In my quest to cover every growth stock with an interest in Zambian copper, there’s an obvious first pick. Enter Jubilee Metals.

Good morning.

Welcome to this week’s Edit.

This article is designed to be a comprehensive summary of an investment case in a few thousand words — calculated so that an investor with no knowledge of the company in question can understand the entire investing thesis.

I am doing these for businesses where I feel there is significant uplift potential within the next one to five years.

Of course, sometimes a stock moves faster, but the general idea is that readers can understand the strength of an investment case, and potentially buy shares with a long-term mindset. Recent companies covered in the junior resource space include Sovereign Metals, Golden Metal Resources and Greatland Gold — and now it’s the turn of Jubilee Metals. I have spent the past few months telling investors that Zambia (and specifically Zambian copper) is the place to be in 2024/25 when seeking long-term profits and intend to cover every small-mid cap company operating in the country over the next few months.

While there are several exciting exploratory names to go into, I am going to start with Jubilee simply because it is already a producer — and this separates it from many of the other names in the country.

It also has diversified operations in South Africa. And from a financial perspective, it seems to have traversed that difficult period where it needs to raise money from share placings to keep the lights on: it’s revenue generating, profitable and growing.

This means Jubilee may be a good start as a central portfolio company for anyone looking to invest in critical minerals in Africa. And the good news is that the future rewards seem to be just as good as with an explorer, but perhaps with less risk.

As per usual, I do insist on the standard caveats:

- This is not financial advice. Do your own research and make your own decisions.

- There are some important first steps to consider before investing in AIM shares, or in mining shares. Generically, these centre around developing financial resilience and diversification.

- While Jubilee is further along its journey than others nearby, it is not a major just yet. Of course, looking at Anglo, being a major is not much shareholder protection regardless.

Let’s dive in.

Jubilee Metals: metals examined

Before we get into operations themselves, it’s important to examine the metals Jubilee is producing — PGMs (platinum group metals), chrome and copper.

The first point to make is that while it does generate significant amounts of PGMs, the company is not a PGM company. It is a multicommodity producer, and arguably, has been miscategorised elsewhere in the past.

Chrome — Chrome was recently listed by FastMarkets as a metal to watch for a potential Chinese export ban, alongside tungsten (see GMET) and several others. The metal is well-known for several uses in which it is essentially irreplaceable; it’s corrosion and heat resistant, so is often used as an alloy in stainless steel or superalloys.

Chromium compounds are also common in plating, and the chemical industry, including pigments, dyes, and catalysts. Most importantly, it has an important (if small) position as a critical mineral for semiconductor manufacturing and is also used in multiple aerospace components due to its unique properties.

High-grade reserves are depleting rapidly, and supply comes from a handful of countries including Russia — where supply is being artificially cut. Demand for stainless steel will continue to grow while production of chrome is expected to remain stable — which could see prices rise over the longer term.

Unlike copper, there is little discussion in the mining space, but chrome has risen sharply in price and will continue to remain elevated.

Platinum Group Metals (PGMs) — PGMs have had a rough ride recently, but this should improve over the medium term. There is a direct comparator for South Africa; the platinum arm of Anglo American (Amplats) now plans to cut 3,700 jobs in the country after price collapses saw profits fall by 71% year-over-year in 2023.

Jubilee has unfairly been lumped in with other PGM producers. While the company is involved in PGMs, this is more a ‘side product’ than the main investment case. And the good news is that this price collapse will not last — even though platinum group metals have fallen by circa 50% over the past year, with the PGM six-element basket roughly two-thirds below its peak of April 2021.

This price fall is mostly due to the fact that supplies from South Africa and Russia have not been damaged as much as was predicted a couple of years ago. Declines in native currencies haven’t offset lower prices in USD — meaning mines are being forced to increase output to reduce unit costs as well as sell excess inventory to generate cash.

But in many cases, this still isn’t enough (you’re seeing similar in the lithium industry where higher cost mines are closing down or going into care and maintenance). The World Platinum Council notes that closing mines due to current pricing could put 1.3 million oz of platinum output and 1.2 million oz of palladium production at risk.

For context, the Council now thinks that platinum production will average 5.6 million oz a year between 2020 to 2024, which is 9% lower than the five-year annual average production of 6.1 million oz between 2015 to 2019.

Overall, the PGM supply deficit is now forecast to be at 8% of demand through to 2027 while above ground stocks will fall by 70% to 1.4 million oz. And with a quarter of mines operating unprofitably, many will likely close temporarily, exacerbating the issue.

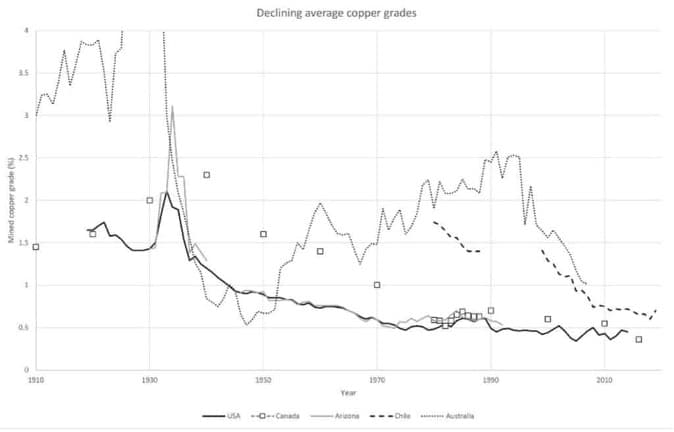

Copper — if you aren’t aware of the impending copper supply gap, then you have probably been living under a rock. And not a blue one. I am not going to go into significant detail as I have in the past but will briefly outline the long-term bull case.

Note, this is not about short-term price fluctuations, but longer term economics. Let’s start with S&P Global, which thinks global demand for copper will double to 50 million metric tons by 2035 — creating a supply gap of 10 million tons. Bloomberg expects this gap will hit 14 million tons by 2040, with demand for refined copper growing by 53% by 2040 while supply will only rise by 16%.

Goldman Sachs research shows that miners need to collectively invest $150 billion in the next decade to plug the copper gap, while also noting that regulatory approval for new copper mines has fallen to its lowest in a decade.

In the 1990s, copper exploration grassroots budgets ranged from 50-60% of overall copper annual budgets; this had fallen to just 34% by 2021. And it takes 16 years — on average, according to an estimate of sources — to discover and develop a new copper mine.

The majors are instead focused on buying up established assets. Multi-billion-dollar deals are ongoing to reduce costs and bring producing mines on board. BHP bought ASX copper producer Oz Minerals for a hefty premium, while Newmont’s record bid for Newcrest may be primarily about gold synergies but also brings the major huge copper deposits.

But it doesn’t matter who owns the mines. There’s still the same number of producing assets in existence.

Ivanhoe founder Robert Friedland famously thinks that more than 700 million MT of copper will need to be mined in the next 22 years just to maintain typical 3.5% GDP growth, without even considering the electrification of the global economy. This is equivalent to all the copper ever mined in history.

Consider Rio Tinto’s new Oyu Tolgoi mine in Mongolia. Wood Mackenzie analysts estimate that the equivalent of 12 new equivalent copper mines will be needed to come online by 2030 to meet expected demand. Yet Oyu is being touted as one of the most important copper deposits in the world, and development from bare earth to near production has been extremely hard.

Trafigura — the world’s largest copper trader — CEO Jeremy Weir noted at last year’s World Copper Conference that ‘if we don’t have enough copper, it could seriously short circuit the energy transition.’ And the International Copper Association thinks that while global supply is expected to jump by 26% to 38.5 million tonnes annually by 2035, it will likely still fall 1.7% short of demand — even assuming that recycling rates increase exponentially.

Globally, 21 million metric tons of copper are mined every year, but it’s not going to be enough. Over the next 20 years, the International Energy Agency expects it to become a dominant mineral alongside graphite and nickel, with demand set to treble by 2040 as net-zero goals accelerate.

Meanwhile, emerging markets such as Zambia are seeing output accelerate. Zambian Finance Minister Situmbeko Musokotwane recently enthused that ‘copper is the new oil.’ And CRU Group analyst Adam Khan notes that Zambia could add nearly 1 million tons of copper production per year over the next decade.

In 2021, the shortage gap — the difference between copper mined and demand — came to just 2% of production, enough to push up copper prices by 25%. 2035’s gap could be at least ten times as much.

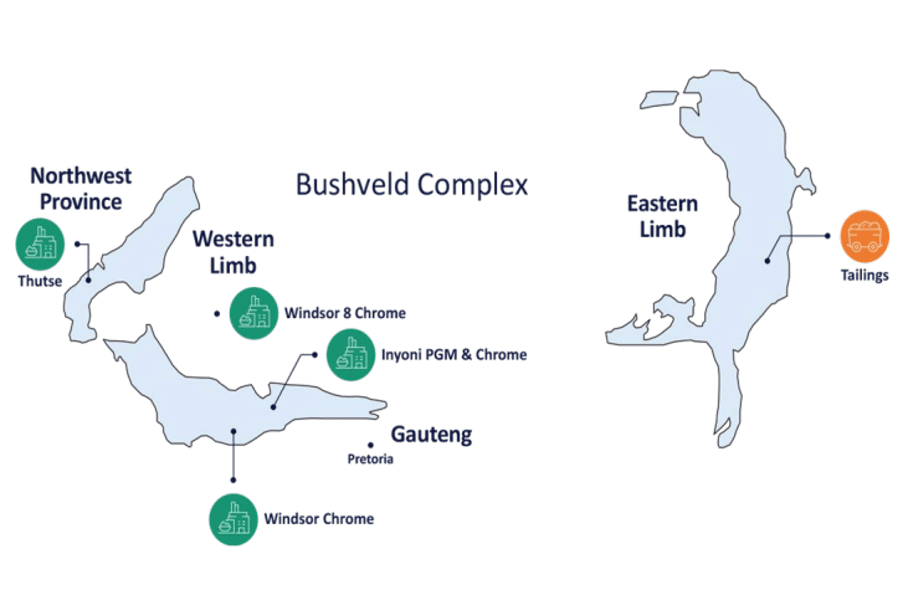

Jubilee Metals: South Africa Chrome and PGMs operations

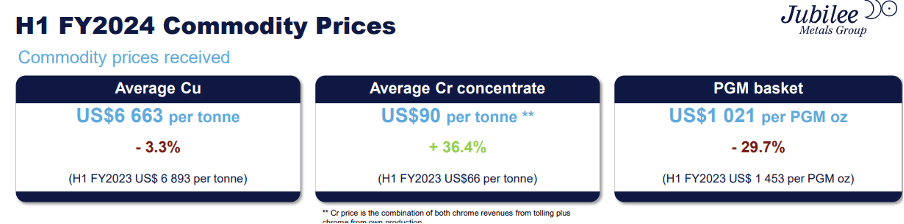

Chrome is currently the most important metal in Jubilee’s portfolio — in half-year results, it generated 70% of revenues. Of course, you have to be careful with statistics; chrome is having a good year, copper an average one, and PGMs terrible. But that’s the advantage of being multicommodity — it offers significant protection from commodity fluctuation.

And within the commodities themselves, there is further protection as Jubilee processes chrome at a fixed margin for sources not of its own — currently standing at 59% of the total. This leaves a double-walled economic moat of revenue generation.

The chrome processing is itself modular — read scalable — and services at Jubilee’s world class facilities are open to clients at large.

The processing facilities can process both Run-of-Mine material and chrome rich tailings to produce a saleable chrome concentrate and PGM rich by-product which acts a primary feed to Jubilee’s Inyoni PGM Processing Plant. Jubilee’s chrome operations are based in South Africa and include Windsor Chrome, Windsor 8 and Inyoni Cr.

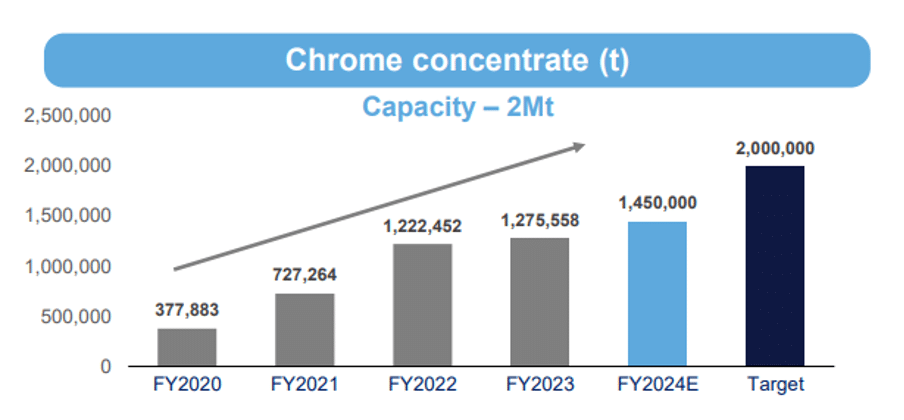

Again — this should be stressed — PGMs are a by-product of the chrome production. In HY24, the company produced 718,189 tonnes of chrome concentrates — and 20,244 ounces of PGMs. In forward guidance, it expects, and is on track, to generate 1.45 million tonnes of chrome concentrates alongside 42,000 ounces of PGMs.

The longer-term plan is to reach 2 million tonnes of chrome concentrate production per annum by 2025, which should improve margins via economies of scale. For context, in FY20, it generated just 377,883 tonnes of chrome concentrates. Chrome margin now stands at $17 per tonne — up 240% year-over-year.

To make this expansion happen, Jubilee now plans to expand Thutse’s capacity further by constructing two new 50,000tpm modules, which are expected to be operational in Q3 CY24, and capable of producing 300,000 tonnes of chrome concentrates per annum. While there is a $12 million cash cost, this is expected to be funded by current chrome operations.

And the best news is that unlike PGMs, chrome should — and I say should because metals are unpredictable — remain elevated simply because there is limited processing capacity compared to demand. There is a reason why Jubilee has managed to expand its processing capacity so quickly: there’s appetite for it.

In PGMs, Jubilee saw production increase by 11.2% to 20,244 ounces in H1 FY24, but ‘challenging’ market conditions saw net realised prices fall by nearly 30% — for reasons explained above.

However, while there were also significant cost increases due to the cyclical feed material blend, these are expected to fall within the current reporting period. And for some context, while PGM margin fell by 81.6% to $126/oz and other operators were forced to slow production, the PGM business at Jubilee continued to remain profitable.

The PGM processing operations are centred on the Inyoni PGM Processing Plant in South Africa. Investing in African countries does come with elevated jurisdictional risk, but the trade-off is that opex is much lower — and this makes it possible to continue profitable activities much longer than is possible in (for example) the likes of Canada or Australia.

Zambia Copper

Chrome is the bread and butter for Jubilee, PGMs are the side dish — but Zambian copper exploration/production is where the true growth story will come into play. The reality is that copper is not a major component of Jubilee’s current revenue streams at less than 10%, but this all changes in calendar 2024.

For context, H1FY24 saw copper production increase by 46.5% to 1,683 tonnes.

There are multiple streams to be aware of:

Jubilee started off in Zambia by acquiring Sable in 2019. In April 2021, Jubilee commenced site construction — then in May 2021, established its copper concentrator (Roan) in Ndola.

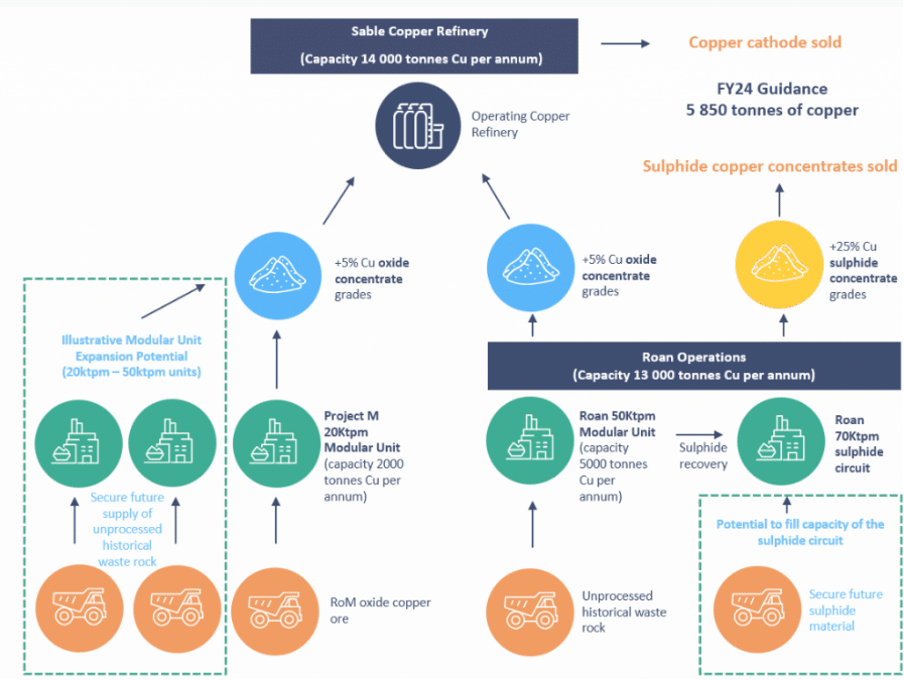

The Roan plant — where the concentrator front-end upgrade is on the verge of completion — should start to ramp up as soon as the end of April. Capacity will then reach 13,000 tonnes per annum of copper concentrates — and it seems on time to deliver, with the company’s technical team working to keep to the timeline (though always budget for a few weeks of delay regardless).

The Sable refinery is also due an upgrade — with the copper sulphide circuit expansion already commenced and expected to be operational at some point between July and September. This increased processing capacity will accommodate the increased copper production surge from Roan and Munkoyo — with combined capacity to increase from 14,000 to 16,000 tonnes of copper cathode and copper in concentrates.

Then there’s the recently announced copper waste rock JV signed with Abu Dhabi based International Resources Holding (affiliated with International Holding Company, the most valuable listed company in Abu Dhabi) to consider, announced on 12 December. Jubilee will end up with a 30% position in the JV.

The market has completely ignored this opportunity — and Jubilee is trading for less than when it was announced. It has secured a massive area of copper waste rock assets on surface in the country — estimated at some 350 million tonnes, with surface sampling establishing grades higher than 1.5%.

It’s worth noting that Jubilee has a technical team on the ground, which has ‘commenced extensive resource definition and process technical review with the aim of completing the project implementation detail,’ with the timeline due to be established within the next month or so.

The initial capital expenditure is expected to be in the region of $50 million — but Jubilee has executed a binding funding term sheet with IRH to form an SPV to acquire the copper waste rock asset and fund all the capital requirement, through a combination of equity in the vehicle alongside shareholder loans. This is expected to conclude by mid-March.

For clarity, Jubilee is in charge of implementing and operating the mining and processing solution; and plans to construct and commission the proposed copper units by the end of the year, with mining to start at the beginning of 2025.

Technically, the JV is targeting 24,000 tonnes of copper per year at a cost below $4,000 per tonne, processing 260Mt of waste rock. While details are being finalised, Jubilee plans a more detailed resource definition.

CEO Leon Coetzer enthuses that the transaction is a ‘a significant milestone on our journey in Zambia, catapulting our copper expansion in the region. The Waste Rock Project, anchored by this substantial resource, will fast-track the rollout of our modular copper processing units in the country with the potential to far exceed our goal of reaching 25,000 tonnes of copper per annum.’

It’s worth noting (again) that the Middle East has plenty of money and little technical mining expertise. You can read this lesson across to multiple other companies in the space.

In addition, Munkoyo (close to Sable) is on schedule — again with that caveat around timelines — and should be capable of supplying ROM to Sable by Q4 2024, meaning a further quality supply of copper.

In terms of full-year guidance, the company has guidance for copper at 5,850 tonnes on the assumption that Roan is upgraded on time.

Finances and Management

The joyful underbelly of small cap finances.

In recent half-year results, Jubilee saw group revenue rise by 18.4% year-over-year to £74.7 million, with EBITDA up by 13.3% to £11.7 million. This left the company seeing profit after tax rise by 7.3% to £4.4 million. Unlike other operators, it is revenue-generating, and profitable.

Chrome/PGM sales rose by 17.9% to £68.4 million, while copper sales rose by some 23.5% to £6.3 million. Copper units cost per tonne improved by 13%, while copper units gross profit rose by more than two-thirds to £2 million.

You can see how the copper is currently small fry, but also that the future of growth rests in the division — as there is significant future potential with the various streams, and the copper price itself should rise sharply from 2025 onwards.

One financial question to be answered is on the net cash position and recent capital expenditure. Capex for the half was £12.9 million, 57% below the £30.1 million spent in the same half in 2023 (due to expansion projects in Zambia and South Africa concluding), though the cash position fell by 60.3% to just £5 million.

In mid-December, Jubilee placed shares at 5.5p per share (above the current price), raising some £13 million with ‘certain institutional and other investors.’ The money was to be used to make an initial payment of $1.75 million for the IRH JV copper waste rock dump (total $4.5 million), expand sulphide recovery circuits at Sable ($5.7 million), and progress project development at Mufulira ($2.5 million).

The placing concluded on 4 January, so I am assuming this cash is in addition to the £5 million cash at hand. That answers any immediate placing concerns.

Is the capital expenditure for the next 12 months going to fall to correspond with the cash position? You might presume so — but it’s a question worth asking. But it is clear that the company is past the highest risk stage. And on a fundamental balance sheet basis, Jubilee is clearly undervalued.

In terms of management, Coetzer is a qualified chemical engineer with more than three decades of experience, including at Anglo American, and then as CEO of Braemore which was eventually acquired by Jubilee where he was appointed CEO in 2010.

The Non-Executive Chairman is Ollie Oliviera, currently lead independent director of Vale SA, and a chartered accountant — who has decades of experience in corporate finance and strategy within the mining sector. Technical Director is Dr Evan Kirby, a metallurgist who owns consulting business Metallurgical Management Services, and has served on the board of many listed companies.

The bottom line

Let’s consider what investors are getting for a circa £150 million market capitalisation:

- Ramp up to 2 million tonnes of chrome concentrates per annum, including two additional 50ktpm modules at Thutse

- Ramp up to 25ktpa of copper, with upgrades at both Roan and Sable and Mukoyo on target

- Zambia waste rock partnership with IRH, potential for a stand-alone 25ktpa project

- Multicommodity, multi-jurisdictional operator

- Revenue generating and profitable

There are even rumours coming out of Zambia that Jubilee is considering buying the Chambishi copper plant, further increasing potential capacity. Given the plant has been in care and maintenance for years, I can’t imagine it would be particularly expensive.

It’s worth noting the push by African nations to ensure processing in their native country — the massive expansion of copper exploration in Zambia (including companies I will get around to soon) means their finds will need to be processed somewhere.

Jubilee has that somewhere. In the ‘gold’ rush, the one selling spades makes the money. It would not be surprising to see buyout offers in the not-too-distant future.

The other important final consideration is the modular tech. Jubilee has a huge advantage in that it has specialist knowledge in modular units within both chrome and copper — though presumably, this could read across to most metals.

This means it can scale over time at an affordable and realistic pace and pack up and reassign modules as and when an exploratory asset is spent. It can also expand operations to almost anywhere in the world, and especially in Africa where demand continues to rise for novel solutions in a continent where infrastructure is often lacking.

Jubilee is extremely well placed in the African mining story — and is one of the top stocks to watch over the next few years. I like to

It’s perhaps not as exciting as an explorer at the mercy of the drill bit. But the takeaway is that while the chrome and PGMs are profitable, Jubilee is about to hugely boost its copper operations at multiple sites — in one of the best regions in the world for copper, and just before copper prices are widely expected to rocket.

The recent share price decline may be the bottom.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

You have forgotten a big area with Jubilee which is ESG. They clean up the mess of old and establishes a new area for people in Zambia and other areas to live safely. They also bring huge employment benifits to the Country

ESG definitely matters and they are ESG leading. However word count is limited 🙂

I have been invested in and watching this share for a number of years. I fully agree with this article in every sense and I would expect the share price over time to increase tenfold from its current price.

That would be great! I think similar as a long term hold, but it needs to deliver the Roan upgrade before investors buy in en masse

A great article, thank you. One typo,its Leon not Louis.

This is what i get for working at 4am! Many thanks, amended

I have been invested in Jubilee for some years now and like your self have seen and I hopes of this company under the leadership of Leon. The snag now is in 4 years time I reach 100 years, I only wish I had more time left to see the final outcome of which I think will be great…Thanks for your views….. Ray Fisher

2024 could be the year – perhaps the wait is almost over? Good luck!

I have been invested in Jubilee for the past 5 years and optimistic that it will be successful.With the diverse basket of materials,it could possibly be taken over by the bigger players – your comments please

Yes, it is definitely a buyout target – though I expect this scenario will become far more likely when PGMs recover, as a combination of chrome, PGM and copper processing will be very attractive to larger players.