tolerance refers to their willingness and ability to tolerate fluctuations in the value of their investments without making impulse decisions. As an investor, you must be ready to watch the news at night about the stock market crashing and still have a good night’s sleep.

Risk tolerance is how comfortable you feel when taking risks in exchange for higher returns. Stocks may be right for you if your long-term goal is more aggressive growth. However, they have the potential for big swings up or down over shorter periods than safer investments like Certificates of Deposits or savings accounts.

Diversify your Investments across Asset Classes and Markets

Diversification means spreading your money across different investments so that if one market or sector performs poorly, the profit from other investments will offset the loss from the initial market. For example, you can invest in a fund that focuses on emerging markets, and it loses money because of an economic downturn in those countries. Your investment in other funds or asset classes will help to cover your losses.

Set your Budget

Determine how much you can afford to invest each month or quarter based on your budgeted expenses, savings goals, and other spending priorities (such as paying off debt). Then divide that amount among different investments based on your risk tolerance – low, medium, and high – so that the overall mix makes sense given your circumstances.

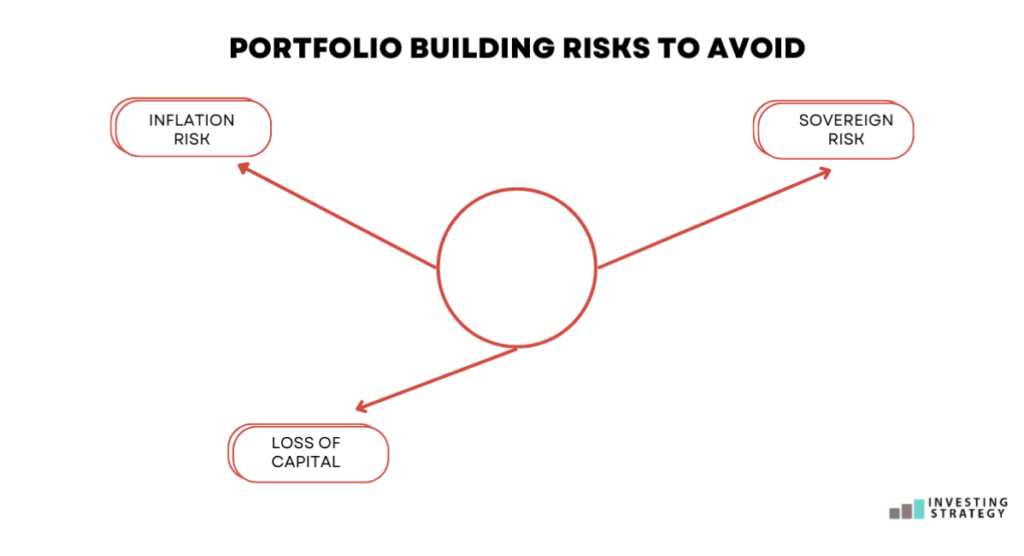

Portfolio Building Risks to Avoid

Although there are many benefits to building an investment portfolio, it also has its risks. Whether you are a novice investor or have been investing for years, it is essential to know these mistakes and avoid them.

Sovereign Risk:

Sovereign risk is the risk of your investment being affected by the actions of a government. If you invest in a company based in a country with unstable currency or its government does not pay off its debts, your investment could be at risk.

Loss of Capital

With investment portfolio building, there is always a risk of losing principal. This can happen if the investments do not perform as expected or an investor does not have the proper portfolio diversification.

Inflation Risk

Inflation risk refers to the possibility that future inflation will be higher than expected, which would cause the value of your investment portfolio to fall. This means that if you decide to cash out your investment portfolio, you may not be able to buy as much as you had initially invested.

Should I Build An Investment Portfolio?

Developing your investment portfolio should be one of the first things you do as an investor. Your portfolio lets you track where your capital is going and what assets yield the most results. You can use this information to make informed decisions and increase your profit earnings. Your portfolio also helps you become disciplined, gain self-confidence, and gives you financial freedom. If you do not have an investment portfolio, here’s your cue to take action.