hVIVO saw record revenues for another year in 2022 as demand for its human challenge trials accelerated. And 2023 could see further gains.

hVIVO (LON: HVO) shares, dual listed on the AIM and Euronext markets, have sent investors on the rollercoaster ride typical of smaller biotech firms. However, unlike many AIM companies, HVO does not appear to be a high-risk investment.

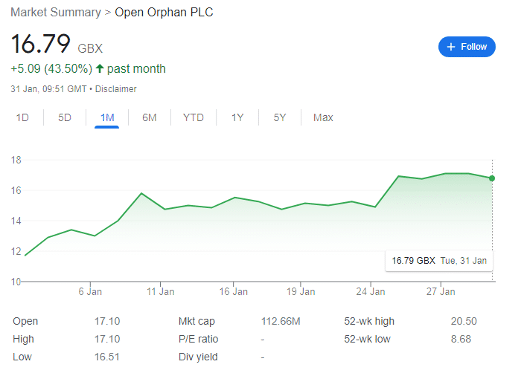

Worth circa 5p per share pre-pandemic, HVO shares rose to a peak of 38.47p by mid-April 2021, partially spurred by ultraloose monetary and fiscal policy, in addition to the meme hysteria attracting retail investors to any company promising potentially exceptional returns.

By the end of last year, the shares had fallen to 10p, but have since recovered to 16.79p, an impressive rise in the space of a month. But there could be further to go for investors prepared to risk the gains already made.

hVIVO in brief

For the uninitiated, hVIVO is a growth-stage specialist contract research organisation (CRO), and has baptised itself as a ‘world leader in testing infectious and respiratory disease vaccines and therapeutics using human challenge clinical trials.’

The company provides end-to-end early clinical development services to a client base including four of the largest biopharma companies in the world. The services business includes a portfolio of more than 10 human challenge models to help test a broad range of infectious/respiratory disease products, offers agent manufacturing, drug development and clinical consultancy services via its Venn Life Sciences brand, and a lab offering via its hLAB brand, which includes virology, immunology biomarker and molecular testing.

Challenge studies — where human subjects are intentionally exposed to disease for research — are run from labs in London, with subjects found through its well-known FluCamp recruitment campaign.

As an aside, challenge studies do come with some ethical concerns as ‘volunteers’ are well paid to be tested on, and some ethicists consider that the financial aspect can be predatory. Of course, almost every company has an ethical trade-off and challenge studies are essential to medical advancement. It’s up to the individual to consider their own moral outlook.

Contract wins

2023 has already seen serious developments for HVO. On 4 January, the £112 million company announced it had signed a £5.2 million contract with a ‘global biotechnology company headquartered in Asia Pacific to test their respiratory syncytial virus vaccine candidate’ through Phase 2a double-blinded placebo-controlled human challenge trials. This is in addition to the £13.6 million RSV contract announced in early November.

The study is expected to begin in H2 2023, with the revenue drawn in over the next two years. CEO Yamin Khan enthused it represents the company’s ‘first contract signed in the (APAC) region in over a decade… a key growth region for the Company, and this contract is an encouraging indicator that our strategy there is bearing fruit.’

HVO also notes that it ‘highlights the growing demand for challenge trials from global biopharmaceutical companies as they seek to gain cost-effective efficacy data to de-risk their development programmes.’

Then on 17 January, HVO announced another two-year €3.2m contract for its Venn Life Sciences division, signed with ‘a major global pharmaceutical client,’ with an immediate start date. The contract involves work ‘on a number of drug development programmes across multiple therapeutic areas, to study the absorption, distribution and excretion of drugs within the body.’

Khan noted that ‘the consultancy work included in this two-year contract highlights the continued expansion of our pharmacokinetic and programming services…for infectious disease products, hVIVO and Venn have also been able to conduct projects from discovery to Phase II Challenge Studies, something no one else can offer.’

There are three takeaways from these contract wins: HVO is attracting more globally significant clients, it has the capacity and expertise to expand, and even more contracts are doubtless on the way as the positive feedback loop of success materialises.

Trading update

HVO released a bullish trading update last week. Revenue rose by 30% year-over-year to a record £50.6 million, ‘further validation of the long-term sustainable growth in the human challenge trial market, for which hVIVO is the world leader.’

EDBITDA margins were ‘no less than 17%,’ significantly ahead of previous guidance of 13-15%, ‘driven by strong trading in H2 2022 and operational efficiencies leveraged on the concurrent conduct of multiple challenge trials.’ And the company is now sitting on a cash pile of £28.4 million, up from £15.7 million only a year ago.

Further, hVIVO noted that it now has a contracted orderbook of £76 million, an increase of 65% year-over-year, and a sixfold increase since 2020. And over 95% of the company’s 2023 revenue guidance is now contracted and visible into 2024.

Interestingly, the company is planning a capital distribution, to reflect the ‘exceptional cash generation’ in the year. This suggests confidence in the pipeline even in the wider recessionary environment, but also means the company cannot find better ways to invest the cash. While refreshingly honest, this could mean HVO is recognising that limiting its growth to a stable pace will also be in the long-term interests of shareholders.

But regardless, Khan believes that ‘as the human challenge partner of choice to the global biopharma industry, hVIVO is well placed to continue to help accelerate the development of important new medicines.’

There is a clear economic moat around the company, and the capital distribution suggests that HVO can deliver increased revenue while also keeping spending tight, so margins may improve even further through 2023. Liberum has upgraded its target price for HVO to 25.1p, a 50% rise on today’s price, and maintains its ‘strong buy’ rating on the stock.

However, AIM-listed companies have a habit of spiking and then pulling back after excellent news. It may be worth waiting for a slightly better entry point, and my usual philosophy is to buy quality companies on the dip rather than on the rise.

Of course, this strategy does involve a risk of missing the boat.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.