Founded in 1999, Alibaba is a surging Chinese tech company that deals with online retail, technology, internet, and e-commerce.

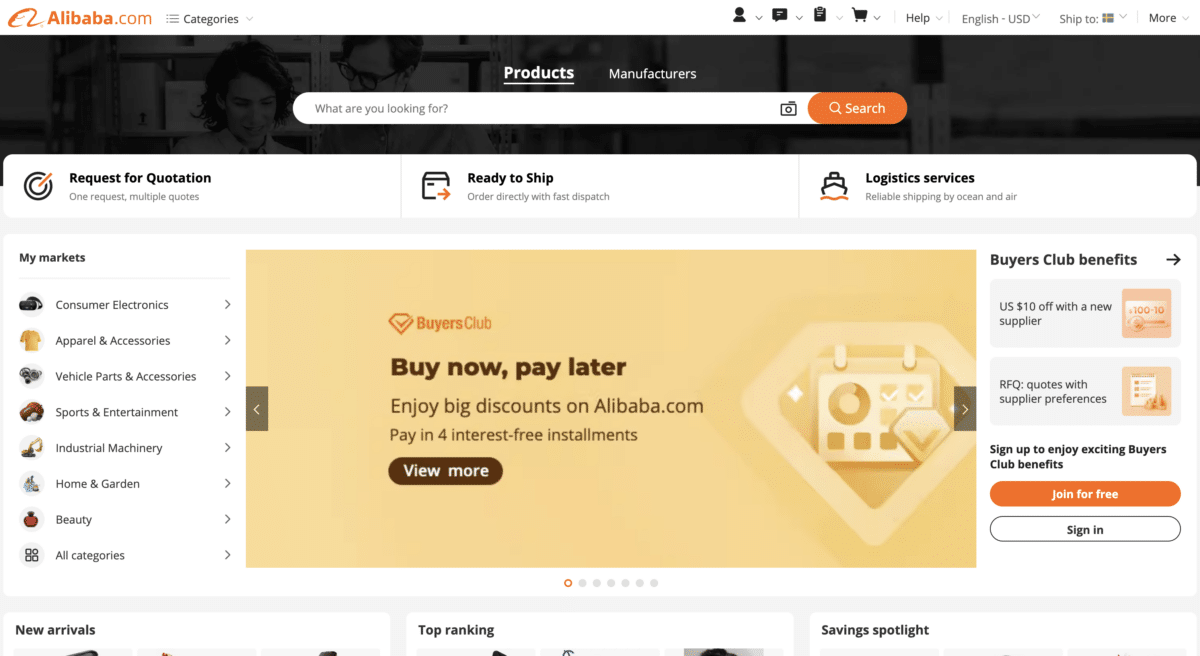

Over the years, Alibaba has branched into many tech-related domains in addition to its e-commerce strong suit. The company now offers cloud computing services, electronic payments, and search engines for shopping.

The e-commerce giant had its initial public offering (IPO) relatively recently. In 2014, it raised 25 billion by making its shares available through the New York Stock Exchange.

Founded in an apartment in Hangzhou, China, Alibaba attracted high-profile investors almost from its inception. Goldman Sachs and SoftBank poured $25 million into the business within four months of its founding. Yahoo later joined the list of investors.

As its activities branched into other tech sectors, one of Alibaba’s subsidiaries developed face-recognition and surveillance software designed to detect the faces of China’s various ethnic minorities. The move raised controversy and has remained largely unaddressed to this day.

How to Buy Alibaba Stock

Given that Alibaba is a Chinese company, buying its shares may not be as straightforward for US-based investors as buying the shares of a US company. There are two classes of Alibaba (BABA) shares available, Class A and Class B shares.

You can’t buy BABA shares directly through US stock exchanges. You can, however, buy American Depository Receipts (ADRs).

Once you decide how much money you’re willing to invest in Alibaba stock, access your brokerage account and make the order.

Find a good online broker that offers you low commissions and is reputable. If you want to buy stock, don’t go for the derivatives that many online brokers advertise. If you invest in a CFD, you won’t own any BABA shares. You will merely speculate on the price variation.

If you buy your Alibaba stock online, you may want to opt for a limit order. Limit orders allow you to enter a price and buy only at that price or better when the market conditions allow it. If you make a market order, you buy at the available market price.

Is Alibaba Stock a Good Buy?

Like many tech stocks, but more than its US peers, Alibaba is a volatile investment. It may carry good returns but may also produce short-term losses that some investors may not be able to handle.

It may be a good choice for investors looking for diversification with the possibility of steady appreciation over time added as a bonus.

One reason why some investors like Alibaba is that the tech giant offers exposure to the Chinese economy while eliminating the currency risks that direct Chinese stock investments carry.

The Chinese economy continues to be one of the most dynamic and fastest-growing global economies. It makes perfect sense for many investors to take advantage of its upsides through an indirect investment like Alibaba.

Alibaba Stock is Tough to Own

Once considered one of the safest Chinese investments, Alibaba has hit some rough waters lately.

- Chinese regulators recently levied a considerable antitrust fine on the company.

- The Chinese Government slapped some new restrictions on e-commerce.

- The Government stopped the Ant Group ICO, which would’ve raised considerable capital for the Alibaba subsidiary.