Venture Capital (VC) hubs worldwide have experienced considerable shifts, with 2021 marking a peak in global VC investment at $671 billion. Despite a 53% drop in the first quarter of 2023, sectors like artificial intelligence (Al) have kept the VC landscape vibrant, contributing to a $94 billion investment in the second quarter.

As VC hubs worldwide are revving up, this piece provides an in-depth look at the world’s leading VC hubs based on PitchBook’s VC Ecosystem Ranking. It takes into account various factors such as deal, exit, and fund activities to deliver a comprehensive view of the largest, fastest-growing, most developed, and highest-value VC hubs in the world.

Quick Overview

- San Francisco, New York, and Shanghai lead as the top three largest global VC hubs, based on overall scores

- North America and Asia dominate the VC landscape with eight out of the top ten cities

- The fastest-growing VC hub is Dubai with a growth score of 72.77, followed by Detroit and Berlin

- Among the most developed VC hubs, San Francisco tops with a development score of 89.44, with Beijing and New York following

- The most expensive VC hub is San Francisco with a total value of $1290.5 billion, trailed by Beijing ($580.1 billion) and New York ($419.3 billion)

- Middle East leads in growth with a score of 72.77, while Europe and North America represent more stable and developed VC landscapes

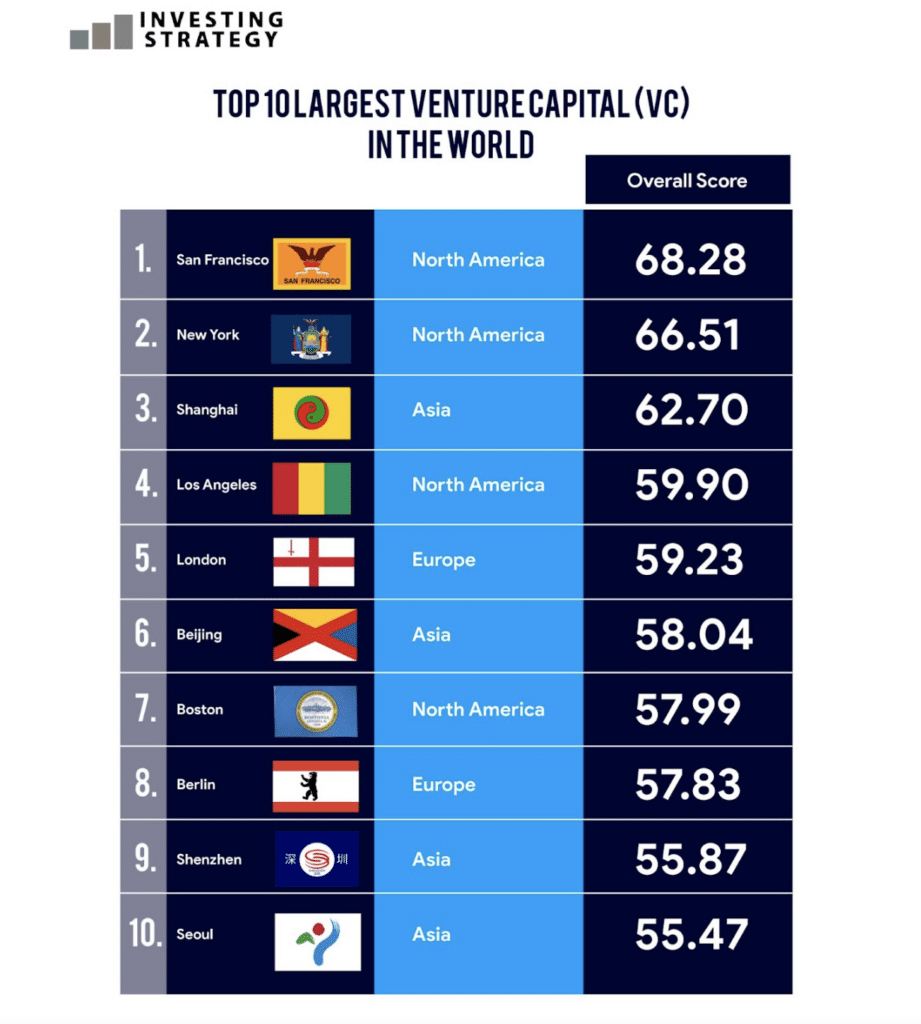

Top 10 Largest Venture Capital (VC) Hubs in the World

San Francisco leads the global venture capital (VC) landscape with an overall score of 68.28, closely trailed by New York at 66.51. Shanghai secures the third spot with a score of 62.70, followed by Los Angeles (59.90) and London (59.23) in fourth and fifth positions respectively.

Beijing steps in at sixth with a score of 58.04, closely followed by Boston at 57.99. Berlin, the second European city in the list, nestles at eighth with a score of 57.83, while Shenzhen and Seoul complete the top ten with scores of 55.87 and 55.47 respectively.

North America and Asia Lead in the Global VC Landscape with Eight Out of the Top 10 cities

North America and Asia significantly dominate the global VC stage, housing eight out of the top ten cities. This dominance is underpinned by robust financial and technological infrastructures, reflecting the regions’ longstanding tradition of innovation and investment acumen.

San Francisco and New York stand out as hotbeds of VC activity. In the first half of 2023, the Bay Area venture capital funding accounted for approximately 40% of the total nationwide. Similarly, the Northeast region of New York mounted 30% of all VC activity in Q2 2023. Within these leading cities, a culture of enterprise coupled with the presence of major tech companies and reputable venture capital firms fosters a conducive environment for startup growth and venture capital influx.

Meanwhile, cities like Los Angeles and Boston also contribute to North America’s VC narrative albeit with a lower, yet respectable, competitive standing.

The narrative shifts slightly eastward with four Asian cities marking their presence in the top ten. Cities like Shanghai and Beijing are not merely representing the region but are emblematic of Asia’s burgeoning technological advancements and growing startup cultures. For instance, the China (Shanghai) Free Trade Zone (FTZ) has attracted over 84,000 new enterprises since it launched in 2013.

Score Disparity, Competitive Edge Among Top Ten, and Potential for Movement

A closer look at these VC hubs reveals a tight competition, particularly among cities ranked fourth to tenth. This not only signifies a race for better standings but also suggests an inherent potential for cities outside the top ten to break into this competitive arena with the right strategic advancements.

The relatively close scores among these cities hint at a potential dynamism with prospects for movement in rankings, possibly driven by local policies, global events, or strategic initiatives aimed at fostering favourable regulatory environments and investing in technological infrastructure.

Europe’s story, though with lesser representation, is not without its promise. The presence of London and Berlin suggests a concentrated VC activity which could either serve as a launchpad for other European cities or warrant a deeper investigation to understand the factors behind this concentration. Whether it’s the regulatory environments or historical financial systems, understanding these dynamics could provide a roadmap for nurturing a more diversified VC landscape across Europe.

The global distribution of these VC hubs reiterates the essence of international connectivity and collaboration. The cross-border flow of ideas, talent, and capital not only fuels further growth but could also lead to a more diversified and resilient global VC landscape. As cities aspire to climb up the rankings, a blend of policy implications, strategic initiatives, and global collaboration could be the catalysts propelling a city’s standing in this global VC ecosystem.

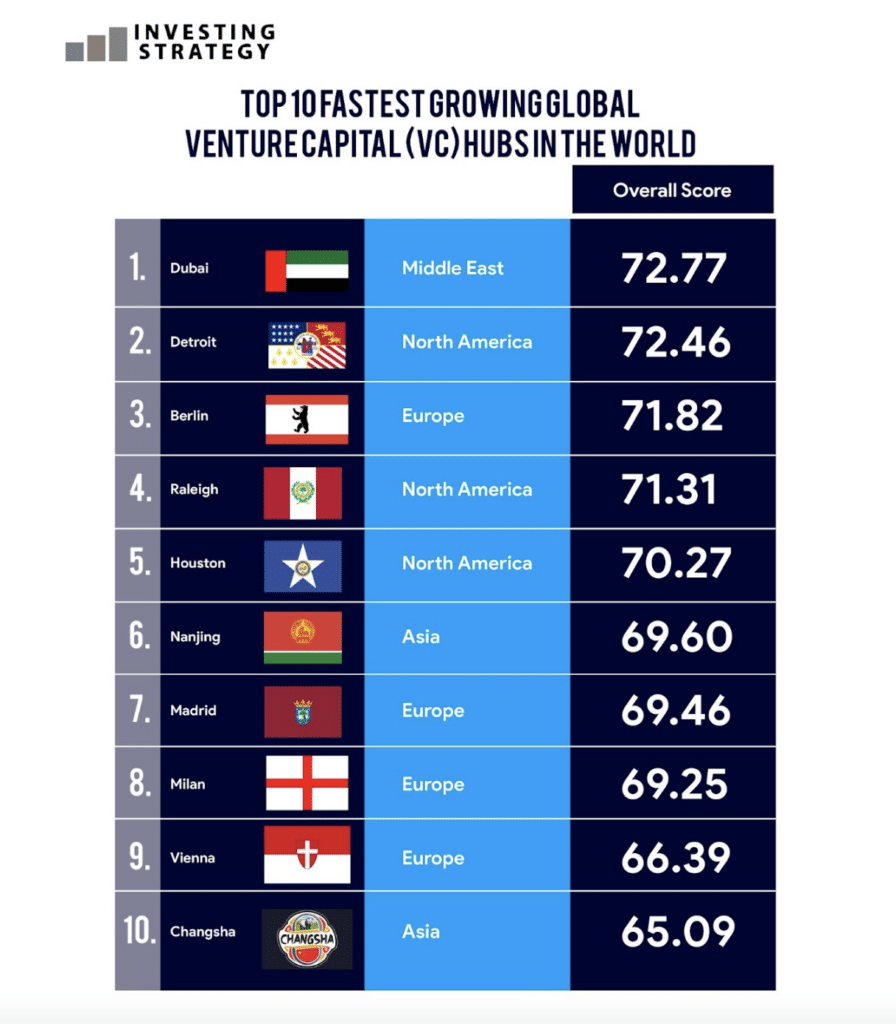

Top 10 Fastest Growing Venture Capital (VC) Hubs in the World

In the rapidly changing world of global venture capital (VC), ten cities have notably risen as the fastest growing hubs. Dubai leads the pack with a growth score of 72.77, closely followed by Detroit at 72.46. Berlin, Raleigh, and Houston also make the top five. The list is rounded off by Nanjing, Madrid, Milan, Vienna, and Changsha.

Dubai is the Fastest Growing VC Hub in the World – a Strong Entry for the Middle East

Dubai’s top ranking marks a strong entry for the Middle East into the global VC scene, outpacing traditional North American and European hubs. In its defence, Dubai International Financial Centre (DIFC) has been a global hub for alternative investments and hedge funds, attracting a significant amount of foreign direct investment (FDI). Besides, more than 90% of all funds raised in the UAE since 2017 have been directed to start-ups based in Dubai.

North American cities Detroit, Raleigh, and Houston are showing consistent growth in the VC sector as well. Particularly noteworthy is Detroit’s emergence, reflecting its historical strength in the automotive industry. In addition, Detroit has been attracting more venture capital and private investment in tech startups and established tech companies, with Michigan’s venture capital dollars increasing by nearly $3 billion over the last seven years.

The presence of Berlin, Madrid, Milan, and Vienna among the top 10 fastest-growing VC hubs showcases diversified growth across Europe. Each city contributes uniquely to the VC landscape, potentially driven by varied regulatory frameworks and entrepreneurial cultures.

Nanjing and Changsha Reflect the Decentralisation Trend in the Industry

The inclusion of Nanjing and Changsha highlights the potential of lesser-known Asian cities in contributing to global VC growth but it is not unexpected. These cities played hosts to events such as the China-Africa Economic And Trade Expo, which has attracted thousands of participants. Besides, their inclusion reflects a broader trend of decentralisation within Asia, moving beyond established hubs like Beijing and Shanghai.

The close growth scores among the top eight cities hint at a fierce competition. This could foster an environment conducive to innovation as cities strive to create more favourable conditions for startups and investors. Also, the distribution of fast-growing VC hubs across different regions emphasises the global nature of venture capital growth, suggesting a worldwide movement towards fostering VC activities.

Comparing Fastest Growing VC Hubs with Largest VC Hubs

Comparing this list of fastest-growing VC hubs with the list of largest VC hubs provides a nuanced understanding. Growth and size offer different lenses to evaluate VC ecosystems. The dynamics in fast-growing hubs like Dubai and Detroit offer unique insights compared to established larger hubs like San Francisco and New York.

As cities from different regions rise in prominence in the VC sector, a balanced global VC landscape could be emerging. This balance might lead to a more diversified and sustainable global VC ecosystem, promoting cross-border collaborations and reducing concentration risk associated with having VC activities clustered in a few regions.

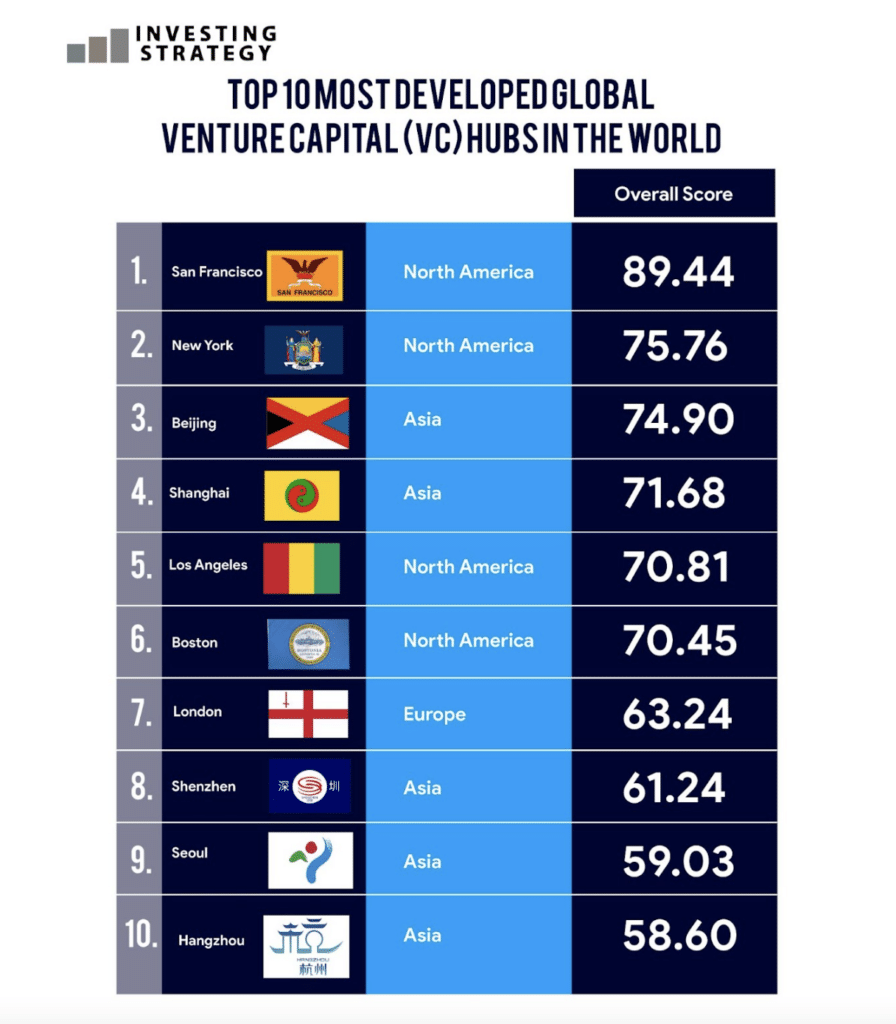

Top 10 Most Developed Venture Capital (VC) Hubs in the World

The world’s most developed venture capital (VC) hubs are spread across three key regions: North America, Asia, and Europe. The top ten cities leading the pack are San Francisco, New York, Beijing, Shanghai, Los Angeles, Boston, London, Shenzhen, Seoul, and Hangzhou. Here are the insights:

North America and Asia Continue to Dominate the VC Hubs with Eight Cities in the Top Ten

North America remains a dominant force in the VC scene with four cities in the top ten most developed VC hubs. San Francisco leads the charge with an impressive development score of 89.44. This supremacy is largely due to the city’s continued attraction of significant venture capital deals despite economic downturns as it was funded to the tune of $31.5 billion with 1,461 rounds in 2022. New York, Los Angeles, and Boston also feature on the list, highlighting the region’s diverse opportunities and well-developed infrastructures.

Asia also boasts four cities in the top ten, underscoring its growing importance in the world’s most developed VC ecosystem. Beijing and Shanghai lead the way, followed by Shenzhen and Hangzhou. These cities’ high development scores reflect China’s concentrated VC landscape, driven by aggressive innovation and substantial financial investments. In fact, while Beijing is home to several of China’s most valuable tech companies, including Baidu, JD.com, and ByteDance, Shenzhen is often referred to as the “Silicon Valley of China”.

London is Europe’s Only Developed VC Hub with a Development Score of 63.24

London is Europe’s lone ranger in this list with a development score of 63.24. Despite being Europe’s only representative, London’s presence reflects the UK’s ambitious net zero transition plan, projected to attract £10 billion per year of investment into the UK and create 600,000 new, green, and high-quality jobs by 2030. The absence of other European cities suggests potential growth areas or a need for further development in their VC ecosystems.

The lack of European cities in the fastest-growing list, contrasting with London’s spot in the developed list, suggests that Europe’s VC ecosystem might be more mature and growing at a slower pace compared to emerging hubs. On the other hand, the consistent appearance of Asian cities in both lists highlights the region’s ongoing evolution and rapid growth in the VC sector.

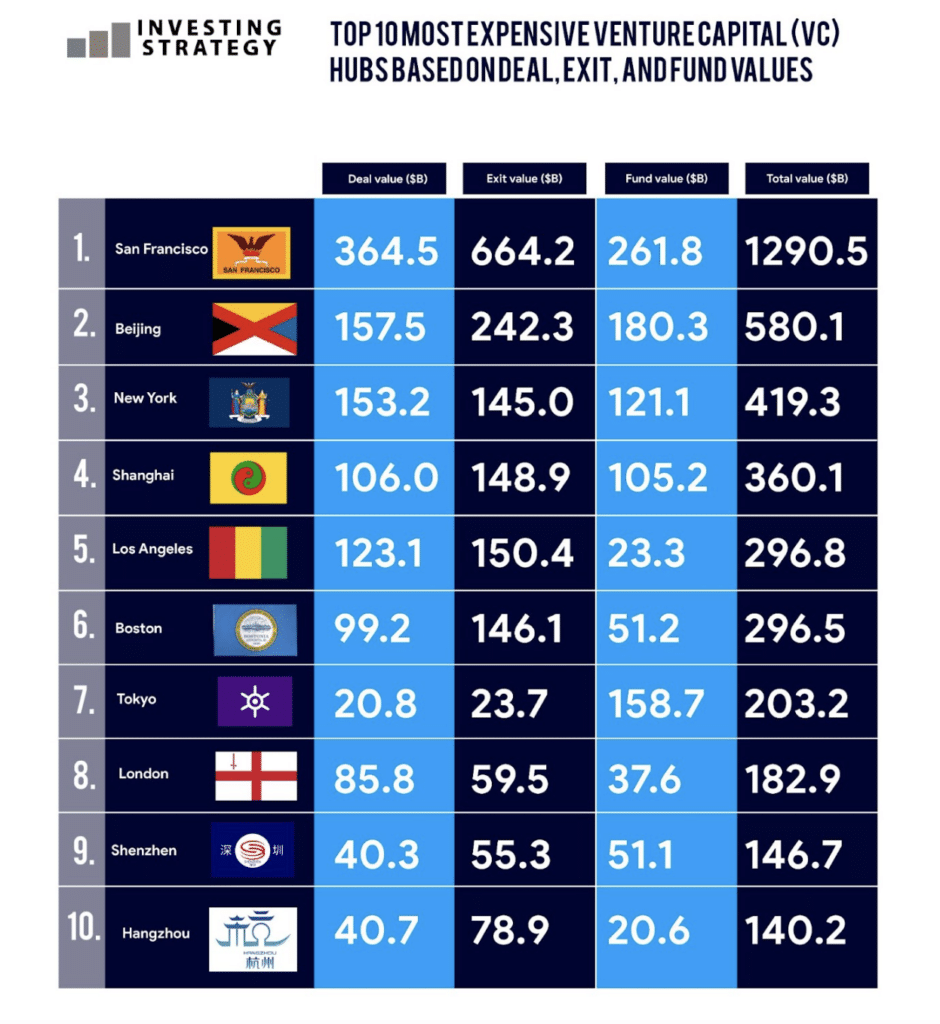

Top 10 Most Expensive Venture Capital (VC) Hubs in the World

San Francisco tops the list of the world’s most expensive venture capital (VC) hubs, boasting a total value of $1290.5 billion. Beijing follows, with $580.1 billion, then New York at $419.3 billion. Shanghai and Los Angeles clinch the fourth and fifth spots, with total values of $360.1 billion and $296.8 billion respectively.

Boston sits at sixth with a value of $296.5 billion. Tokyo, a newcomer to the list, claims the seventh spot with $203.2 billion, followed by London at $182.9 billion. Shenzhen and Hangzhou complete the top ten, with respective total values at $146.7 billion and $140.2 billion.

The United States Boasts Five, While China Features Four of the World’s Most Expensive VC Hubs

The United States flexes its muscles in the VC arena, with five cities – San Francisco, New York, Los Angeles, Boston, and London – clinching spots in the top ten. The high deal, exit, and fund values of these cities shows the robustness of their VC ecosystems.

China’s thriving VC landscape is reflected in four of its cities – Beijing, Shanghai, Shenzhen, and Hangzhou – securing places in the top ten. The substantial deal and exit values in Beijing and Shanghai highlight the rapid growth and significant financial activities fuelling this region’s VC sector.

Tokyo’s debut at seventh place is particularly noteworthy due to its high fund value, suggesting a unique VC ecosystem where large funds may be targeting long-term investments. Tokyo’s presence amidst Western and Chinese cities underscores the diverse strategies employed in venture capital across various global regions.

Comparing the Most Expensive with the Most Developed VC Hubs

A comparison between this list and that of the most developed VC hubs reveals some overlap – San Francisco, New York, Beijing, and Shanghai dominate both lists. However, emerging hubs like Dubai and Detroit are absent from the ‘most expensive’ list, indicating varying stages of VC ecosystem maturity and hinting at potential future shifts in value rankings.

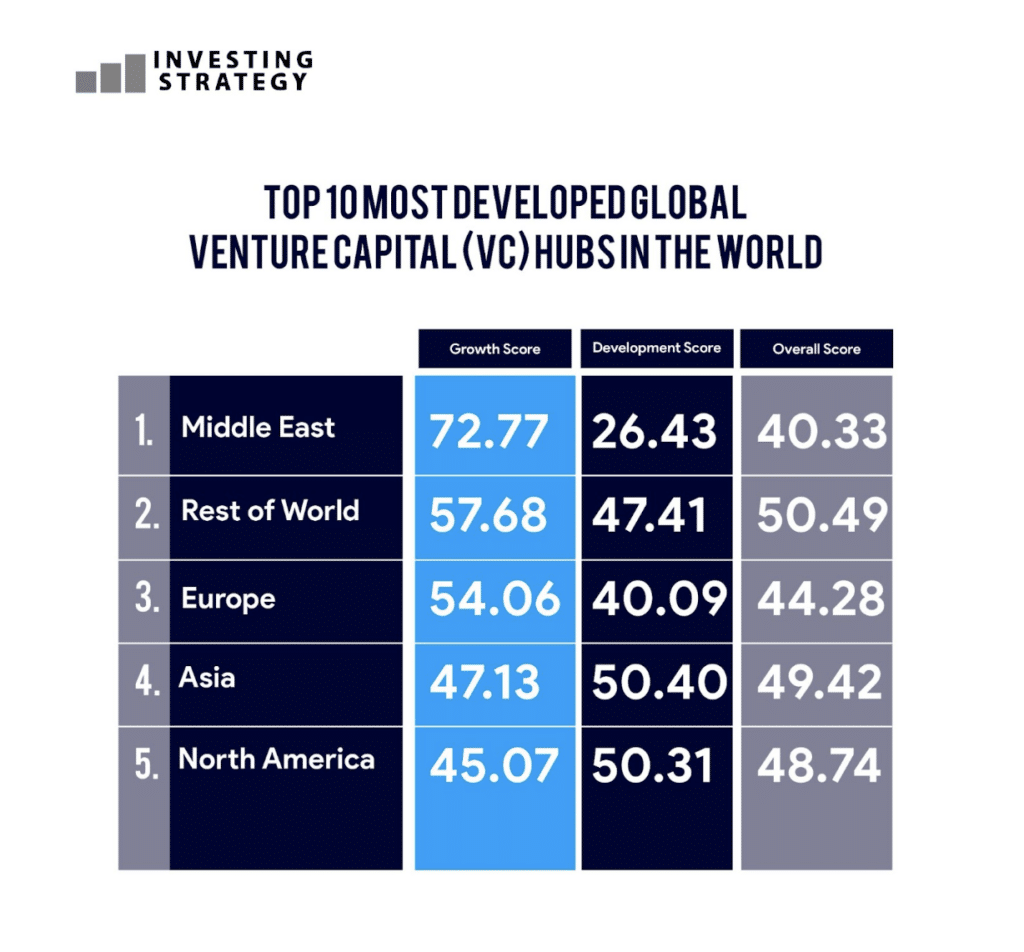

Top Global Venture Capital (VC) Regions Based on Growth, Development, and Overall Scores

The Middle East, despite lagging in development with a score of 26.43, leads the pack with an impressive growth score of 72.77. This gives the region an overall score of 40.33, a testament to its transitional phase. The region’s high growth score is a clear sign of a burgeoning VC sector, spurred on by determined efforts to diversify economies and stimulate innovation. For instance, countries like the United Arab Emirates and Saudi Arabia have launched ambitious plans to diversify their economies away from oil. The UAE’s Abu Dhabi Economic Vision and Saudi Arabia’s Vision 2030 both aim to stimulate innovation and entrepreneurship, attract foreign investment, and create a vibrant society with a diversified and sustainable economy.

Coming in second are regions collectively referred to as the Rest of the World, which includes Africa, Latin America, Oceania, and others. These regions have managed to strike a balance between growth and development, resulting in an overall score of 50.49. This score suggests a broad spectrum of VC activities and potential, driven by local initiatives and emerging markets. Furthermore, technological advancements have made it more accessible and cheaper to start new businesses in these regions, increasing funding opportunities. Venture Capitalists (VCs) often invest in startups that everyday people interact with, such as apps, as opposed to a Private Equity (PE) fund that invests in power plants.

Europe and North America, with overall scores of 44.28 and 48.74 respectively, represent the more stable and developed VC landscapes. Although their growth scores may not match that of the Middle East, their development scores are significantly higher, indicative of a mature VC ecosystem. These regions offer a consistent, stable environment for VC activities.

Asia, with near-equal growth and development scores, presents a balanced profile, resulting in an overall score of 49.42. This equilibrium reflects a mix of established VC hubs like Beijing and Shanghai, along with rapidly growing hubs like Nanjing and Changsha. Asia’s substantial representation across all categories underscores its ongoing development and significant role in the global VC ecosystem.

A comparative view of these regions reveals a dynamic interplay between growth and maturity. The Middle East’s surge in growth provides a stark contrast to the mature landscapes of Europe and North America. Meanwhile, Asia and the Rest of the World present balanced profiles, demonstrating a blend of growth and development. These dynamics underscore the multifaceted nature of global VC ecosystems, with each region at a different stage in its VC journey, contributing uniquely to the global VC narrative.

Conclusion

The global VC landscape is a vibrant and dynamic ecosystem, marked by a blend of established hubs, emerging hotspots, and fast-growing regions. The future of this landscape will likely be shaped by a combination of factors, including local policies, global events, and strategic initiatives aimed at fostering favourable regulatory environments and investing in technological infrastructure. As cities and regions continue to evolve, the global VC landscape is set to become more diversified and resilient, promoting cross-border collaborations and reducing concentration risk.

FAQs

San Francisco leads the global VC landscape, followed by New York, Shanghai, Los Angeles, and London. The list is completed by Beijing, Boston, Berlin, Shenzhen, and Seoul.

Dubai is the fastest growing VC hub in the world, followed by Detroit, Berlin, Raleigh, and Houston. The list is rounded off by Nanjing, Madrid, Milan, Vienna, and Changsha.

The most developed VC hubs are San Francisco, New York, Beijing, Shanghai, Los Angeles, Boston, London, Shenzhen, Seoul, and Hangzhou.

San Francisco tops the list of the world’s most expensive VC hubs, followed by Beijing, New York, Shanghai, and Los Angeles. The list is completed by Boston, Tokyo, London, Shenzhen, and Hangzhou.

The Middle East leads in growth, while regions collectively referred to as the Rest of the World, which includes Africa, Latin America, and others, strike a balance between growth and development. Europe and North America represent more stable and developed VC landscapes, while Asia presents a balanced profile with near-equal growth and development scores.