Golden Metal Resources boasts the largest undeveloped tungsten deposit on US soil. And that’s just the start.

Good morning.

Once again, I have typed up an ‘Edit’ — in copywriting terms, this is a comprehensive summary of an investment case in a few thousand words — designed so that an investor with no knowledge of the company can understand the entire investing thesis.

I am doing these for companies where I feel there is significant uplift potential within the next one to five years. Of course, sometimes a stock moves faster, but the general idea is that readers can understand the strength of an investment case, and potentially buy shares with a long-term mindset.

Another applicable recent Edit is Sovereign Metals; I am reasonably confident that the company’s rutile (titanium) and graphite deposit will be fully bought out by shareholder Rio Tinto. Tungsten — the core metal of today’s company — occupies a similar market position as titanium and is regarded as a key critical input metal in multiple high-value markets.

Today’s topic is Golden Metal Resources. Led by CEO and geologist Oliver Friesen (who may have missed his calling as a university lecturer), the company has gone from strength to strength since launching its IPO in May 2023. I spent the last few months of 2023 banging the drum for the company, arguing that the market was completely asleep to the opportunity presented.

For context, shares in the company were changing hands for less than 8p at the start of December, spiked to 16p by the end of January, and are currently hovering between 13p and 14p today. It’s nice to be right (though a child could have seen what was coming) and I believe significantly more gains are in the pipeline for long-term investors.

As per usual, I do insist on the standard caveats:

- This is not financial advice. Do your own research and make your own decisions.

- There are some important first steps to consider before investing in AIM shares, or in mining shares. Generically, these centre around developing financial resilience and diversification.

Let’s dive in.

Golden Metal Resources: Tungsten economics

With any company — whether in mining, life sciences, new tech or other — it pays to start with the product. While GMET is not yet a producer, the flagship deposit is centered around Tungsten. While there are various other metals in the mix, the investment case at present rests on the value of this metal — so it pays to understand the current tungsten market dynamics.

We’ll start with some context. The critical minerals trade war between China and the west is heating up, and the Communist country has already banned the export of most types of graphite, in addition to several rare earth elements. China has long understood that supply is more important than price — while the bull-bear mining supercycle makes investing in future-proofing supply essentially impossible for western companies whose investors are addicted to fast returns.

Chinese control of critical minerals is a growing problem: tensions between the US and China are rising, and have been for some time.

Whether regulatory problems over US-listed Chinese tech stocks, disputes over the origins of covid-19, arguments over a potential BRICS reserve currency, a possible TikTok ban in the US, tensions over Ukraine, Israel and Taiwan, spy balloons, bans on certain semiconductor exports from the US to China, the Huawei ban in the US, the iPhone ban for government employees in China, the contested Aukus pact for Australian nuclear submarines, or the proposed naval base in Africa…

It’s fair to say that bilateral relations between the two powers are not exactly friendly. Further export bans appear likely in the not too far-flung future.

Of course, export restrictions are nothing new: China had export restrictions on various minerals up until around 2014 when the country was forced to divest its position after the World Trade Organization ruled that they were inconsistent with the state’s international obligations.

One metal that was highlighted at the time was tungsten, which was subject to export controls until 2015-16. It is my belief that tungsten will soon face new export controls, given that China controls 86% of global tungsten supply.

The metal is important for various applications, including as catalysts and for military-based penetrating projectiles and turbines. This is because it’s incredibly hard and dense, at 19.3g/cm3 — comparable to uranium and gold. It also has the highest melting point of all known elements and the highest boiling point, at 5,930 degrees Celsius.

In the applications where it’s used, it’s essentially irreplaceable.

And China could restrict some tungsten sales without doing too much economic damage to itself. For perspective, the US is stopping China from getting hold of enough advanced semiconductors to further develop its tech, so China wants to make it hard for the US to get the raw materials to build its own tech in the first place.

Of course, restricting tungsten sales will hurt China, but in the game of world economics, it will hurt the US far more. But regardless, from 1 January 2026, the US Department of Defense is banning the import of tungsten from China, as well as from Russia, North Korea, and Iran. Given this, there’s a good chance both that China will act first, and that the US will anticipate this by helping companies on US soil develop their own reserves.

In further bad news for the west, the US has spent decades selling down its stockpiles of critical minerals, including tungsten, for the simple reason that it’s easier to sell an asset than collect or raise taxes. For context, the Defense Logistics Agency (DLA) stockpile was worth circa $42 billion (inflation-adjusted) in 1952 and is now worth just $888 million today with tungsten specific stockpiles being effectively depleted.

Congress expects the service responsible for maintaining the critical minerals stockpiles will become insolvent by FY25 — after selling off metals including a whopping 76 million pounds of tungsten ores and concentrates. The influential House Armed Services Committee is now planning to significantly change course with a goal to now rebuild these critical stockpiles in short order.

It might have problems though — China has spent decades cornering the critical minerals markets, and any attempt to bolster tungsten reserves will see China impose an export ban to make it more expensive to get these reserves from the other countries the US gets the metal from.

This is probably why Congress agreed to allocate $600 million from the recent $40 billion Ukraine aid legislation, specifically to further invoke the Defense Production Act to expand access to critical minerals. This builds on Biden’s executive order in 2022 which sought to improve US supply chains and identify risks — itself an improvement on a Trump-era executive order authorising grants and loans to procure critical minerals.

Indeed, several congressmen have made clear they view the strategic critical minerals reserve to be just as important as the strategic petroleum reserve which takes up all the headlines. This makes sense when you consider that the US plans for 50% of all cars sold in the country to be an EV by 2030 — and the massive subsidies for the sector within the Inflation Reduction Act (IRA).

And given that Trump started the push to become more self-sufficient for critical minerals, there is little risk this position will shift after this year’s US election.

The Flagship: Pilot Mountain

So Tungsten is a critical mineral, the US has no domestic production, and needs to get some online soon. And there is only one publicly traded tungsten-focused company in the entire country:

Golden Metal Resources.

The perceptive among you may have spotted the business case.

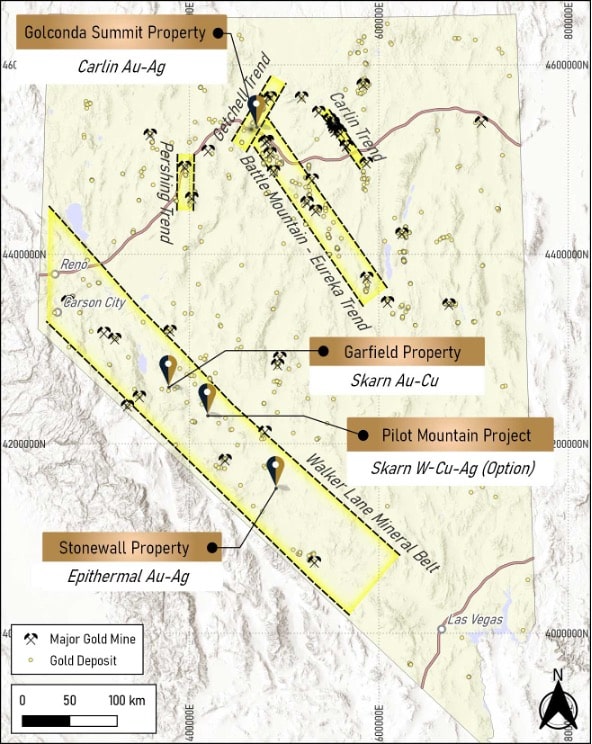

Not only is GMET the only tungsten company in the US, but flagship Pilot Mountain is the largest undeveloped tungsten deposit on US soil. Tungsten is on the critical minerals list and Pilot is perfectly located for power, water, transport, skilled labour, and best of all, the pro-mining politics of Nevada — which has consistently been ranked among the top mining jurisdictions worldwide by the Fraser Institute, year after year.

The asset covers close to 6,000 acres of land just 20 kilometres from Mina in Nevada. There is an existing Mineral Resource Estimate sourced from 2017-18, which covers 12.53 Mt at 0.27% W03 for 34.3kt of contained tungsten metal, with significant copper-silver-zinc credits. This resource only covers two deposits on the property — and an encouraging scoping study was also conducted in 2018.

It’s worth noting there has been significant additional exploration since this resource was established — with two recent announcements are worth highlighting. The first came in June 2023, where GMET announced that its geophysical, geological, and geochemical surveys (alongside a bunch of technical jargon) had yielded a total of five high priority exploration targets:

- Desert Scheelite Parallel West

- Porphyry Depths

- Desert Scheelite East

- Porphyry South

- Good Hope West

There are some significant takeaways from these RNSs; Porphyry South target represented ‘the most compelling porphyry deposit target’ — arguably investors now know where the drill bit is going first.

And overall the targets demonstrated ‘potential for a significantly greater in-ground resource than currently known, marking a significant further uplift in Project potential.’ This matters because any increase in potential mineralisation correspondingly increases the asset’s appeal as a target for non-dilutive grant funding — the Holy Grail of the junior resource sector.

On 8 February 2024, the company announced that through a technical review of historical drilling logs and metallurgical test reports, alongside ‘significant evidence’ of garnet composition homogeneity across mineralised intervals — that industrial mineral garnet comprises approximately 40% of the mineralised intervals across the Desert Scheelite and Garnet targets.

Accordingly, the company now thinks that a significant quantity of garnet exists within the deposit — with the usual caveat that further studies will be required. For context, garnet imported into the US traded at $190 per tonne in 2023, rising to $220 for domestic trading.

Clearly, nobody is becoming a billionaire on the garnet potential (regardless of its important commercial applications). The real prize is that while the tungsten, copper, silver and zinc had already been considered in previous reports, the industrial garnet potential has not. GMET thinks this could be ‘very material to the overall economics of Pilot Mountain’ and is planning to appoint a garnet specialist to complete project analysis.

Simultaneously, the company is finalising drill permits applications for the asset which are to be submitted to the local Bureau of Land Management office shortly (or by now perhaps have already been filed). Permits will cover a range of exploratory and infill drill pad locations.

It’s important to add some colour to why this matters: the garnet discovery was completely out of left field. It adds another saleable product to improve the economics — and Friesen thinks that the garnet ‘could be recovered via gravity and/or magnetic separation methods prior to the grinding and flotation stages – therefore significantly decreasing the wear and tear on the overall processing circuit and therefore the potential operating costs.’

The good news is that adding a gravity concentrator or magnetic separator (or similar, subject to testing) to the circuit will be capital light. But more importantly, massively less wear and tear represents a rare win-win-win: GMET has a more attractive asset, can sell more product, and can reduce opex costs as all of the later components in the circuit (such as grinding, floatation etc) will be dealing with significantly less material than previously supposed.

Of course, I think it is worth noting that exact cost benefits will be determined by further investigation. But as mentioned above, increased mineralisation makes government grant funding more likely. And given the tungsten at hand, it was already very likely (though nothing is ever guaranteed).

To that grant funding then. GMET already holds a signed Letter of Intent (non-binding offtake agreement) with the US-based Global Tungsten & Powders LLC for tungsten production from Pilot. I do like when a company is appropriately named. This agreement provides for a minimum of 50,000 metric MTUs W03 contained in tungsten concentrates, which may be increased to 70,000 MTUs by common agreement.

Importantly, the larger partner remains open to further cooperation — specifically in regard to rebuilding the decimated strategic stockpiles of critical minerals like tungsten — and again, this has been supported by multiple agencies including the US Defense Logistics Agency and US Department of Defense.

For the forgetful, GMET appointed Chang Turkmani as its Strategic United States Government Advisor in early June, with a view to start shortlisting and applying for grants. The kicker is that because some grants are applied for through an unsolicited application process, the company can’t say which grants it has applied for, how long it would take for an award to be granted, nor how much it would get.

In the words of the CEO, ‘minimal updates will be given for the time being, as such disclosure may interfere with our ongoing endeavours in this regard. However, it is important for our investors to know that, while this key part of the business ticks away in the background, we will continue pushing forward exploration and development across the portfolio at pace.’

There is one bittersweet possibility to consider though. Federal grants generally take between nine months and a year to be approved — while state grants are often quicker. But presumably many of the grants were applied for over six months ago, and therefore the garnet dimension could see either reapplications, or at the very least, updates. Garnet may not be as crucial as Tungsten but arguably will have a positive effect on the size of the funding.

The end result may be larger government funding — millions of it. But the ‘cost’ could be delays to grant funding announcements; most are expecting an update relatively soon based on standard timelines but this may now slip.

The final factor that must be considered is that the US government could, in some form, force GMET to sell Pilot Mountain (for a decent profit) to a major in the name of national security. CFIUS typically only reviews foreign investments into US mines, but as stockpiles once again become politically important, this is a risk/reward to bear in mind. I’d say this is an unlikely outcome, but if the past few years have taught us anything at all — politics shift fast.

The portfolio expanded

If Pilot Mountain were not enough on its own, Golden Metal boasts three additional exploratory assets — one of which could eventually rival its current flagship.

Over the past few months, the news flow from Garfield has been particularly impressive:

- Significant high-grade copper, silver, and gold mineralisation has been identified

- Samples exhibited copper concentrations up to 4.27% Cu and gold grades up to 27.2g/t Au

- Overlimit assay results exceeded expectations, with some samples showing copper equivalent values exceeding 23.92% CuEq

- The delineation of high-grade mineralisation over a large, recently expanded, footprint suggests the potential for a significant copper deposit

- GMET has engaged expert geochemist Simon Griffiths, which signifies a serious commitment to further exploration

- Additional high-grade mineralisation, with gold grades up to 22.7g/t Au, has been discovered on newly staked ground adjacent to the project

Then on 23 January, Friesen announced that the company had discovered ‘bonanza silver grades’ of up to 1,225g/t Ag at the Pamlico Gold Zone — alongside the Identification of a uranium target near the High-Grade Zone. Once again, this added further prospectivity to the project, enhancing its overall value.

The CEO enthused that the results ‘are highly significant as we have gone from high-grade copper-gold-silver results achieved over a large footprint to now multiple overlapping geological datasets which strongly confirm the presence of a significant porphyry style system driving mineralisation across the Project.’

He further noted that ‘the provenance of the high gold and silver mineralisation looks to be related to overprinting epithermal style mineralisation, which is not typical of porphyry style systems and materially increases the overall prospectivity of the Project by greatly improving the gold-silver potential.’

And happily, the geophysical anomaly which could represent the centre of the porphyry system has already been identified by a third party survey AND overlaps the new uranium target. This project could well go on to deliver handsome profits, and there is a very obvious drilling location — with the caveat that it remains early days.

Golconda has also seen strong development since the IPO:

- Rock sampling shows continued strong arsenic anomalism (>500ppm As) along the Golconda thrust fault. This may validate the presence of a ‘feeder zone’ and indicates the potential for Carlin-Type gold mineralisation at depth

- This is encouraging given the known presence of multiple large gold deposits nearby in similar geological environments

- For context, Golconda is strategically located at the confluence of the Getchell Trend and the Battle Mountain-Eureka Trend, where significant gold deposits have been discovered

- Previous exploration by Nerco in 1989 identified significant gold mineralisation within upper plate Havallah Sequence rocks at the Trench Zone, with trenching sample assay results showing promising gold grades.

- Golden Metal expedited the submission of a new permit notice application to the Bureau of Land Management for trenching and drilling activities.

- The permit notice has been accepted, marking a crucial milestone for the project’s advancement. Following the submission of a bond guarantee, the company can proceeed

Friesen argues that Golconda offers ‘the potential for a major gold discovery, in a region that hosts several multi-million ounce gold deposits in a geological environment markedly similar to that which has been confirmed at Golconda. We look forward to providing more information to the market as soon as possible.’

Given the time since the last update, one would expect news soon.

Finally, there’s the Kibby Basin Lithium assets:

- Golden Metal has identified a significant 10 square kilometre conductive zone

- The technical team conducted a full historical data compilation review over its Kibby North and Kibby South lithium brine assets

- This included a detailed examination of the Quantec Geoscience Ltd magnetotelluric geophysics survey report dated 28 February 2018, which highlighted a distinct conductive zone with low resistivity, approximately 3.1 square kilometres of which is now covered by GMET’s properties

- Drill holes completed by Belmont’s JV partner Marquee Resources Ltd in 2022 demonstrated that this MT anomaly coincides with significant lithium brine mineralisation.

- Drillhole KM22-02 intersected lithium mineralization averaging 558ppm Li over 169m from the top of the aquifer at 365m, with open lithium mineralization continuing to the bottom of the hole

- Brine water sampling analyses from the hole correlated with the core assay samples, indicating lithium brine continuity

- Golden Metal believes there is a high likelihood of lithium brine continuity into its properties

The CEO notes ‘the presence of a large and sizeable conductor – known to be caused by significant lithium-brine mineralisation elsewhere in the survey area – located directly in the centre of our Kibby South licence.’

Finances & Management

Final results show that on 30 June 2023, GMET held cash (or equivalents) to the tune of £1.37 million. Loss from continuing operations in the year to this date stood at £848,000 — so there appears to be a solid cash runway.

Of course, it’s never as easy as it seems. While the company is currently engaging in cost-conscious exploration over a set off assets that are all geographically close to each other, future drilling will be expensive. This will require capital, and in normal exploratory circumstances, you would expect to see shares issued to fund the drilling.

Given the assets at hand, I am certain this would be well received. However, Golden Metal is not a typical junior resource sector stock — because drilling at its flagship (if all goes to plan) will be funded courtesy of the US government. Of course, this still leaves the other assets to drill.

In particular, Garfield’s anomaly that likely sits at the centre of a large porphyry system amid potential uranium mineralisation is a return waiting to be made. But the important point to consider is this: the rise year-to-date is not retail. Retail does not have the financial firepower. And given the relative lack of trades at its US over the counter, it must either be institutional, strategics, or high net worth investors piling in.

And because Pilot is so strategically valuable, my best guess is that GMET will attempt to organise a non-retail placing — where investors get the best of both worlds; access to Pilot Mountain drilled for free, while effectively paying for the drill bit at the other assets.

In terms of current shareholders, GMET remains a ‘son of POW.’ The project incubator model is perhaps less well known than in the States, but Power Metal Resources currently owns just over 61% of Golden Metal — and while GMET is entirely independent from the parent, it does have significant advisory support at hand. I’d also point out that POW’s business model requires its spinouts to succeed.

It’s also worth noting that Friesen owns 0.79% of the company, most recently buying £7,480 of shares on the open market at 9.35p per share. Skin in the game is always a good sign. Speaking of the CEO, he is known for his engagement with shareholders — both through detailed technical videos and also just to answer any questions.

The bottom line

Golden Metal Resources has:

- The largest undeveloped deposit of a critical mineral in the US

- Access to significant grant funding, pending approval

- A competent and engaged CEO

- Large and supportive majority shareholder

- Extremely promising secondary assets

- Exposure in various forms to tungsten, garnet, silver, gold, copper, uranium, lithium and zinc

- And most importantly, a general feeling of optimism

Perhaps not ‘most importantly.’ But after a couple of years of doldrums in the small caps, it’s hard not to enjoy watching a company with strong assets and solid leadership create an atmosphere of positivity.

Over to you Oliver.

We await news.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

An excellent and informative summary and as a shareholder in POW I am grateful for you bringing this to a wider audience.