In the US, the everything bubble has inevitably burst. But the coming melt-up could be equally as rapid and take institutions with similar surprise. Just under a year ago, I called the end of the US’s ‘bubble of everything.’ Stocks, crypto, housing, and debt; all were far too high compared to reality, amid rising inflation […]

3 best UK water stocks to watch in 2023

United Utilities, Severn Trent, and Pennon Group constitute the three best UK water stocks to watch in 2023, despite the complex cocktail of incoming headwinds. Water is rarely thought of as a commodity, but this may change very soon. A hallmark of commodities trading — including oil, gold, and wheat – is that they must […]

3 best UK oil stocks to watch in 2023

Shell, Harbour Energy, and Tullow Oil could be three of the best UK oil stocks to watch in 2023, as rising commodity prices meet with the rising tide of global recession. Oil has been the investing winner of 2022, and it’s not hard to see why. After a disastrous pandemic, where benchmark Brent Crude went […]

The true power of pension contributions

The Byzantine UK personal tax system makes pension contributions far, far more efficient than many investors realise. The disastrous UK mini-budget has all but been eradicated. New Chancellor Jeremy Hunt has made it clear that the unfunded tax cuts, including changes to the additional 45p rate, corporation, tax and the basic 20% income tax rate […]

Best soft commodities to trade in 2023

Cotton, wheat, and orange juice could all rise in 2023 as global economic demand soars while supply remains heavily constricted. Hard commodities stormed the headlines in 2022. It began with two years of global lockdowns crashing demand, with Brent Crude going negative for the first time in mid-2020. Then as the global economy recovered, demand […]

3 reasons why Microsoft could soon be buying Netflix

Netflix’s share price crash combined with obvious Microsoft synergies could make their recent advertising partnership a test run for greater things. It is unlikely to have escaped many investors that Netflix is having a bad year, even compared with the wider Nasdaq Composite crash. The US tech-heavy index has fallen by 33% year-to-date to 10,652 […]

3 best US tech stocks to buy on the dip

Meta Platforms, Alphabet, and Amazon could constitute three exceptional buying opportunities as the Federal Reserve’s resolve wavers. Right now, the US Federal Reserve funds rate is sitting in the range of 3% to 3.25%, having risen by 75 basis points at its latest meeting. While the central bank’s Chair, Jerome Powell, has warned ‘we need […]

Could the UK bank rate hit 10% by mid-2023?

Diverging monetary and fiscal policy, a political blunder of epic proportions, and an increasingly hawkish Federal Reserve could see UK rates hit double-digits sooner than the markets think. Right now, the markets are pricing in an increase in the UK base interest rate to 6% by mid-2023. However, a worst-case scenario could plausibly send them […]

Mark Zuckerberg’s $71 Billion Wealth Wipeout Puts Focus On Meta’s Woes

As other US tech moguls suffered losses this year, Mark Zuckerberg is no exception. However, his loss is exceptionally huge, making him drop fourteen places on the list of the world’s wealthiest billionaires. Mark Zuckerberg, the CEO of Meta (Facebook), an international technology conglomerate, has seen his wealth increase and drop in the past. However, […]

3 best UK defensive stocks for the 2023 recession

AstraZeneca, National Grid, and British American Tobacco are three FTSE 100 stocks boasting attractive defensive qualities for risk-averse investors. As the UK economy lurches from crisis to crisis, many investors are taking a step back to recalibrate their portfolios, as they brace for the emerging recession to take a turn for the worse. Soaring energy […]

How to trade sudden political shifts: Ukraine, China, India, the UK and the US

Sudden political shifts, such as the start of the pandemic, Ukraine war, and potential sterling crisis, can tempt investors to try their hand at trading. Tread lightly. The world has changed since the humdrum days of 2019. While investing over the long term for predictable returns remains the best way to reliably grow wealth, flash […]

2 best gold stocks to watch as inflation roars in 2022

The twin titans of the gold mining industry, Newmont Corporation and Barrick Gold, could see significant upside as the world tips into recession. UK CPI inflation in August was at a heady 9.9%. And despite a slight drop on July’s 10.1%, it shows no sign of slowing down. The Bank of England has predicted that […]

UK mini-budget: what to watch for and how to prepare

Uncosted tax cuts and a plunging pound offer potential investing opportunities for the quick-witted trader with an appetite for risk. On Friday, the new Downing Street duo, Chancellor Kwasi Kwarteng and PM Liz Truss, will announce a mini-budget. Dubbed a ‘fiscal event,’ this is the initial response to the cost-of-living crisis that the Bank of […]

3 best solar energy stocks to watch in 2022

Enphase Energy, First Solar, and SolarEdge Technologies could be three of the best solar energy stocks to watch as the UK and US seek further energy independence. 2022 is the year to think about investing in some of the best solar stocks. Demand for renewable energy is skyrocketing. The surge of post-pandemic demand combined with […]

UK Energy Bills Freeze: key issues and long-term problems

The UK energy bills freeze saw a deep sigh of relief sweep through UK households. But with Sterling sinking, it would be premature to pop the champagne. On 8 September, newly-appointed PM Liz Truss announced that the UK household’s average annual energy bill will be limited to £2,500 for the next two years. Previously, this […]

What Liz Truss As Prime Minister Means to the UK Economy

Britain’s next prime minister, Liz Truss, is ushered into power with a barrage of economic problems that presently ravage Britain. The 47-year-old Conservative politician who has served as foreign secretary beat Rishi Sunak in an election she convincingly won fair and square to become the next prime minister. With new roles come new problems to […]

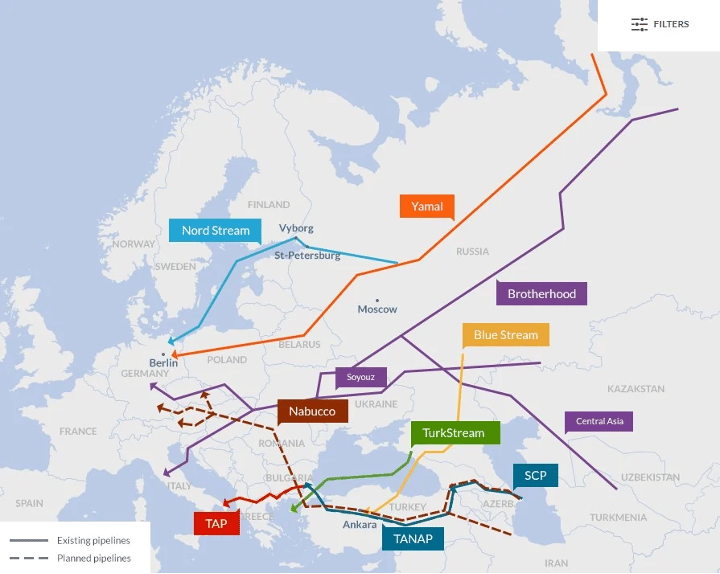

Natural gas: price is the symptom, supply is the cause

As Nord Stream One closes indefinitely, soaring gas prices mean the opening up of both painful choices and rare investing opportunities. Gas is now the UK’s foremost political and economic problem. The country has a new Prime Minister whose instincts are to avoid ‘handouts,’ but will nevertheless be forced to give them out. Meanwhile, the […]

Is a UK housing market crash now inevitable?

The UK housing market has long been an unassailable economic force. Until now, that is. According to the ONS, the average UK house price now stands at a record £286,000, an increase of 7.8% over the past year. For context, it was just £157,200 in 2009. While a further increase is possible, a substantial fall […]

5 signs that the 2023 global recession could evolve into the worst ever

The pandemic hangover, energy costs, geopolitical tensions, tightening monetary policy, and a volatile market together constitute globally significant risks. The 2023 global recession is just around the corner. The response to the covid-19 pandemic crash was the most expensive global economic bailout ever, backed by virtually every government in the world. Now an unprecedented crisis […]

Apple’s iPhone 14 September Launch: What You Need to Know

Apple’s iPhone 14 event may come earlier than expected this year. The company is eyeing a date next month for its schedule. Amid the global inflation, stock market fluctuations, and demanding fiscal policies, the flagship iPhone is set to drop at the earliest on Wednesday, September 7. According to records, iPhone sales constitute massive earnings […]