One of the hottest and most popular topics you’ll find on the internet is artificial intelligence (AI). The buzz around AI is not merely a fleeting trend; it’s a testament to this technology’s awe-inspiring advancements and ever-growing applications, which have captured the imagination of entrepreneurs, researchers, and investors alike. As AI continues to reshape industries […]

Avacta shares: brief update for Q2 2023

Avacta has expanded its footprint in the US. The listing could be next. As a long-term investor in FTSE AIM stocks, I am used to the rollercoaster-like volatility that has been Avacta this year. Despite a strong Science Day and solid recent Phase 1 results, the biotech shares are up just 9% year-to-date. However, it’s […]

New Tax Year explained: sorting the SIPPs from the ISAs

Pensions, savings accounts, and premium bonds: where to start if you’ve left it to the last minute. The most recent ‘tax year’ concludes today, 5 April 2023. The new tax year begins tomorrow. Officially, we’re at the height of ISA season — and with the madness that has been the past few years, it can […]

AI Revolution Hits Snag – Italy Bans ChatGPT

Is the world prepared for the coming AI surge? The answer at this point would have to be “absolutely not!” We like the functionality and useful input AI can give us daily, but do we understand the possible future implications of this technology? Most of us are blissfully unaware of what surprises it may harbor […]

Coolness towards stocks may be good for the stock market

The sentiment towards the stock market and stocks themselves is not at its peak currently. The banking crisis has caused most indicators that measure the willingness to take risks on the stock market to hit rock bottom. Investment bank J.P. Morgan’s poll among its clients is no exception. The question asked was how likely the […]

Global Banking Crisis 2023: Why Are Bank Shares Falling?

Lately, I’ve noticed bank failures and plunging bank stocks. Two big tech-focused banks fell due to bank runs, prompting authorities to support the financial system urgently. Silicon Valley Bank and Signature Bank in the US, along with Switzerland’s Credit Suisse, experienced failures, raising questions about European banks’ foundations and causing investors to reevaluate the banking […]

Deutsche Bank: the Helm’s Deep of global banking

As Silicon Valley Bank and Credit Suisse fall, investors are casting doubtful eyes at another bank which has traditionally stood on shaky ground. Deutsche Bank shares climbed out of their hole of 2022, rising to €12.34 on 27 January 2023. By 9 March, they had dipped to €11.51 — before sinking to €8.54 on 24 […]

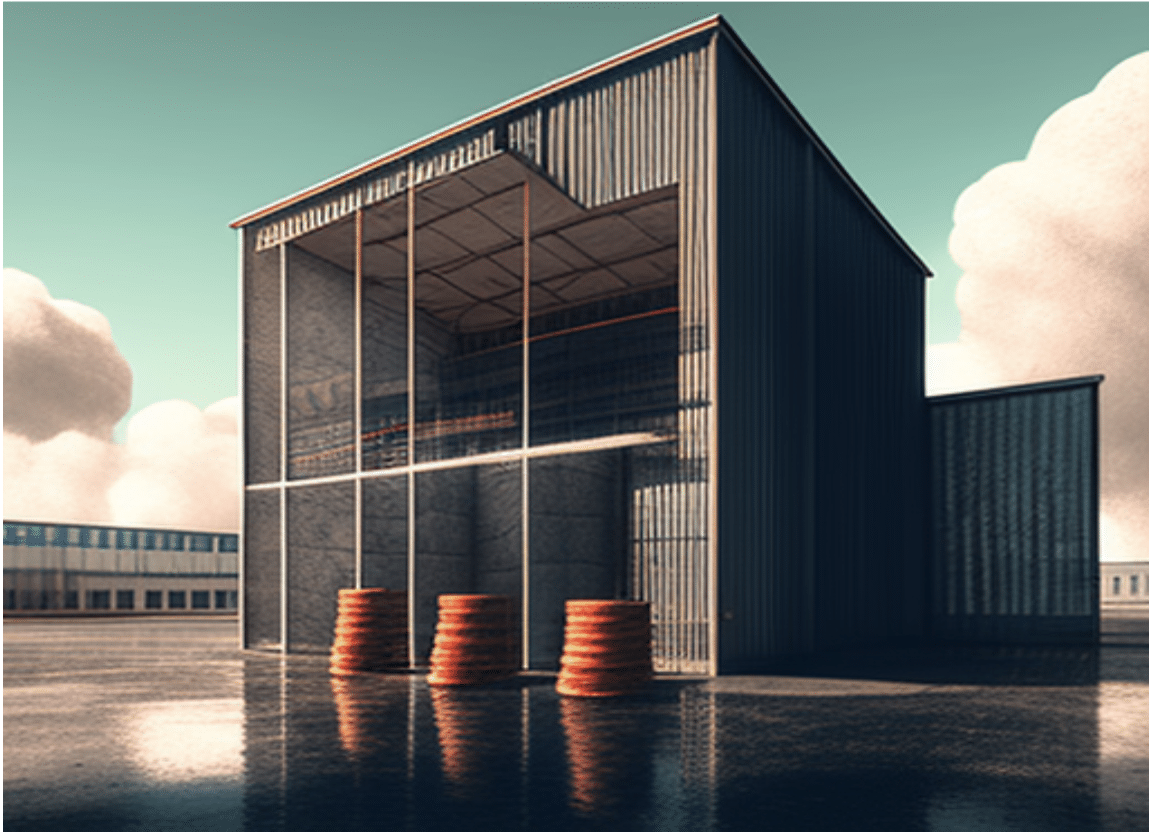

3 best pure-play copper stocks to watch in 2023

Antofagasta, Freeport-McMoRan, and Southern Copper could constitute the titan pure-plays to consider in 2023. Copper is the unsung hero of the green energy revolution. Lithium, graphite, and REEs all see significant coverage, but there seems to be — outside of the investing community — a delusion that there is sufficient copper available at the current […]

Where to Retire in the UK: Analysis of the Top Destinations in 2023

Retirement can pose challenges, particularly in the UK, where living costs and standards differ greatly depending on the region. While many retirees opt to stay close to their families and friends, others may want to discover new places to live during their golden years. However, selecting the best place to retire in the UK requires […]

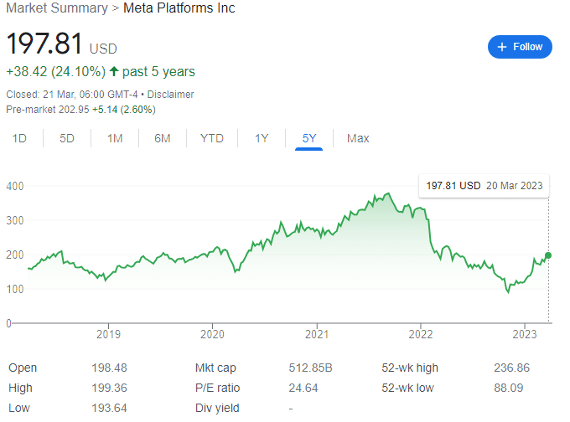

Meta shares: TikTok ban a slow dance away?

As bans on government devices gather pace worldwide, a US-wide prohibition on the popular social media platform could be coming close. Meta (NASDAQ: META) shares are on the rebound. The Facebook, Instagram, and WhatsApp owner saw its stock collapse from a record $379 in September 2021 to just $91 by early November 2022. But things […]

Credit Suisse crisis: the death of market certainty

UBS’s wedding to Credit Suisse — with Thomas Jordan holding the shotgun — puts the nail in the coffin of investing certainty. As a long-term investor, I’m looking at the forced marriage between UBS and Credit Suisse with a keen sense of worry. The Swiss state and the global banking system are doing their best […]

What the Spring Budget Means to You, Your Money, and Your Business

This post briefs you on the UK’s Spring Budget, announced on March 15, 2023, by Chancellor Jeremy Hunt. The UK is trying to grow the economy without scaring off financial markets. But what does it mean to you, your money, and your business? Two big deals in this budget are capital allowances worth £27 billion […]

Investors flee to safe assets – gold increases

The price of gold increases rapidly when investors seek safe assets. Leaving uncertainty behind is a trend that quickly sweeps across both Europe and Wall Street, and gold is a safe bet to hold in hand. Gold, an asset that feels safe At least that’s how many investors feel right now, who this week have […]

Jeremy Hunt: is retirement planning no longer possible in the UK?

Meddling with pensions is always a recipe for disaster. Stop tinkering and get the tax burden on earnings down instead. As a higher-rate taxpayer with three delightful but dependent children, there is nothing quite so brutally tax efficient as contributing excess income to a private pension (SIPP). I’ve covered the oddities of the UK’s personal […]

Interest Rates and Inflation – UK Investors Price in March BoE Rate Hike

Soaring inflation has been wreaking havoc on people’s savings and livelihoods the world over. In the US, UK, and EU, the respective central banks have embarked on aggressive interest rate-hiking campaigns to temper inflation. Although their efforts have been met with some success, inflation continues to be much higher than central bank targets. Inflation in […]

What Is the Average Credit Score in the UK in 2023?

Credit scores vary depending on credit reference agencies. With the changing economic situation, what is the average credit score in the UK in 2023, what makes a good credit score, and how can you improve it? We have the inside scoop. In most countries, you must have a good credit score before accessing a loan. […]

This ETF is soaring – investing only in women-led companies

Companies with women in top positions have performed 20 percent better in recent years. Here is the ETF that only invests in women-led companies – and it seems to be soaring this year as well. The Hypatia Women CEO ETF is a ETF that only invests in companies led by women. The fund was recently […]

Poolbeg Pharma: an infectiously good FTSE AIM opportunity

POLB 001 is in the early days, but initial data suggests it could become a key treatment for influenza alongside promising oncological applications. Poolbeg Pharma (LON: POLB) shares are not for the faint-hearted. Despite rising by 42% over the past year, the FTSE AIM biotech has seen serious share price spikes and crashes. As a […]

Premium Bonds: why they’re now attractive to high earners

Premium Bonds work as an emergency savings pot, offer tax-free prizes, and a safe tax savings pot. They’re also unlikely to be meddled with anytime soon. Picture the scene. It’s 2008. Interest rates have dropped below 1%, and will remain there for over a decade, only slowly starting to creep up in December 2021. The […]

How Well Will Brits Invest in Stocks and Shares in 2023?

Despite the current economic challenges in the UK, the 2022 bear market, and global uncertainties, recent data suggests British investors have high hopes for 2023 investment returns. But how far can they go? A recent survey by eToro revealed that over half of UK share investors are optimistic about the investment market in 2023 and […]