As bans on government devices gather pace worldwide, a US-wide prohibition on the popular social media platform could be coming close.

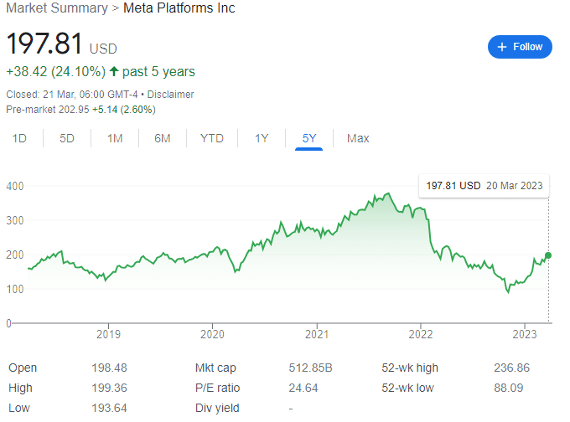

Meta (NASDAQ: META) shares are on the rebound. The Facebook, Instagram, and WhatsApp owner saw its stock collapse from a record $379 in September 2021 to just $91 by early November 2022. But things are looking up again.

Slightly after its record low, I posted an article covering the possibility that TikTok — Meta’s arch-rival and largest competitor – could be banned both in the United States and across much of the western world.

While this was at the time viewed by most as a laughable possibility, the chance of this happening is now swinging toward likely. And it’s this that is seeing Meta shares surge in my view.

Of course, CEO Mark Zuckerberg has made some welcome changes. His $1 billion per month Metaverse obsession was barely mentioned in last week’s update on its ‘Year of Efficiency.’ Thousands of employees have instead been laid off, and the company is redirecting tech efforts towards developing its own AI tools.

Quietly, Metaverse investing will continue in the background, and I think it could yet pay off especially as competitors drop their own programs entirely. But Zuckerberg has realised that it is better to keep quiet and instead wait to crow about the advances when growth returns. Better late than never.

And despite changes to Apple’s privacy terms costing the company circa $10 billion per year, the family of apps — Facebook, WhatsApp, and Instagram — continue to boast almost 3 billion daily active users. This represents two in every three internet users worldwide — and almost everybody when you strip out China.

The stock could also benefit from the international banking crisis. Tech companies have a strong inverse relationship with interest rates; and a pause or even reduction of the federal funds rates is now looking more possible. Of course, reversing course could make the current crisis worse by sending a message to the markets that the crisis requires an emergency response — but that’s the banking sector’s problem.

Even after a truly disastrous 2022 for the share price, Meta revenue fell by just 1% year-over-year in 2022 to $116.61 billion. It was clearly oversold, and a strong further recovery seems likely.

Especially if the 100 million Americans who use TikTok wake up one day to find the app disabled on their phones.

TikTok ban?

To be clear, many governments have already banned the app on national security grounds on government-owned devices. This includes — but is not limited to — the US, the UK, New Zealand, Belgium, Denmark, Canada, and employees of the European Union.

But India is the interesting test case for those who think an overnight ban in the US is unthinkable. In June 2020, TikTok boasted 200 million Indian users and the country was the company’s largest market outside of China. But the government banned it all the same, alongside all other Chinese-owned apps, overnight, citing privacy and national sovereignty issues.

Private corporations could be starting to impose a ban too. Denmark’s public service broadcaster and the BBC have imposed bans on staff devices.

The key problem is that China is theoretically able to requisition any and all TikTok data as parent company ByteDance is headquartered in Beijing. And while ByteDance may argue that this is a ‘fundamental misconception,’ the reality is that when the CCP says jump, Chinese corporations must only ask ‘How High?’

Chinese law dictates — in plain black and white — that companies must hand over internal information to the state for national security purposes when requested.

Politically, the key worries are that the Chinese government could use the app to spy on US citizens, use it to spread propaganda, issue phishing attacks and blackmail, or is even damage the populations’ mental health.

For perspective, research from the Centre for Countering Digital Hate shows that new accounts can rapidly be shown suicide or eating disorder content within five minutes of opening the app.

And given Russia, Taiwan, spy balloons, and a series of increasingly bitter regulatory tit-for-tats over US-listed Chinese tech stocks, an outright ban would be one of the few laws to find an easy path through Congress as politicians on both sides both view China with suspicion.

Technologically, it’s impossible to completely eradicate the app, but a combination of legislation and executive orders aimed at distributors, ISPs and cloud services would be sufficient to enforce enough of a ban that few would be able or even want to access it.

CEO Zi Chew has developed a $1.5 billion plan — codename Project Texas — to allow the US government to vet the app’s code and a separate board of directors of a potential US subsidiary. But it may be too little too late.

But the interagency Committee on Foreign Investment in the United States — including the DOJ and the FBI — has now upped the ante, demanding that ByteDance divest from TikTok or face a nationwide ban.

The nail in the coffin was ByteDance admitting that it had spied on several US-based journalists late last year. In December, a bipartisan coalition was pushing for a national ban, and this month 12 senators have introduced a bill which would make it possible for US President Biden to ban the app by executive order if he deemed it necessary.

For context, among other allegations, Forbes had found that Chinese state media has used TikTok accounts (which, at the time, did not contain labels disclosing that they were run by state media) to attack key politicians before the midterm elections. And FBI Director Christopher Wray has repeatedly expressed concerns that the Chinese government might use TikTok to influence US politics.

A ban seems inevitable at some point soon.

And when it comes, Meta shares could skyrocket.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.