In the US, the everything bubble has inevitably burst. But the coming melt-up could be equally as rapid and take institutions with similar surprise.

Just under a year ago, I called the end of the US’s ‘bubble of everything.’ Stocks, crypto, housing, and debt; all were far too high compared to reality, amid rising inflation which no central bank had attempted to contain or cared to even highlight.

Fast-forward to today, and the bubble has well and truly burst. The S&P 500 is in a bear market, while the NASDAQ 100 is down a whopping 31% year-to-date. Blue-chip tech stocks like Meta, Apple, Amazon, Microsoft, Netflix, and Tesla alongside dozens of their comrades have collectively seen hundreds of billions of dollars wiped from their market caps.

Bitcoin is down by 66% over the past year, and every other cryptocurrency has followed. And now the housing domino is falling, with US homes prices having fallen by 1.6% between June and August. And with the Federal Reserve determined to course-correct sky-high inflation down to around 2% — CPI is now at 8.2% — further interest rate rises to the high single digits appear a striking possibility.

The Case-Shiller Index shows that the average San Francisco home price is already down by 8.2% from the peak. Increased pandemic-era investor purchases across America — including speculators, institutions, landlords, and wannabe Airbnb barons — are now seeing prices fall rapidly as the non-sticky portion of the sector attempts to exit before the peak becomes the trough.

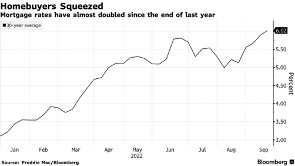

According to the Mortgage Bankers Association data, the average rate on the typical 30-year mortgage is now circling 7%. According to Freddie Mac chief economist Sam Khater, this represents ‘its highest level since April of 2002.’

And according to Bankrate, credit card rates are also rising, with annual rates up to 19% from 16.3% at the start of this year. Meanwhile, a five year auto loan is up to 5.63% from 3.86%.

Then there’s the student loans dilemma. Despite the $10,000 forgiveness, the average US student debt still stands at roughly $30,000. And the interest rate on federal loans has risen to 4.99%, up from 2.75% in 2020-21. Private student loans can now be as high as 15% dependent on credit score.

Recession is almost certainly coming, with a recent Bloomberg expert study putting the chances at 100% in the next 12 months. And 37% of small US businesses are behind on their rent, despite employing half of the country’s workforce.

The expectation is that the Federal Reserve will continue to increase interest rates to bring down inflation while simultaneously trying to sell off a proportion of its near-$9 trillion balance sheet. This will put further pressure on everything: growth stocks which rely on cheap debt, cryptocurrencies whether stalwart or novel, house prices, unsecured debt, and the wider economy in general.

2023: year of the melt-up?

But here’s the thing. Every investor from New York to Tokyo knows all about the domestic financial pressures facing the US. External pressures, including the Ukraine war, strained Sino-US geopolitical tensions, supply chain challenges and the wider labour shortage are also widely understood.

And key to this upcoming hypothesis— these headwinds are already priced in.

Now consider this. A key factor behind rising inflation is energy costs; in fact, explosive energy contributes to virtually every inflationary factor within the wider economy.

But when recession hits, energy demand sinks, and this may already be happening. Natural gas prices have fallen to less than a third of their summer peak, while the Brent Crude benchmark is down to circa $95, from a high of $140 only a few months ago.

In addition, Russian oil and gas will once again become politically palatable when a peace deal is inevitably signed. If this times well with the upcoming recession, there could be a huge energy glut, especially if it synergises with the increasingly rapid transition to renewables.

When the pandemic originally struck in early 2020, the S&P 500 fell by roughly a third from 3,380 points in mid-February 2020 to 2,305 points by mid-March 2020. But it recovered from this steep fall in the space of four months, and then proceeded to hit a record high by December last year.

And despite dipping back to 3,862 points today, it’s still nearly 500 points above its pre-pandemic value, and up 50% over the past five years. In fact, the index has returned circa 8% per year between 1957 and 2018.

At present, the economic calculation is simple: higher rates are worth it to cure high inflation, even if the inflation is supply-side, and tightening monetary policy causes a downturn. The ghost of Volcker is breathing ice down Powell’s neck.

But demand seeps out of economies with a bang, not a whimper. If the recession becomes too deep, the Fed will pivot. And low energy prices, low interest rates, and low inflation could see the melt-up rocket faster than most analysts can react.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.