The pandemic hangover, energy costs, geopolitical tensions, tightening monetary policy, and a volatile market together constitute globally significant risks.

The 2023 global recession is just around the corner. The response to the covid-19 pandemic crash was the most expensive global economic bailout ever, backed by virtually every government in the world.

Now an unprecedented crisis is coming down the tracks.

2023 global recession: 5 factors to consider

- Pandemic Hangover

While it may feel like coronavirus is over, its aftereffects will linger for years. Businesses in every sector have been left with crippling debt, in addition to a higher wage bill as the Great Resignation takes off, with millions of older workers leaving the workforce altogether.

Supply chains have been relentlessly squeezed. In particular, increased shipping costs exacerbated by China’s zero-covid policy have seen the world’s largest port, Shanghai, shut intermittently for months.

Meanwhile, real estate prices have accelerated at an unprecedented pace, mainly because of changing attitudes towards remote work and an easy money supply. This has dragged more of the world’s population into larger long-term debt, that is becoming ever harder to service.

Further, while some individuals saw their wealth increase in the pandemic era, far more were hit hard. This leaves consumers financially ill-prepared for the coming downturn.

2. Energy

The world runs on fossil fuels. While Brent Crude has now fallen to $93/barrel after striking a multi-year high of $140 earlier this year, it remains substantially above the $70 2021 average.

But while oil is problematic, gas is the real issue.

In the UK, wholesale gas prices have risen 11-fold compared to pre-pandemic levels to around 550p per therm. Two-thirds of UK households will be in fuel poverty by January, and Auxilione is predicting the average UK household’s annual energy bill will top £6,000 by April.

While some of this increase can be attributed to post-pandemic demand, the lion’s share of the rise is attributed to Russia’s invasion of Ukraine.

Gazprom has already constricted gas supply to Europe through Nord Steam 1 to 20% of capacity, and is cutting flows completely for three days at the end of August for maintenance. Some fear the supply will not be turned back on.

Worse, the historic drought could leave the Rhine unnavigable for alternative supplies, and is seeing France shut down multiple nuclear reactors. And in China, the energy-critical Yangtze is already unnavigable.

And the only realistic short-term solution is to capitulate to Russia, which is politically impossible.

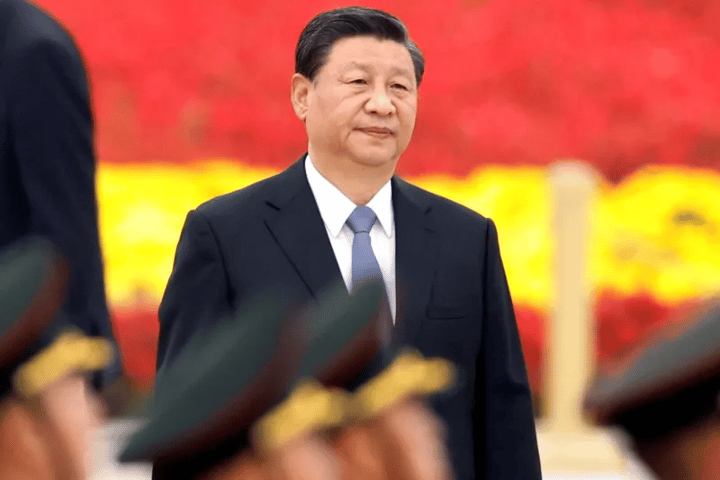

3. Geopolitics

International relations are fracturing as economic pressures continue to cook. While Russia has been sanctioned by the west, India and China are buying its oil at a discounted rate, undermining western sanctions while also gaining an economic advantage.

Russia is now making more money from selling fossil fuels than pre-pandemic.

This is fuelling tensions in the west, as the solution to the recession is Russian gas. But worse, it’s solidifying the east vs west geopolitical shift that could prove disastrous long term.

The other concern is Taiwan, which manufactures 95% of the world’s microchips. A possible Chinese invasion of the contested region could be even more economically disastrous than that caused by the Ukraine war, as it could drag NATO members into direct conflict.

4. Monetary Policy

Decades-high inflation and rising interest rates are simultaneously making money less valuable and debt more expensive. Citi predicts UK CPI inflation will strike 18.6% in early 2023, and further increases to unheard-of levels are now no longer unthinkable.

Of course, the Bank of England is increasing interest rates; the base rate is currently at 1.75% and rising. But realistically, even an increase to 10%, sparking an economic and housing collapse, is unlikely to solve the problem.

Inflation is now supply-led through energy rather than demand-led. However, the need to act to arrest a potential currency crisis and stop the dreaded wage-inflation spiral means double-digit interest rates are far more likely than most economists think.

The pound has already dived against the dollar in 2022.

5. Markets and commodities

In the face of rocketing inflation, it’s tempting to consider where best to protect your money. However, safety is hard to find. While the FTSE 100 has maintained its value so far this year, the recession will likely see it succumb. Internationally, almost every index is down from its year start.

Commodities are also falling, predominantly on rising dollar demand. Cryptocurrency has been in freefall for months. Real estate is at the mercy of rising interest rates. Even gold, the traditional inflationary hedge, is at a near-record high, with a long way to fall in a shock event.

Morgan Stanley has a solution: hold cash and wait for investment opportunities to appear in the downturn. Even then, most economists argue the dollar is at dangerous levels.

To put this in perspective: the titan believes it’s better to watch inflation chip away at your funds than to invest in any asset class. And wait for the crash— a once-in-a-generation opportunity to buy the dip.