Cotton, wheat, and orange juice could all rise in 2023 as global economic demand soars while supply remains heavily constricted.

Hard commodities stormed the headlines in 2022.

It began with two years of global lockdowns crashing demand, with Brent Crude going negative for the first time in mid-2020. Then as the global economy recovered, demand increased faster than producers could keep up with.

This post-pandemic demand combined with Ukraine war shockwaves sent the prices of oil and gas to multi-year highs, precipitating an energy crisis that has required an unprecedented government response.

Likewise, industry-critical metals — including gold, iron, nickel, and palladium — soared to record or near-record highs as severe stress was placed on both sides of the supply-demand equilibrium.

The resulting inflation is sending interest rates to highs not seen since the 2008 financial crisis, with resultant equity bear markets.

But while hard commodities are now coming off their highs as fears of a global recession elevate and the US dollar continues to strengthen, weakening soft commodities could now be the new opportunities.

Best soft commodities in 2023

Cotton

Cotton hit a high of $156 per pound in May, its highest price in more than a decade, and a threefold increase compared to its $50 pandemic era low. The material is an essential raw component in the manufacture of textiles, including in many forms of clothing.

However, cotton has since fallen to $86 per pound, as operators worldwide raced to up production to take advantage of the temporarily high prices.

But this may be an overcorrection. India, China, and the US together comprise 70% of the world’s cotton production, and record heatwaves and increased agricultural pests have crippled production.

Moreover, the US has banned imports of Chinese cotton from Xinjiang amid accusations of possible Uyghur slave labour. And in India, up to four inches of heavy rain in the Haryana region is predicted to decimate both its cotton quality and yield.

In addition, the US Department of Agriculture has cut its domestic production estimate by roughly 500,000 bales, which could lead to stockpile reductions. It cited a combination of drought and heavy rain as factors, with production cuts in top state Texas unavoidable.

Of course, these pressures will take time to feed into the supply side.

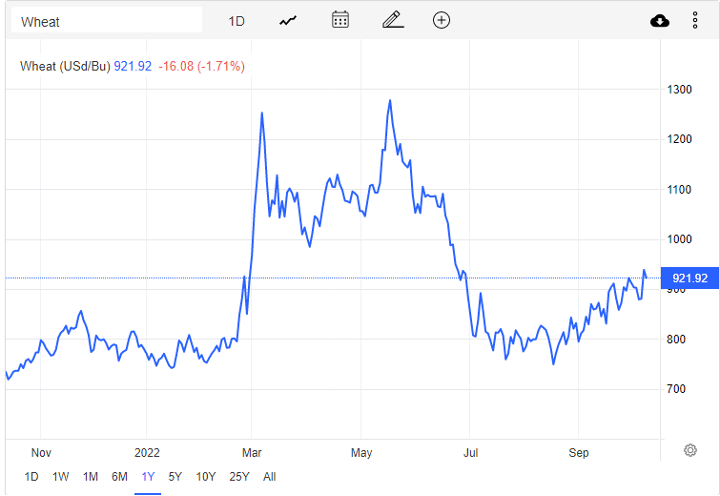

Chicago Wheat

Wheat hit a high of $1,264 per bushel in May, benefitting from the same Ukraine war uncertainties as cotton, before falling to $921 today. The grain is unique in its ease of growth, diverse use base, and its key role in the production of milk, meat, and eggs.

Russia and Ukraine together comprise more than a third of total global wheat production. Indeed, the commodity is so crucial to Ukraine that its blue and yellow national flag signifies the sky over a field of wheat.

This ‘bread-basket of the world’ saw exports from the Black Sea resume after Russia and Ukraine backed an UN-brokered deal earlier this year, despite the ongoing war. But Ukraine’s grain exports are still down 46% year-over-year to 2.65 million tonnes in the 2022/23 season. And the deal expires next month, amid a changing political calculus.

With recent territorial gains and the attack on the Crimean bridge, Russia may not be willing to sign off on another deal, especially given the recent shelling of Ukrainian civilian areas and OPEC+ defiance of American requests to up oil production.

Moreover, second-largest exporter India has banned most exports in response to drought. And in the US, heatwaves have seen the second smallest harvest in the past 20 years, down to 1.65 billion bushels.

Of course, high wheat prices could send traders to oats or corn as alternatives. But as food demand is inelastic, they may simply match wheat’s highs.

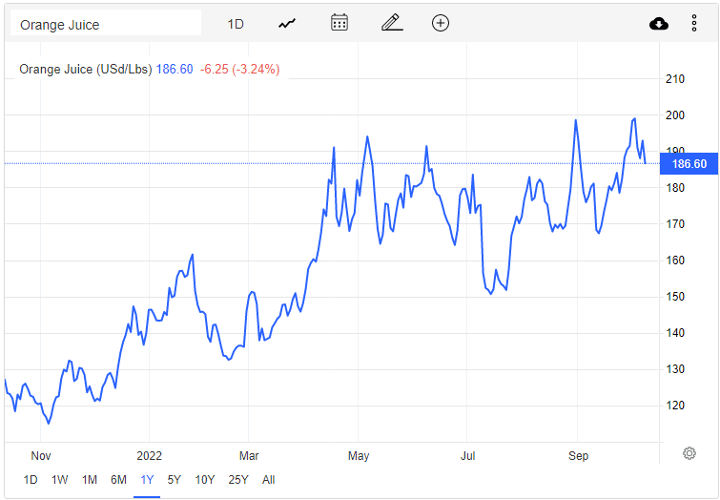

Orange Juice

Perhaps the most overlooked soft commodity in the world, orange juice is becoming a trading powerhouse for investors with a high-risk appetite. Its vitamin C is regarded by governments as a medically important, and cheap, disease-fighting compound for the general population.

The liquid is already up 28% year-to-date to $186.60 per pound, boosted by analyst expectations that Florida production will be hit by widespread greening fungal disease. According to the US Department of Agriculture, orange production was already estimated to fall by circa 13% to 13.5 million tons, its lowest in 55 years.

But Hurricane Ian has heaped yet more disaster on the crucial orange-growing area, damaging orange trees and causing widespread inshore flooding, hitting as much as 90% of production.

And while Brazil and Mexico make up most of the market, Florida accounts for most of the premium not-from-concentrate market. This could see the state’s disastrous yield weigh up the orange juice price by a disproportionate margin, perhaps far more than analysts currently anticipate.

Of course, as with all trading, there are no guarantees.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Leave a comment