Diamonds, like crude oil, are among the most valuable and sought-after in the world. Extreme heat and pressure deep within the earth’s mantle form them, and volcanic eruptions bring them to the surface. But currently who has the most rough diamonds? Which countries produce, own, and trade the most diamonds in the global market today?

This data-driven piece will try to answer these questions, using the latest statistics from the Kimberley Process.

We will rank countries by their diamond production, reserves, and trade using the KP data. We will also compare the volume and value of diamond output for different countries, and analyse how different regions contribute to the global diamond supply.

Quick Overview

- Russia produced 35% of the World’s Rough Diamonds in 2022 by volume.

- Namibian diamonds, polished by the Benguela current, are highly sought-after, worth $601/carat on average.

- World diamond production increased by 1.3% to about 120.2 million carats in 2022.

- Africa is the largest rough diamond producing region, accounting for 51% of output by weight and 66% by value.

- Botswana, despite producing only 59% of Russia’s diamond weight, had a trade value nearly 1.5 times higher than Russia in 2022.

- The regions that produce the most diamonds are Africa, Europe, and North America.

World’s Top 10 Diamond Producing Countries by Volume (Carats)

| Rank | Country | Rough Diamond Production (by Carats) |

| 1 | Russia | 41.9M |

| 2 | Botswana | 24.8M |

| 3 | Canada | 16.2M |

| 4 | DRC | 9.9M |

| 5 | South Africa | 9.7M |

| 6 | Angola | 8.8M |

| 7 | Zimbabwe | 4.5M |

| 8 | Namibia | 2.1M |

| 9 | Lesotho | 727.7K |

| 10 | Sierra Leone | 689K |

The table presents the top 10 diamond producing countries, measured in carats. A carat, equivalent to 0.2 grams, is used to measure the weight of diamonds and other gemstones. Over 2,265 of carats equal one pound.

The global rough diamond production was 119.2 million carats, a slight increase from 117.4 million. Russia, Botswana, and Canada were the top three producers, accounting for over two-thirds of the total volume. Russia produced 41.9 million carats, or 35.1% of the global share, due to its abundant diamond-bearing kimberlite pipes in the Yakutia region.

Botswana produced 24.8 million carats, or 20.8% of the global share, driven by its partnership with De Beers, a leading diamond company. Canada produced 16.2 million carats, or 13.6% of the global share, boosted by new deposits in the Northwest Territories and Nunavut, and the expansion of existing mines.

The remaining seven countries produced less than one-third of the total volume, each contributing less than 10% to the global share. The DRC produced 9.9 million carats, or 8.3% of the global share, primarily from artisanal and small-scale mining. South Africa produced 9.7 million carats, or 8.1% of the global share, but its production has declined over the years due to depletion of reserves and competition from other countries.

Angola produced 8.8 million carats, or 7.4% of the global share, supported by its rich alluvial deposits and potential for new kimberlite discoveries. Zimbabwe produced 4.5 million carats, or 3.8% of the global share, mainly from the Marange fields, but faced challenges such as political instability and sanctions.

Namibia produced 2.1 million carats, or 1.8% of the global share, relying heavily on marine mining. Lesotho produced 727.7 thousand carats, or 0.6% of the global share, known for its high-quality and large-sized stones. Sierra Leone produced 689 thousand carats, or 0.6% of the global share, mostly from artisanal and small-scale mining, which suffered from illicit trade and corruption.

The average and median rough diamond production per carat per country were 11.9 and 9.8 million carats, respectively. Canada rose from fourth to third place, while Russia increased its production by 3.9 million carats. Canada also had the largest growth in production share, by 1.4 percentage points.

World’s Top 10 Diamond Producing Countries by Value

Botswana leads the pack of the total value of rough diamond production for the year with a rough diamond value of $4.98 billion, accounting for nearly a third of the global share. Russia, despite being the largest producer by volume, comes in second in terms of value at $3.55 billion. This discrepancy between volume and value can be attributed to the lower average price per carat of Russian diamonds compared to those from Botswana.

Angola, with a value of $1.97 billion, holds the third position. The country’s value has seen a significant increase of 58% from the previous year, which can be attributed to improved production volume and quality, as well as enhanced transparency and governance in the diamond sector.

Canada, despite a slight decrease in value from the previous year due to operational challenges and mines reaching their end of life, still managed to secure the fourth position with a value of $1.88 billion. South Africa, with a value of $1.54 billion, rounds out the top five, showing a strong recovery from the Covid-19 pandemic with a 28% increase from 2021.

Namibia, at sixth place with a value of $1.23 billion, has seen growth driven by higher production volume and quality, particularly from its offshore mining operations. Zimbabwe, despite being seventh, has shown promising growth of 18% from 2021, reaching a value of $424 million, thanks to reforms in its diamond sector and increased investment.

The eighth and ninth positions are held by Lesotho and Sierra Leone, with values of $314 million and $143 million respectively. While Lesotho has seen a decrease in value due to operational difficulties, Sierra Leone has experienced a 25% increase, driven by higher production volume and quality, as well as improved regulation and monitoring of the diamond sector.

Tanzania, with a value of $110 million, holds the tenth position. The country’s value has increased by 10% from 2021, driven by higher production volume and quality, as well as enhanced cooperation with diamond industry stakeholders.

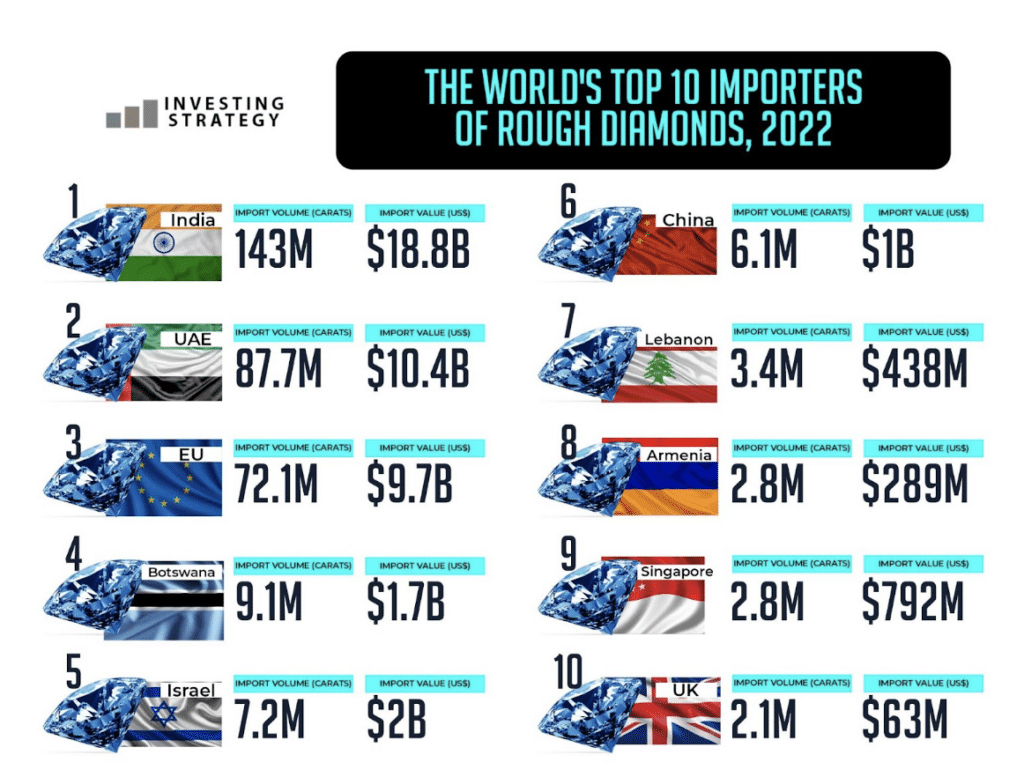

World’s Top 10 Importers of Rough Diamonds

India, the United Arab Emirates, and the European Union are the top the importers of rough diamonds in 2022, accounting for a significant portion of the global import volume and value. India, with its robust diamond cutting and polishing industry, imported 143 million carats of rough diamonds valued at $18.8 billion, making it the largest importer. The United Arab Emirates, a major diamond trading hub, particularly in Dubai, imported 87.7 million carats valued at $10.4 billion. The European Union, home to prestigious diamond markets and leading diamond jewellery brands, imported 72.1 million carats valued at $9.7 billion.

Botswana, the fourth-largest importer, imported 9.1 million carats valued at $1.7 billion. Despite being the world’s second-largest producer of rough diamonds, Botswana’s import volume is significantly lower than the top three importers, indicating a strong domestic industry. Israel, the fifth-largest importer, imported 7.2 million carats valued at $2 billion. Israel’s diamond industry is notable for its cutting and polishing expertise, as well as its significant exports of polished diamonds.

China, the People’s Republic, is the sixth-largest importer, with 6.1 million carats valued at $1 billion. China’s diamond jewellery market is rapidly growing, and it is also a growing producer of synthetic diamonds. Lebanon, the seventh-largest importer, imported 3.4 million carats valued at $438 million. Lebanon serves as a regional hub for diamond trading and jewellery manufacturing, catering to the Middle East and Africa markets.

Armenia, the eighth-largest importer, imported 2.8 million carats valued at $289 million. Despite its small size, Armenia plays an active role in the diamond industry, focusing on cutting and polishing low-quality stones. Singapore, the ninth-largest importer, also imported 2.8 million carats, but with a higher value of $792 million. Singapore’s role as a global financial centre and gateway to Asian markets makes it a significant player in diamond trading and jewellery retailing.

The United Kingdom, the tenth-largest importer, imported 2.1 million carats valued at $63 million. The UK primarily serves as a consumer market for diamond jewellery, but it also hosts some diamond trading activities.

There’s a high concentration of the global import volume and value in the top three importers, indicating their dominance in the market. The significant increase in the import volume and value of rough diamonds from 2020 to 2022 suggests a strong recovery from the COVID-19 pandemic’s disruption to the diamond supply chain and demand.

The wide variation in the average price per carat of rough diamonds among different importers, ranging from $131 for India to $30 for the UK, reflects the different levels of quality, size, shape, colour, clarity, and origin of the imported rough diamonds. It also indicates the different levels of demand, supply, competition, regulation, taxation, and exchange rates among different markets.

The import volume and value of rough diamonds are influenced by various factors, including production volumes and prices from mining companies, availability and prices of synthetic diamonds, consumer preferences for natural vs. synthetic diamonds, environmental, social, and governance issues, technological innovations, geopolitical risks, and macroeconomic conditions.

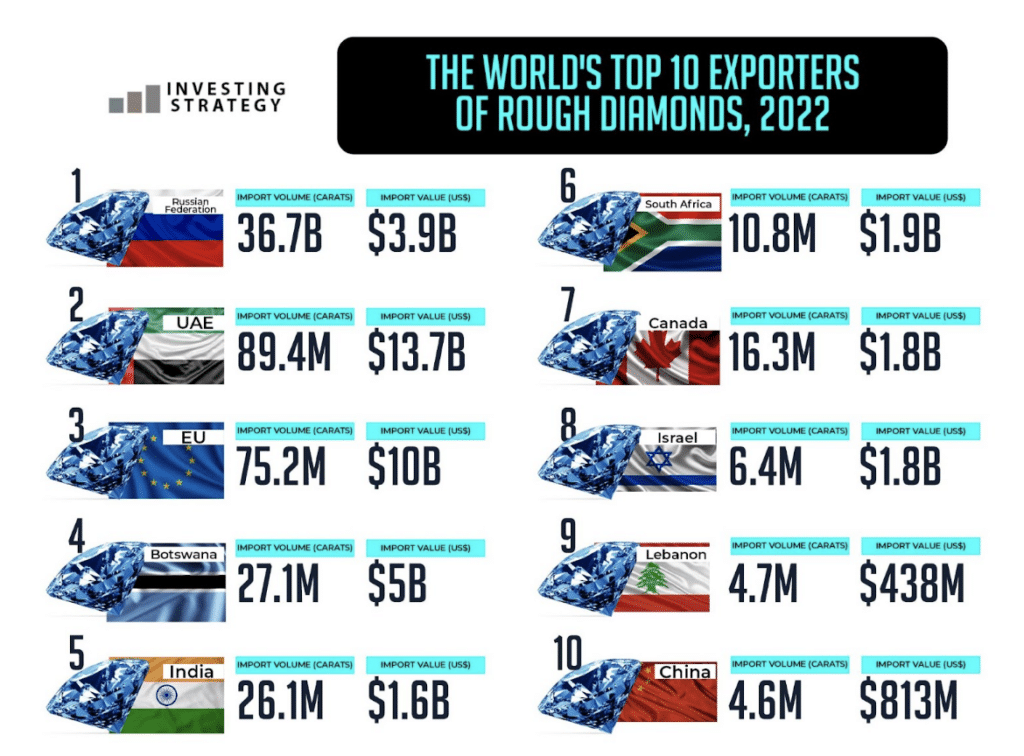

World’s Top 10 Exporters of Rough Diamonds

The Russian Federation was the titan in terms of export volume of rough diamonds, exporting an impressive 36.7 billion carats. Despite this, the export value of these diamonds was $3.9 billion, suggesting that the diamonds exported by Russia may be of lower quality or smaller size compared to other countries. Russia’s dominance in the diamond export market is consistent with its status as the world’s largest producer of rough diamonds, accounting for approximately 35% of the global total. Belgium was the primary destination for Russia’s diamond exports, further highlighting the interconnectedness of the global diamond trade.

In contrast, the United Arab Emirates (UAE) had a significantly lower export volume of 89.4 million carats, but the highest export value of $13.7 billion. This discrepancy suggests that the diamonds exported by the UAE are of higher quality or larger size, commanding higher prices on the international market. The UAE’s rise as a leading trading hub for rough diamonds can be attributed to its strategic location, close proximity to Africa where many diamonds are mined, and India where 90% of the world’s diamonds are polished. The recent opening of diplomatic and trading ties with Israel, the Middle East’s second-largest diamond centre, has also bolstered the UAE’s diamond trade.

The European Union (EU) also played a significant role in the global diamond trade, exporting 75.2 million carats of rough diamonds worth $10 billion in 2022. The EU’s diamond trade operates under a single legislation to implement the Kimberley Process Certification Scheme (KPCS) minimum requirements, with seven EU KP authorities verifying rough diamond imports destined for anywhere in the EU. This unified approach ensures the legitimacy and ethical sourcing of the EU’s diamond exports.

Botswana, with an export volume of 27.1 million carats and an export value of $5 billion, is another key player in the global diamond market. The country’s diamond production is primarily of gem-quality, which fetches higher prices on the international market. This focus on quality over quantity has allowed Botswana to carve out a significant niche in the global diamond trade.

India, despite being the fifth largest exporter of rough diamonds with an export volume of 26.1 million carats and an export value of $1.6 billion, plays a pivotal role in the global diamond trade. As the largest importer of rough diamonds, India is the world’s diamond polishing hub, with 90% of the world’s diamonds being polished in the country. This unique position allows India to influence the global diamond trade significantly, from the rough diamonds mined in various countries to the polished gems that adorn jewellery around the world.

South Africa, Canada, Israel, Lebanon, and China were also among the top 10 exporters of rough diamonds in 2022. South Africa exported 10.8 million carats worth $1.9 billion, while Canada exported 16.3 million carats valued at $1.8 billion. Israel, a significant player in the diamond trade, exported 6.4 million carats worth $1.8 billion. Lebanon and China exported 4.7 million carats ($438 million) and 4.6 million carats ($813 million), respectively.

Which Regions Produce the Most Diamonds?

| Rank | Region | Share of Rough Diamond Production (%) | Share of Rough Diamond Value (%) |

| 1 | Africa | 51.4% | 66.4% |

| 2 | Europe | 34.9% | 32.9% |

| 3 | North America | 13.5% | 52.8% |

| 4 | South America | 0.2% | 2.4% |

Africa’s dominance in the diamond industry is clear, with the region contributing to over half of the world’s rough diamond production and two-thirds of its value. This can be attributed to the rich diamond reserves found in countries like Botswana, Congo (Kinshasa), South Africa, and Zimbabwe. The high-quality diamonds found in these regions significantly contribute to Africa’s leading position in the global diamond market.

Europe, primarily driven by Russia’s vast diamond resources, holds the second position in both production and value. Russia’s expansive territory is home to numerous diamond-bearing kimberlite pipes, some of which are among the world’s largest and richest. This allows Europe to account for approximately 35% of the global diamond output and 33% of its value.

North America, despite producing only 13.5% of the world’s rough diamonds, remarkably contributes to over half of the global diamond value. This is largely due to Canada’s high-quality diamonds, which fetch a higher average price in the market. Canada, being the world’s third-largest producer by volume and fourth by value, significantly boosts North America’s standing in the diamond industry.

South America, on the other hand, has a minimal role in the global diamond industry, contributing to only 0.2% of the world’s diamond production and 2.4% of its value. The region’s diamond deposits are predominantly alluvial, found in riverbeds or coastal areas, and are typically of lower quality and size. Brazil is the only notable diamond producer in South America, accounting for about 90% of the region’s output.

Looking ahead to 2023, the global diamond production is expected to remain robust, supporting growth across all regions. However, the industry’s trajectory in the second half of the year could be influenced by consumer demand, particularly in China and India, the two largest markets for diamond jewellery. Depending on the recovery of consumer demand in these markets, the industry could either continue its rebound or undergo a short-term readjustment.

Conclusion

The global diamond industry presents a dynamic and multifaceted investment landscape. The industry’s performance is largely driven by the production and trade activities of key players in Africa, Europe, and North America. Africa, with its rich diamond reserves, leads in production volume and value. Europe, primarily Russia, holds a significant share due to its vast diamond resources. North America, particularly Canada, contributes significantly to the global diamond value due to the high quality of its diamonds.

Investors interested in doubling their money in the diamond industry should consider these regional dynamics and the specific factors influencing each region’s performance. For instance, Africa’s dominance is attributed to the high-quality diamonds found in countries like Botswana and South Africa. However, political instability, regulatory challenges, and social issues related to diamond mining could pose risks.

Furthermore, the diamond industry is not immune to global economic trends and consumer preferences. The industry’s recovery from the COVID-19 pandemic disruption and the growing consumer demand for diamond jewellery are positive signs. However, the increasing availability and acceptance of synthetic diamonds, environmental and social concerns, and technological innovations are reshaping the industry.

FAQs

Botswana, Russia, and Angola are the top three countries in terms of the value of rough diamond production, with Botswana leading due to its high-quality diamonds.

India, the United Arab Emirates, and the European Union are the top three importers of rough diamonds, with India being the largest due to its robust diamond cutting and polishing industry.

Africa is the leading region in diamond production, accounting for 51.4% of the global rough diamond production volume and 66.4% of its value.

The diamond industry faces challenges such as political instability, regulatory issues, environmental and social concerns, competition from synthetic diamonds, and technological innovations.

The value of diamonds is influenced by the 4Cs: carat weight, cut, colour, and clarity. Additionally, the country of origin and the quality of the diamonds also play a role in determining their value.

Investment opportunities in the diamond industry include traditional diamond mining and trading companies, diamond cutting and polishing, jewellery manufacturing and retailing, synthetic diamond production, and technological solutions for diamond certification and traceability.