Investing in the stock market can be a lucrative opportunity, depending on the stock you choose.

While profits are not guaranteed, you can mitigate risks by selecting stocks that have been affected by the COVID-19 pandemic or economic downturn but are now showing signs of recovery. Some of these stocks are currently available at a discounted rate, providing investors with the opportunity to purchase them at a lower cost.

By choosing the following five specific stocks, buyers may see an improvement in their fortunes. It is important to note that volatility and market conditions can also play a role in the performance of the stocks.

1. Etsy

Etsy was once a popular platform, but by 2022, sales had significantly decreased due to a waiver implemented during the early stages of the Covid-19 pandemic which caused consumers to abandon its online presence.

Despite the economic uncertainty, there has been an increase in the value of the dollar, leading to a sharp decline in annual profits this year. However, there is a possibility that Etsy will regain its stability over time.

Etsy has been recovering from losses by improving its e-commerce platform and offering situation-specific items. Even though it faced challenges with year-over-year comparisons, the company is focusing on maintaining strong demand.

In the most recent quarter, Etsy’s gross merchandise sales reached over $594.47 million on its marketplace, a significant 12% increase from the $532.43 million in the previous quarter. The company is also seeing an influx of new customers. Despite the impact of the dollar rate, the business has continued to grow.

In fact, the management team has said it expects its GMS to be between $3.6 billion to $4 billion in Q4 2022. This represents a 5% year-over-year decrease and a revenue of 700-780 million.

2. Kinder Morgan Inc (NYSE: KMI)

Kinder Morgan, Inc. (NYSE: KMI) is a leading energy infrastructure company in North America. The Boston-based hedge fund has held shares of KMI since the start of 2018.

Despite outperforming the broader market index initially, the stock has seen a significant decline over the past year due to weak financial performance and declining commodity prices. However, the hedge fund has still benefited from substantial dividends from Kinder Morgan, with a current yield of 5.89%.

Kinder Morgan is currently a cost-effective stock option with strong potential for growth. The company projects net earnings of $2.1 billion for 2021, a significant uptick from their projected 2020 earnings of $119 million.

Additionally, the company’s adjusted EBITDA and Distributable Cash Flow (DCF) forecasts are estimated to be $6.8 billion and $4.4 billion respectively, providing further indication of their financial stability and potential for success.

3. Alphabet

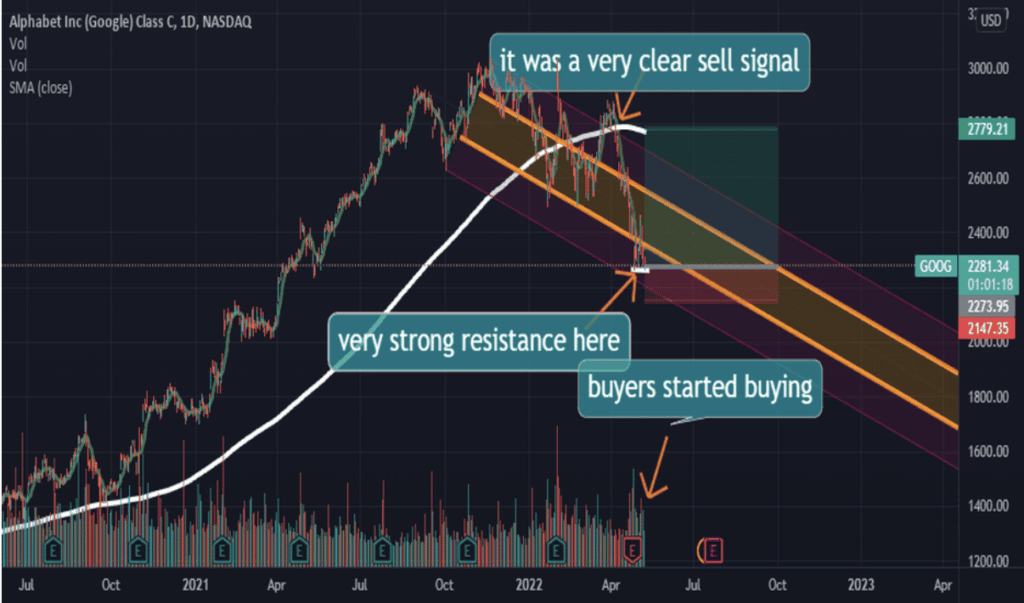

Alphabet Inc, a multinational technology giant, is the parent company of Google. In the second half of 2021, several of its former subsidiaries experienced a decline in value. However, the company is expected to regain its balance after gaining momentum and performing well in recent months.

In January 2021, the company’s stock price dropped 36% due to macroeconomic challenges such as rising interest rates and inflation. Additionally, concerns about a potential prolonged economic downturn also contributed to the decline in its share value.

Despite the recent dip in Alphabet’s (GOOG) stock due to the bear market, the company remains a profitable and competitive entity. Investing in Alphabet for the long-term can yield significant benefits for early investors, particularly if the company continues to uphold its powerful position in technology. Additionally, the company’s core technology products for advertising and search provide strong revenue potential, making it a potentially profitable investment opportunity.

For instance, Google’s Play Store sees a high number of installations for Alphabet-developed apps, and the company’s YouTube channel receives a significant amount of viewership. Overall, it is likely that the company’s stock price will rise in the current year.

4. Teladoc Health

The economic downturn has caused some companies to struggle, but Teladoc Health is working to rebound from a significant loss recorded during the pandemic. The company experienced a 72% loss in the previous year, due to over $10 billion in impairment costs.

Despite this, the company has potential for growth and is projected to be valued at over $636 billion by 2028 (according to Fortune Business Insights). Despite currently trading at a low rate, I believe the healthcare company can overcome challenges and recover in the coming year.

Furthermore, if it continues to generate significant growth, it could once again become a highly sought-after investment, increasing the potential for a short squeeze.

5. Tesla

Tesla, a company known for its electric vehicles and energy storage products, has seen a significant decline in its value over the past year, losing 66%. The global recession has had a negative impact on consumer spending power and slowed sales, particularly in China, which has contributed to this decline.

However, in the fourth quarter of the year, the company reported producing 439,701 automobiles and delivering 405,278 vehicles. Despite not meeting its long-term goal of 50% growth, Tesla’s deliveries for the entire year increased by 40% to 1.31 million and production increased by 47% to 1.37 million. Despite the recent setback, Tesla is well-positioned to potentially take over the car production market in the future.

Given its impressive growth rate and potential for continued success, it is surprising that Tesla’s stock is currently valued at such a low price-to-earnings (P/E) ratio of just 23. Despite this, Tesla continues to command a premium in the market due to its ability to expand its electric vehicle (EV) business without disrupting its existing operations.

Furthermore, industry experts such as Bloomberg predict that by 2040, at least two-thirds of all new cars sold worldwide will be electric vehicles. With this in mind, it is likely that Tesla will overcome any current macroeconomic challenges in the coming years, making it an attractive investment opportunity for stockholders.

Can You Invest in These Stocks?

I cannot promise definite profits, however, investing in these stocks may be a viable option due to their promising outlook. Additionally, these stocks have exhibited growth in the market as they have seen an increase in buyers. For example, Etsy has welcomed over 6 million new buyers in both of the past two quarters.

It appears that the challenging times may have passed and investing in Etsy stock could potentially yield substantial long-term returns for shareholders, similar to other stocks. Data and history indicate that they can be a sound investment. However, it is important to thoroughly research and align any investment decisions with your overall investment plan and strategy.

This article has been prepared for information purposes only. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.