China’s economy is recovering and has opened up to foreign investment and international trade. This means some stocks are seriously worth your consideration.

Being the second world’s largest economy, China’s economy has experienced a full-blown crisis since the outbreak of Covid-19. Chinese officials implemented several stringent measures to curb this situation, including enacting a zero-case policy. Despite such efforts, the virus spread didn’t stop soon enough, and economic conditions worsened.

According to a report by Nippon, growth in China’s economy slowed to its second-lowest level since 1992, with the annualised GDP rate falling to 0.4% between April–June 2022. This is to demonstrate how the Covid-19 pandemic nearly gave the economy an unwelcome historical record.

Now, things are looking good. Reuters reported that, following three years of pandemic isolation and border closure, China is ready to deal with the outside world again. Vice-Premier Liu has declared the country’s openness to international trade.

In the same report, Liu called for international investors to play a critical role in Beijing’s attempts to revive its slowing economy. In light of this, investors may consider purchasing stocks from the Chinese emerging markets index.

With China’s recovery, some stocks are begging you to buy them. This article will discuss these stocks and why they are worth your trust.

1. Alibaba Group Holding Ltd. (BABA)

Alibaba is an e-commerce company that provides online and mobile retail services. It offers advertising and marketing solutions to merchants through its platforms, such as Taobao Marketplace and Tmall. In addition, the company operates Alipay, a third-party online payment platform that enables users to pay for goods or services online through their mobile phones.

Alibaba is China’s largest e-commerce company, with a market capitalisation of $294.89 billion. In 2020 its revenue was $94.46 billion. In 2021, it reached $129.44 billion, and by 2022 it had climbed to a staggering sum of $129.98 billion. Alibaba’s highest closing stock price is $317.14, recorded in October 2020. This represented a significant rise from its earlier low prices.

The company is a top performer due to its solid fundamentals and growth potential. With China’s economic recovery, the stock has become even more attractive. The stock price has increased dramatically this year. On January 30, 2023, the closing price was $111.2 compared to $88.09 on December 30, 2022.

2. Bilibili Inc. (BILI)

BILI is a Chinese video entertainment platform that enables users to watch and create content. The company offers a website and mobile application which allows users to access content from various genres, such as animation, music, cartoons and comics, and game-related products. It also provides community features such as forums, groups, and events for users to interact with each other.

The company has a market cap of $9.69 billion and is headquartered in Shanghai, China. Bilibili Inc. is traded on Yahoo Finance under the ticker symbol ‘BILI.’ It reported $21.54 million in revenue for the quarter that ended December 31, 2022. This represented an increase of 10.03% from last year’s quarter, when it earned $19.38 million.

BILI is a promising investment because of its strong growth potential and competitive advantage. The company has been able to boast a strong revenue growth rate since 2017, increasing its revenue by more than nine times. At the close of trading on December 30, 2022, BILI’s share price was $23.69. By January 30 — just a month later — it had risen to $25.32 per share.

3. Jingdong Inc. (JD)

JD is a Chinese e-commerce company. The platform was founded in 2004 by Liu Qiangdong, who is still the chairman and CEO of JD. The company operates two major e-commerce platforms: an online marketplace and a fast-growing shopping mall. JD offers consumers worldwide access to millions of products from thousands of brands — all at friendly prices through these platforms.

JD has seen rapid growth over the last few years, with its revenue increasing from $28.69 billion in 2015 to $147.29 billion in 2021 — an increase of more than five times. The company also saw a significant spike in its share price over that period. During that time, JD’s stock price reached its highest end of a day of $106.88 per share, a significant increase from its lowest of $19.27 per share.

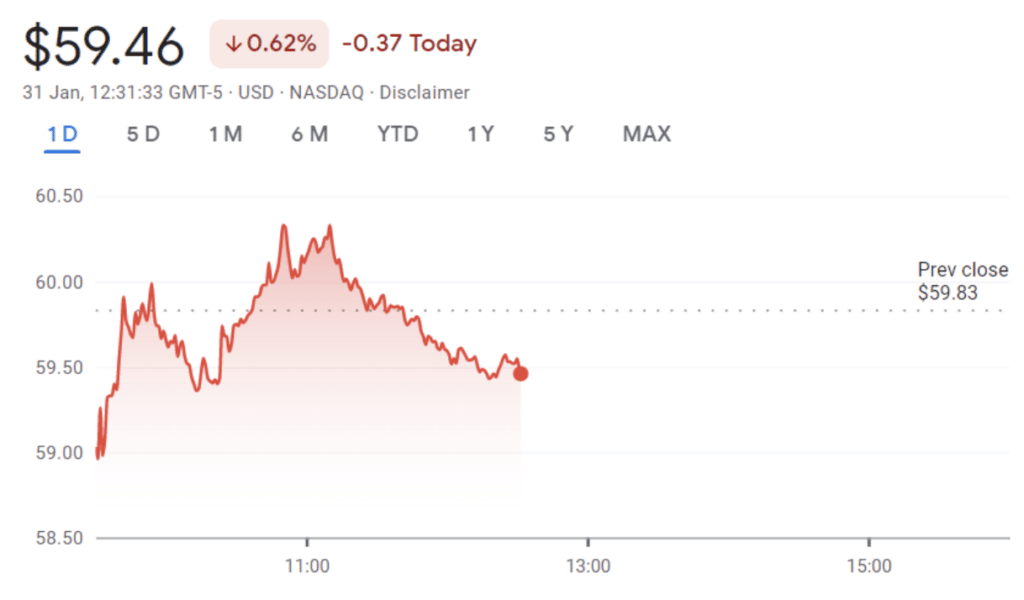

The rise was an impressive feat, but the company’s success continued beyond there. JD has grown each year, becoming one of China’s largest retailers. In fact, it is the second-largest e-commerce company in China, behind only Alibaba. At the time of writing, JD’s stock price sits at $59.83 per share — a decrease from its all-time high but still much higher than (the $56.13) it was on December 30, 2022.

4. Baidu (BIDU)

Baidu is one of China’s largest internet companies and can be a great addition to your investment portfolio. It is often referred to as ‘the Google of China,’ but Baidu has a different business model than its American counterpart. The company provides search engine technology and solutions and offers other services, such as artificial intelligence and autonomous vehicles.

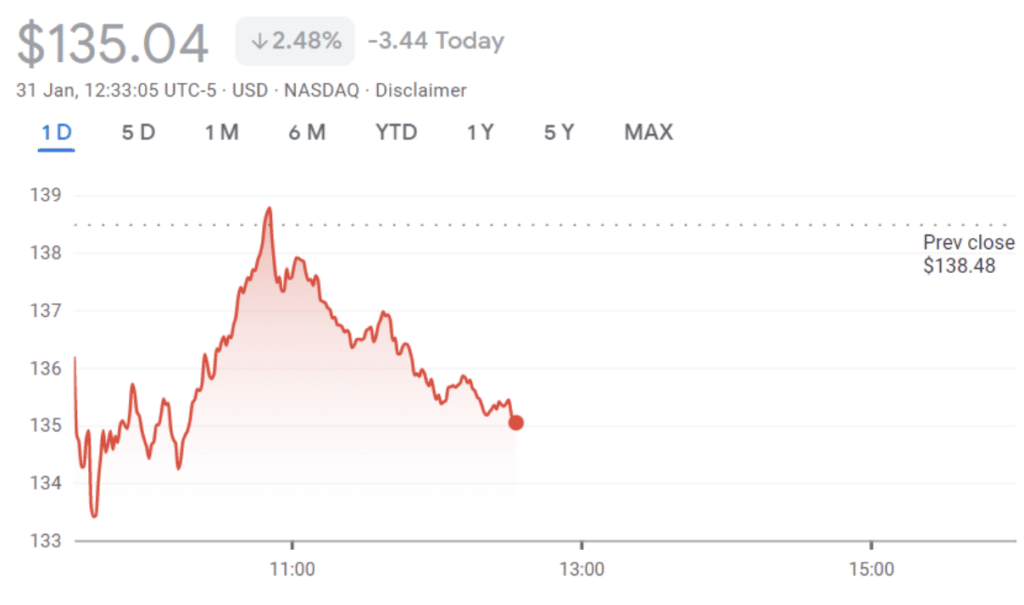

Baidu went public on August 5, 2005, at $27 per share. By 2022, the stock price had rocketed to an estimated $140 — a staggering increase from its initial value. The current stock price for Baidu is $138.48 per share, and it’s shown steady growth over the past decade. In fact, according to an article on The Ranking Digital Right, the company is the ninth-largest internet company in the world — behind Twitter, Google, Yandex, and others.

Baidu has a market cap of $48.05 billion as of January 30, 2023. In addition, it has been successful in China, holding most of China’s search engine market and commanding an estimated 72% share. The company’s success is attributed to its ability to provide a user-friendly search engine and mobile experience, which has increased advertising revenue.

5. BYD Company Limited (BYDDF)

BYD Company Limited (BYDDF) is China’s largest manufacturer of electric cars and battery-powered vehicles. The company was founded in 1995 by Wang Chuanfu, the chairman. In the early 2000s, the company also provided consumer electronics and information technology services, such as smartphones and cloud storage.

BYD’s market cap as of January 30, 2023, was $108.855 billion. In addition to being a leading producer in China’s electric car market, BYD has been successful because it has been able to penetrate international markets due to its technology patents and partnerships with companies such as Apple Inc. In fact, BYD is now a leading competitor to Tesla Motors Inc., the pioneering company in electric car manufacturing.

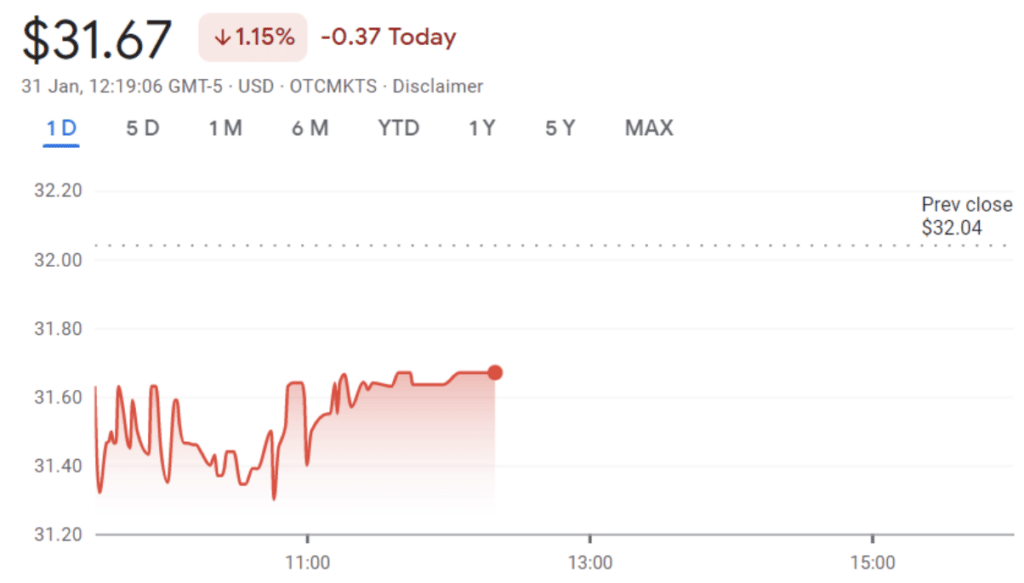

The company’s closing share price has grown from $24.57 on December 30, 2022, to $32.04 on January 30 — a promising sign of growth. BYD’s success is attributed to its ability to penetrate the Chinese market, which has been one of the most profitable markets for electric cars. This is one of the stocks you’ll want to have as an investor in the electric car industry.

Why Are These Stocks Worth the Investment?

Aside from choosing a stockbroker to be on the safer side, these stocks are worth your investment due to the following reasons:

- Unique Business Models

These companies have unique business models, which make them stand out from their competitors. BYD Co., for example, is a manufacturer of electric cars that also designs, manufactures, and sells its vehicles under the BYD brand. The company’s BYD Song Plus DM-i is considered one of the best-selling electric cars in the world today.

- Revenue Streams

These companies have multiple revenue streams, which means they have more than one source of income. For instance, Baidu has a search engine, an e-commerce platform, and a mobile OS. It also has various other services that generate revenue for the company.

- Large Market Share

These companies have a significant market share. For example, Baidu has a search engine that is used by more than 70% of Chinese internet users. This means it has the largest market share in China compared to its competitors.

- High Profitability

These companies are coming back to being highly profitable as they were before Covid-19. Alibaba, for example, had a revenue of $21.40 billion in 2016. This is more than six times its revenue in 2021, which was $129.44 billion.

- Growth Potential

These companies have high growth potential. The Chinese internet market is still growing fast, and so will Baidu still keep growing. This company is well-positioned to keep taking advantage of this growth opportunity.

What Does the Future Hold If I Invest?

Investing in these stocks is like trading the volatility index – you never know what’s coming. But to invest is to expect the stocks to grow as quickly as before the Chinese government shut its borders. Since the Chinese economy is the second world’s largest economy, investing in these stocks should command just-enough profit. But then, it all boils down to your trading strategies. But also note that there is no guarantee your investment will go according to plan because things change fast in the business world.

This article has been prepared for information purposes only. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.