Diverging monetary and fiscal policy, a political blunder of epic proportions, and an increasingly hawkish Federal Reserve could see UK rates hit double-digits sooner than the markets think.

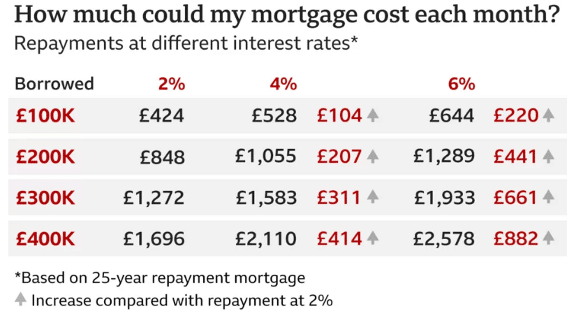

Right now, the markets are pricing in an increase in the UK base interest rate to 6% by mid-2023. However, a worst-case scenario could plausibly send them much, much higher, with an increase to 10%+ no longer an impossible reach.

And there are three key reasons why.

Inflationary-linked monetary policy

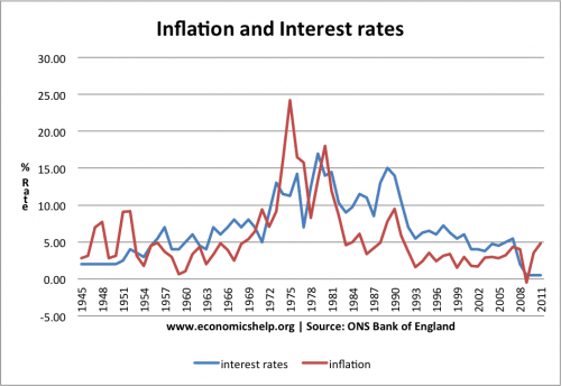

The key interplay between the inflation-interest rates relationship is that high inflation can only be tamed by increasing interest rates. This is because while more expensive debt slows growth, it also takes heat out of the economy.

This has been an iron-clad rule since the post-war years, with the correlative effect obvious when interest rate movements are superimposed on inflation, as below:

UK CPI inflation remains at 9.9%, as basics including energy and food continue to rise in the wake of increased post-pandemic demand and Ukraine War-decreased supply.

While last week’s ‘fiscal event’ has overshadowed the macro outlook, interest rates were always going to need to rise higher to combat the current decades-high inflation, even if most of it is coming from the supply side.

Loosened fiscal policy

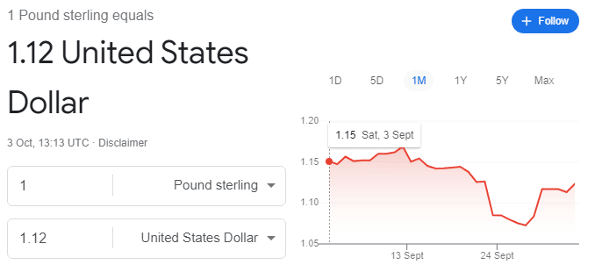

However, last week’s ‘mini-budget’ has exacerbated the problem, unleashing unprecedented chaos among UK markets. Sterling tanked against almost every currency in the world, and the FTSE 100 dived, even though its international stocks usually benefit from a weakened pound.

Meanwhile, the country’s £1.5 trillion pensions market was almost wiped out. The collapse in bond prices saw fund managers who had heavily overleveraged in supposedly safe liability-driven investments (LDIs) were forced to sell assets to cover the resulting higher collateral requirements.

This created the negative feedback, or ‘doom loop,’ where the fire sales of assets depressed prices, triggering more and larger collateral calls amid concerns that every UK private pension fund was on the verge of collapse.

The Bank of England was forced to pause its quantitative tightening agenda to reduce its £838 billion of bonds, and instead issue £65 billion in extra emergency bonds to calm the markets. However, this emergency sale ends on 12 October, and similar volatility could well ensue.

Chancellor Kwasi Kwarteng has now rowed back on the mini-budget, disposing of the promise to scrap the 45p additional tax rate for employees earning over £150,000.

Accordingly, despite still being down significantly against the US Dollar over the past year, sterling has stabilised close to its pre-mini-budget level. Of course, this is at the expense of baked-in future sky-high interest rate rises, with the market pricing in a rise to 6% by mid-2023 alone.

One consequence is the impact on mortgages. Moneyfacts research shows that the average two-year fixed rate mortgage deal is now at 5.75%, up from just 2.34% at the start of December.

But as IFS Director Paul Johnson notes of the Chancellor’s concession, ‘the difference this makes really is trivial. This was, if anything, possibly the smallest measure from a fiscal point of view.’

For context, Kwarteng had approved £45 billion in uncosted annual tax cuts, worth roughly 0.35% of GDP, and the move represents a reversal worth just £2 billion a year.

Therefore, the government, and by extension, the UK markets, could be suffering from a credibility crisis. Indeed, there are now no guarantees that the government will not bow to future political pressure on unpopular policy.

And further volatility could be unavoidable if the Chancellor pursues even more tax cuts during an inflationary, recessionary period.

US Dollar strength

One further problem for sterling comes from the strength of the US Dollar. Rising inflation in the states has seen the Federal Reserve act more aggressively than the Bank of England or European Central Bank, imposing a 75 basis points rise in its last meeting compared to the Bank of England’s 50 basis points.

The danger is that the Federal Reserve’s continued rapid interest rate rises will force other reserve currencies like sterling to match, or even exceed their moves, to avoid parity or even economic desertion.

Of course, a global recession, a US-led agreement to weaken the dollar, or another economic shock could change the outlook drastically.

But in my opinion, a 1980s-style 10% base rate is coming.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.