While inflation has become a red flag in the stock markets of Europe and the US, it is being welcomed with open arms on the Japanese stock market.

Japan, the world’s third-largest economy, has struggled with deflation for a long time, which is not conducive to a favorable stock market environment.

However, inflation has now arrived in Japan and has been embraced by the stock market. A three percent inflation rate is better than deflation.

Warren Buffett takes advantage

Furthermore, there is a reform of the rigid governance in Japanese companies, which investment bank Goldman Sachs believes will increase the valuation of Japanese listed companies.

One person hoping for this is master investor Warren Buffett, who has recently made additional investments in Japan.

Planning to buy more

Berkshire Hathaway now owns nearly 8 percent of Japan’s five largest trading companies and intends, according to Buffett, to buy more.

These trading companies, including Mitsubishi Corp, have a structure that resembles Berkshire Hathaway to some extent.

The majority of their assets consist of shares in other listed companies in Japan.

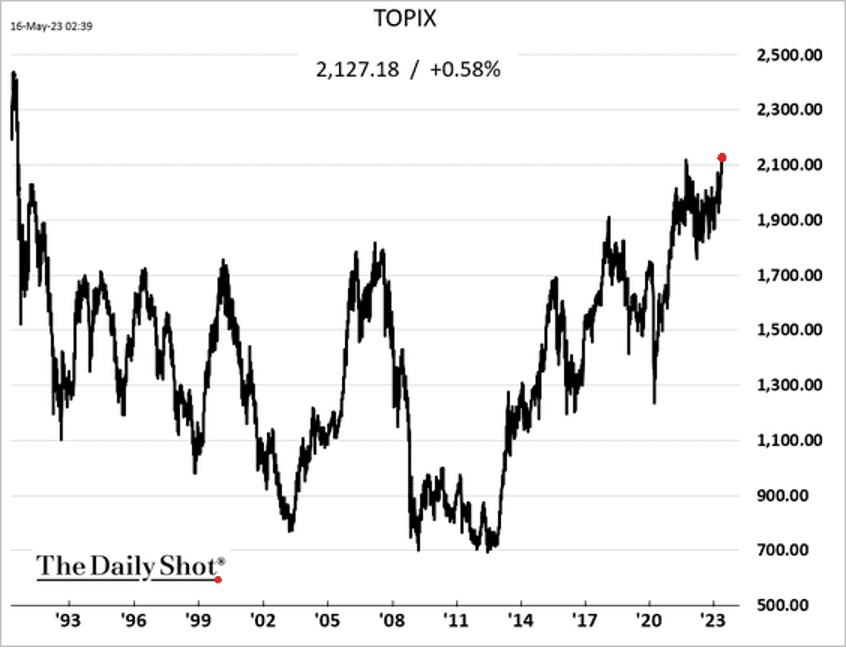

Highest in 34 years

Buffett’s purchase and statement were likely contributing factors to the Japanese stock market, specifically the Topix index, reaching its highest level in 34 years last week! It is now only 16 percent away from the peak level reached in 1989.

Japan’s long journey on the stock market serves as a reminder to investors that it can take a long time to recover and the risks of investing in a stock or market solely based on its previous decline in value.