Despite prophecies and high short-term volatility, the stock market has shown surprisingly stability over time. Last week, the well-respected American investor Stanley Druckenmiller was quoted in the media regarding his views on the global economy in general and the stock market in particular. When asked about the future of the stock market, he gave a […]

Fund manager: Tech investments are short-term

Diversify your portfolio and don’t solely focus on tech, as it is a short-term mindset, advises fund manager Freddie Lait. Many of the largest tech companies have seen surges in their stock prices recently, with Meta, Microsoft, Amazon, and Alphabet all posting record gains. However, according to fund manager Freddie Lait of Latitude Investment Management, […]

COPL shares: a brief look at the value disconnect

Canadian Overseas Petroleum’s share price has dipped below 5p. I smell the oily scent of opportunity. Canadian Overseas Petroleum (LON: COPL) shares are the classic FTSE AIM story. Look at that chart. It’s just disgusting. First there’s the peak to a record 81p in late March 2021. COPL shares then fell to 19p by the […]

Volex shares: an intriguing FTSE AIM opportunity

Volex is seeing revenue, profitability, and contract wins rise exponentially. And it might still be undervalued. As a long-term FTSE AIM investor, most readers will know that I focus on two high risk sectors: exploratory miners and cutting-edge biotechs. However, I do make exceptions where I consider that a company is undervalued by the market. […]

Regional Cost of Living Differences and Affordable Living Solutions in the UK

Living costs in the UK are on the rise, and it’s impacting a lot of people. Nearly 90% of grown-ups in Great Britain say their expenses are going up. Everyday stuff like a place to live, food, getting around, and staying healthy are all getting pricier. But not every place in the UK is the […]

How to Create a Personal Financial Roadmap in 2023

In 2023, planning your personal finances is crucial for effective resource management and goal achievement. A financial roadmap offers benefits such as reduced stress, increased savings, and financial independence. By following a tailored plan, you can make informed decisions, prioritise objectives, maintain healthy cash flow, make better investments, and secure a stable financial future for […]

Apple Cash Account: the end of traditional retail banking?

Apple’s 4.15% interest account in partnership with Goldman Sachs will break traditional banking’s grip on the retail market. More will follow. With a market capitalisation of $2.75 trillion, Apple is easily the most valuable company in the world. It was the first to breach the $3 trillion symbolic high watermark in early January 2022, and […]

Regulatory News Service: what it is and what it’s not

With StockBox on-site at PREM’s Zulu Lithium Project, excited investors should consider the limits of RNS regulations and guidance. With Mark EJ Fairbairn of StockBox currently on-site at Premier African Minerals’ Zulu Lithium Project, one question that seems to be popping up on a regular basis is the extent to which Mark can deliver information […]

Student loans in England are an inequitable farce

Gen Z and Gen Alpha face a system designed to tax aspiration out of existence. Long-term readers will have considered my views on the insane complexity of the UK’s tax and pension regimes, my thoughts on the Truss-Kwarteng budget that never was, energy bill support, and the potential house price crash. One area I have […]

Retail investors: not as powerful as you might think

Many retail investors seem to be labouring under the misapprehension that they can affect the markets. This is a dangerous illusion. I have been working as a freelance analyst for many years now. And in that time, I have only ever once seen retail investors beat institutions at their own game. I’m talking of course […]

How Much Should I Save Before Investing?

Saving and investing are two super important parts of a solid financial plan. Think of saving as your safety net and a way to reach short-term goals, while investing can give you bigger long-term returns and help you reach those big long-term financial dreams. But hold on! Before you start investing, you need to figure […]

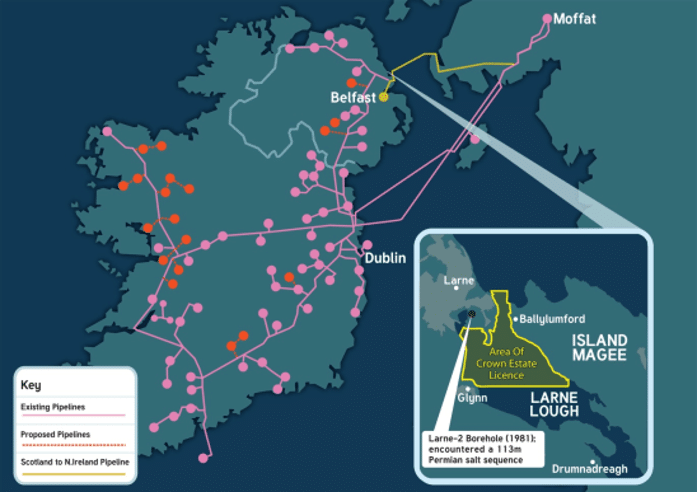

HARL shares: should Wood sell Islandmagee?

Islandmagee’s value will eclipse the company’s market cap assuming the Judicial Review is thrown out. Our CEO should sell it. I have spent the past few months covering Harland &Wolff’s £1.6 billion FSS contract in partnership with Navantia and the associated ship works. Long-term, this will be the company maker that propels HARL’s share price […]

ARC Minerals: Q&A with Executive Chairman Nick von Schirnding

ARCM shares are where KOD shares were — an excellent deal has been signed and the market remains asleep. This won’t last very long. There are currently two copper exploration companies with prospects in the Zambian Copperbelt that have captured my attention. The first is micro-cap Tertiary Minerals (LON: TYM), which I have covered in […]

Sexual Misconduct Allegations Pile Up for CBI

The Confederation of British Industry is in trouble after more sexual misconduct allegations surfaced, and the trickle of companies leaving the lobbying giant has turned into a flow. In addition to Aviva, Mastercard, and Natwest, now BMW and John Lewis have joined the ranks of those departing. According to the Guardian, a woman working for […]

TYM shares: after ARCM, the next FTSE AIM copper play to watch?

Highly prospective Zambian Copper Projects could make TYM undervalued for the high-risk long-term investor. Tertiary Minerals (LOM: TYM) has interests in five solid copper projects that could make it a quality speculative FTSE AIM share for the portfolio. Let’s dive in. Oh, would you look at that. An incredibly volatile chart. On AIM. TYM shares […]

Best Stock Screeners of 2023: Guide, Review, and Comparison

Stock screeners are handy tools investors and traders use to sift through countless publicly traded stocks, focusing on specific criteria. They apply specific criteria like financial ratios, market capitalization, dividend yield, and price-to-earnings ratio. What stock screeners do is that they help you find investment or trading opportunities that suit your preferences, risk tolerance, and […]

Power Metal Resources: Q&A with CEO Sean Wade & Exploration Manager Oliver Friesen

Power Metal Resources is one of my top long-term FTSE AIM picks — primarily for its uranium portfolio in the Athabasca Basin. Perhaps the most common question that I’m asked — both in person and online — is which hot AIM share will be the next PREM or KOD. I rarely entertain these questions, as […]

Passive Investing Explained: What It Means and Why It’s a Hot Trend in 2023

In today’s fast-paced, information-rich world, investors are increasingly drawn to time-tested, data-driven approaches for wealth growth. Amid the vast array of investment options and competitive financial landscape, individuals seek reliable strategies that promise long-term growth with minimal complexity. By harnessing market data and proven investment principles, investors can minimize risk, cut costs, and capitalize on […]

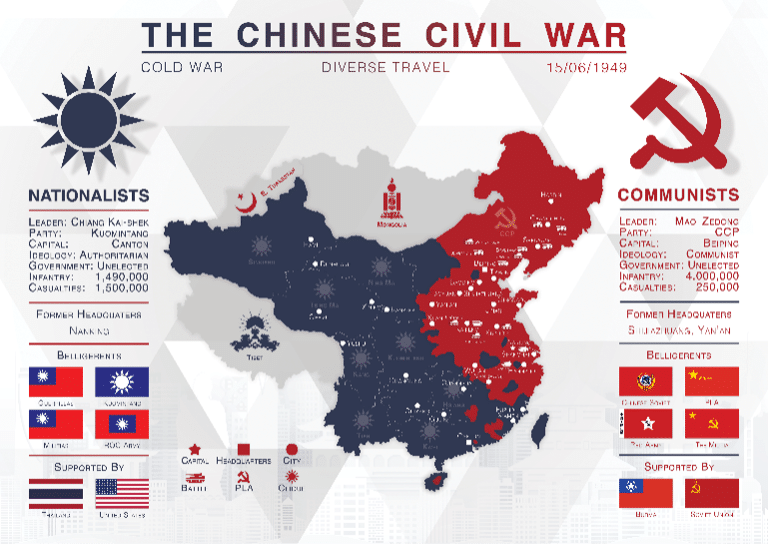

Will China invade Taiwan? The long read

The Porcupine Strategy and US support would make taking Taiwan a pyrrhic victory; but an invasion cannot be ruled out. It is with a sense of trepidation that I write this article. Just before the Silicon Valley Bank/Credit Suisse debacle, I noted that another black swan event may be imminent. Now it seems that Taiwan […]

Neo Energy Metals: exceptional uranium opportunity? Q&A with Chair Jason Brewer

Launching its London IPO later this year, Neo Energy Metals could be the best uranium opportunity of 2023. Chairman Jason Brewer gives his insight. Over the past few weeks, I have covered the bull case for uranium in detail — and also set out the investment case for majority-state-owned Kazatomprom, which is responsible for more […]