Everything you need to know about investing in Greatland Gold. The company is superb value at less than 6p per share — here’s why.

Greatland Gold is arguably one of the most popular FTSE AIM shares on the market — and it’s not hard to see why. The gold explorer rocketed above 37p per share in December 2020, but has also sunk to less than 6p as of today.

And over the past year, there has been no real spikes, with the stock instead trundling slowly downwards.

There are good reasons for this, which I will go into detail about shortly — I called this share price slide in an interview with StockBox in August and gave an updated opinion last week (see videos below). I now want to go into the detail here.

However, before I go into delve into the orebody, it’s important to consider the caveats:

- This is not financial advice. Do your own research and make your own decisions.

- This is high-risk, high-reward territory. You might lose some or all of your money.

- There are some important first steps to consider before investing in AIM shares, or in mining shares. Generically, these centre around developing financial resilience and diversification.

These are all really important to consider. Greatland Gold is not Barrick Gold. It’s also not Legal & General, a FTSE 100 index tracker, Apple, or spot gold itself.

Investors should go in with their eyes open — whatever you see on social media, in research notes, or even from Greatland’s management team, there is a general expectation that you understand you are in a riskier stock — even at these price levels.

The other qualification is that this research is not FCA-registered. I either author or edit a significant number of regulated broker notes where the language and tone are limited in nature — here, I am free to cover some subjective elements which a NOMAD or compliance team would not allow. In fact, rather than repeat all the technical details that are available elsewhere, I’m going into the realm of speculation, so take my opinions with a pinch of salt.

I focus on generating the highest return possible in the shortest amount of time, using money set aside for risky investing. I enjoy the rollercoaster ride that comes with small cap investing because, psychologically, I am prepared to lose it. I do try to repeat this point as often as possible.

Every junior resource investor has at some point lost a significant amount of money in a single company. This could be because of a failed drilling campaign, plant problems, financial issues, regulatory difficulties — the list is practically endless. If you want a taste of what can go wrong, without any warning, it’s worth asking anyone who invested in Sirius Minerals or Horizonte Minerals.

I have been lucky so far in that few of my mining investments have come to a sticky end as yet. However, you can only be lucky for so long, and I fully expect to get properly bitten eventually — and part of investing in exploratory miners is accepting that some investments will lose money.

But if you want 1,000%+ returns, you need to sweat for it. For context, the S&P 500 has delivered average annual returns of circa 11% since 1957 – anything above this is considered higher risk by the markets.

With all that being said:

Let’s dive in.

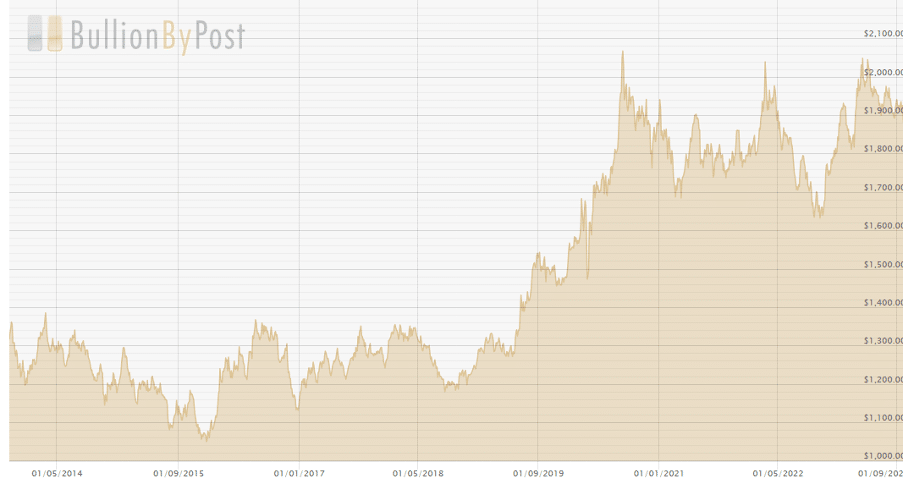

Considering the gold price

I am not a gold ‘expert,’ so will keep this section relatively brief. However, the long-term investment case for gold is not complex: the precious metal is the real asset safe haven of choice during times of inflationary or geopolitical stress. Indeed, I assign circa 5-10% of my net wealth to physical gold at all times, and most investors in my circle use the metal similarly, as an insurance policy.

Spot gold is trading around the $1,900 area, close to its record high. There are tons of tailwinds that should see the metal remain elevated:

- Huge geopolitical instability — Russia/Ukraine, Israel/Hamas, China/US/Taiwan.

- Inflation — which is not defeated. Oil prices are rising again and European gas prices are at a seven-month high.

- Central Bank activity — states are starting to pause rate rises, making gold relatively more attractive. They also like to print money like no tomorrow.

- Monetary activity — central banks are buying gold at a record pace. For context, they added a whopping 1,136 tonnes of gold worth some $70 billion to their stockpiles in 2022, by far the most of any year in records going back to 1950, according to the World Gold Council.

- Debt — Public and private sector debt is unmanageable. This will haunt the west, but gold will keep its value in any event.

- Supply issues — there are fewer gold operations coming online and the ones that are, are coming online at a lower grade than historically. This is partially due to political issues in South America, but also due to generic permitting and financing problems.

Greatland will also generate significant amounts of copper as the two metals are usually found together. I’ve covered the copper supply gap in depth before, but for brevity — there isn’t anywhere near enough. And where demand rises and supply falls, prices rise.

But the bottom line for gold is that it will likely command higher prices than historically as geopolitical uncertainty continues to rage.

Greatland Gold Management & Backers

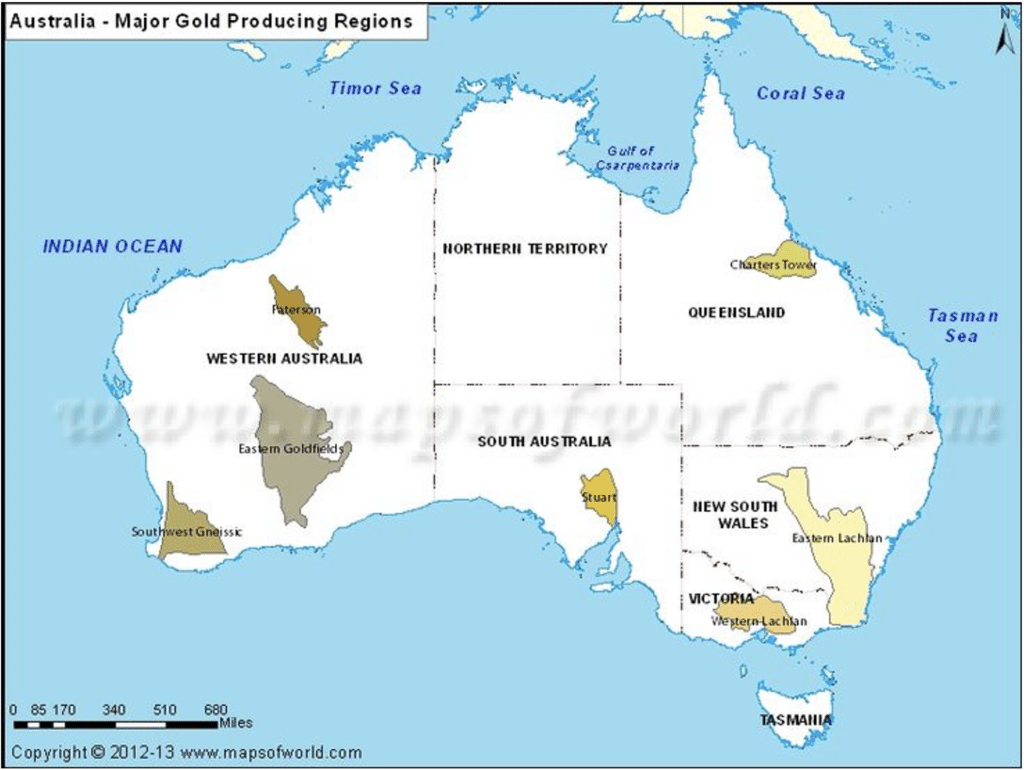

Australia is the world’s second largest gold producer, just behind China in terms of overall production. Accordingly, there’s dozens of high quality outfits for the best people to choose to work with — and many of them have chosen Greatland. It’s perhaps over-kill to list them all, but here’s a Cadbury selection:

- Non-Executive Chairman: Mark Barnaba — also Deputy Chairman at Fortescue and a board member at Australia’s Reserve Bank.

- Non-Executive Deputy Chair: Elizabeth Gaines — former CEO and current Executive Director at Fortescue.

- Non-Executive Director: Clive Latcham — former copper group mining executive at Rio Tinto.

- Non-Executive Director: Paul Hallam — former director of operations at Fortescue and also former Executive General Manager of Development and Projects at Newcrest.

- Managing Director: Shaun Day — former CFO of Northern Star Resources among others.

- Executive Director: Jimmy Wilson — former President of Iron, Energy Coal and Stainless Steel at BHP.

- Chief Operating Officer: Simon Tyrrell — former GM Processing, Asset Management and Major Projects at Northern Star.

- Head of Business Development: Rowan Krasnoff — former BDM at Fortescue.

You might have noticed that this feels a bit like a Fortescue party. That’s because to some extent it is: Greatland Gold’s largest shareholder, with 8.5% of shares is Wyloo Metals. Wyloo is wholly owned by private investment group Tattarang, which in turn is owned by Andrew and Nicola Forrest.

Who is Andrew Forrest, I hear you ask? Other than holding personal wealth of circa $18.5 billion, he’s best known as the founder, former CEO and current Executive Chairman of one of Australia’s largest mining companies.

You guessed it — Fortescue.

And because Andrew is so bullish on Greatland, Wyloo lent AU$50 million to Greatland last month, helping to meet funding requirements through 2024 including the completion of the flagship Havieron Feasibility Study. In other words, shareholders are very unlikely to get diluted before the juicy details get dropped — if ever.

Aside from this standby debt facility, on 15 September 2023, the company had cash of £60 million, debt of £44 million, and therefore net cash of £16 million. This leaves it with circa £42 million of runway when including Wyloo’s cash addition.

But other than the strong financial position, the key point to understand is that half a management team of one of Australia’s most successful miners is now running the GGP show, financially backed by its multi-billionaire founder. These people do not back losers.

And they don’t care where the share price is now — they care where it will be in a few years.

The road so far

Greatland acquired the Havieron exploration licence back in 2016, and then later on entered into a $65 million farm-in agreement with Newcrest for the asset.

In November 2020, the pair also entered into the Juri JV — and at the start of 2021, works commenced at Havieron. The pre-feasibility study came out in October 2021, and in March 2022 the company announced the flagship’s Mineral Resource Estimate and Ore Reserves.

In August 2022, GGP retained its 30% holding of Havieron after the 5% option process with Newcrest concluded, and then in September 2022, Wyloo made a strategic AU$60 million investment alongside another AU$60 million in potential equity contribution through exercise of future warrants.

In late May 2023, Greatland entered into its Paterson South farm-in and JV with Rio Tinto, and also received an updated debt support letter from its backer banking syndicate comprising ANZ, HSBC, and ING regarding a proposed AU$220 million debt facility.

The original syndicate letter was signed in September 2022, but this improved letter of support in late May 2023 confirmed the syndicate’s ‘fully supportive’ views, including saving the company ‘from incurring the commitment and other fees associated with the proposed AU$220 million debt facilities until the Havieron Feasibility Study is finalised.’

Or in other words, the banks are happy to wait for gold. Then as mentioned above, the AU$50 million additional debt investment from Wyloo.

Apparently, it’s just the retail investors getting bored.

The flagship: Havieron

I will not go into all the technical details of Havieron. These can be found elsewhere and copying pasting it is a bit of a waste of paper. But as an overview:

- Newcrest owns 70% economic interest and is the manager and operator

- Greatland is the junior partner and holds 30%

- The PFS is completed

- The DFS is in progress

- A MRE update is in progress

The most up-to-date figures investors have come from March 2022:

- Ore Reserve was 2.9Moz @ 3.7g/t AuEq

- MRE 6.5Moz @ 2.2g/t AuEq

In the company’s own words, the mineral resource estimate update has been delayed (maybe for a year or so) as it continues to evaluate ‘several value enhancing options to maximise value and de-risk the project.’ It’s worth noting that the drilling programme is already complete and this is more of a technical exercise than anything else, with the updated MRE to be used to strengthen the Feasibility Study.

The updated MRE is targeted for the ‘December quarter 2023’ — or in other words, could come any day. It’s worth colouring in the context: there’s been well over 80,000 metres of additional drilling completed since the 2022 MRE — key growth areas are at the SE Crescent, Northern Breccia, and Eastern Breccia.

If you consider that the maiden resource estimate was 4.2 Moz AuEq in December 2020, and then 4.4 Moz in October 2021 at the PFS Resource estimate, and then 6.5Moz by March 2022, that’s more than 50% growth in 18 months (a fact highlighted in the recent corporate presentation).

Given 80,000m more drilling and backers prepared to increase/improve financing terms, and that the next MRE update will be another 18 months or so since March 2022 — another huge increase could be coming.

For context, the share price is under 6p — the same value as in April 2020, months before the maiden resource estimate was reported.

This 6p share price level is important because at 6p the entire company has a market capitalisation of circa £300 million. And an independent review of Havieron in August 2022 set the asset value at $1.2 billion (several times more than a couple of years prior). This valuation was done to set a value for 5% of Havieron ($60 million) as Newcrest had the option at the time to acquire this additional bite.

But as Newcrest chose not to exercise this option, Greatland retains its 30% ownership of Havieron — which is equivalent to $360 million — or £293 million. Accordingly, and I have made this simplified argument beofre, anything at or just below the 6p mark is essentially a floor on the company’s true value, and that excludes the vast tenures elsewhere.

However, this valuation is almost certainly a gross underestimate. As a reminder, this is simply my opinion and I am making some assumptions, so any investor who feels they have additional useful information — I welcome any feedback.

But in essence:

- The valuation was made using confidential terms and conditions. This almost always favours the major rather than the junior partner.

- Data used to value Havieron for this estimate had to come from before 15 December 2021.

- Commodity prices (gold and copper) used at the valuation were ‘very conservative.’

- The valuation could have been arrived at via several valuation methods (consider the Valim Code), and likely the method which gave the lowest valuation possible given Newcrest’s position at the table.

At the time, Day noted that it set:

‘a price not a value for the asset, the joint venture agreement doesn’t represent true market value in the opinion of the board and this very much is anchored off the back of that mechanism…it’s a highly prescriptive process and particularly the binary nature of the outcome, if you were appointing an independent valuer and one party puts the lowest bid and one party puts in the highest bid they can imagine, that independent person can come out with a compromise based on their value and anyone who’s had their house valued as opposed to a real estate opinion on it probably understands that’s inherently a conservative approach.’

So to conclude, Havieron is one this valuation worth £293 million — at the lowest conservative estimate, when gold prices were much lower than they are today, and using data which excludes the past two years of drilling — drilling that three of Australia’s largest banks, Fortescue’s founder, and half the old Fortescue management team are happy to get behind.

Of course, you can’t talk about Havieron without Telfer. The Telfer mine — including the Telfer processing plant — is owned and operated by Newcrest, and Telfer and Havieron are located less than 30 miles from each other. The generic idea is that ore from Havieron will be processed at the undercapacity Telfer plant — massively reducing capex costs for Havieron and increasing Telfer’s LOM feasibility.

Of course, Newmont is merging with Newcrest, so where the pair will land regarding Havieron and Telfer is uncertain. This lack of clarity is also dragging down Greatland’s share price — I’ve gone into detail on what it could mean below.

Paterson Region Exploration

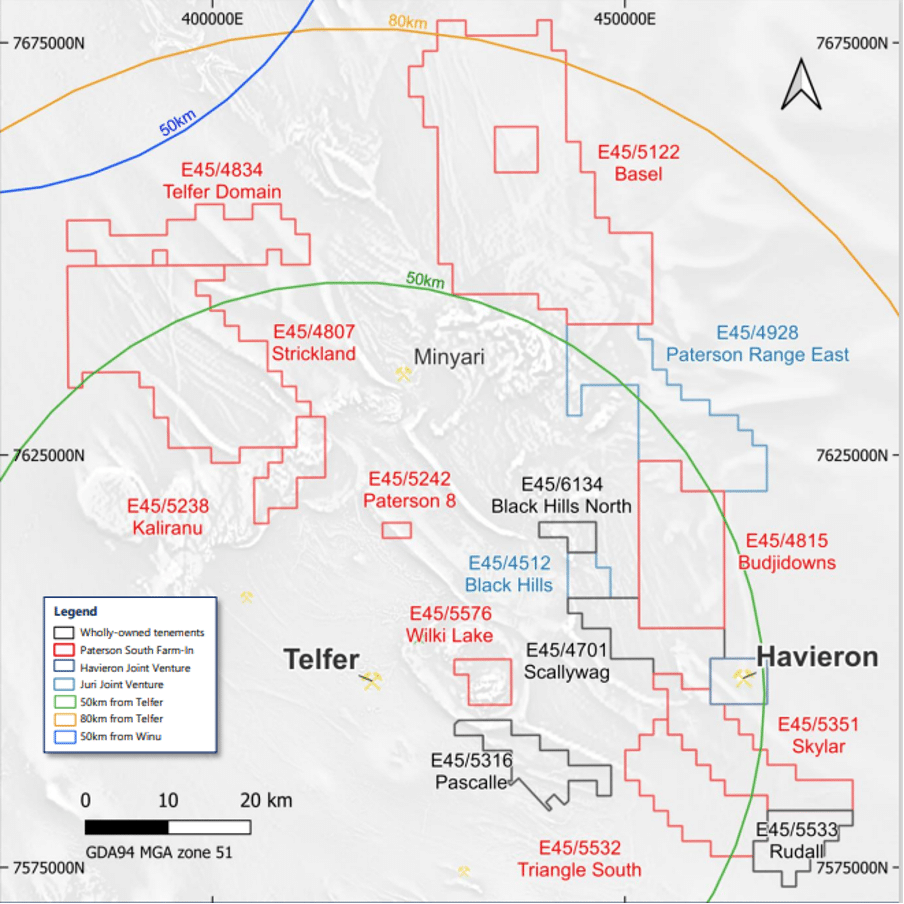

For clarity, Greatland holds 100% interest in three Paterson region exploration assets:

- Scallywag, where investors are waiting for significant assay results from a diamond drilling campaign

- Canning, where there are two magnetic anomalies similar to Havieron’s geological signature

- Citadel Hill, where GGP is waiting for an exploration license to be granted for a 71sq km area, North of Havieron

There are then two ongoing Joint Ventures to consider:

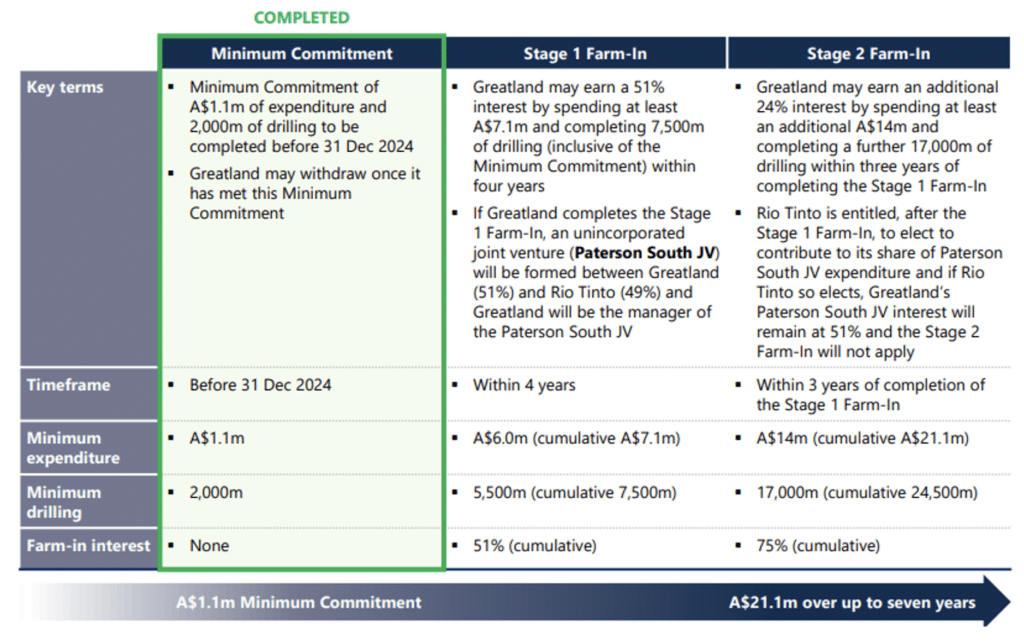

- Paterson South, in which Greatland can earn a 75% interest in a JV with Rio Tinto. The maiden drilling campaign is completed, and assay results are pending.

- Juri, in which Greatland has a 49% interest and Newcrest is now managing the asset as of July 2023

Paterson South Rio Tinto JV

GGP handed over management of Juri to concentrate as manager on this new farm-in and JV with Rio Tinto earlier this year. This project covers over 1,850 square kilometres of relatively unexplored tenure close to Havieron. The tenure hosts magnetic anomalies similar to Havieron and also some targets that have signatures similar to Telfer.

The farm-in was announced on 30 May 2023, with Day noting that the tenement package is an ‘outstanding opportunity with a number of high priority, highly prospective and heritage cleared drill targets…the addition of the Paterson South Project more than doubles our current footprint with the most prospective targets within 50km of Telfer.’

And for context, Rio Tinto operates the Winu deposit close by.

Juri Newcrest JV

Confusingly, the Juri JV covers two assets (collectively the Juri Tenements):

- Paterson Range East

- Black Hills

Again, Greatland considers that there could be a Telfer-like deposit within the assets, with the mine only circa 20 miles away.

Under the Juri Farm-In and Joint Venture Agreement:

- Stage 1: Newcrest must spend AU$3 million within 24 months of entering into the Juri Farm-In and Joint Venture Agreement to earn an additional 26% interest in the Juri Tenements (cumulative 51% interest).

- Stage 2: Newcrest must spend an additional AU$17 million in relation to the Juri Tenements within 36 months of completing Stage 1 to earn an additional 24% interest in the Juri Tenements (cumulative 75% interest).

Following the completion of Stage 1 on 20 August 2021, Newcrest exercised its right to increase its interest in the Juri Tenements to 51% (with the remaining 49% still held by Greatland) and also elected to proceed to Stage 2 on 18 October 2021.

With Newcrest now in charge of managing the JV, it’s essentially a case of waiting for more results — some came back in February 2023, but more information will follow.

Further exploration tenure

Beyond these key assets, Greatland is also engaged in further exploratory work beyond Paterson, including Ernest Giles, Panorama, and Bromus. These have minimal value at present in my view — but have the potential to deliver further value add over time.

Current events analysis

I’ve tried to keep Greatland Gold’s management, backers, and asset base as concise as possible to help convey the investment case to new potential investors. Now we venture into the realm of speculation, where I will do my best to consider the various moving parts and where Greatland Gold investors could see the company go next.

Trying to break this all down has been more time-consuming than I had first assumed, but here goes:

Greatland is delaying its ASX IPO after getting the additional Wyloo funding, saying it is not optimal to pursue a cross-listing in 2023. The company says it remains committed to a listing eventually — and there are several reasons why it could be delaying.

This could include JORC compliance issues, wanting to deliver an updated MRE and DFS first, or even waiting for sentiment to improve in the junior resource sector. Perhaps it plans to buy Telfer and the remaining 70% of Havieron from its partner. Perhaps a cocktail of reasons.

But consider the Newmont-Newcrest hybrid.

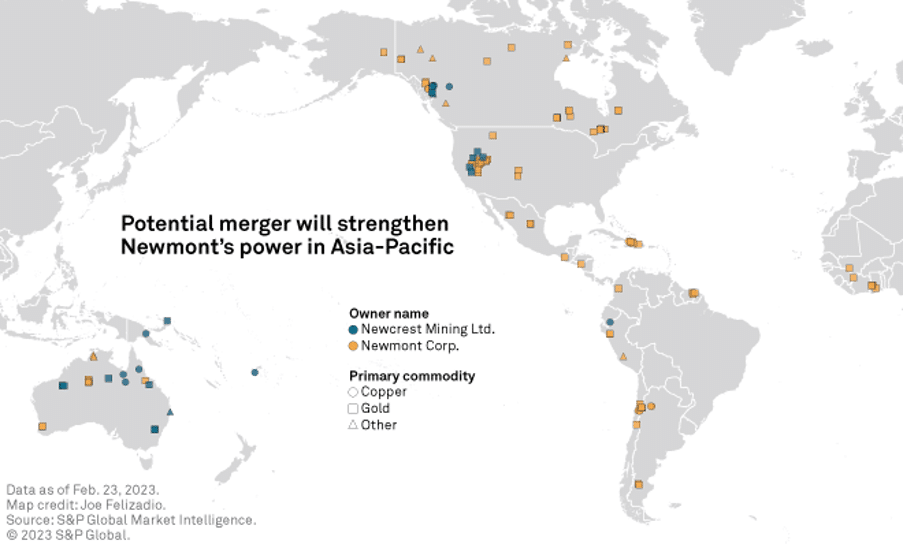

Newmont’s $16.8 billion bid for Newcrest has been strongly approved by shareholders, with 93% voting yes. This creates a certainty black hole for Greatland as some analysts consider the new company would want to divest itself of Telfer and Havieron, while others think it would retain the assets.

It’s not hard to see why this deal makes sense for the titans though this an inflationary environment — pre-tax synergies will be $500 million within two years and there will be at least $2 billion of enhanced cashflow through ‘portfolio optimisation.’ Interestingly, Newcrest was originally founded in 1960 as Newmont’s Australian division and was spun off in 1990 after its merger with historical BHP gold assets.

But the merger will now create the largest precious metals miner in the world and will also be the largest mining takeover in Australian corporate history. It would leave the new entity with four of Australia’s largest gold mines and producing almost twice as much gold as the nearest competitor Barrick.

The question is this: what to do about Havieron and Telfer? Fortunately, the Grant Sameul assessment is out as part of the wider Newmont-Newcrest merger scheme booklet. I scanned through all 774 pages of the report and came to page 278/774 on the PDF, where the independent assessor makes the case that:

‘Grant Samuel has valued Telfer in the range $500-600 million. The valuation incorporates the value of the existing operating mine at Telfer and the value of the Havieron Project (at Newcrest’s 70% interest).’

As a caveat, this is not based on the expected updated MRE, and also based on a series of assumptions ranging from a best case to a worst case scenario. Interestingly, it’s worth noting that investors were relatively annoyed with the $1.2 billion former valuation for Havieron — and now a new assessment places the value of both Telfer and Havieron at 50% less than this figure.

There is one key thing to digest here:

Valuing assets gets wildly different numbers based on the methodology used.

It’s not really worth getting into the scenarios that Samuel Grant has come up with. I’ve helped to edit several similar research notes (surprisingly, they’re not one-man jobs) and they all come with masses of caveats and assumptions.

But it is important to note that on page 31 (PDF), the report says that ‘the joint venture agreement includes tolling principles reflecting the intention of the parties that, subject to the feasibility study and a positive decision to mine, Havieron mineralised material will be processed at Telfer.’

The meat of the text as it relates to GGP investors comes a little later on, on page 280 (PDF) onwards.

SG notes that Greatland first made an offer to acquire another 5% interest in Havieron from Newcrest for $85 million, which was not progressed — and (as noted above), in August 2022, Newcrest also declined to purchase a 5% interest for $60 million.

SG suggest that these two valuations imply both that Havieron is worth more that $1.7 billion and less than $1.2 billion. However, it can also be just as easily explained that Newcrest was consistently happy with its 70% ownership of Havieron.

For context, SG does note that progress over the past two years could significantly increase the value of Havieron, but also suggests that ‘upfront capital expenditure estimates are expected to increase materially due to the expanded scope and increased geotechnical and hydrogeological understanding of the deposit.’

SG also uses share price and capital raisings undertaken by Greatland to attempt to value the assets — stating that Havieron comprises ‘most, if not all, of the company’s value.’ This is an overreaching statement given the tenures being explored.

But regardless, based on GGP’s share price — underpinned by Wyloo’s capital raising in September 2022 — SG concedes on one metric that 100% of Havieron is worth circa $1.4 billion.

Completely coincidentally, this is somewhere in the middle of the $1.2 billion and $1.7 billion prior valuations, but nevertheless, SG concludes that because of the emerging picture of materially higher development costs subsequent to this investment, its $500-600 million valuation of both Telfer and 70% of Havieron is a ‘reasonable balancing of these issues.’

I’ll translate: They don’t really know an exact figure. Because of course they don’t — they don’t have the DFS or the updated MRE.

The report goes on to cross check this valuation through Telfer, and admits that:

- Implied EBITDA multiples for Telfer are low as open pit operations are only scheduled to last to FY26

- Significant capital will be needed to develop Havieron

- There is a lack of clarity surrounding Havieron DFS and Telfer underground mine expansions

- There are challenging economics at Telfer’s existing operations

Again with the assumptions — but paradoxically, this new valuation could be good news for GGP shareholders.

Using August 2022 numbers where Havieron is worth $1.2 billion, Greatland would have had to find 70% of $1.2 billion ($840 million) to buy Newcrest’s share — and then more for Telfer as the processing plant is needed to make the investment case — both to process Telfer and Havieron ore, but to include spare capacity as well.

Newcrest invested $181.4 million in Telfer in 2021 to continue production until the end of 2023. It then invested a further $214 million to extend mine life to 2026 late last year. Telfer hosts the largest gold processing facility in Paterson province, and the project produced 407,550 ounces of gold in 2021-22. It still holds significant value, despite its age, and that processing facility could be put to better use.

Previously you were looking at least $1 billion for the two assets to be bought out in full — and now there is a $500-600 million figure — half of what was previously assumed. Hilariously, this would leave GGP’s 30% interest in Havieron at roughly the same value as the $220 million that three banking titans are prepared to lend it in debt.

It’s also worth noting that Barrenjoey analyst Dan Morgan has consistently argued that Telfer and Havieron do not make sense in the wider conglomerate’s portfolio as it is processing below capacity, and the combined Newmont-Newcrest monster will likely want to sell the assets.

There is some speculation here: Newmont/Newcrest want to offload the assets and would welcome a smaller valuation to get rid of them. Greatland is the obvious buyer but needs it low valuation. And who advised Fortescue for years? Grant Samuel.

Greatland has made clear it does not wish to use the $220 million debt funding from the banking syndicate until the feasibility study is concluded. And it’s delayed its ASX IPO — several months ago journalists were speculating it planned to raise $100 million. And it has around $60 million in cash.

Add in a little additional Wyloo money, or a ‘supportive’ banking syndicate ready to go, and you’re there.

But there is another possibility. In July 2020, Rio Tinto’s then group executive of growth and innovation Stephen McIntosh enthused that after its Winu find, the company would be happy to build more gold mines in Paterson as long as they met requisite development thresholds. The exact quote used was:

‘We are encouraged already by the fact that within two kilometres of Winu itself we are already seeing very high-grade gold as one new target. Who knows what the next one will turn up?’

With Rio already in a farm-in with GGP, and holding thousands of square kilometres of exploratory tenure, I speculate that the major could become a cornerstone investor in Greatland or buy out some of Telfer/Havieron in order to have a processing plant ready to go as its exploration activities turf up new gold/copper discoveries.

It’s worth noting that Rio was prepared for Greatland to explore in its stead in Paterson South — but imagine if the two together created a JV covering every single asset in the entire Paterson region they hold between them?

Perhaps Telfer and Havieron is not compelling, but what happens when you add in Rio Tinto and Greatland’s vast tenure, where multiple assets are showing promising early signs of Telfer/Havieron anomalies? Both companies have already proven they can find the gold and copper — Rio at Winu and Greatland at Havieron. Add in an undercapacity processing plant — and there’s your value.

The bottom line

Greatland Gold has:

- A ridiculously overqualified senior team

- Which is almost certainly scheming to gain 100% of Telfer/Havieron

- Joint Ventures with both the Newmont/Newcrest hybrid and Rio Tinto

- The prospect of a super-JV with Rio if they can’t get 100% of Havieron

- Masses of highly prospective exploratory tenure

- 30% of Havieron, which will imminently deliver an updated MRE and then DFS

- That 30% can be valued at anywhere from circa $150 million to $1.7 billion+. Seriously

- A banking syndicate happy to lend $220 million

- Wyloo flower power

- A plan to launch an ASX listing, massively improving liquidity and access to a senior investor base

Is it high risk? Perhaps. If you take the Samuel Grant valuation at face value, GGP shares are still overvalued — but those assumptions would also give Greatland an exceptional prospect to buy its flagship outright.

In the most recent Sunday Roast podcast last week, Day noted that if Newmont chose to divest Telfer/Havieron as part of their $2 billion of divestments plan, it would be an ‘amazing opportunity.’ The CEO also noted that ‘shareholders should have confidence that there is a team and BOD built to do that and some of the shareholders such as the largest Wyloo Metals give the strategic capability to do that as well.’

And while there is risk, at less than 6p per share, GGP is also potentially extremely rewarding.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Related: Greatland Gold: choices, choices

Magnificent Summary.

Thank you Raymond

thanx for this valuable look inside Greatland, but what do you think will Rudall be playing in this scheme?!