Everything you need to know about investing in Conroy Gold. The company now represents excellent value for long-term value investors. Here’s why.

On the FTSE AIM index, there are two types of gold stocks. The first are those companies which are extremely popular with shareholders and remain at the centre of the wider investor consciousness — think Greatland Gold or Amaroq Minerals — which boast outsized market capitalisations, and which have proven and significant, commercial finds.

Then there’s the gold stocks which could be the next Greatland or Amaroq. These are the microcaps with a depressed market capitalisation and a reasonable chance of delivering outlandish rewards over the next few years. The trick with these types of companies is to find the best value from a risk to reward perspective, and then invest in a small number with the hope that one or two strike gold (literally).

Conroy Gold is one of these stocks — and arguably is much further ahead than much of the competition given its ongoing Joint Venture and drilling to date.

However, before we get started, there are the standard caveats to consider, that remain true of all small cap junior resource shares:

- This is not financial advice. Do your own research and make your own decisions.

- There are some important first steps to consider before investing in AIM shares, or in mining shares. Generically, these centre around developing financial resilience and diversification.

Conroy Gold has a strong investment case, but it is a junior. It’s not a major like Newmont, nor representative of spot gold itself, and investors are taking on some extra risk in return for the hope of significantly higher rewards.

The other qualification is that this research is not FCA-registered. I either author or edit a significant number of regulated broker notes where the language and tone are limited in nature — here, I am free to cover some subjective elements which a NOMAD or compliance team would not allow.

I focus on generating high returns using money set aside for small cap investing. I enjoy the rollercoaster ride that sometimes accompanies this strategy — and understand that not every investment will succeed. But for context, the S&P 500 has delivered average annual returns of circa 11% since 1957 – anything above this is considered higher risk by the markets.

And I’m targeting much more than 11% with Conroy Gold.

With that being said:

Let’s dive in.

Conroy Gold share price

Conroy Gold (LON: CGNR) shares are up by 26% over the past five years — though peaked at 45p in early January 2021, coinciding with the pandemic era cheap money and GameStop short squeeze madness, and around the same time its current JV partner was getting involved.

There were similar peaks through 2022, but the company has been hit by the same macroeconomic pain as every other junior on the market; inflation briefly rose to 11% in the autumn of 2022 — and the Bank of England started increasing interest rates in December 2021, from 0.1% to the current 5.25% today.

Nobody can fight the macro, but I believe that junior resource is now on the floor. And with CPI inflation predicted to fall below 2% at points during 2024, analysts expect rate cuts from H2 onwards.

Now appears to be the time to buy.

The other clue to consider is CGNR’s position on the Lassonde Curve — JV partner Demir has nearly concluded Phase I of drilling operations and there should be significant value accretion as Phase II begins.

For context, CGNR is now trading for the same price as in July 2020, but has enjoyed millions of dollars of drilling since — refining targets for future success. And with a market capitalisation of £5.8 million, there’s been nearly as much money spent on drilling by its JV partner as the entire value of the company at present.

Gold price: what’s going on?

When considering any investment in any company, it pays to start with the product. In the case of Conroy, the primary product is (unsurprisingly) gold. You may laugh, but Golden Metal Resources is mostly involved in tungsten and copper, while ASX-listed Emerald Resources is an oil, gas, and gold play. While we’re at it, Scottish Mortgage has nothing to do with mortgages.

But Conroy is in the business of gold — so a brief overview of the current spot price is relevant.

The precious metal remains the long-term real asset safe haven of choice during times of inflationary or geopolitical stress. I assign circa 5-10% of my net wealth to physical gold at all times, and most investors in my circle use the metal similarly, as an insurance policy.

Spot gold is trading around the $2,000 area, close to its record high. There are tons of tailwinds that should see the metal remain elevated:

- Huge geopolitical instability — Russia/Ukraine, Israel/Hamas, China/US/Taiwan.

- Inflation — which history tells us has a habit of resurging like the Lernaean Hydra.

- Central Bank activity — states are starting to pause rate rises, making gold relatively more attractive.

- Monetary activity — central banks added a massive 1,136 tonnes of gold worth some $70 billion to their stockpiles in 2022, by far the most of any year in records going back to 1950, according to the World Gold Council.

- Debt — Public and private sector debt is unmanageable. This will haunt the west, but gold will keep its value in any event.

- Supply issues — there are fewer gold operations coming online and the ones that are, are coming online at a lower grade than historically. This is partially due to political issues in South America, but also due to generic permitting and financing problems.

But the bottom line for gold is that it will likely command higher prices than historically — the metal is seen as a store of value and simply does not fluctuate like others which are far more dependent on traditional supply/demand dynamics.

Conroy Gold assets

Conroy Gold’s primary licence area is located the Longford-Down Massif — where the company has discovered a 40 mile trend — in which multiple major gold targets have been identified. These include Clontibret and Glenish in County Monaghan, Clay Lake in County Armagh, and Slieve Glah in County Cavan.

One of the problems the company has faced is the geographical location of its gold on the island of Ireland. If a 40 mile trend were identified and owned in Nevada (US) or Western Australia, the market cap would likely be much higher as the locations/local investors are far more attuned to junior exploration.

Then there’s the mixed success rate of 21st century mining across the British Isles — Scotgold seemed promising but collapsed, Sirius Minerals tanked, and the various Cornish miners are facing varying challenges.

But Ireland — and this region in particular — has a significant mining history, including 20 lead mines, a copper mine and also an antimony mine in Clontibret. Indeed, it was the dewatering and back channel assays within the antimony mine shafts that first lead Conroy to start drilling and discovering the 40 mile trend.

While the company has multiple promising targets, it’s perhaps best to stick to the two so as not to overwhelm readers with information overload:

Clontibret

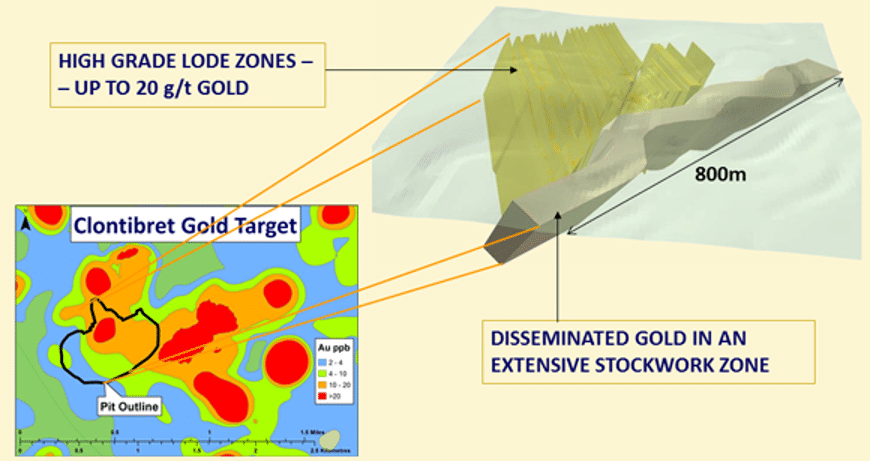

CGNR has a JORC compliant total resource of more than 1 million ounces of estimated gold over just 20% of the Clontibret target area — while drilling over the remaining 80% has also intersected promising assays.

A mine scoping study was conducted by Tetra Tech, concentrated on the high grade lode zones and some higher grade zones within the stockwork. It returned with a minimum mining width of 2 metres, a long term gold price of $1,372 and a cut-off grade of 0.60 g/t gold. This resulted in total contained resource of over 600,000 ounces (259,956 ounces indicated, 341,148 ounces inferred).

Consider the differences between inferred and indicated resource here.

The study considered a conventional open pit operation based on contained gold of 441,200 oz. Parameters includes a head grade during mine life of 1.53g/t gold, a process rate of 800,000 tonnes per annum, an assumed overall gold recovery of approximately 85 per cent — alongside a mine life of 11.2 years with in-situ gold averaging over 50,000 Oz per annum in the first five years.

Capital costs were estimated at $77.8 million, with a payback period of two years. This gave a 49.4% Internal Rate of Return and a Net Present Value (at the standard 8% discount rate) of $72.3 million.

Of course, this was just a scoping study — but is using a gold price set at a third lower than it stands today, alongside similarly conservative numbers, across a few selected parts of just 20% of the asset.

Clay Lake

Named for the 30g Clay Lake Nugget (which contained 28g of gold and is now on display in the Ulster Museum), this target covers a 2 by 1 kilometre area towards the North-Eastern end of the 40 mile trend — and 4.5 miles northeast of Clontibret.

During historical exploration, gold in soil samples averaged at circa 50ppbAU, though one sample returned a significant 1,531ppbAU. The target is a black carbonaceous shale hosted gold deposit; such deposits can be very large — and encompasses several geological attributes analogous with other sediment-hosted gold deposits, including the Tier 1, 169.3 million ounce Muruntau mine at Tien Shan, and the Kinross mine in Brazil.

Demir Export JV and financing

Demir Export is not a household name in the UK but is a mainstay of the mining industry in its native Turkey — especially in iron and zinc. The company finalised a Joint Venture with Conroy on 31 March 2022, whereby it made an initial payment of €1 million to the business.

The aim of the JV was stated to be bringing Clontibret to ‘construction ready’ status and then bringing it into gold production — while also bringing the other assets within the portfolio including Clay Lake into construction ready status.

Phase I of the earn-in would see Demir spend €4.5 million (plus the initial €1 million) to earn 25% of all JV assets, with work commencing in January 2022. At the time, Chairman Professor Richard Conroy enthused that he was ‘very pleased that the Joint Venture Agreement with Demir Export has been completed. My colleagues and I are enjoying working with the Demir Export team and look forward to building a long term, successful relationship.’

Fast-forward to the AGM in December last year and the JV had made even more discoveries — a second district scale gold trend within the Longford Down Massif — Skullmartin, now in addition to the Orlock Bridge trend previously discovered. This comprised (among other positive indicators) visible gold in the Skullmartin Gold trend at Creenkill together with gold assay results of up to 123 g/t Au.

Drilling has also indicated continuity between Clontibret and secondary target Corcaskea. For context, over 6,000 metres of drilling has now been completed as part of the JV, including 500+ samples taken — and the companies believe that Clay Lake could well be a ‘major gold deposit.’

The JV is now close to an inflection point: Demir Export had by December spent circa €5 million — with another perhaps €1 million required to be spent to acquire a 25% interest in the Joint Venture licences. You might assume that the larger company will be close to meeting this requirement; and then it’s a question of Phase II.

Given the expenditure thus far, Demir will almost certainly wish to continue to phase II where a similar level of exploration spend will be required to earn an additional 15%. Then there’s phase III, where Demir will be required to spend whatever is needed to get to construction ready status for Clontibret at a minimum (in other words, a Bankable Feasibility Study). This would see Demir increase its interest by 17.5% to 57.5% in the asset(s).

Conroy then the standard various options for its remaining 42.5%, including participating pro rata in mine construction, or a carry loan, or a net smelter royalty.

Remember, Conroy has a £5.8 million market cap — so if Demir opts to continue to proceed, the market value of Conroy would become substantially less than the JV exploration spend.

Drilling at the JV licences (the company has others not included within the JV within Ireland and Finland) is entirely covered by the Joint Venture, so the vast majority of typical expenditure is nothing to worry about. In FY23 (year ended 31 May 2023) loss after tax from continuing operations was circa €363,000 — and the group had cash reserves of €557,934. It also had net assets of close to €20 million.

It’s worth noting that CGNR raised £400,000 at 13.5p per share in mid-2023 and will likely need to raise small amounts to cover working capital alongside other typical costs as and when its cash buffer runs low — this is fairly typical. But again, the most important company assets are being proven and brought to Bankable Feasibility Study status by Demir Export.

Again, with the caveat that Phase II and Phase III are initiated.

Recent exploration

Going through every single target over the past few years is doubtless overkill, but it’s worth noting the recent scout drilling results released in late January. The licenced areas over the Orlock Bridge and Skullmartin gold trends now cover an area in excess of 1,000 square kilometres — with geophysics and geochemical sampling showing a series of targets over both gold trends. These targets will require follow up exploration including scout trenching and/or scout drilling.

The main findings include:

- Further demonstration that the Clontibret gold deposit is open in all directions

- Gold-in-bedrock assayed in Corraweelis (Slieve Glah) gold target

- Understanding of Creenkill gold target further enhanced

Were the grades exceptional? No. But that’s not the point of this initial drill programme — which is a key point that investors have missed. The idea is to find enough gold to make more drilling worthwhile, and not only to find decent targets, but also to rule out those which merit no further exploration.

2024 will see the JV target the most prospective areas indicated over the past couple of years through Phase II — which is where investors want to see the grades.

The last word

Conroy Gold likely has a bit of a ‘jam tomorrow’ reputation. Indeed, the 2017 shenanigans saw one major shareholder at the time, Patrick O’Sullivan, attempt to remove multiple directors (this was eventually successful). His intention was to replace them with himself, Paul Johnson and Gervaise Heddle.

I’m not going to go into details, but Paul and Gervaise are heavyweights in the mining world for many, many reasons (Paul saw Power Metal’s ascendancy, Gervaise Greatland Gold’s). If you don’t know these two individuals, you should. Both of those companies will resurge in the new bull market in my view — and their personal successes are far more than just these two examples.

But the takeaway is this: Paul (and family) still own 3.5% of the company. Jonathan Swann (another competent HNW investor) owns circa 5.5%. Patrick still owns circa 6.3%. Professor Conroy owns circa 6.7%, and there is also a very supportive 19.7% investor in Philip Hannigan — who owns Hard Metal Machine Tools which has lent financial support to CGNR on occasion.

Here’s the thing. They’re all still in.

Why? Because there’s gold in those hills. There is a reason why Demir Export, with access to 20 years of historical data and the millions spent on exploration to that point, signed a JV.

There is some valid criticism to consider. There has been no official resource update since the 2017 JORC resource despite thousands of metres of drilling, and this is arguably overdue. But there is more gold to be found at Clontibret, and Clay Lake looks exciting. Indeed, the board recently announced that the target could be ‘of world class significance.’

As long-time readers will know, I aim to take positions close to the bottom. More shares for the same money is the name of the game — and I think CGNR is close to the bottom both in terms of the macroeconomic environment and also the individual investment case.

My general perspective is that Conroy would prefer to just build a small plant and get mining. But Demir wants to explore all licence areas under the JV — and to home in on the key targets needed to get an upgraded JORC resource. The larger partner has not ruled out a three way deal with a major to get the gold out of the ground post-Phase III.

This is the plan for Conroy Gold: buy shares and hold. It might take some time, but the value is there.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Gold appears to be breaking 2500$ / oz and heading much higher. Inflation adjusted, it needs to break $3500 ish to make a new all time high. Gold juniors are at all-time lows or almost there and generally lag by 6 to 18 month but smoke appears to be rising, all be it sketchy. Any bull run could see multiples of x10 to x50 in some stocks, hence the need to spread the risk but even just one winner could dramatically super charge a pension, be Lucky