The opportunities and challenges of 401(k) investing are vast, and your daily decisions can significantly influence your long-term finances. Read this article to explore the opportunities in 401(k) investing and learn how to use it to your advantage.

Concise Overview

- Making preparations for retirement is essential for all workers

- A recommended attempt towards saving for retirement is an employer’s 401(k)

- You might have heard of it before, but this article simplifies the concept and explains all you need to know

Introduction

As an investor, you know that investing is a long-term game that requires two things — patience and purpose. Warren Buffet, one of the greatest investors of all time, corroborates this fact when he said you should “only buy something that you’d be pleased to hold if the market shuts down for ten years.”

Retirement investment is one of the most common among investors — both the old and young — and several options exist. This article covers all you need to know about and how you can invest in 401(k), one of the most ubiquitous retirement options.

What Is a 401(k)?

A 401(k) is an investment plan employers offer employees, allowing them to save money on a pre-tax basis and prepare for retirement days. By “pre-tax basis,” employees can save a portion of their remuneration, while the rest becomes taxable income for the IRS. If an employee earns $1,000 monthly and invests $200 in 401(1), the IRS will deduct tax from the remaining $800, and the $200 becomes a tax-free income.

Brief History

The idea of a 401(k) originated from a direct petition from employees of Eastman Kodak, a photographic film producer, to the U.S. Congress. Their petition requested that Congress exempt the portion of their salaries invested in the stock market from income taxes. The petition was finally approved in 1978 and passed into the Revenue Act of 1978, excusing employees from taxes on deferred compensation.

Congress added the provision under section 401(k) of the Internal Revenue Code, which explains how the investment plan got its name. However, 401(k) wasn’t used for retirement purposes until 1980, when Ted Benna, a benefits consultant and attorney in the United States, came up with the idea while trying to develop a tax-friendly retirement savings plan for his client. The client rejected the idea, so he pitched it to the company where he worked. The Johnson Companies quickly accepted and adopted Benna’s idea and became the first company to create a 401(k) plan for its employees.

How Does It Work?

The 401(k) retirement plan allows employees to divert a specific percentage of their salary into a 401(k) account. This account now serves as an investment portfolio for various security assets like stocks, mutual funds, and bonds. As explained earlier, whatever is left after the 401(k) deduction becomes taxable income.

To regulate how much people can deposit into their 401(k)s, the IRS puts a cap on employees’ monthly contributions. This limit is subject to changes in the cost of living. According to the IRS, its current value in 2022 is $20,500, which will increase to $22,500 in 2023.

Types of 401(k)

A 401(k) helps employees save for their future without worrying about taxes. According to a 2021 report from the U.S. Bureau of Labor Statistics, 68% of people in private industries and 92% working for state and local governments have access to retirement benefits. The U.K Office for National Statistics also reports a 79% participation rate in pension schemes as of April 2021. Between finding an employer that offers retirement plans and saving for resting days, there are two major types of 401(k):

- Traditional 401(k)

A traditional 401(k) is a defined contribution plan that lets you save for retirement and get a tax break. Your contributions may be tax-deductible and grow tax-free until you begin making withdrawals.

The money in a traditional 401(k) account is invested in stocks, bonds, mutual funds, and other investments. When you invest with a traditional 401(k), you’re putting money into an account held at your employer’s bank or investment firm. The money is pooled with everyone else’s contributions to creating one large pool of assets for investing purposes.

Depending on the organization, employees can get compensation from their employers for contributing to their 401(k) when they reach a certain threshold. For example, your employer can pay 50 cents for every dollar you contribute or 6% for every $1000. Your employer can also decide whether or not they’ll allow you to borrow from your 401(k).

- ROTH 401(k)

The ROTH 401(k) is a retirement account that allows eligible individuals to make after-tax contributions and receive tax-free distributions. It’s similar to a traditional 401(k) in that it allows employees to save for retirement while reducing their taxable income during the year they contribute. But unlike a traditional 401(k), where you pay taxes on your contributions and withdrawals, you don’t pay taxes on ROTH 401(k) contributions or withdrawals.

Employees interested in ROTH 401(k) must meet specific requirements to qualify. Your employer must offer one of these requirements and another type of retirement plan, like a traditional 401(k). The employer or plan provider must also offer you the option to make after-tax contributions to the plan; they can’t require it. If your employer offers both and you’re eligible for one but not the other, you can choose between them by signing up for whichever one better meets your needs.

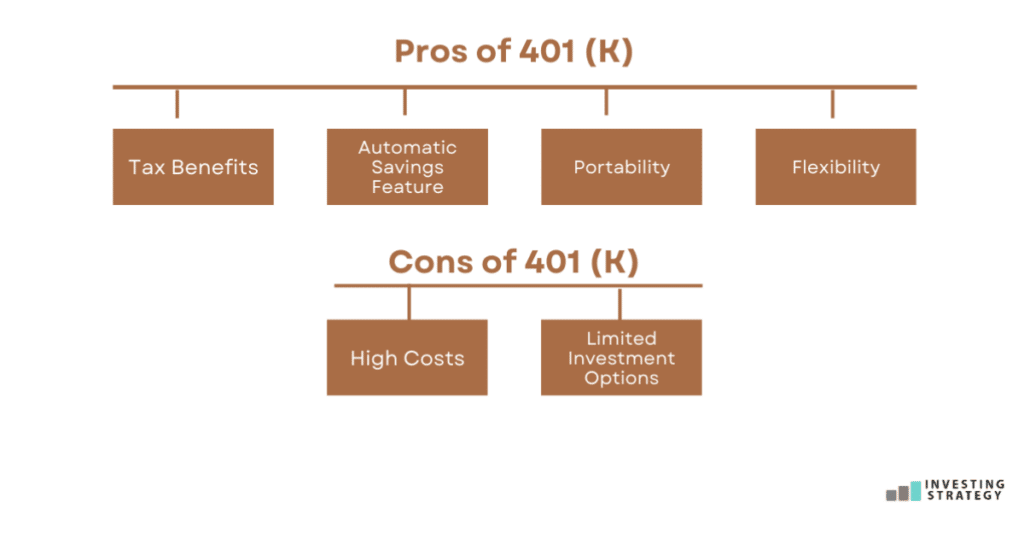

Pros and Cons of 401(k)

As a profit-minded investor, you want to consider your options before putting your money into any venture. Given retirement plans, here are the pros and cons of 401(k):

Pros

- Tax Benefits

One of the main reasons employers offer 401(k) plans is because they’re tax-advantaged. Contributions are made before taxes, and any growth in the account isn’t taxed until withdrawal. This advantage could be a vital consideration for people in a high tax bracket now, expecting to drop to a lower one after retirement.

- Automatic Savings Feature

Many employers automatically enrol their employees in their 401(k) plan at a certain percentage of salary, which can be helpful if you need to contribute more to your retirement fund. You don’t have to worry about making regular contributions — it happens automatically each pay period until you change it or quit working there and stop participating altogether (unless they require employees to continue contributing after they leave). This can help people who otherwise might not save at all or would forget to take action on their own over time, especially if they’re not used to saving for retirement as part of their budgeting process already (which many aren’t).

- Portability

If you leave the company and decide to work elsewhere, your 401(k) savings stay with you, even if it was money that your employer contributed. This makes it easy to take with you when switching jobs — be sure not to touch any funds until retirement (as they’re still technically owned by the company).

- Flexibility

You can invest your 401(k) in various options, including different funds and assets, meaning you have more control over your money and where it goes. So if one investment isn’t working out as well as planned, you can switch it up for another option. You can change your contribution rate anytime, and some companies offer incentives to encourage interested employees. You can also take out a loan from your 401(k), but only if you’ve been with the company for at least two years and are under age 59 1/2. You also have to pay that money back within five years, or else it’s a withdrawal, meaning taxes will be taken out of it.

Cons

- High Costs

Many people need to realise the fees associated with 401(k) investments. These fees can eat away at your returns over time if you are not careful. So, find your fees and ask if any lower-cost alternatives might be available through your employer.

- Limited Investment Options

Some employers only allow employees to choose from a handful of mutual funds as investments within their 401(k)s, which may not offer your portfolio the best possible return or diversification. If this is the case for you, consider rolling your 401(k) into an IRA after leaving your job so that you can choose from hundreds of different funds and ETFs instead.

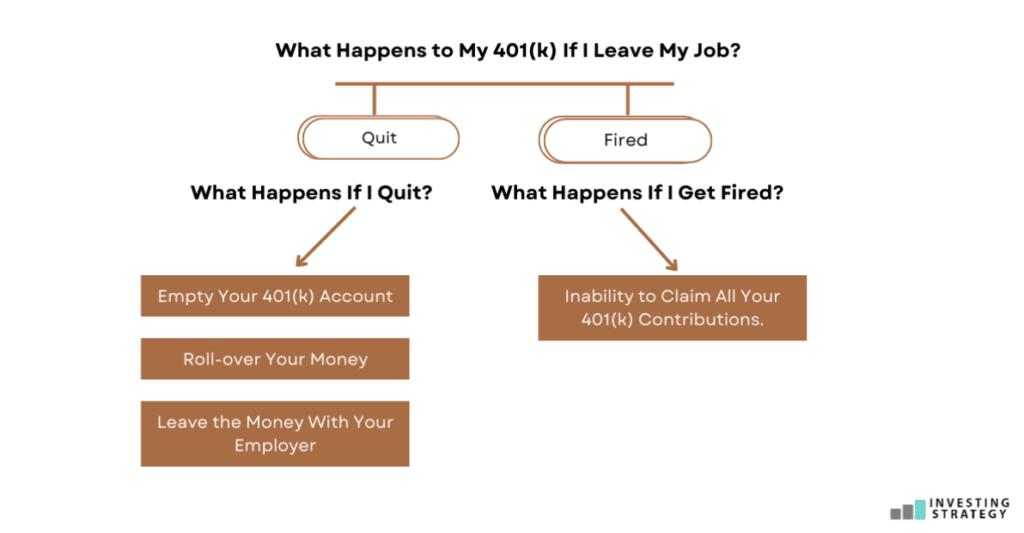

What Happens to My 401(k) If I Leave My Job?

Since employers offer 401(k)s, and contribution payments are deducted from salaries, the 401(k) plan will automatically stop if you stop working with that employer. Regardless of your reason for leaving, the question of what happens to your 401(k) after your departure is critical.

People typically leave their jobs for two primary reasons: they quit or got fired. To evaluate an employee’s options when they leave a job, we’ll look at both cases;

What Happens If I Quit?

In this situation, several options are available to employees, each with merits and demerits. Let’s explore some of these options.

- Empty Your 401(k) Account

You can walk out the door of your former employer’s company after quitting with your 401(k) sitting in your pockets. That’s true! Employees can request the money in their 401(k) from an employer at the exit time. However, you must know that withdrawing your 401(k) cash before retirement means you will pay income tax, and the investment company will charge an additional 10% penalty fee if you are below 59 1⁄2.

- Roll-over Your Money

You don’t need to withdraw your 40(k) money to your savings account to collect it from your former employer. You can move it into your new employer’s 401(k) or an Individual Retirement Account (IRA).

You can move your old 401(k) into the new one if you find a new job and your new employer has retirement plans for its employees. But you must first confirm if you can roll over from your new employer. If the rollover option is available, you can directly or indirectly transfer into your new account. The direct transfer option is an employer-employer transaction and helps you avoid taxes during the transfer. You only need to fill out a form with the old employer, and both employers will handle the remaining processes.

An alternative to the direct transfer option would be to withdraw the money from your old account as a check and deposit it into your new 401(k) account with the new employer. This option is known as the indirect transfer, and you would have to pay income tax on the amount received plus a 10% early withdrawal charge if you are less than 59½ years old.

Rolling your 401(k) into an IRA is another option, especially if you are not leaving for a new job or your new company does not have an employee retirement plan. With an IRA, you’ll have to open an account yourself, giving you more control over how much you can invest. Rolling over your 401(k) into an IRA exposes you to many advantages. Your capital is protected from taxes and inflation, and retirement withdrawal will be tax-free.

Talk to a financial advisor to find out which option is best for you if you want to roll over your 401(k).

- Leave the Money With Your Employer

The least recommended option to do with your 401(k) when leaving a job is to leave your money with your former employer. For most 401(k) plans, you are allowed to leave your money with your employer when you are leaving a job if you have over $5000 in the 401(k) account. Your employer and investment firm are obligated to continue managing the money until you reach 59½, when you can withdraw it, and you won’t have to pay any taxes.

However, if you leave your old 401(k) behind with the company, there are two things to keep in mind. Firstly, you must understand that you trust your former employer’s investment decisions, and your investment value can depreciate over time. Since you are no longer at the office, you would need to find out if your former employer is making sound investment decisions that will grow your 401(k). So by the time you are old enough to cash out your retirement funds, you might have less money than you hoped. Is that a risk you are willing to take?

Another thing to consider is that once you leave an employer-sponsored retirement plan, there are limits on how much money you can take out each year without incurring taxes or penalties if the charges required to break these limits are too high for the money left in your account after all those years of saving up – then again: no luck!

It also goes without saying that if something happens and your former employer declares bankruptcy, your money goes down with the company.

What Happens If I Get Fired?

If you are fired from your workplace, you won’t be able to claim all your 401(k) contributions. Typically, employees and employers can contribute to a 401(k); this distinction makes the difference if you want to access your 401(k) after being fired.

Employees have complete access to their contributions in the 401(k) account. However, you will only be able to claim funds that your employer contributed to your 401(k) if it has been vested. Employer contributions in your 401(k) take a specific period before they become yours entirely. This transfer of ownership is known as vesting, and the period varies between employers. Fired employees can only claim vested funds in their 401(k) and lose any unvested funds.

Can I Get a 401(k) If I Am Self-Employed?

Yes, you can! Investing in a 401(k) if you’re self-employed is possible. The process is similar to that of employees. You can open an account with any financial institution that offers 401(k) plans and then contribute up to the federal limit (currently $18,500 per year). The most significant difference is that you’ll be responsible for managing your retirement savings plan, but it’s relatively easy, and many resources are available online.

Are 401(k)s A Good Investment?

The answer to whether or not 401(k)s are a good investment is relative from one person to another. However, 401(k)s are more of a retirement plan than an actual profit-based investment, and they offer more benefits than other retirement plans like IRAs, pensions, and deferred annuities. To get the best out of your 401(k), save as much as you can regularly, and your future will thank you.