FTSE small cap stocks remain my favoured high-risk investments. Here’s 10 to consider for 2023. After an extremely successful 2022, and having covered dozens of speculative AIM companies, I am currently reviewing my portfolio of small-cap stocks for an even better 2023. As a caveat — and I have mentioned this before — this is […]

5 downtrodden share tips from Q4 2022, and what to do next

ReNeuron, Angus Energy, Caracal Gold, Bidstack, and Atlantic Lithium have not performed as hoped. Where next? As an avid investor in high-risk FTSE small-cap stocks, I always seek to write balanced articles that consider the various potential catalysts, dangers, and unpredictability of AIM shares. I don’t offer advice but seek to highlight opportunities — while […]

Where to Invest in the U.K. for the Best Rental Yields (2023 Study)

Where to invest in the U.K. for the best rental yields is a hot topic as investors seek profitable investment opportunities in the 2023 real estate market. Rental yield is a critical indicator for property investors. It measures the return on investment of a rental property. Therefore, it is crucial to know the factors that […]

How Can You Invest Your Money in the UK?

Soaring inflation has destroyed the feasibility of savings accounts as investment vehicles. Putting and keeping money in a savings account used to be the “laziest” investment method. Looking to make money off the interest, savers didn’t have to do much but ensure that they didn’t need the money they kept in such accounts. That is […]

The Cost of Hiring a Financial Advisor in the UK (2023 Analysis)

Many UK investors struggle to navigate the complex world of investments, making financial advice a necessity. However, hiring a financial advisor can be expensive and many investors are deterred from seeking professional guidance. In this analysis, we will delve into the pain points of UK investors looking for affordable and reliable financial advice. We will […]

BSFA shares: extremely promising, early stages, and some questions left unanswered

BSF Enterprises is home to the UK’s first ever full-scale fillet of lab-cultivated meat. High-risk investors like me are salivating. BSF Enterprise (LON: BSFA) shares are pretty much the last man standing in the artificial meat arena. Despite falling from a record 21.4p on 1 February, it pays to zoom out. The Main Market stock […]

Clontarf Energy: a brief look at the updated investment case

CLON shares have shot up after signing a non-binding heads of agreement with Next ChemX. This is not a low risk trade. Clontarf Energy (LON: CLON) investors did not enjoy a particularly pleasant 2022. A £3.5 million placing in late April was followed by significant investment into its proposed Sasanof-1 exploration well in Western Australia. […]

Vast Resources shares: diamonds in the rough?

High-risk, high reward. Exploratory mining, 129,400 carats of diamonds, and an explosive share price. My cup of tea. Vast Resources (LON: VAST) shares rocketed from 0.21p on 27 January to 0.79p by the start of February as the FTSE AIM miner announced exceptionally good news — more on that later — to investors. However, the […]

Audioboom shares: classic case of buy, hold, and wait

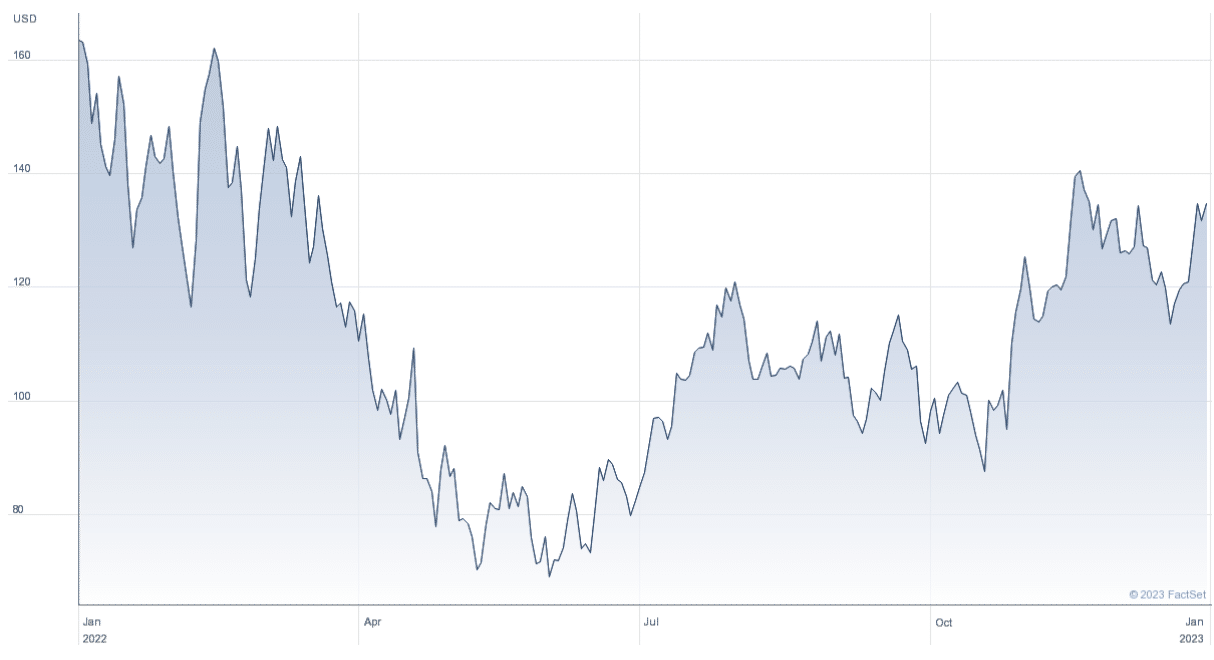

BOOM shares are an atypical FTSE AIM stock pick; at this price point a relatively low risk long-term portfolio addition. Audioboom (LON: BOOM) shares are becoming a strong contrarian stock pick for 2023. Arguably, the company’s BOOM ticker was responsible for its giddy 2,260p record high of April 2022 as Reddit stock hysteria combined with […]

With Looming China Recovery, These 5 Stocks Are Begging You to Buy Them

China’s economy is recovering and has opened up to foreign investment and international trade. This means some stocks are seriously worth your consideration. Being the second world’s largest economy, China’s economy has experienced a full-blown crisis since the outbreak of Covid-19. Chinese officials implemented several stringent measures to curb this situation, including enacting a zero-case […]

Bank of England Raises Interest Rates amid Raging Inflation

The Bank of England has recently raised its interest rate by half a percentage point, from 3.5% to 4%. The move is part of an effort to stem the tide of inflation that’s been raging for years. The interest rate is now the highest it’s been for the last 14 years. Like the Bank of […]

ITS shares: a good old-fashioned short-term trade

In The Style cannot continue as a going concern for long. Is a buyer waiting in the wings, or could ITS soon be facing down administration? In The Style (LON: ITS) shares are a long-term investor’s worst nightmare. ITS launched its FTSE AIM IPO in March 2021, raising £49 million in an oversubscribed placing valuing […]

Five Stocks To Sell As UK Interest Rates Hike

It is no secret that the economy of Europe, especially the United Kingdom, has faltered for some time, owing largely to the widespread Covid-19 pandemic. Inflation has increased significantly due to greater consumer demands—yet citizens are also being forced to pay high energy fees, which is attributed to the ongoing Russia-Ukraine war. It has destabilized […]

BOIL shares: going nowhere? Then short it

Baron Oil shares will likely dip in the coming days. Short it at your peril. Baron Oil remains one of my top four FTSE AIM picks for 2023. And fortunately, the stock has risen by 185% over the past year, and by over a third in the past month alone. However, BOIL is a volatile […]

Why UK small-cap biotech shares are going extinct

When a UK biotech firm starts to show promise, they set sail across the Atlantic. Investors can’t blame them. As a UK-based financial commentator, there is long-running joke about the UK’s FTSE 100. The premier index is often referred to as a ‘dinosaur’ index, filled with oil majors, miners, and banks with no real technological […]

Spotify, Google, Microsoft, and more: How Tech Layoffs Affect Stock Market and Why You Should Care

Tech layoffs are nothing new, but the numbers reported at some of the world’s largest tech companies have been staggering. To put it bluntly: layoffs are not good news for investors. From Apple to Google to Spotify to Microsoft to Amazon and beyond, many of the world’s largest companies are cutting jobs—and it isn’t pretty. […]

hVIVO shares: further to go in 2023?

hVIVO saw record revenues for another year in 2022 as demand for its human challenge trials accelerated. And 2023 could see further gains. hVIVO (LON: HVO) shares, dual listed on the AIM and Euronext markets, have sent investors on the rollercoaster ride typical of smaller biotech firms. However, unlike many AIM companies, HVO does not […]

Is 2023 the Right Time to Wade into Crypto Investing?

With “crypto winter” upon us and one scandal after another rocking the industry, is it now the right time to adopt a contrarian approach and start investing in crypto? Experts say you make most of your money during bear markets. You just don’t know it at the time. Although they have shown some signs of […]

2023 small-cap graphite stocks review: TGR, BRES, MARU, and GROC

Tirupati Graphite, Blencowe Resources, Marula Mining, and GreenRoc Resources could see significant share price growth through 2023. This is my prediction: graphite is the new lithium; or more accurately, graphite will become the new lithium over the next couple of years. Graphite is just as essential for the EV revolution and green tech. Graphite in […]

5 Struggling Stocks to Buy at a Discount Right Now

Investing in the stock market can be a lucrative opportunity, depending on the stock you choose. While profits are not guaranteed, you can mitigate risks by selecting stocks that have been affected by the COVID-19 pandemic or economic downturn but are now showing signs of recovery. Some of these stocks are currently available at a […]