Bezant Resources is another beaten-down microcap with significant near-term potential. Here’s why.

Good morning, and welcome to another EDIT — a series of articles in which I attempt to concisely explain the comprehensive investment case for a single company in the small cap sector. With my focus currently on copper and southern Africa, Bezant Resources (LON: BZT) is next up.

Before we continue, the standard caveats:

- This is not financial advice. Do your own research and make your own decisions.

- There are some important first steps to consider before investing in AIM shares, or in mining shares. Generically, these centre around developing financial resilience and diversification.

- While Bezant appears to be a solid opportunity at this price level, it is a small cap. This means higher risk than those associated with larger companies, but with correspondingly larger potential upside.

These risk warnings may feel repetitive, but I think it is important for investors looking for lucrative returns within the junior resource sector to be aware that risks are often correspondingly magnified.

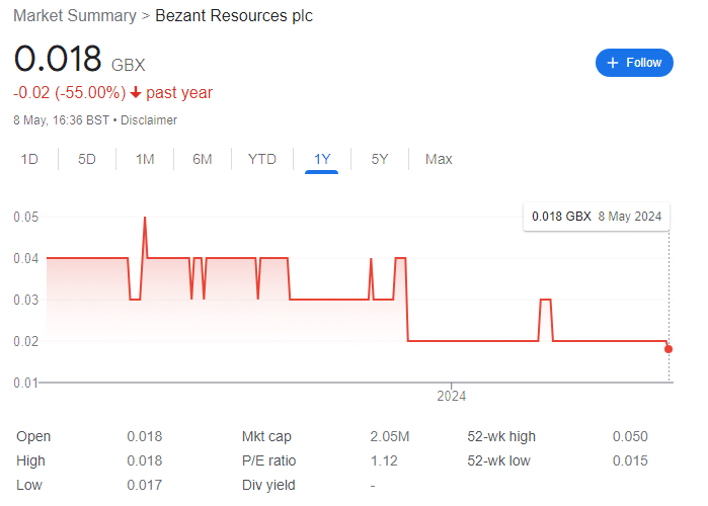

Bezant shares have more than halved over the past year — and now stand at roughly 0.02p each — with a market capitalisation of circa £2 million.

Clearly, this is not a stock you are going to throw your life savings into. But much like Mila Resources (which is up by 50% since I covered it last month), Bezant has strong potential as a recovery play — based on a couple of hoped-for near-term catalysts.

Let’s dive in.

Bezant Resources: the flagship

While Bezant may not consider itself to have a flagship — and prefers to be viewed as multicommodity — the flagship is very arguably its 70%-owned Hope and Gorob Copper Project.

These mineral deposits are situated within the Namib Desert of Namibia — itself within the Swakopmund district of the Erongo region. Capital city Windhoek is roughly 250km northeast and Walvis Bay (Namibia’s main port) about 120 km northwest. And the entire project can be accessed via gravel roads.

The flagship has enjoyed significant exploration spend through nine different companies over more than a century. Bezant itself has drilled 28 diamond holes over 2,680m across 2020 and 2023 — and a further 118 diamond holes were drilled by Kuiseb Mining covering almost 40,000m between 2006 and 2008. There was also significant drilling activity during the 1970s, and much of this historical work has been used to help derive the recently updated MRE.

For context, in a late October RNS, Bezant released an updated indicated and inferred Mineral Resource Estimate (MRE) for the asset — you can read more on what these terms mean here.

Completed by Addison Mining Services to JORC standard, the MRE now comprises a gross 15 million tonnes at 1.2% Cu, for 190,000 tonnes of Cu estimated across the Hope, Gorob Vendome and Anomaly deposits.

Breaking this down, the asset boasts:

- An Indicated Resource of 1.24 million tonnes at 1.6% Cu and 0.4 g/t Au at the Hope deposit.

- An Inferred Resource of circa 14 million tonnes at 1.2% Cu across the Hope, Gorob, Vendome and Anomaly deposits, including approximately 3 million tonnes at 1.7% Cu and 0.4 g/t Au at Hope.

It’s worth noting that this estimate ignored gold content (excluding Hope) as historic holes simply were not assayed for gold — however Addison did note that based on Bezant’s own drillholes, there could reasonably be gold grades averaging between 0.2 to 0.4 g/t Au across the asset — which given the current gold price could significantly impact on profit margins.

Addison also identified the potential for open pit extraction, with an open pit resource of 2.4 million tonnes — and also the potential (assuming favourable copper grades from further drilling) of increasing the size of the open pit amenable resource for a further 700,000 to 1 million tonnes. For perspective, they consider that an open pit operation that could support five years mine life at an annual rate of 500,000 tonnes per year.

Further, it postulated that in the future, underground mining could be feasible by using a former concrete lined shaft with additional access from the base of the open pit — and that the 190,000 tonnes of contained copper in the MRE could be significantly increased both by drilling further untested areas, and also by drilling to increase gold credits to improve the CuEq grade.

Chairman and CEO Colin Bird enthused that he was ‘very pleased with the outcome of our work over the last two years and we now have a JORC (2012) resource, which our consultant agrees is both capable of significant increase and equivalent copper value.’

The CEO also noted that the company had been ‘active on all aspects of the factors which goes toward building a mine. We are confident that we now have sufficient information, resource modelling, financial modelling and environmental innovative approach to bring a small mine into production.’

Of course, there is no better time to be building a copper mine than in 2024. I’ve gone into the copper supply gap in detail before, but the basic premise is that there isn’t enough. Merger activity is heating up, the metal itself continues to rise in value, and the supply gap is only going to get worse.

Then on 9 February, investors got an update — Bezant had undertaken a Social and Environmental Impact Assessment (scoped, managed and undertaken by EnviroNam Consultants), which had been submitted to interested and affected parties — and now anticipated a near-term issue of a Mining Licence.

The Holy Grail of the junior resource sector.

In the meantime, Bezant has been busy. It’s already completed significant ore sorting, magnetic separation, and flotation test work, and is now advancing multiple workstreams so that if and when the licence lands, it can get into production as soon as possible. In addition to the below, contract negotiations linked to initial development are also underway including project based financing.

Current ongoing work:

- Metallurgical test work to include drilling of further PQ sized core samples from selected positions in the Hope deposit to generate a 1-tonne composite sample. Ore sorter design, magnetic separation, and final design floatation test work and circuit optimisation studies.

- A southern African specialist group has been appointed to provide final opencast mine design and production profiles, that will be used for tendering of the mining contract as well as implementation.

- Several contract mining contractors that have offered their services have been approached with a view to supplying an outsourced opencast mining solution. These include contractors that have expressed interest in providing a total logistics solution (including pre-concentrate transport).

- On completion of the opencast mine design, the decline access and underground mine design are to be completed and external consultants have been approached to assist with this work stream. An underground mining engineer has been appointed to supervise mine design.

- A potential provider has been approached to supply a design for a hybrid renewable energy solution for the mine site. The supplier has also indicated interest in funding and supplying the solution on an IPP basis (financed off the balance sheet).

- A potential supplier has submitted a budget, design and costing for the supply of major infrastructure including accommodation and workshops.

It’s worth noting that at the most recent placing, the company noted it was targeting an 8,000 tpa open pit operation and was ‘concluding arrangements for non-equity financing for the mining operation.’

Most recently on 14 March, Bezant announced that that the EPL 7170 licence has been renewed for 2 years from 22 October 2023, pending the obtaining of an environmental clearance certificate from the Ministry of Environment, Forestry and Tourism.

And most importantly:

‘in anticipation of a near-term issue by the Namibian Ministry of Mines & Energy of a Mining Licence the Company is continuing with the work programmes and negotiations in relation to financing and the acquisition of equipment and existing infrastructure referenced in its 9 February 2024 and 4 December 2023 announcements.’

Other key Bezant projects

Eureka project, Argentina — maintaining licence holding costs, and has continued dialogue with third parties interested in acquiring or earning into the project.

Kanye manganese project, Botswana — focus remains on a preliminary Mineral Resource Estimate and then follow-up drilling. In the meantime, the environmental management plan has been renewed through to 29 January 2025. Drilling has thrown up results including 6m @ 28.64% MnO from 6m depth in hole MS-RC-12 at the Moshaneng prospect.

Mankayan copper-gold project, the Philippines (24.2%-owned) — IDM International (through Crescent Mining Development Corporation) is continuing to work on initial Pre-Feasibility Studies, which they expect to complete later in 2024.

There are two MREs for the asset, though one is out of date and the second not an updated JORC statement according to AIM rules. However, for guidance purposes, previous part owner Mining and Minerals Industries Holding released an updated MRE prepared by Derisk Geomining stating that:

‘Mankayan is now estimated to have combined Mineral Resources of 793 million tonnes containing 2.8 million tonnes of copper, 9.6 million ounces of gold and 20 million ounces of silver. It has Indicated Mineral Resource of 638 million tonnes @ 0.37% Cu, 0.40g/t Au and 0.90g/t Ag, and Inferred Mineral Resource of 155 million tonnes @ 0.29% Cu, 0.30g/t Au and 0.5g/t Ag.’

Currently, the spotlight remains firmly on Hope and Gorob — but Mankayan also holds clear potential.

Finances

Investors have some decent insight into the finances. Let’s start with interim results to 30 June 2023 — the company generated a loss of £463,000 over these six months after tax and held circa £365,000 in cash at the time.

It would not take a mathematical genius to guess the next move, and sure enough, on 4 December 2023 came the inevitable fundraising. 3.2 billion shares were issued to raise some £800,000 — £758,000 via brokers and £42,000 via subscription — including £15,000 from Bird and £12,000 from CFO Raju Samtani.

Then on 5 March, the company agreed with longstanding backer and investor Sanderson Capital Partners to extend the repayment date for the £700,000 drawn down under the unsecured convertible loan funding facility entered into with Sanderson Capital on 22 November 2021.

The £700,000 drawdown is now repayable by 31 July 2025 and convertible by the Lender at the fixed price of 0.06p per share. That’s more than three times the current share price, and a 140% premium to the recent placing price.

No further amounts can be drawn down under the Facility. The Company has an option to convert all or part of the £700,000 drawdown if the Company’s share price exceeds 0.14 pence for 10 or more business days. Sanderson (and associates) owns 6.69% of Bezant’s shares.

So — we can assume a monthly cash burn of circa £77,000, which when you consider the cash position at end the end of June and placing capital — gives roughly a six month runway to get the mining licence and financing in place.

The bottom line

Bezant Resources sports a small market capitalisation with a very near-term catalyst. And the company has enough cash at hand for the time being.

Patently, the near-term trajectory and share price turnaround is going to rely on gaining both a mining licence and funding for Hope and Gorob.

This may come sooner rather than later.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.