CLON shares have shot up after signing a non-binding heads of agreement with Next ChemX. This is not a low risk trade.

Clontarf Energy (LON: CLON) investors did not enjoy a particularly pleasant 2022. A £3.5 million placing in late April was followed by significant investment into its proposed Sasanof-1 exploration well in Western Australia.

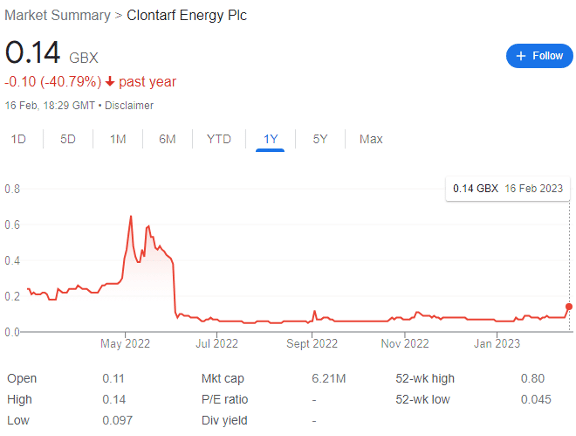

With excitement building for its 10% economic interest, CLON shares shot up to as high as 0.65p during May, before a painful RNS hit on 6 June — sorry for any PTSD — where it announced the final result: ‘No commercial hydrocarbons were intersected. As planned, the well will now be plugged and permanently abandoned.’

The share price promptly collapsed, and it had been trundling along ever since, though it’s worth noting that further exploration in the area is ongoing.

Ouch. This only goes to show that high-risk, high rewards is a double-edged sword that cuts both ways.

But 2023 is looking at least a little brighter — not for those who bought at the top sadly — but nevertheless, CLON shares are now changing hands for 0.14p apiece, an increase of 137% year-to-date. However, it has been a volatile rise, and the £6 million market cap clearly makes this company highly speculative.

The question for investors is this: are you ready to be hurt again in the quest for high-risk profits?

Clontarf Energy: projects in brief

CLON is an emerging lithium and oil and gas exploration and production company now focused on projects in South America and Africa. The company was formed following the sale of Pan Andean Resources’ Colombian and Peruvian assets for $32 million to Petrominerales, whereby a merger of the remaining assets including those in Bolivia and Ghana formed the basis for Clontarf Energy.

CLON owns a 60% economic interest in the Ghana Tano 2A Block, a 1,532km Block, close to four recent discoveries by Tullow Oil plc and Kosmos. It’s also signed a Memorandum of Understanding (MoU) with Chadian authorities on sedimentary basin acreage available close to the export pipeline.

And crucially, it’s also in discussions with YLB, the Bolivian State Lithium company, on exploration and development of high grade, low impurity salt-lakes. Samples are being analysed, and initial processing work is underway. There are also ongoing discussions for additional oil and gas exploration opportunities in other prospective countries.

This summary has pretty much been lifted straight from the investor site — and doesn’t do much to inspire confidence. However, recent concrete developments could be changing the investment case.

Financial situation

The most recent figures available for CLON come from interim results covering the six months to June 30. Importantly, the company cited it was ‘confident of adequate funding, whether in London or Australia, for near to medium term ongoing activities’ when the results were released on 22 September.

But here’s the rub — the company lost over £4.5 million before tax in the half and was left with just £188,000 in cash. Almost all of this loss was attributed to the costs of attempting to develop Sasanof-1. But it also had net liabilities of almost £1.9 million, which altogether represented ‘a material uncertainty that may cast doubt on the Group’s ability to continue as a going concern.’

It doesn’t take an investing genius to figure out CLON’s next move — and sure enough, on 16 January, another placing for £1.3 million was issued for 2 billion new ordinary shares, representing 45.76% of the company’s new share capital.

The problem is that this new capital, despite hugely diluting existing shareholders, and combined with the £188,000 in cash that had likely already been spent, didn’t even cover the liabilities as of 30 June 2022.

The catalyst comes

On 15 February, a longed-for catalyst hit investor inboxes, sending shares rocketing up by 100% to 0.14p. CLON announced a heads of agreement around the potential formation of a 50:50 joint venture with US-based NEXT-ChemX Corporation, covering the testing, marketing, and deploying of NCX’s proprietary direct lithium ion extraction technology in Bolivia.

Importantly, this agreement is non-binding and subject to final due diligence. The parties have entered into formal documentation, which is intended to occur within the next 30 days, i.e. by around 17 March.

NEXT-ChemX’s ion extraction tech uses the surface area of hollow fibre membranes to extract lithium ions from brines, by imitating biophysical processes of natural principals to induce ions in solution to cross the membrane barrier. For context, this mimics how mammal organisms remove wastes from a donor liquid without physically mixing with an acceptor liquid.

NCX has proven that the tech works in the lab, though it remains untested in field work. It’s also worth noting that the tech is patent pending, another risk to be managed. However, the technique uses limited water and energy, and produces far less waste than conventional extraction methods.

NCX is planning to assemble a pilot plant in Texas to test large volumes of brines, moving towards feasibility and commercialisation. The plant will test circa 1,000 litres of each specific brine, with an overall 20,000 litre trial run size, allowing a customised NCX DLE commercial system to be assembled on site for field testing.

CLON is in discussions with YLB to test NCX’s tech on priority brines, with negotiations on their source and volume ongoing. The idea is that pilot plant testing and extraction will begin next month, with results expected in May.

As part of the agreement, CLON will contribute $500,000 towards the pilot plant as an ‘exclusivity fee’ for the use of NCX technology. NCX will then issue shares equal to $500,000 at some point in the future to CLON.

Like a man desperately trying to eek the last of the fairy liquid out of a demonstrably empty bottle, there’s further placings to be had. CLON is issuing 385 million new shares on proceeding with the $500,000 pilot plant contribution, 250 million more after successful pilot processing of Bolivian brines through the NCX pilot plant, and a further 250 million after entry into a construction and processing contract between the JV and the Bolivian authorities on processing of Bolivian brines utilising NCX tech.

In addition, NCX retains the option — though not the obligation — to invest £250,000 into CLON at a negligible price for up to 30 days after the HoA was signed.

Chairman David Horgan makes the fair argument that ‘projected global (lithium) demand cannot be delivered without major Bolivian output. The delay has been the shortcomings of evaporative ponds at high altitude, some rainfall and impurity levels. We believe that these constraints may be bypassed through innovative technology.’

So — in summary, CLON has entered a non-binding agreement to partner with a company that has developed a lab-tested but unproven-in-field novel lithium extraction tech, which is not yet patented. CLON, which remains financially insecure at best, is expected to contribute $500,000 it doesn’t have to fund the pilot plant, which will be paid back at an unspecified time, and along the way will issue a further 885 million new shares.

On a fundamental basis — excluding technical analysis — this seems very risky. Of course, if all goes to plan, proving extraction success in Bolivia could also be exceptionally rewarding.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.