NVIDIA Corporation (NASDAQ: NVDA) is one of the most successful and innovative companies in the field of artificial intelligence (AI). The company’s graphics processing units (GPUs) power some of the most advanced applications in gaming, data centers, cloud computing, autonomous vehicles, and more.

NVIDIA’s stock has soared more than 250% in the past year, reaching a market capitalization of over $970 billion. But NVIDIA is not the only player in the AI space. There are several lesser-known companies that are developing cutting-edge technologies and products that could challenge or complement NVIDIA’s dominance.

In this article, we will introduce you to five of these potential AI stars that could be the next NVIDIA.

Understanding NVIDIA’s success

NVIDIA began its journey in 1993, founded by Curtis Priem, Jensen Huang, and Chris Malachowsky. Initially, they’re primarily focusing on graphics processing units (GPUs) for gaming. This early choice played a pivotal role in shaping the company’s destiny.

NVIDIA’s GPUs quickly became the gaming industry’s darling. They were speedy, and they delivered high-quality graphics. This success allowed NVIDIA to plant its roots firmly in the gaming sector. Yet, the company didn’t stop there; it looked beyond and saw the untapped potential of its GPUs.

The rise of artificial intelligence marked a significant turning point for NVIDIA. The company realised its GPUs could do much more than render game graphics. They could also handle AI computations. So, NVIDIA started to develop software tools like CUDA to help AI researchers and developers use their GPUs more effectively. And just like that, NVIDIA became a crucial player in the AI sector.

The key to NVIDIA’s ongoing success has been a constant drive for innovation. They keep pushing the boundaries of what their GPUs can achieve. This relentless pursuit ensures they stay at the leading edge of tech innovation and sets them up for future growth.

Along the way, NVIDIA made some clever business moves too. They acquired other companies to boost their capabilities. Take their US$7 billion purchase of Mellanox Technologies in 2019, for instance. This deal gave NVIDIA a significant boost in data centre capabilities. NVIDIA’s stock has flourished because of its visionary thinking and swift adaptation to tech trends.

They’ve grown in their original gaming market, expanded into AI and data centres, and built a strong pipeline for the future. This combination has cemented NVIDIA’s status as a dominant player in the tech industry and is reflected in its soaring stock. In essence, NVIDIA’s success story is all about forward-thinking, constant innovation, and strategic growth.

In May 2023, Forbes contributor, John Dorfman, reported that Nvidia stock had appreciated by 172% since the turn of the year. This growth was fueled due to the company’s exploitation of artificial intelligence. So, what are the hidden gems with potential, and how do you identify them? Let’s explore.

Identifying lesser-known stocks

Uncovering lesser-known stocks can be a thrilling adventure. These stocks often belong to emerging or smaller companies, and while they may not be in the limelight, they can offer some solid opportunities for growth. Here’s a guide on how to spot these potential gems.

Start with thorough research, and hunt for companies in industries on the rise or ripe for innovation. Tech, healthcare, and renewable energy are a few sectors worth exploring. A good grasp of the industry can hint at which companies might take off next.

A deep dive into the company’s financials is next. Check their financial health. Look at revenue growth, profitability, and debt levels. Companies with a healthy balance sheet are seeing revenue growth and have manageable debt, which is often well-placed for future growth.

Leadership matters too. Companies with visionary leaders often excel. So, look at who’s steering the ship and their plans for the company’s growth. Consider the strategies they’ve laid out to tackle competition and manage risks.

Don’t forget to scope out the competition. Understand the company’s market position, competitors, and what makes them stand out. A company that offers something unique or carves a niche for itself might just be on the brink of a growth spurt.

Lastly, consider bringing in some expert opinions. Financial advisors or seasoned investors can provide invaluable insights, especially when dealing with lesser-known stocks. They can offer a different perspective, help dodge common pitfalls and guide you toward informed decisions.

The discussion has revolved around identifying lesser-known stocks. But what exactly are these stocks? It’s time to delve deeper.

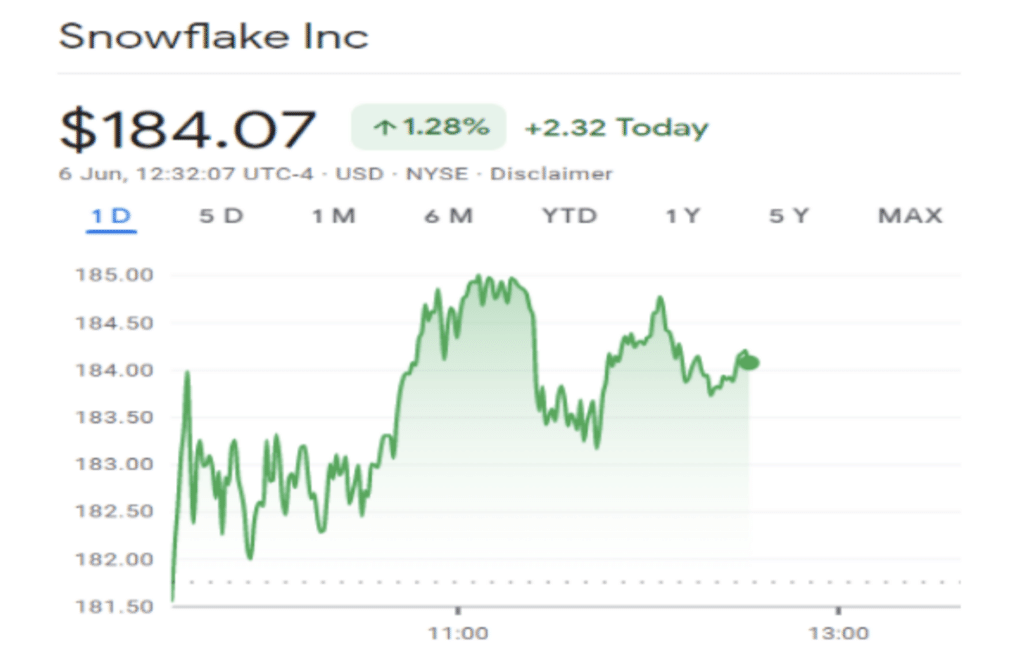

1. Snowflake (SNOW)

- Price Per Share: $181.75

- Market Cap: $59.23 Billion

- Sector: Technology

Snowflake Inc., a cloud-based data warehousing company, has been making waves since its establishment in 2012. Snowflake offers a unique service called “Data Warehouse-as-a-Service,” allowing businesses to store and analyse data in the cloud.

What sets Snowflake apart is its innovative architecture. Unlike traditional systems, Snowflake separates computing and storage, allowing users to scale each component independently. This approach offers cost-effectiveness and adaptability to companies, as they can pay for storage and computing resources based on their specific needs.

In September 2020, Snowflake debuted on the stock market, attracting significant investor attention. As more organisations migrate their operations to the cloud and prioritise data-driven decision-making, Snowflake benefits from these trends.

The price per share of SNOW at the end of June 6 stood at $181.75. Meanwhile, it has a market cap of $59.23 billion. It’s close to the price per share of NVIDIA, which was at the same time at $391.71 on the previous close date.

According to Snowflake’s Chairman and CEO, Frank Slootman, the company had an impressive fiscal year in 2023. They experienced a remarkable 70% year-over-year growth in product revenue, reaching a total of $1.9 billion. Additionally, Snowflake achieved a non-GAAP adjusted free cash flow margin of 25% during that period.

These results highlight the company’s strong performance and financial success in the market. The CEO also restated their confidence in achieving the company’s fiscal 2029 goal of $10 billion in product revenue.

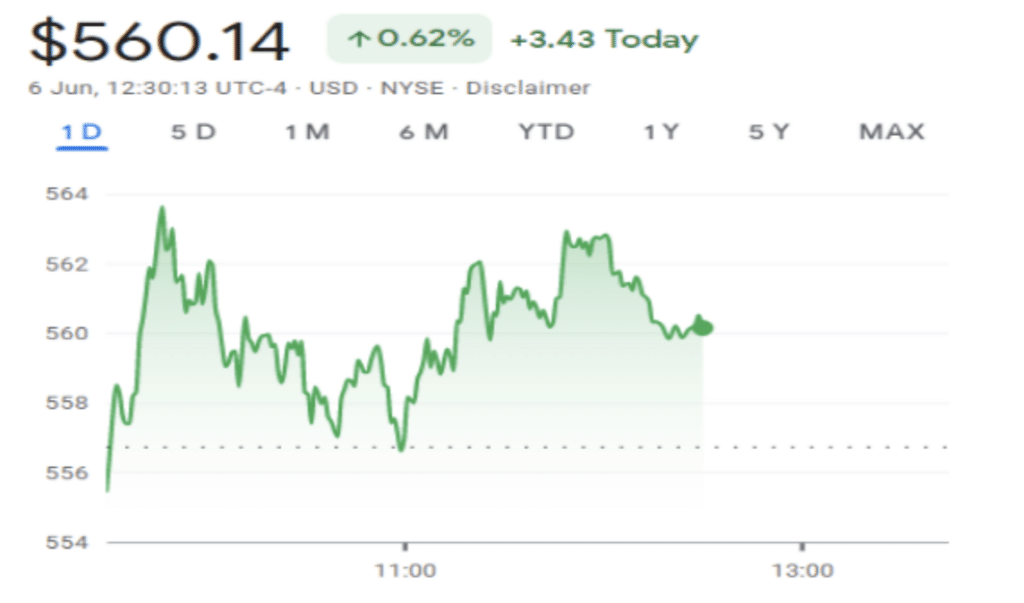

2. ServiceNow Inc (NOW)

- Price Per Share: $548.18

- Market Cap: $113.42 Billion

- Sector: Technology

ServiceNow Inc. is a renowned company in the technology sector, offering cloud-based software solutions for enterprises. Their focus lies in IT service management (ITSM), IT operations management (ITOM), and IT business management (ITBM). Organisations can streamline operations, improve productivity, and enhance customer satisfaction by leveraging their platform.

ServiceNow’s comprehensive suite of tools and services simplifies and optimises IT operations, enabling businesses to deliver exceptional services and experiences. They have expanded beyond IT services to cater to departments such as HR, customer service, and security operations.

The success of ServiceNow can be attributed to its scalable and user-friendly software solutions that address crucial business needs. Their platform centralises operations, automated workflows, and offers valuable insights through analytics and reporting.

Continuously innovating, ServiceNow regularly introduces new features and enhancements to meet evolving business demands. This is why they can expand their customer base, raising their price per share to $548.18. Of course, it’s a lesser-known stock, even when its share price is well above NVIDIA.

With a market capitalization of $113.42 billion, ServiceNow is establishing itself as a significant player in the industry. Considering these factors, ServiceNow could be valuable to your investment portfolio. It holds the potential to become the next NVIDIA, making it an exciting prospect for investors.

3. Datadog Inc (DDOG)

- Price Per Share: $100.35

- Market Cap: $32.3 Billion

- Sector: Technology

Datadog Inc. (DDOG) is a lesser-known stock gaining attention in the technology sector. It is a cloud monitoring and analytics platform providing companies real-time insights into their IT infrastructure, applications, and logs. This enables businesses to improve operational efficiency and overall performance.

What sets Datadog apart is its ability to gather data from various sources and offer a comprehensive view of an organisation’s digital ecosystem. It delivers monitoring and observability solutions for cloud infrastructure, containers, microservices, and distributed systems. This makes it an essential tool for businesses embracing modern technology architectures.

The company’s strong market position and impressive customer base demonstrate the value and reliability of its platform. The customer base includes well-known names like Samsung, Peloton, and The New York Times. Datadog’s growth potential lies in its ability to capitalise on the increasing demand for cloud-based monitoring and analytics solutions.

Datadog (DDOG) is rapidly emerging as a major player in the tech stock industry, aiming to follow in the footsteps of NVIDIA. A clear indicator of its progress is the significant increase in its share price. On May 5, 2023, each share closed at $76.57, and just a month later, on June 5, it soared to $100.35.

With a current market capitalization of $32.3 billion, the market is acknowledging the value and potential of Datadog. This positive trajectory places the company in a promising position within the tech stock industry, comparable to the growth experienced by industry giants like NVIDIA.

4. Five9 Inc (FIVN)

- Price Per Share: $70.31

- Market Cap: $4.97 Billion

- Sector: Technology

Five9 Inc. (FIVN) is a leading company in the contact centre software industry. Founded in 2001 and based in San Ramon, California, Five9 provides cloud-based customer service, sales, and marketing applications. They went public in 2014 and are listed on the NASDAQ stock exchange under the FIVN ticker.

Five9 software allows businesses to manage customer interactions across various channels like voice, chat, email, social media, and mobile. Integrating customer relationship management systems, Five9’s platform offers real-time reporting and analytics to help businesses optimise their contact centre operations.

With a global presence, Five9 serves various industries, such as telecommunications, finance, healthcare, retail, and technology. Their innovative technology and customer service have earned them numerous accolades, including being recognized as a Gartner Magic Quadrant for Contact Center as a Service (CCaaS) leader.

In 2022, Five9 Inc achieved a remarkable milestone with a record-breaking total revenue of $778.8 million. This represents a significant 28% increase compared to the previous year’s revenue of $609.6 million. The price per share closed at $70.31 dated June 5. These positive financial indicators position Five9 Inc as an enticing stock to consider.

It’s important to highlight that Five9 Inc currently holds a market capitalization of $4.97 billion. This speaks to the company’s stability and potential for future growth and development in the market. With its strong financial performance and market presence, Five9 Inc has the potential to follow in the footsteps of successful companies like NVIDIA.

5. Marvell Technology (MRVL)

- Price Per Share: $58.03

- Market Cap: $50.41 Billion

- Sector: Technology

Marvell Technology is a leading global semiconductor company specialising in storage, networking, and connectivity solutions. The company was founded in 1995 and is headquartered in Santa Clara, California. Marvell’s product portfolio includes chips and controllers for solid-state drives (SSDs), hard disk drives (HDDs), and data center infrastructure.

They also offer networking solutions for Ethernet switches and PHY transceivers and wireless connectivity solutions for Wi-Fi and Bluetooth. One of Marvell’s notable contributions to the industry is the ARMADA system-on-chips (SoCs). They’re widely used in applications like network storage, printers, and smart home devices. Additionally, their Prestera family of Ethernet switches has become a staple in data centres and enterprise networks.

Marvell Technology has seen a 14.13% increase in revenue for the twelve months ending April 30, 2023. This growth has resulted in a total revenue of $5.794 billion. Additionally, the company’s market cap sits at $50.41 billion, making it one of the key players in the semiconductor industry. Investors seeking an investment opportunity similar to NVIDIA may find Marvell Technology intriguing.

Conclusion

When evaluating the potential of lesser-known stocks that could become the next NVIDIA, it is essential to consider the growth potential of the featured stocks. Snowflake, ServiceNow, Datadog, Five9, and Marvell Technology all show promising signs of success in their respective industries.

Also, it is crucial to consider several factors when investing in high-growth stocks. Thorough research is critical, including examining the company’s financial health, leadership, market position, and competition. Seeking expert advice and opinions can also provide valuable insights.

In the tech sector, identifying promising investment opportunities requires staying informed about industry trends and innovation. These lesser-known stocks can deliver substantial growth, similar to NVIDIA’s success. However, it is crucial to carefully weigh the risks and rewards before making any investment decisions.

This article has been prepared for information purposes only. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.