Risk management is an essential skill for investors, irrespective of risk appetite. Investors are advised to diversify their portfolios and invest in low-risk assets to manage their risks regardless of age or investment goals. This article extensively discusses one of the most common low-risk investment assets, bonds, and how to invest in them.

Concise Overview

- Investing is an essential part of financial literacy

- Irrespective of your risk appetite, investors must always have low-risk investments to help manage investment funds

- Bonds are a great low-risk investment option

Introduction to Bonds

As individuals, we lend money to people around us—family members, friends, colleagues, and others. Sometimes, we even borrow from them when we need to settle debts or cover expenses. The truth is that everybody borrows! And sometimes people don’t pay back their debts, or when they pay back, you’ll be at a loss when the money is adjusted for inflation.

It is possible to approach the borrowing scene with a profit mindset, meaning you can lend money and receive interest on your loan until you get a refund. Governments, agencies, and large corporations sell bonds to the public as a way to raise funds by borrowing from them. This article covers everything you need to know about bonds and how to invest in them.

What Are Bonds and How Do They Work?

A bond is a type of debt security that an investor can purchase. Bonds are created when a government or corporation borrows money and issues bonds in return for the loan. When you buy a bond, you’re essentially lending money to the issuing entity and earning interest on it until it matures.

When the bond matures, you get your money back. You can also sell your bond before it matures if you want to recoup some of your investment or earn more interest on it for extended periods.

The issuer provide you with a fixed rate of return, which means you know exactly how much money you’ll make if everything goes according to plan. However, there’s a chance you could lose some or all of your investment if interest rates rise or the company issuing the bond goes out of business.

Investing in Bonds

Investing in bonds is a simple process. But it requires proper understanding to avoid situations where your money is tied up with a government or corporation, and you cannot access it. If you want to invest in bonds, here is a short and surefire approach you can follow.

Know the Bond You Want to Buy

In stocks, you can buy the shares of any company you deem profitable. The situation is similar for bonds, but more options for investors regarding bond investment are available. You can lend money to governments, government agencies, corporations, and other establishments.

As a beginner, buying government bonds is the safest way to invest in bonds. The risk is low, and they are guaranteed by the country’s federal government, meaning the chances of a credit risk is shallow. Detailed information about the different types of bond investment will be discussed further in this article.

Understand the Bond’s Terms

All the different types of bonds have different terms and conditions that investors must understand before buying them. One of these terms is the maturity date—the expected time for the issuer to refund the loan to the investor. Investors must also know other terms like the interest rate, par value, and duration.

Purchase the Bonds

There are two ways to buy bonds. You can purchase the bond either as an individual or through a broker. Purchasing as an individual is quite demanding because you need to understand the technical terms used by the issuer. Also, you must have a certain amount of money to purchase directly.

However, if you are purchasing from a broker, the processes are simplified, and some brokers even send you tips to help you become a better investor. Investing in ETFs and mutual funds can reduce your risk in bond investment. These organisations combine multiple bonds and sell them to investors as one. This helps to reduce your risk and manage your investment.

Track Your Investment

Once you have purchased the bonds, the last thing to do is sit back and watch the bonds mature. The bonds have a fixed interest rate, and you can continue withdrawing this interest until the bond agreement expires. If, at any time, you are no longer interested in holding the bond, you can sell it off at a higher price and make extra gains.

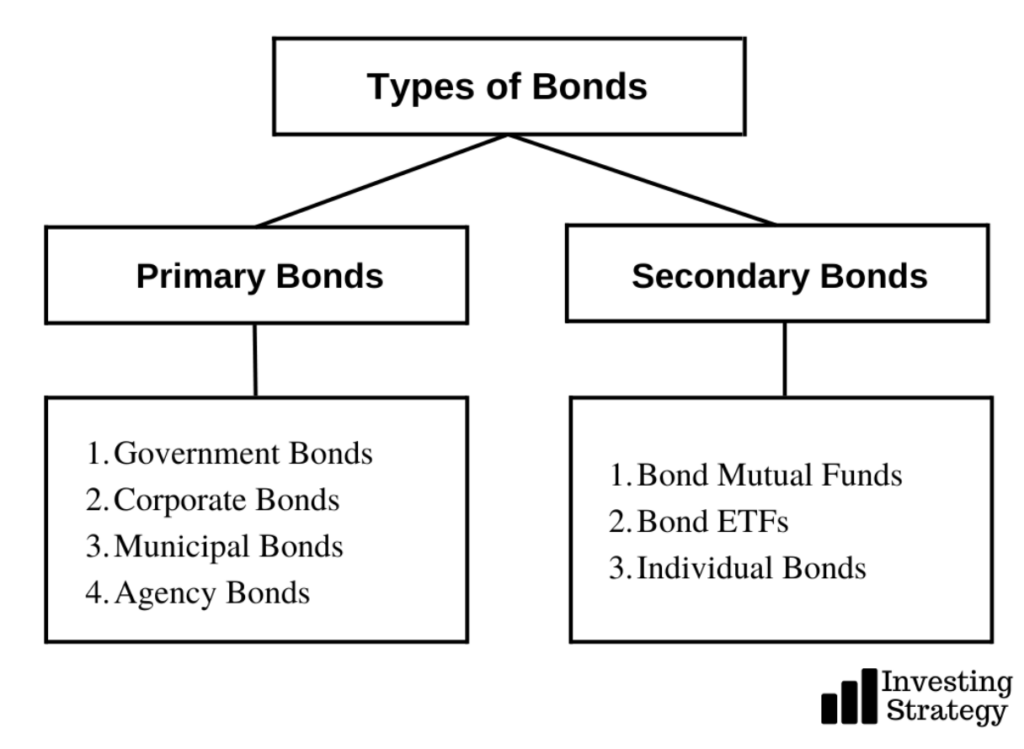

Types of Bonds

Bonds can be confusing for even the most seasoned investors. So before investing in bonds, you must understand the different types of bonds. You can classify bonds into two major categories: primary and secondary.

Primary Bonds

Primary bonds refer to the most common types of bonds available. There are four bonds in this category, and they are:

- Government Bonds

Government bonds are a type of bond issued by the government to pay for its expenses. These bonds are issued at a discount, meaning the bond’s face value is less than the price you pay. For example, if you buy a $1000 30-year bond with a 5% interest rate, you will initially pay $900 for it and receive $1000 when the bond matures in 30 years.

The interest rate on these bonds is usually fixed, making them less risky than other kinds of bonds because you know exactly how much money you’ll receive every year until they mature. They also have low default risk because government bonds are backed by national governments’ ability to tax their citizens—if a default occurs, taxpayers will be held liable for repayment.

- Corporate Bonds

Corporate bonds are a type of security that corporations issue. They are also known as debentures, a financial instrument allowing companies to raise capital.

Corporate bonds have many uses, including providing funds for expansion or acquisitions, paying off debt, and making dividend payments to shareholders. They are sold in the open market or on exchanges to investment banks and retail investors through a bond broker or the corporation’s website.

- Municipal Bonds

Municipal bonds are debt securities that local governments issue. They are typically used to finance public projects like schools, hospitals, roads, and bridges, and they have several advantages over other types of bonds. For example, they usually have a lower interest rate than corporate bonds because they aren’t as risky and don’t require the same amount of collateral.

Municipal bonds also enjoy a tax-free treatment at the federal level if you hold them in a tax-advantaged retirement account like an IRA or 401(k).

- Agency Bonds

Agency bonds are issued by an entity that does not issue debt on its behalf. Instead, it issues debt on behalf of others, like governments or private entities. These bonds are typically used to raise money for public projects such as building roads or repairing bridges. Agency bonds can also be issued to provide funds for private projects related to housing or education.

Secondary Bonds

Other types of bonds exist after the primary bonds. They have little volume and are not common among bondholders. Some of the types of bonds in this category include:

- Bond Mutual Funds

Bond mutual funds are a type of investment that allows investors to purchase a portfolio of bonds. Financial professionals manage bond mutual funds using their expertise to determine which bonds will be included in the portfolio.

- Bond ETFs

Bond ETFs are a type of bond that an investor can purchase through an exchange-traded fund (ETF). They allow investors to gain exposure to bonds without buying individual ones, which can be costly and time-consuming. The price of a bond ETF will change as interest rates change because the value of bonds that make up the ETF will fluctuate with interest rates.

- Individual Bonds

Individual bonds are bonds that an individual purchases. They can be bought through a brokerage firm or directly from the company that issued them. Individual bonds are debt securities issued by corporations, governments, or other entities and issued in the form of a bond indenture, a legal contract between the issuer and the bondholder.

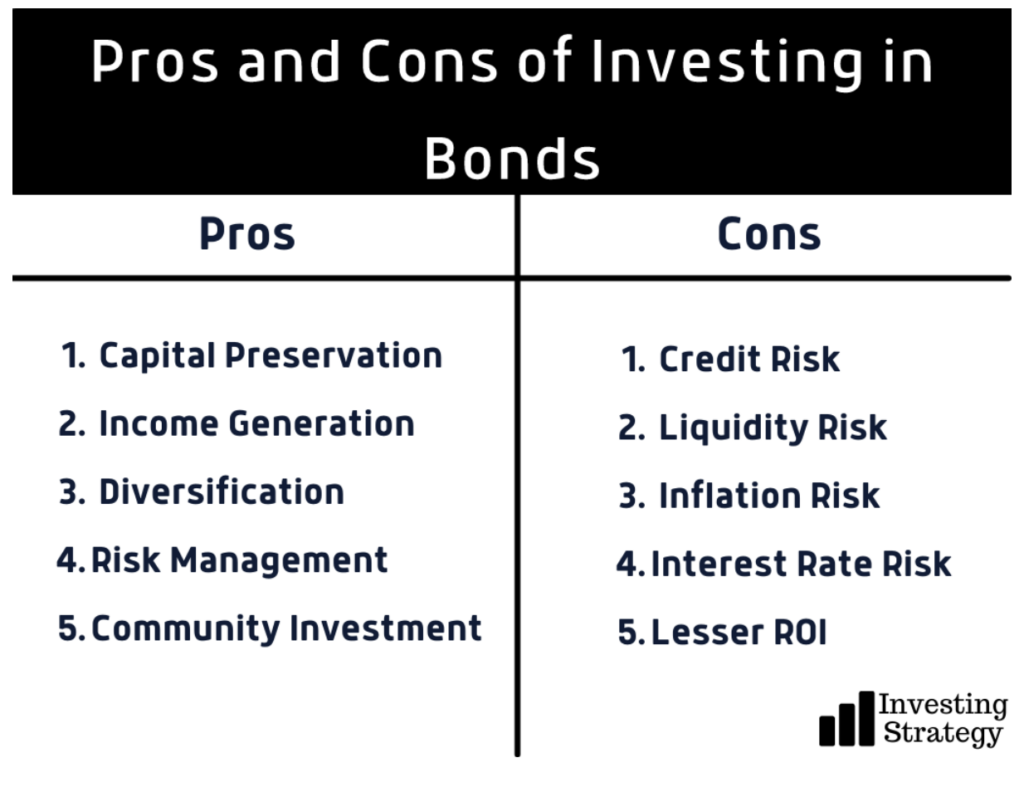

Pros and Cons of Investing in Bonds

Investing in bonds can be hugely rewarding, yet it has unique risks. Below are some of the risks and rewards of investing in bonds.

Pros

- Capital Preservation

Bonds are also considered low-risk investments because they are less volatile than stocks. They offer investors a fixed income and protect your money from market fluctuations and other factors that might negatively impact your investment portfolio. Hence, investors can be sure of what they’ll receive if they sell their bonds after a certain period.

- Income Generation

Income generation is one of the most significant advantages of investing in bonds, and it’s often a major factor for people choosing to invest in these securities. Income can come from two sources: interest payments and coupon payments.

Interest payments are made at regular intervals and typically represent a percentage of your invested amount. Coupon payments are made either quarterly or annually and are usually calculated as a percentage of your original investment.

- Diversification

Bonds, like stocks, are a type of security that represents ownership in a company. Unlike stocks, however, bonds are debt instruments—they’re loans to the company you invest in and come with specific legal rights. Although bonds typically pay lower rates than stocks (and thus provide less return), they can help balance out your portfolio by reducing its overall risk.

- Risk Management

Bonds are a great way to reduce risk in your portfolio. Bonds have a known, fixed rate of return that can be bought or sold at any time. The interest rate on a bond is fixed, so you can predict what return you will receive from your investment. They also pay higher interest rates than other types of investments. This means if you’re looking to protect your assets and get a decent return on your money, bonds are the way to go. Thus, they’re an attractive option for investors looking to reduce their portfolios’ overall risk and volatility.

- Community Investment

When you invest in bonds, you’re helping people and organisations get what they need to further their goals. You can choose which projects you want your money to be used for by carefully selecting which bonds will fit your portfolio best.

You can also choose how much risk you want to take based on how long you plan to hold onto the bond. The longer your investment term is, the higher your potential gain will be. The higher the gain, the more risk there is that something could happen that would affect its value before it reaches the maturity date.

The benefits extend beyond financial gain. This is because companies who have issued bonds often feel obligated to repay those who have lent them money by being more socially responsible than they otherwise might have been without an obligation to do so. This means they can use funds raised from issuing bonds toward causes that benefit local communities by providing jobs or services.

Cons

- Credit Risk

Bonds are considered safe investments, but they still carry a certain risk. The most significant risk is credit risk or the possibility that the bond issuer will default on their obligations. This can happen if they can’t pay back what they owe on the bond.

If you invest in bonds issued by foreign governments, there’s also currency risk. That is, the possibility that the value of your investment will change due to currency fluctuations.

- Liquidity Risk

Liquidity risk refers to the fact that investors may not be able to sell their bonds at any time. This is because bonds are not as liquid as stocks and other securities, which can be bought and sold quickly on the open market. The lack of liquidity in bond markets means investors must consider how long it will take to sell their bonds if they need cash in a hurry.

- Inflation Risk

The price of bonds is inversely related to their interest rate, which means if interest rates go up, it will be harder for investors to get a good return on their investment in bonds. Bonds are typically issued in large denominations, so even small inflation changes can significantly impact the total value of your portfolio. This can make bonds less attractive for investors looking for steady returns.

- Interest Rate Risk

One of the primary risks associated with investing in bonds is interest rate risk, which occurs when an investor’s portfolio value declines due to a rise in interest rates. Bond prices and yields move in opposite directions; as interest rates rise, bond prices fall, and vice versa. For example, if you buy a bond that pays 5% annual interest but then interest rates rise to 10%, you will likely have to sell it at a loss because it will no longer be attractive to other investors.

- Lesser ROI

Although bonds are considered a safer investment than stocks, they also offer a lower return on investment. Besides, inflation can further reduce this ROI, making bonds less attractive to investors.

Bonds Investment Tips

Bondholders make several mistakes that make them lose their investment. You can avoid these mistakes by taking note of the following tips:

- Track Your Investment

Before committing to an investment, you must be aware of the period it would take for the bond to mature. Government bonds can take up to ten years before they mature, and you might not be willing to wait that long for an investment.

- Check For Ratings

As assets, bonds have ratings that help investors know if they are worth investment. Always ensure to check the rating of bonds before investing. You can also check after investing to decide whether to pull out or hold on till the maturity date. As a rule of thumb, bonds with lower ratings are riskier investments, and you should avoid these kinds of bonds as an investor.

- Research the Issuer

Before buying a bond, research the background of the company issuing the bond. It helps you decide if the company will be able to pay bond interest regardless of the market condition.

- Evaluate Your Risk Appetite

It was mentioned earlier that investors should avoid bonds with the low rating because of their high risk. However, these types of bonds usually have high interest, which can tempt investors. Before you invest, you must evaluate your risk appetite and invest accordingly.

- Consider External Risks

Governments and other bond-issuing agencies have a fixed rate they pay bondholders. When interest rates fall below this value, the price of the bond increases and vice versa. Interest rate is only one in the vast array of external factors that affect the bonds’ value. As an investor, you must be aware of macroeconomic factors affecting investment and long-term plans.

Should I Add Bonds to My Investment Portfolio?

Bonds allow investors to diversify their investment portfolio and get a steady income on their investments. Before deciding to invest, you must evaluate your risk appetite and find a government or corporate bond that offers a similar term. Bonds protect you from market volatility if you have some of your stocks and high-risk investments. Finally, deciding to invest in bonds largely depends on your ability and willingness.

This article has been prepared for information purposes only. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.