Islandmagee’s value will eclipse the company’s market cap assuming the Judicial Review is thrown out. Our CEO should sell it.

I have spent the past few months covering Harland &Wolff’s £1.6 billion FSS contract in partnership with Navantia and the associated ship works. Long-term, this will be the company maker that propels HARL’s share price back to its previous titanic levels.

Indeed, shipbuilding is finally back in full swing at the company after delivering its first complete vessel since 2003 to London-based waste manager Cory. 22 more are to follow.

However, there is a problem. Despite the obvious valuation mismatch between already-won contracts, anticipated business, and the current share price, HARL needs money. And it needs now, to fund projects until it turns profitable.

Finances in brief

First things first. Management have bought significant numbers of shares at a price far in excess of the current price point. CEO John Wood clearly believes in the long-term prospects, and this comes across in every interview.

To funding — the company has upsized its debt facility with Riverstone Credit Partners from $75 million to $100 million and is planning to close £200 million of refinancing with UK Export Finance and Astra Asset Management this quarter. It’s worth pointing out that interest on the debt held with Riverstone is going to be paid on maturity — this increases available cash flow but is also building up a sizeable future obligation.

Navantia is injecting £77 million into HARL’s sites, but this money is earmarked as capex for infrastructure development and does not improve the immediate financial picture.

In the business update on 1 March, the company noted that ‘a slightly more conservative view of the annualised cash break-even threshold is prudent at this stage and believes that annualised cashflow break-even will be achieved in FY24.’

Further, it’s currently ‘evaluating a number of different financing mechanisms, including long-term asset financing, in order to achieve a balanced capital structure for the Company’s further development.’

While it can never be ruled out, a share placement appears unlikely. The £29 million market cap works in investor favour — for once — as you could double the share count and still not scrape enough cash to cover going concerns.

Fortunately, there is a simple solution in plain sight. But many of you won’t like it.

Islandmagee: strategic importance

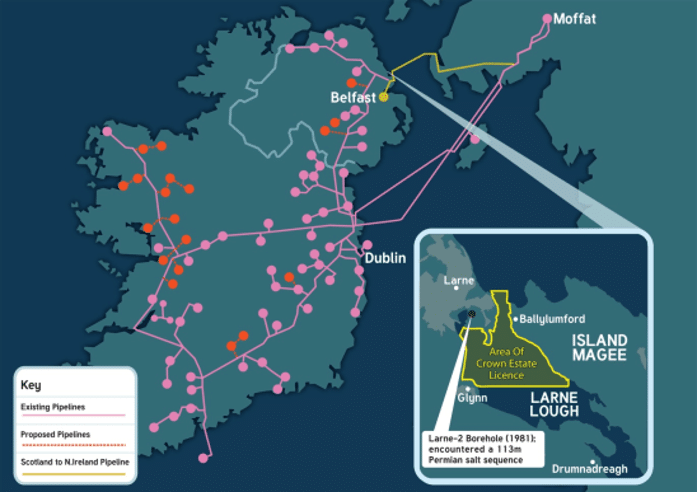

Islandmagee is a proposed gas and hydrogen storage project, first established in 2010 when a large layer of salt was discovered under Larne Lough in County Antrim (NI). It’s the only largescale gas storage project on the island and is an excellent prospect to help boost energy security across the British Isles.

Based on 2018 data, the proposed facility could even provide over 25% of the UK’s natural gas storage capacity. The company plans to create seven caverns capable of storing 500 million cubic metres of gas — it’s worth noting that since Rough was closed (even though a reopening is likely), the UK has circa 1% of its annual gas demand in storage against a European average of circa 25%.

Islandmagee could in theory provide security of supply for at least two full weeks — and we’ve seen how keeping our gas storage so low while simultaneously relying on it for power might not have been a bright idea.

The site also boasts the twin infrastructure requirements — it’s adjacent to the Ballylumford power station and also the pressure reduction station — one connection point for the mains grid, and the second a connection point to mains gas.

Judicial Review

There is an ongoing Judicial Review into Islandmagee concerning the company’s Marine Licence, Abstraction Licence and Discharge Consent, with hearings due to commence from 2 May to 5 May.

The twin applicants for the JR are No Gas Caverns Limited and Friends of the Earth Limited, who wish to strike out ‘certain evidence provided by the Department for Agriculture, Environment and Rural Affairs (DAERA), as well as to seek disclosure of certain information held by DAERA.’

For context, the licence was granted in October 2021 — so the very fact that this review has been allowed shows that there is reasonable doubt that the JV has been carried out correctly. While HARL insists that it ‘remains optimistic of a positive outcome,’ there is one ground upon which it could lose.

The complainants are very concerned about the impact of tunnelling out the salt caverns will have on local wildlife, and particularly the impact on marine life when this salt is ejected into the sea.

There are four main complaints in the JR:

- failure to properly assess the energy use of the project or the need for increased gas storage

- failure to carry out correct or sufficient environmental impact analysis

- applying the less stringent 2011 Environmental Impact Assessment regulations rather than those from 2017

- DAERA’s decision to remove the requirement for the developer to provide a bond to secure the decommissioning of the caverns at the end of their useful life which was included in a draft consent in 2014

Judicial Reviews can be won on any of five possible grounds: illegality, procedural unfairness, irrationality, and the more recent legitimate expectation and human rights.

I won’t delve too deeply into the legal specifics — if you don’t have legal training then case law is unlikely to mean much to you — but a JR challenge needs to meet a very high threshold for any of these grounds to be successful. And the first three complaints — regardless of environmental concerns — are relatively weak.

However, I am concerned about fourth complaint.

On the illegality ground, the claimants can argue that DAERA acted ‘ultra vires’ — or beyond its legal remit. On the procedural unfairness ground, they can argue that there is bias in the decision given the government’s clear desire for more gas storage. On the irrationality ground, they can argue that ignoring the need to fund decommissioning is ‘outrageous in its defiance of logic.’

And worst of all, there’s potentially a strong case to be made on the legitimate expectation ground.

The complainants can argue, with merit, that removing the original requirement to fund decommissioning through a bond goes against a preconceived expectation. DAERA has instead sought to rely on future legislation which will require the UK taxpayer to guarantee the cost of decommissioning of the caverns.

There is no guarantee that this future legislation will ever be passed.

It’s important to note that judicial review isn’t about the merits of a decision, but about the process by which a public body has made it. In my view, there is a reasonable chance that the court will require DAERA to reconsider reinstating the bond requirement — which HARL, of course, cannot afford by itself.

On the other hand, the court may throw out the entire JR altogether. But there is a case to answer, and investors should be prepared for a potential setback.

Islandmagee potential update

Happily, there is also good news. On 17 April, HARL shared the Islandmagee Large-Scale Hydrogen Concept Study by Atkins that was commissioned last year. The full RNS is readily available, but for brevity the report found that ‘subject to regulatory approval, hydrogen can be stored in the salt caverns and withdrawn to a hydrogen grid when required.’

Key factors to note:

- integrating hydrogen is technically feasible and can be located on the current Islandmagee site utilising many of the shared benefits of the location

- additional capital expenditure required to integrate hydrogen compression, dehydration, and cooling would be circa £168 million

- additional costs would need to be incurred and further operating protocols put in place for hydrogen venting around existing leaching and de-brining equipment

- the re-use of planned natural gas plant facilities to develop the hydrogen facilities would be economically and operationally prudent so that systems are not re-designed for hydrogen unless required

HARL simultaneously noted that the study will ‘stimulate further detailed conversations on mechanisms to monetise the project,’ with ‘further announcements’ to come in due course. Again, HARL does not currently have access to the £168 million needed to make this happen.

CEO John Wood: relevant comments

While Wood seems very confident that the company will win the JV (and again, this is perfectly possible), he also gave some clues as to his future thoughts for Islandmagee in the recent investor presentation.

These are very close to direct quotes, though I have removed some of the waffle. Sorry John, I also tend to veer off on a tangent!

- ‘Islandmagee would hold enough gas to supply the UK for 19 days or NI for 60 days’

- ‘we don’t have any plans for a capital raise or dilution at this time…you know what AIM’s like, every two minutes if you’re not announcing something everybody expects a fundraise so I think we’re just trying to put this whole concept of funding to bed once and for all’

- ‘it helps with the UK EF guarantee that hopefully we get attached to that funding so it’s probably taken a bit longer than we wanted it to take’

- ‘when you look at the share price I mean we announced a £1.6 billion contract and the share price went down’

- ‘would people like us to reduce the debt level in the company and not take the project checked on or do we actually push ahead with the program given the healthy return’

- ‘(Islandmagee’s value) is certainly high double-digit millions at the moment, maybe once the outcome of the judicial review comes we might push up into the three digits’

- development options are ‘a complete sale of the project, to a farm down…which would leave us with 25-30% of the program…to a loan through the National Infrastructure Bank to actually develop the project given it’s a Strategic National Asset for the UK’

What does this all mean for Islandmagee?

Let’s break this down. Shareholders aren’t getting diluted. Again, the market cap is so low, this would only serve to alienate the investor base for little capital.

I think taking out yet another loan — given that the company already has two big loans, a small market cap, and doesn’t expect to be profitable for 18 months — is not a good idea, even from the UK Infrastructure Bank, even if it were to be approved.

Going it alone would require millions to develop the gas caverns, and then the additional £168 million for the hydrogen development (at least), and then potentially more for the decommissioning bond should the JR go against the company.

This leaves a farm down, or a sale. If Wood thinks Islandmagee could be worth £100 million post-JR, then a £50 million valuation for the asset right now isn’t unreasonable. Let’s assume the major partner in any JV would fund the entire capex in exchange for 70% ownership interest, then HARL could both benefit from 30% of the project without the risk and be left to focus on the FSS contract.

But my personal view — and I’m aware not everybody will agree — is that HARL should sell Islandmagee and concentrate on delivering the FSS contract alongside further wins.

Consider what a £50 million cash injection could do for the share price, investor satisfaction, and client confidence.

HARL might even reach 30p.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.