Welcome back to Investing Strategy, where long-time readers are joining me on my quest to provide comprehensive coverage of every small cap junior resource company listed in London.

Of course, I am sure that this will be much like painting the Forth Bridge — by the time we get every one of them online, it will be time to revisit the first! But perhaps not, the actual task of painting the bridge was continuous until 2002, at which point a new paint was discovered which is capable of lasting 20 years at a time.

Today, it’s the turn of Fulcrum Metals (LON: FMET), which arguably enjoys something of a perception problem in terms of both its current business and future potential.

This seems to be a running theme — Jubilee Metals is predominantly a chrome/copper processor and is often unfairly lumped in with PGM group companies. Greatland Gold is known only for Havieron yet has masses of exploratory tenure with the majors. Sovereign Metals is known as the owner of the largest rutile deposit in the world, but also has the planet’s second-largest graphite resource…

Once a narrative takes place, it can be hard to break misconceptions. At present, the popular perception of Fulcrum (if any) is that it is in the same category as other predominantly Ontario-focused operators listed in London, including Panther Metals, First Class Metals, Landore et al.

This piece is not a critique of those companies – but it is important that they get separated out. FCM’s business model is to be the first curve mover, buying an asset, doing some initial work, and then selling it on. Panther is in full exploration mode and is arguably best categorised as your typical exploration business with the standard model. Landore is perhaps fundamentally undervalued but needs a JV partner to make further progress.

All three have been hard hit by weak junior resource sentiment, and particularly in Ontario, where the government is now working hard to improve conditions — including expanding the critical minerals innovation fund by $15 million and streamlining the previously archaic mining permit approvals process.

For context, the fund is designed to spur technology advances from mining to processing to manufacturing in the transition to cleaner energy — and is a potential source of funding for Fulcrum in the near future.

Before we get into the details, I will issue all the standard caveats:

- This is not financial advice. Do your own research and make your own decisions.

- There are some important first steps to consider before investing in AIM shares, or in mining shares. Generically, these centre around developing financial resilience and diversification.

- Small caps are generically higher risk than larger companies, but come with correspondingly larger potential upside.

Fulcrum launched its IPO in February 2023 — smack bang in the middle of the downturn — raising £3 million at 17.5p per share. It’s now fallen to 15p per share and has been stuck in a range of roughly 15-16p since June 2023.

This potentially demonstrates two things: First, many shares are in ‘sticky’ hands (long-term investors who are not selling). Second, while the stock may have dipped by 15% since the IPO, this is little compared to many other AIM-listed shares, which implies Fulcrum has some kind of Patronus that is protecting it from a larger sell-off.

For context, a 15% fall (or rise) is a normal Tuesday for many stocks on the index.

Let’s dive in.

Fulcrum Metals: assets to assess

There are a few ways to split Fulcrum’s asset base — but to make things easier for those new to the company, I am splitting them into three distinct groups:

- Athabasca, Saskatchewan assets

- Ontario-based initial assets

- Ontario-based tailings assets

It’s best to think of these as separate strands, or strings to the bow — this becomes clear later on.

Athabasca Saskatchewan assets

Fulcrum owns four assets in this area, including Charlot-Neely, Fontaine Lake, Snowbird and South Pendleton. Athabasca is well known as the world’s number one uranium address — for reference, I am also keeping a close eye on Power Metal’s upcoming Uranium Energy exploration IPO.

For some perspective, Charlot-Neely is a 76 square kilometre asset located near the famous Beaverlodge District. Historic grab and trench samples came back with uranium showings of 0.15% to 6.22% U308, historical drill intersections of up to 0.023% over 3.2 metres and radioactive sources where the source has not yet been identified — alongside a historical diamond drilling report from a previous operator which shows some promising gold potential.

Fontaine Lake is a 59 square kilometre asset located near the Beaverlodge District on the northern edge of the Athabasca Basin, where the uranium mineral pitchblende was first discovered in 1946. Uranium production from the Beaverlodge District occurred between 1953 and 1982, yielding approximately 28,560 t U3O8, from ore that graded from 0.15% to 0.25 % U.

On 3 April, FMET entered into a non-binding Letter of Intent with Terra Balcanica Resources, which through an option agreement will be able to acquire a 100% interest in these assets through a staged program.

Details are here — but for brevity, over the course of four years (assuming it chooses to do so), Terra will have a CAD$3.25 million minimum work expenditure commitment, will pay Fulcrum CAD$300000 in cash and issue CAD$3 million in terra shares to FMET.

Fulcrum will retain a 1% net smelter royalty on all claims, with a buydown option of 0.5% NSR for CAD$1 million. The deal is expected to be confirmed by 1 May 2024.

The bottom line for these assets is that Fulcrum has struck a solid deal, which leaves it with much of the potential upside but without needing to fund the exploration. As ever, a promising potential asset is just a patch of dirt until someone puts a drill in it — but the good news is that uranium is red hot right now.

Ontario-based initial assets

These mostly gold -based assets are essentially those which are tailings-based or not tailings-based. Technical I know — again the good news is that gold is at a record high and continuing to climb. However, I would break these assets down further into core and non-core:

Core

Jackfish Lake — mineralization area of 1km x 1km with rock samples of up to 39.8g/t Au and 1.01% Cu. Mineralisation also found at the Terrace Bay Batholith contact zone, which hosts several nearby mines and deposits including the North Shore Gold deposit (28km west), Empress, Ottise and Gold Range. Anomalous mineralisation also expressed along the unexplored eastern margin of the Terrace Bay Granite.

Big Bear — 253 geophysical anomalies have been identified, with 39 designated for priority investigation. Gold in soil anomalies identified ranging up to 0.71g/t extending up to 250m wide and open along strike. Gold bearing quartz veins have also been outlined within seven separate areas.

Work done thus far implies a structure linking the Johnston-McKenna and Pyramid Schreiber occurrences as an exploration target.

Tully — benefits from a well-established mine camp with excellent infrastructure, which is not surprising given that the asset is Along the Timmins-Porcupine Gold Belt which has produced more than 70Moz of gold. Tully has a historic NI-43-101 consistent gold resource of 107,000 ounces, with 76,000 ounces at 6.56g/t Au in the Indicated category and 31,000 ounces at 5.17g/t Au in the inferred category. Historic drilling includes 2,555g/t Au over 0.5 metres within 322g/t Au over 5.7 metres — to interpret this, please read this piece here.

Non-core

These three non-core assets and being marketed as potential JV or acquisition targets.

Tocheri Lake — untested and underexplored position, prospective for copper, nickel, zinc and silver.

Winston Lake — comprising two asset areas of Beavertrap and Carib Creek, prospective for zinc, copper and gold.

Dog Lake — located on the south-eastern limb of the Michipicoten Greenstone Belt, which hosts Alamos Gold’s Island gold mine (1.3Moz Proven and probable10.12g/t Au) and Argonauts Gold’s Magino project (1.3Moz measured at 0.98g/t Au). Dog Lake is just 30km from these two assets, and has four known mineral occurrences, prospective for gold, copper and nickel.

| BROKER | PROS | FEATURES |

|---|---|---|

| + Founded in 1974 + First-class web trading platform + Superb educational tools + Great deposit and withdrawal options | Fees: Spread cost; Overnight financing costs; Inactivity fees Min. Deposit: $£250 Tradeable Symbols: 19537 |

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. |

||

| + Fast withdrawal + 0% commission on US stocks + Real Cryptos, Stocks + Copytrading + Social Trading + PayPal deposits possible + One Stop Shop | Fees: $5 withdrawal fee. Inactivity fee. Min. Deposit: $50 Pairs Offered: 47 Leverage: 1:30 Tradable Assets: 2000+ |

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

||

Recent updates

Big Bear — over the summer of 2023, Fulcrum’s phase 2 rock sampling and geological mapping across Big Bear came back with excellent results. I would recommend reading through the RNS in full, but for our purposes:

- 141 rock samples were collected, with notable high-grade gold findings including the Schreiber No. 1 vein showing concentrations up to 17.6g/t Au. Additionally, high-grade float vein material suggests possible vein extensions. A newly discovered vein north of the former Johnston‐McKenna Mill showed initial grab samples up to 1g/t Au, indicating a potentially significant discovery. Anomalous gold in gossanous sheared basalts and sheared basalts west-southwest of the Twomey Powerline Occurrence suggests possible larger-scale gold targets.

- Out of 329 soil samples, 38 returned highly anomalous values, outlining 9 soil anomalies. Further detailed work is recommended in several areas, including around the Schreiber-Pyramid and Twomey areas and the Johnston-McKenna area.

- The exploration program revealed a 3km gold-bearing corridor open along strike and to the north. Over 25 rock samples showed gold concentrations exceeding 1g/t Au, with 11 high-grade samples exceeding 10g/t Au. Nine areas of highly anomalous soil values were identified, ranging up to 0.92g/t Au. Detailed mapping of shear zones suggests potential for economic mineral deposits. Structural observations indicate a potential regional-scale shear zone passing through the area, suggesting significant gold prospectivity.

There is now a drill target pipeline consisting of four drill-ready targets at Schreiber-Pyramid No.1 North and No.1 South, Johnston-McKenna and Cook Lake, alongside five further targets which are not quite there yet; Johnston-McKenna Mill, Johnston-McKenna South, Schreiber-Pyramid South, Twomey Powerline and Schreiber-Johnston Gap.

A decision needs to be made on next steps, including drilling.

Tully — the status as of October 2023:

- Reviewing historical paperwork revealed original assay certificates showcasing exceptional high-grade gold intercepts, especially in drill hole 97-01 from Black Pearl Minerals’ 1997 program. Fulcrum has verified these certificates, confirming intercepts, including an exceptional 2,555.5g/t Au over 0.5 meters.

- Site visits have been conducted to assess access points and the condition of historic drill cores and samples. The good news is that he mine road leading to the project area remains in good condition, as is the Tully road branching, though some clearing will be required for drill access.

- A comprehensive pre-drilling program has commenced, involving digital data review, establishing mineralisation controls and grade distribution, and identifying target areas for resource extension. This will include reviewing and locating previously unaccounted holes, sampling selected drill core intervals, and preparing for hyperspectral core scanning analysis.

CEO Ryan Mee noted at the time that ‘the next phase of work marks an exciting time for Fulcrum as final data reviews and targeting is underway using photon assay methods ahead of the drilling programme. Photon assay is a relatively new concept which has been adopted by several companies with coarse gold deposits and has proved to be more effective in providing accurate gold grades over larger sample sizes which has in some cases improved grades.’

In summary, Big Bear is ready for a big drill, and Tully is perhaps the most advanced asset in the portfolio.

Ontario-based tailings assets

So far, this is nothing particularly out of the ordinary. Yes, you have a decent outcome for the uranium projects, and yes, Tully has a 107,000 ounce resource, and yes, Big Bear is very much drill ready.

But while these assets might make for a good investment case, you could probably find another dozen stocks with similar prospectivity. What sets Fulcrum apart from the run of mill (forgive the pun) explorers only really started to crystallise in late November — the Ontario-based tailings assets and by extension, the associated future potential.

This is where it gets interesting, and potentially fairly complex. While the above is all strictly factual, I am now going to venture into the realm of speculation.

Okay, here we go.

On 30 November 2023, Fulcrum announced it was entering into an option agreement to acquire a 100% interest in the Teck Hughes gold tailings project in Kirkland Lake (Ontario). Simultaneously, it told the world it was in ‘advanced discussions’ with Extrakt Processing Solutions to licence its proprietary technology — which is designed to separate metals from tailings without using cyanide.

More on Extrakt and its link to a major player comes below, but we need to get through the asset first. There’s a wonderful history lesson on Teck Hughes in the RNS, which I will spare you, and instead will cover the clef notes.

Suffice to say, there was a big gold mine, which made a massive tailings dump — Fulcrum wants to get the gold out and sell it for a profit. Some concepts are easier to grasp than others. The terms of the option appear both fair and fairly standard.

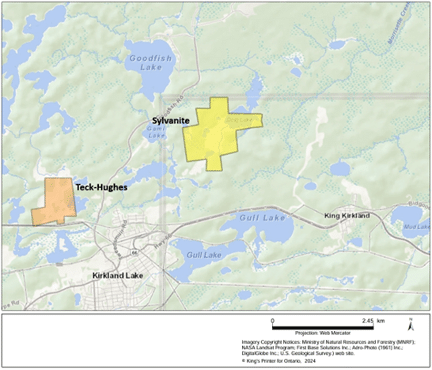

Teck Hughes is located circa 1.5km from the town of Kirkland Lake and consists of seven claims covering 112 hectares.

Historically the asset milled over 9.5 million tons of ore and produced just over 3.7 million ounces of gold. Sampling and auger drilling campaigns, starting from 1980 and then from between 2018-22 produced a non-compliant resource 43-101 estimate.

As part of the most recent campaign, 95 auger samples were assayed with the highest sample assayed at 1.23g/ton Au, and with 72 of the 95 samples assaying between 0.5 to 0.8 g/t Au. Taking this data alongside historical drilling results, the company has calculated that solely over the north, west and northeast arm of the tailings there is 6,531,300 tons of material at an average of 0.66g/ton Au for 138,460 ounces contained gold.

CEO Ryan Mee noted at the time that the project:

‘has the potential to be generating cashflow in the future, without the precursor mining stage saving not only time but capital. Our strategic structuring of the tailings project agreement allows Fulcrum to conduct the necessary pre-production work without the upfront commitment of the acquisition cost, which based on the non-compliant resource calculations of 121,700 ounces of gold equates to less than USD$3.30 per ounce of gold.’

For some perspective, the average price of gold in ground from a defined resource is typically around $82 per ounce — and needs to be drilled. This is a very cheap acquisition but makes sense when you consider the gold was previously unrecoverable.

Then on 24 January 2024, the business announced the start of the sampling programme at the asset — described as a ‘milestone’ which marked ‘a significant step forward as the Company enters the first phase of a testing and study agreement with Extrakt Process Solutions LLC, which moves the Company closer to agreeing a licencing agreement with Extract.’

The general idea of the sampling programme is to evaluate the real world efficiency of the solution in recovering gold (and other by-products) — with Fulcrum at the time in talks with the Ministry of Energy, Northern Development and Mines pertaining to the award of the mineral recovery permit for Teck-Hughes.

So, the company decided to start hand sampling at least five kilograms each from across five sites to get a representative sample — to be sent to Extrakt for amenability testing in Kentucky. They noted that the actual sampling should take less than a week, with test work to be completed circa 8-12 weeks from the delivery date.

Here’s the quick maths: assume the samples got sent in the post on 1 February and arrived on 8 February. Personally, I’m assuming that the CEO drove them down himself.

4 April is eight weeks later, and 2 May is 12 weeks later. It’s probably fair to allocate a week to get the results into a presentable format, and then a few days to get everyone from the Nomad to management to sign off on the wording — meaning results should arrive at the latest within the next month.

Then on 10 April 2024, Fulcrum announced another option agreement to acquire 100% of the Sylvanite gold tailings project — just 3km from Teck-Hughes. Like Teck-Hughes, this was previously a large producing mine, having milled nearly 4.6 million tonnes of ore and generating 1.67 million ounces between 1927-61.

There remains a historic tailings estimate of circa 67,000 ounces of gold, and recovery test work conducted in 2008 suggested that gravity, grinding and floatation combined could boost recovery of the gold from this pile to 70% — a theory given weight by subsequent pilot plant tests in 2010 and 2012 using 850kg of sample material.

The pilot at the time was considered a success, having demonstrated a viable and scalable non-chemical mineral processing approach to recovering a saleable gold concentrate, and also leaving reprocessed tailings with properties suitable for use as a subsoil when restoring vegetation cover on the former tailings area.

Mee notes the asset ‘not only enhances our presence in the Kirkland Lake gold camp, one of the most productive gold camps in Canada, but provides us with an opportunity to create a tailings hub and, therefore, economies of scale.’

While the acquisition cost is slightly higher at $3.80 per ounce, the fact the tailings are in established mining camps mean they are far less capex-heavy to bring to production. In terms of the option agreement, the basic premise is that Fulcrum can scale up to 100% ownership in stages, worth a total consideration of CAD$340,000 — though the optioner does get to keep a 1.5% NSR, of which half can be bought by Fulcrum in the future for CAD$500,000 at any time.

I would advise would-be investors to go through the RNSs — there is nothing particularly out of place, but it’s not practical to have every detail here.

The reason to invest

| BROKER | PROS | FEATURES |

|---|---|---|

| + Founded in 1974 + First-class web trading platform + Superb educational tools + Great deposit and withdrawal options | Fees: Spread cost; Overnight financing costs; Inactivity fees Min. Deposit: $£250 Tradeable Symbols: 19537 |

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. |

||

| + Fast withdrawal + 0% commission on US stocks + Real Cryptos, Stocks + Copytrading + Social Trading + PayPal deposits possible + One Stop Shop | Fees: $5 withdrawal fee. Inactivity fee. Min. Deposit: $50 Pairs Offered: 47 Leverage: 1:30 Tradable Assets: 2000+ |

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

||

If you’ve made it this far, it’s time to go into detail on what separates Fulcrum from other explorers in Ontario — or indeed, in general.

It’s Extrakt, and perhaps more importantly, their recently announced relationship with Bechtel. This is the key to generating real value.

Let’s break down what the company has publicly said to start with:

In that November 2023 RNS, the company announced it was in ‘advanced discussions with Extrakt for the use of its proven non-cyanide gold leaching tailings extraction technology.’ Practical testing of this tech, as we know, happened over Q1 and results are due imminently.

At the time, Mee enthused the tech ‘has the potential to have a significant impact on the metals industry. Importantly, the non-use of cyanide makes is pivotal from an operational cost perspective, and even more importantly from an environmental perspective.’

It was at the time also in negotiations to licence separation technology to both enhance precious metals recovery from tailings and dewater them afterwards. Extrakt test work incorporates a full suite of metallurgical characterisation including ICP (minimum 40 elements, including gold), XRD mineralogical analysis and batch leach testing — and as Teck-Hughes and many other tailings are only assayed for gold, there is potential additional upside for other commodities to be recovered.

Fulcrum and Extrakt have agreed a four phase deal as a first step to a licencing technology agreement. As follows:

- Phase 1 (High-Level Gold Recovery Investigation) — primary evaluation of how effective enhanced gold recovery through Extrakt technology is out in the field.

- Phase 2 (Conceptual Study) —to provide Fulcrum with insights into project viability using the information developed during Phase 1. Accuracy level of this study is circa 50%.

- Phase 3 (Laboratory Test Work) — to optimise some of the leach parameters as well as develop necessary scale-up parameters for all the major equipment of the operation.

- Phase 4 (Economic Assessment Study) —to provide a more accurate insight into the project viability using the more detailed test work results for the whole flowsheet. The study is aimed to be at a pre-feasibility level of circa 30% accuracy level.

Mee remains ‘delighted to be working with Extrakt and using their innovative technology… potential for considerable return on investment and perhaps more significantly, further opportunity in the extracting industry, which is effectively metals extraction without the risks of mining.’

Importantly, the pair are already looking ahead to Sylvanite, where sampling and test work with Extrakt will follow once Teck-Hughes is completed.

Now, there are three separate questions to muse on regarding this potential breakthrough technology.

- What does it actually do?

- Does it work?

- What is the long-term potential?

1. What does it actually do?

You’ll notice that the RNSs have little detail on what the tech does, or its potential advantages over the current situation. Don’t worry, I’ve hunted some of the detail down.

Extrakt has developed a new solid-liquids separation technology and leaching process to recover metals and more water, named TNS. After some fairly extensive research, it’s been approved for some 40 patents, covering multiple applications including formulations suitable to separate metals from complex oxide and refractory mineralized materials.

The process has theoretically, and at least once practically, been proven to recover more gold and silver than traditional leaching.

Further, while the cyanide-free tech is also more environmentally friendly, it’s also much faster. Silver cyanide leaching, for example, takes hours to days, and Extrakt’s tech is measurably quicker. It also separates liquids from solids, enabling dry-stacked tailings — working with coarse particles and not inhibited by the presence of clays.

The implication is that being able to recover minerals from what was previously classified as waste, companies can better fulfil sustainability commitments, use less green bush resources, conserve nature and also reduce their environmental footprint.

2. Does it work?

I hear about revolutionary new mining tech every other week. Few are actually as good as they claim to be, but Extrakt has some excellent evidence it does what it says on the tin.

Most importantly, in February 2024 Bechtel announced a new ‘strategic global alliance’ with Extrakt, specifically for TNS. Bechtel is a household name in resource circles, but for reference, it has been around since 1898, has completed more than 25,000 projects in 160 countries and is the gold standard in mining.

It does not get involved in tech that does not work.

Of all the other tech advances out there, Bechtel has chosen Extrakt’s.

Bechtel will identify commercial opportunities and provide engineering services to support the alliance, while Extrakt will continue to advance the TNS technology, manage intellectual property, and offer technical services.

Extrakt CEO William Florman enthused that he was ‘thrilled to team up with Bechtel in the global rollout of our technology, as they are an ideal partner to deliver this transformative solution to our customers’ while Bechtel President of BETS Faisal Mohmand noted he was ‘proud to bring this solid-liquid separation technology to the global market to support the energy and mining industries, address long-standing challenges, and drive sustainable practices for future generations to thrive.’

Secondarily, the tech is already being tested by Silver One at its Candelaria silver mine in Nevada— and to great effect. The company has reported that TNS could ‘potentially double silver recoveries and cut leaching times compared to its previous cyanide leaching.’

The business noted that among other ESG implications, TNS unlike cyanide consumes minimal water, and no toxic effluents are produced — and further, that tailings produced are inert and non-acid generating.

President and CEO Gregory Crowe noted that ‘the results show the technology performs well in the treatment of difficult or refractory mineralized material, such as the partially leached material on the Candelaria heap leach pads.’

Among the technical data, I’d also note the timings — all EPS tests had a leach time of just 24 hours, and this was non-optimised. Extrakt thinks these could be reduced even further. For a direct comparison, earlier bottle roll tests conducted by the Company on leach pad and fresh mineralization samples have been run for 46 to 96 hours and column tests for 120 days — and these were previously RNS’d.

This means you have a tech which can reduce capex and opex costs, increase metal recovery, and be better for the environment.

The other good news, from what I can gather, is that the patents are all about how standard components are put together, alongside the chemicals, additives, and overall process. This means that unlike other innovations which often require a specific part handmade by blind Belgian nuns in the ruins of the Acropolis at the apex of Mars and Jupiter, it *should* be easy to roll the tech out at scale, with short lead times and simple installation.

3. What is the long-term potential?

Fulcrum is seeking a licence from Extrakt, and potentially an exclusive licence over a specific geographical area. Let’s say that the tech works — Bechtel is involved — and all results from Teck-Hughes come back as hoped.

There is at least $10 billion on gold in tailings in Ontario alone, and this is almost certainly an underestimation given the lack of data available. This represents a huge external problem, and a massive potential opportunity.

All over Ontario, there are gigantic piles of toxic waste as a result of centuries of mining activity. The government has no real plan to deal with these. For context, at Teck-Hughes, tailings were pumped 2km north into Lost Lake and later held back by wooden dams when the lake hit capacity. It’s an oozing, steaming mess — and a key reason why locals resist mining developments is that they know, no matter what a company’s fine words might be, that they will create a long-term mess over time.

A swimming pool of filth leaching into the wider area, and the walls are close to bursting. Stability issues are also a big problem, because a heap of watery acidic tailings is hard to keep back. Water always finds a way.

Along comes Fulcrum, which has the practical experience to roll out Extrakt’s technology. They can deal with these tailings — and once they’re done, they walk away with the precious metals, leaving behind only water, chemical waste (which is disposed of) and a heap of dry, non-toxic tailings that can safely be let into the wider environment. How will this affect how the area can be used — or improve daily life?

Here’s the thing. When another operator wants to start a new mine, this often annoys local people. But when Fulcrum deals with the tailings that has been a blight for decades, how easy will it be to expand?

Mining licence rejected because your ESG considerations are too weak? There’s only one tech in town that can help you, and Fulcrum will have it. This could become the new standard. The business model could see rapid growth, with Fulcrum securing a pipeline of projects —Bechtel as the EPC, and Extrakt as the tech provider.

This makes Fulcrum more of an ESG and tech company than an explorer — and also makes it investible because, and I have made this point before, a different class of investor is attracted to new tech and ESG improvers compared to the standard junior explorer investor. As any investor will know, the key to success is often a tech that comes out of left field and wipes out competitors.

And it also means Fulcrum should be able to get finance on better terms.

Speaking of…

Finances & Management

Panther Metals has a significant holding. Mee as CEO holds roughly 13.8%, while director Aidan O’Hara holds a similar amount — and more than half of shares are not in public hands.

Aidan needs no introduction, while Ryan is a co-founder and serial private investor in natural resources, with over 16 years of experience in audit and consulting.

Seed funding for the business came from people close to the directors and the lowest price anybody invested in FMET initially was 10.25p, which explains the relative strength of the share price — unlike others where seed founders get shares for pennies and then sell at the spike.

On Panther, the off-market transactions as wished for are keeping the stock healthy — for context, Panther sold circa 2.3 million FMET shares at 15.2p each in March 2024 (retaining 15.3%), and CEO Darren Hazelwood clearly believes the company will succeed at Teck-Hughes, noting that:

‘Fulcrum have the potential to set the London junior market alight. A story I believe the Fulcrum team are currently underplaying.’

These Panther shares are not out on the market, instead being taken by existing and new shareholders in Fulcrum — generally people with a long-term interest in the business and believe in the strategy.

As an aside, Panther is also worth considering — and this share sale was long-awaited given the company’s need and desire to self-finance without diluting its investor base in this current market. And it is now hard locked into its current shareholding until 15 May 2025, with an orderly market provision on the stock until 15 May 2026.

In many ways, this removes a near-term volatility risk. In the period to 30 September 2023, Fulcrum reported a pre-tax loss of £434,473 but held a cash balance of £804,026. However, cash burn will have slowed as the focus moves to this new opportunity.

The bottom line

Fulcrum Metals has some genuinely valuable assets in Canada, but the bottom line is that getting hold of a licence for Extrakt’s technology could see its share price explode over the next few years. And a lot will depend on the licensing terms.

Of course, it remains early days. But FMET is not a company that has been going on for decades. It’s relatively young, with a clear focus since 2017 to build something different.

And as the Greek philosopher, Archimedes, said:

‘Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.’

| BROKER | PROS | FEATURES |

|---|---|---|

| + Founded in 1974 + First-class web trading platform + Superb educational tools + Great deposit and withdrawal options | Fees: Spread cost; Overnight financing costs; Inactivity fees Min. Deposit: $£250 Tradeable Symbols: 19537 |

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. |

||

| + Fast withdrawal + 0% commission on US stocks + Real Cryptos, Stocks + Copytrading + Social Trading + PayPal deposits possible + One Stop Shop | Fees: $5 withdrawal fee. Inactivity fee. Min. Deposit: $50 Pairs Offered: 47 Leverage: 1:30 Tradable Assets: 2000+ |

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

||

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.