Greatland Gold: choices, choices

Newmont has finally made a decision. The time has come for Greatland to make theirs. In ‘The Lord of the Rings: The Two Towers,’ (spoiler warning), King Theoden of Rohan, played to perfection by Bernard Hill (the extended trilogy is the best cinema ever made, watch it if you haven’t, dozens of awards, incredible screenplay, […]

Investing Strategy: The Greatland Gold Edit

Everything you need to know about investing in Greatland Gold. The company is superb value at less than 6p per share — here’s why. Greatland Gold is arguably one of the most popular FTSE AIM shares on the market — and it’s not hard to see why. The gold explorer rocketed above 37p per share […]

Kefi shares: investor overview for Q4 2023

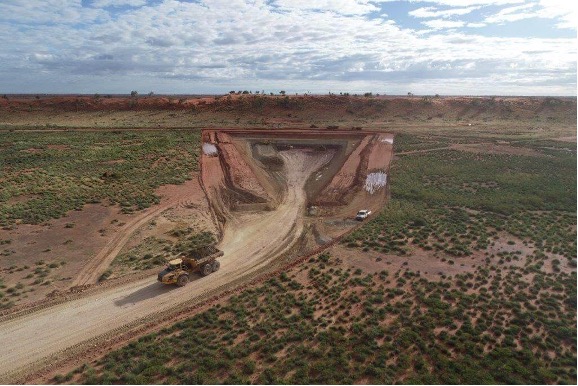

Flagship Tulu Kapi in Ethiopia ticks all the right boxes. The value disconnect seems clear and in theory, won’t last long. As a long-term investor in promising junior resource sector companies, I am always on the lookout for undervalued shares. And Kefi may now make the cut. For context, exploratory gold shares have a much […]

Amaroq shares: more to come from Greenland operator?

Amaroq Minerals (LON: AMRQ) shares were changing hands for circa 41p in mid-May when I last covered the gold explorer, interviewing Edward Wyvill, Head of Corporate Development and IR. The stock has now shot up to over 56p, driven by solid Q2 results, excellent long-term financing announcements, and general optimism for its flagship project’s prospects. […]

Hummingbird Resources: the investment case in brief

Hummingbird is looking undervalued — but the investment case is more complex than first appears. Hummingbird Resources released its Q2 2023 trading update fairly recently, and the company now seems to be in a position to properly start scaling up at its assets. Up circa 78% year-to-date, the £75 million gold producer has seen its […]

The 2023 investment case for Greatland Gold shares

GGP shares are now fully financed to production at its flagship 30%-owned Haverion project, which is set to deliver feasibility study results early in the new year. Greatland Gold (LON: GGP) is a London-listed mining developer and explorer focused on precious and base metals in Australia. While the miner has interests across six projects scattered […]