Kendrick Resources is an illiquid microcap with significant potential for high-risk investors. Here’s why.

Here we go again. Kendrick Resources (LON: KEN) is the latest to receive the ‘Edit’ treatment — but this company is a very different proposition to the much larger entities covered over the past few months.

Kendrick is currently sitting on a mere £1.09 million market capitalisation, and — unlike, for example, £176 million Jubilee Metals — is clearly not going to be a central portfolio stock.

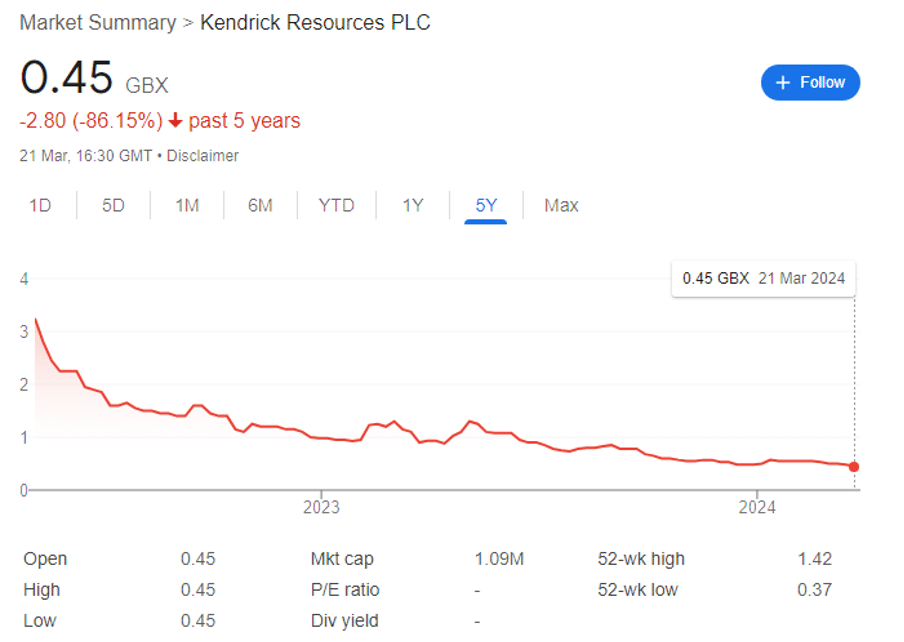

Kendrick shares have fallen by more than 80% since its relaunch IPO in May 2022. At the time, the company successfully fundraised £3.25 million at 3.25p per share — and the stock is now changing hands for less than 0.5p.

Some of this fall can be attributed to the wider negative market sentiment. Some is due to the collapse of the nickel price (though the focus is on the vanadium assets these days).

And some is arguably down to the fact that nobody has ever heard of it. There are probably more reasons, but I am looking at a fundamental valuation of a microcap — and from where I’m sitting, there is significant upside potential for high-risk investors with a long-term mindset.

Before we get started, the usual caveats:

- This is not financial advice. Do your own research and make your own decisions.

- There are some important first steps to consider before investing in AIM shares, or in mining shares. Generically, these centre around developing financial resilience and diversification.

- While Kendrick Resources appears to be a good opportunity, it is a microcap. This means higher risk than those associated with larger companies, but with correspondingly larger potential upside.

Let’s dive in.

Kendrick Resources: understanding Vanadium

While Kendrick does have some exploratory nickel interests, the reality is that the nickel market is in such a dire state that these assets have little near-term value to investors. Indonesia has — with the help of a trigger-happy China — been developing dirty nickel projects at such a pace that BHP, which has some of the lowest cost nickel operations in the world, has taken a $2.5 billion impairment on its West Australian operations and is considering a full closure.

While activists are attempting to force metal traders to make a distinction between clean and dirty nickel, this is unlikely to happen in the near future — and by extension, the nickel assets Kendrick owns are not going to be near-term catalysts in a market this dire.

They do still have value, but this will likely only crystallise years from now.

Happily, the good news is that the company also has exploratory Vanadium assets, where the near-term prospects are far, far better. In fact, vanadium is the reason for this Edit — much like Jubilee’s Chrome, Golden Metal’s Tungsten or Sovereign’s Titanium, junior resource investors looking for a junior with a specific metal are going to want to add a little Kendrick — because unlike gold, lithium or copper explorers, there are simply very few vanadium explorers.

And this offers a diversification opportunity.

Vanadium is a transition metal which is used in specific applications within steelmaking, energy storage and aerospace. Perhaps the most important use case is in vanadium redox flow batteries (VRFBs); as global demand for renewable energy such as solar or wind power continues to rise, so too is the need for accompanying energy storage.

Vanadium demand for VRFBs is predicted to grow at a CAGR of 57% through to 2030.

Vanadium has a unique ability to store and release energy efficiently, alongside a long lifespan and high charging cycle efficiency. It’s also very heat resistant and durable, making perfect as a key ingredient in steelmaking. At the end of 2023, the global vanadium market was worth $46.2 billion, and it is expected to more than double over the next decade due to demand in the EV industry.

It’s worth a quick comparison to lithium — lithium batteries are much lighter and charge much faster. Lithium is not going to be replaced by vanadium in family cars, but vanadium electrolytes are non-flammable and have 5 times as long lifespans. VRFBs also have lower energy density and higher initial costs — making lithium perfect for anything portable and vanadium preferable for anything static.

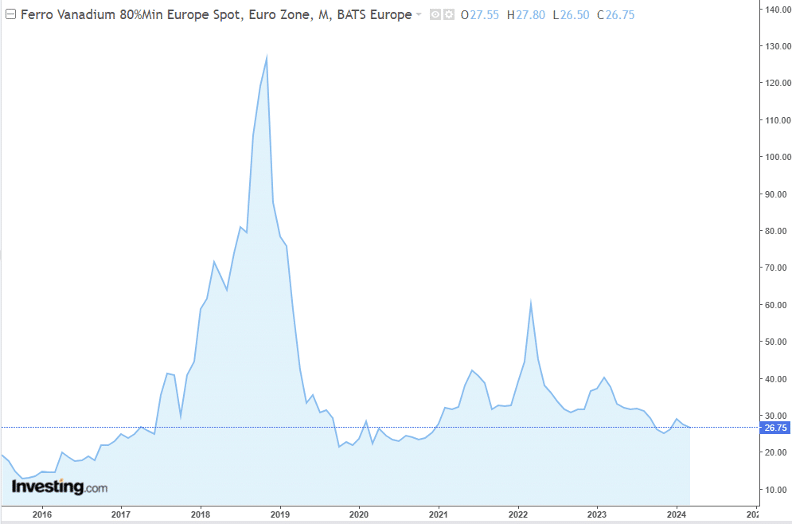

However, it’s still the steel-making which dictates vanadium’s price, which is pretty much entirely determined by Chinese demand. China’s property sector is in trouble — a massive global problem which could explode at any time — but vanadium will nevertheless remain linked to rebar steel demand. It seems that Chinese growth should start to improve again in 2024, and with it, vanadium prices.

But longer-term, the key point to understand is that demand for vanadium over the next decade is going to increase as VRFB demand rises, while simultaneously, quality mines are not coming online.

Global vanadium consumption increased from 109,835 tons in 2019 to 112,157 tons in 2020. And at a CAGR of 2.7% steel production through to 2030, one project the size of flagship Airijoki needs to go into production every 3 years.

This positions Kendrick well — for a £1 million company.

The Vanadium flagship

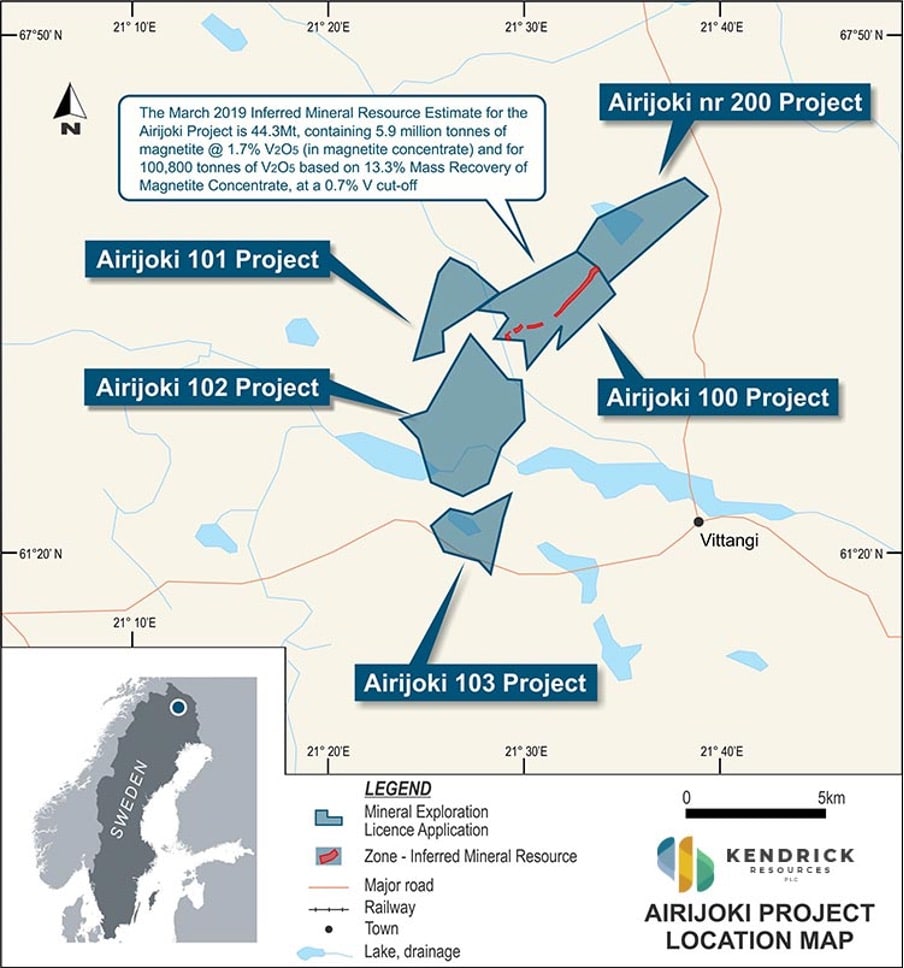

By far the most advanced Vanadium asset on the books is Airijoki, located in Vittangi, Sweden.

There is already a JORC resource at the asset, comprising 44.3 Mt @ 0.4% V2O5, in-situ, containing 5.9 Mt of magnetite averaging 1.7% V2O5 (in magnetite concentrate) for 100,800 tonnes of contained V2O5 based on a 13.3% mass recovery of magnetite concentrate and a 0.7% V2O5 cut-off grade, on a 100% equity basis (and net attributable basis).

This is a pretty promising start — a decent overall quantity, with more than half of the V2O5 concentrated in the magnetite at 1.7% — making the economics of extraction very reasonable. And the 13.3% projected recovery rate is also in line with major projects of this type.

However, the resource is at this stage only inferred, rather than indicated or measured. There is relatively low confidence in the accuracy of these numbers, but then again, you are talking about a microcap.

And Kendrick is continuing to extend the asset, having recently reported assays on 8 February, which confirmed additional vanadium mineralisation to the north of the current resource. It has also gained access to a further five contiguous exploration licences, which could further expand the resource.

The business has now switched away from further drilling to expand the current Mineral Resource and towards ‘focusing on the development and implementation of an appropriate strategy to build a sustainable vanadium business.’

While this does not completely rule out further drilling, the plan is to build strategic alliances with iron ore and vanadium processors within Scandinavia — an alignment of sorts with end users of vanadium, principally in the Vanadium Redox battery sphere. The general idea is to become a ‘significant contributor to the supply of vanadium in the Scandinavian battery arena.’

Within the eight 1,394m scout diamond holes drilled at the Airijoki 200 license towards the end of 2023, seven intersected vanadium. Two highlights include:

- 0.52% V2O5 – whole rock (1.77% V2O5 – magnetite concentrate) over 28.80m from 77.55m

- 0.72% V2O5 – whole rock (2.15% V2O5 – magnetite concentrate) over 12.00m from 89.50m

Kendrick now expects the JORC resource could be extended for a further two kilometres north.

The company now feels it has proven the resource to the point where it has achieved a critical mass of resource tonnes and grade — so the plan now is to ‘build alliances and establish long-term commercial cooperation agreements necessary to ensure a market for future vanadium production.’

Executive Chairman Colin Bird noted at the time ‘the fact that we have a number of other high quality defined drill targets on the as-yet largely untested licences comprising the Airijoki project, bodes well for future resource growth.’

Espeladen Nickel

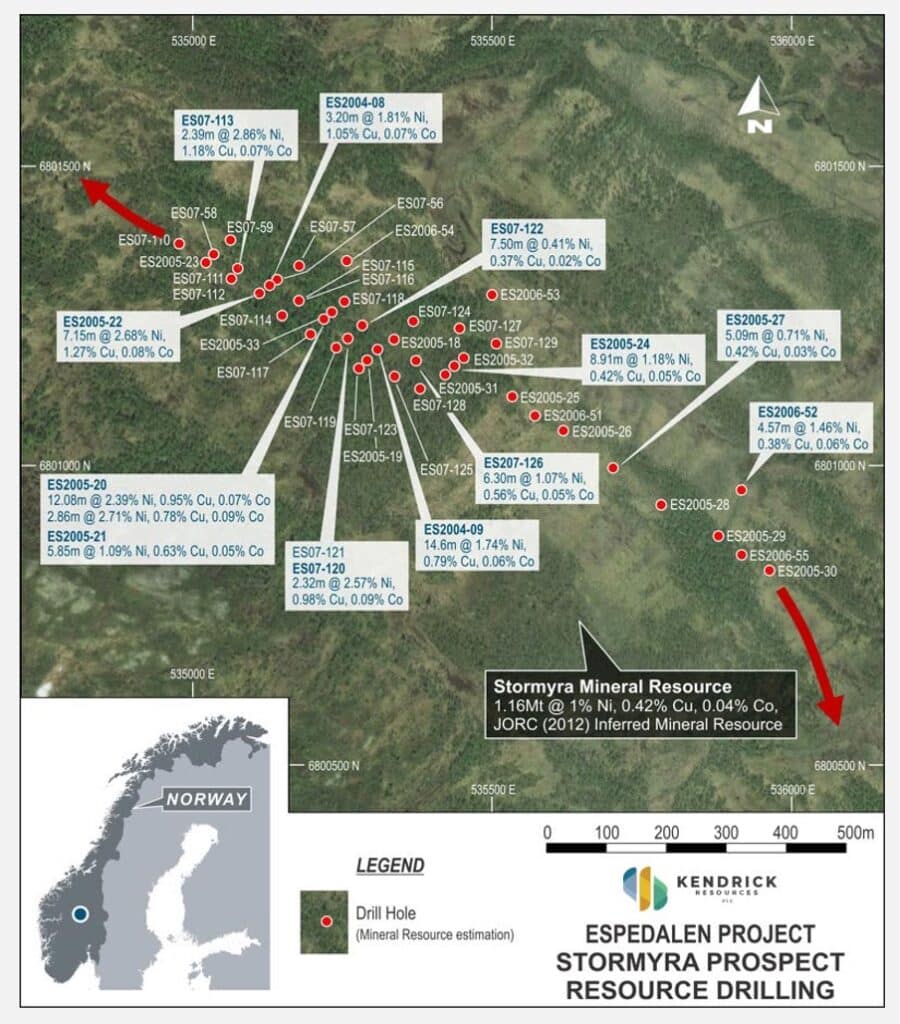

Espeladen in Norway is another ‘advanced’ project at Kendrick, and again, the company has recently extended the mineralisation at the asset — including the delineation of new nickel drill targets at Stormyra based upon positive findings from ground magnetic and electromagnetic surveys.

These targets boast a magnetic signature similar to that expressed of the already known mineralisation — the first, an extra 500 metres of untested south easterly extension of the Stormyra orebody that can be drilled with the objective of increasing the existing in-house resource tonnage — and the second, a strong conductive body at depth further to the southeast which could potentially represent deeper mineralisation reflecting the source of nickel-bearing fluids in the complex.

These are two viable drill targets ready to go, and there remains a further 10 drill-defined anomalies waiting to be tested.

Bird notes that ‘the opportunity to build on the historical mineral resource of 1.1Mt at 1.1% Ni and 0.50% Cu is looking extremely likely, placing Stormyra as the forefront deposit within the Espedalen Complex for development…our preliminary investigations over the Complex have enhanced the Espedalen project and provide clear evidence for the development of an as yet undetermined resource tonnage most likely at cumulative grades exceeding 1% Ni with a significant copper and possibly cobalt by-product.’

Management & Finances

In the management team, there are two names to pick out.

Colin Bird is Executive Chairman — a man with 40+ years of experience in mining. Bird famously founded Kiwara Resources and sold its Zambian copper asset to First Quantum for $260 million back in 2009.

Incidentally, Bird is once again positioning in the Zambian copper space — with some interesting opportunities at low prices. On the other hand, he works in exploratory junior resource, and so has come up empty before; but this is the nature of exploring.

Martyn Churchouse is Managing Director — a geologist also with 40+ years of experience in mining, including the classic MSc in Mining & Exploration from the Camborne School of Mines. Martyn has been around the AIM mining block a few times and has significant experience in African exploration.

There are also three non-executive directors, with a variety of skill sets.

Interim results for the six months to 30 June 2023 saw Kendrick record a £244,000 loss after tax, and a £791,000 cash position. This assumes a cash burn of circa £40,000 per month, and as nine months have since passed, you can expect there to be roughly £400,000 in the bank.

Of course, drilling is not cheap — but the company has now decided to move away from this expense and towards the next phase where capex/opex will presumably be funded from elsewhere. And it’s worth noting the net asset value at the time of these results; a solid £5.36 million which likely has increased since June due to the drilling results.

Is there a need for cash? Not in the immediate term, though the company needs to get a deal of some kind over the line in 2024.

The wider investment case

Kendrick has 10 assets at hand — Airijoki and Espeladen have enjoyed the most recent news, though the Koitelainen Vosa Vanadium Project in Finland is also arguably worth noting.

This asset boasts 116.4Mt, containing 5.8 million tonnes of magnetite @ 0.3% V2O5 (In-Situ) and @ 2.3%V₂O₅ (in magnetite concentrate), for 131,000 tonnes of V2O5 based on 5.0% mass recovery of magnetite concentrate. Again, this is a tidy resource to have on the books — and there’s seven further assets to consider.

The good news for would-be investors is that all of the assets are in Scandinavia — where mining sentiment is far better than most of Europe — and all-weather railways run close to most of the assets. In particular, the Kiruna Mining Hub in Northern Sweden gives Kendrick access to all the contractors/consultants and skill the company could want, while there is also a major nickel smelter operating in southern Norway.

The bottom line

The grand plan is to build a centralised plant in Finland to process vanadium magnetite concentrates from both Airijoki and Koitelainen into V2O5 flake or VRFB electrolytes for sale into Europe — taking advantage of the reduced capex costs of a central plant, alongside relatively low opex. For context, the company puts its power costs at approximately 10c/kwh.

Airijoki is just 4km from infrastructure, and Koitelainen only 15km. And then there’s the upgrade factor to consider; upgrading to magnetite concentrate grade will yield significant financial benefits, and the grades at the assets are already very good.

Of course, to make this happen, Kendrick needs a partner to come on board. This has been the focus since mid-February.

While there can be no guarantees, Kendrick currently sports a market capitalisation just above £1 million. And there is virtually no liquidity in the stock (and an 11% spread) — one good bits of news, a few trades, and the company could rise much closer to its IPO price.

Once again this is not a central portfolio stock. But a small non-core position to tuck away for the longer-term may be a good idea.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.