African Pioneer has many assets to consider — but two stand out at present.

Here we go again. Welcome to this week’s EDIT, where I take a comprehensive look at a small cap company — usually one where sentiment has beaten it down, but where the fundamentals remain reasonably strong and near-term catalysts are on the horizon.

Before we get started, the usual caveats:

- This is not financial advice. Do your own research and make your own decisions.

- There are some important first steps to consider before investing in AIM shares, or in mining shares. Generically, these centre around developing financial resilience and diversification.

- While African Pioneer (LON: AFP) appears to be a solid opportunity at this price level, it is a small cap. This means higher risk than those associated with larger companies, but with correspondingly larger potential upside.

Let’s dive in.

African Pioneer relaunched its IPO in mid-2021 at 3.5p per share — and has since fallen to less than 2p. It’s worth noting, however, that the stock has remained relatively stable since June 2023, and it is far from the only junior resource company with solid fundamentals, which has been beaten down by the weak investing environment.

African Pioneer: copper boom

The good news for would-be investors is that African Pioneer is solely focused on copper. Of course, the company’s tenure is prospective for multiple metals both base and precious, but the singular focus is on what is arguably the most important metal in the world, excluding iron.

If you aren’t aware of the impending copper supply gap, then you need to get out more.

S&P Global thinks global demand for copper will double to 50 million metric tons by 2035 — creating a supply gap of 10 million tons. Bloomberg expects this gap will hit 14 million tons by 2040, with demand for refined copper growing by 53% by 2040 while supply will only rise by 16%.

Goldman Sachs research shows that miners need to collectively invest $150 billion in the next decade to plug the copper gap, while also noting that regulatory approval for new copper mines has fallen to its lowest in a decade.

In the 1990s, copper exploration grassroots budgets ranged from 50-60% of overall copper annual budgets; this had fallen to just 34% by 2021. And it takes 16 years — on average, according to an estimate of sources — to discover and develop a new copper mine.

The majors are instead focused on buying up established assets. Multi-billion-dollar deals are ongoing to reduce costs and bring producing mines on board. BHP bought ASX copper producer Oz Minerals for a hefty premium, while Newmont’s record bid for Newcrest may be primarily about gold synergies but also brings the major huge copper deposits.

But it doesn’t matter who owns the mines. There’s still the same number of producing assets in existence.

Consider Rio Tinto’s new Oyu Tolgoi mine in Mongolia. Wood Mackenzie analysts estimate that the equivalent of 12 new equivalent copper mines will be needed to come online by 2030 to meet expected demand. Yet Oyu is being touted as one of the most important copper deposits in the world, and development from bare earth to near production has been extremely hard.

Trafigura — the world’s largest copper trader — CEO Jeremy Weir noted at last year’s World Copper Conference that ‘if we don’t have enough copper, it could seriously short circuit the energy transition.’ And the International Copper Association thinks that while global supply is expected to jump by 26% to 38.5 million tonnes annually by 2035, it will likely still fall 1.7% short of demand — even assuming that recycling rates increase exponentially.

Ivanhoe founder Robert Friedland famously thinks that more than 700 million MT of copper will need to be mined in the next 22 years just to maintain typical 3.5% GDP growth, without even considering the electrification of the global economy. This is equivalent to all the copper ever mined in history.

Globally, 21 million metric tons of copper are mined every year, but it’s not going to be enough. Over the next 20 years, the International Energy Agency expects it to become a dominant mineral alongside graphite and nickel, with demand set to treble by 2040 as net-zero goals accelerate.

Meanwhile, emerging markets such as Zambia are seeing output accelerate. Zambian Finance Minister Situmbeko Musokotwane recently enthused that ‘copper is the new oil.’ And CRU Group analyst Adam Khan notes that Zambia could add nearly 1 million tons of copper production per year over the next decade.

In 2021, the shortage gap — the difference between copper mined and demand — came to just 2% of production, enough to push up copper prices by 25%. 2035’s gap could be at least ten times as much.

Copper recently hit a high not seen since January 2023.

Disruptions at many major mines are forcing smelters to pay higher prices to obtain mined ore, and Chinese plants which produce most of the world’s refined copper are moving closer to implementing a joint output cut. Many smelters are no longer able to operate profitably as they have to fight for ore, and many will cease processing.

Simultaneously, investors are becoming more optimistic about China — the manufacturing purchasing managers index in March just registered the highest reading in a year.

What do the big names say right now?

- Goldman Sachs — copper prices will hit $10,000 per tonne by the year-end on robust Chinese demand and the ‘ongoing supply-side shock.’

- Bank of America — analyst Michael Widmer notes that ‘the much-discussed lack of mine projects is becoming an increasing issue for copper. This, along with investment in green technologies and a rebound of the global economy, should lift prices to US$10,250/t (465c/lb) by the fourth quarter.’

- Macquarie — revised down its copper supply forecast by 1 million tonnes for 2024 since last September. Argues ‘lower production is likely to have a lagged ripple effect through the supply chain.’

- Citi — ‘copper’s second secular bull market this century is being driven by booming decarbonisation-related demand growth. Only higher prices will solve these deficits.’ They point out that the 2000s bull run saw copper rise fivefold in three years and note there could be ‘explosive price upside’ again over the next three years.

- Morgan Stanley — ‘elevated mine supply disruptions point to a deficit of 700,000 tonnes and should start to feed through to refined production too,’ and they predict a $10,200 per tonne copper price by Q3.

- Trafigura — chief economist Saad Rahim thinks that ‘if you look at the demand that is coming from data centers and related to that from AI, that growth has suddenly exploded’ and argues there could be another one million ton demand as a result on top of the expected current four to five million ton supply gap by 2030.

At some point it gets a bit overdone, but every single person in the world of copper expects demand and pricing to rise as supply continues to remain constrained.

African Pioneer assets

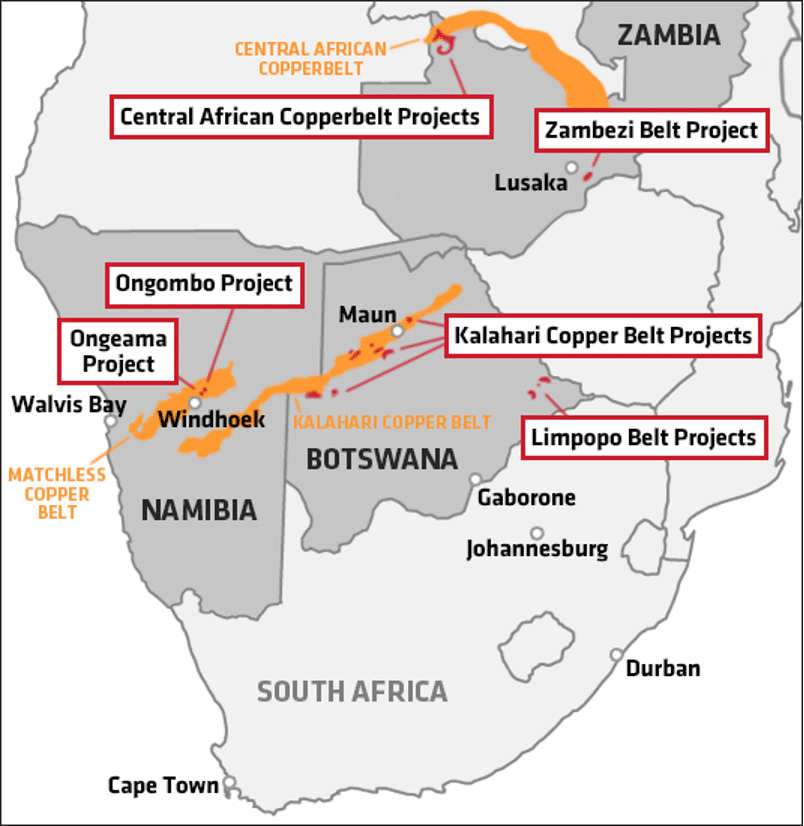

African Pioneer’s copper assets can be split into three distinct divisions:

- Botswana — Kalahari Copperbelt

- Namibia — Matchless Copperbelt

- Zambia — Central African Copperbelt

In Zambia there is also potential for cobalt, in Botswana silver and in Namibia, gold.

It’s worth noting some of the finds made by other companies in these belts.

- Kalahari is 800km by 250km and stretches from Northern Botswana into eastern Namibia — and Cupric Canyon’s world-class Khoemacau Copper-Silver Project, Sandfire Resources T3 deposit and its A4 Dome prospect were all found here.

- Matchless is a 350km belt which includes producing mines at Matchless and Otjihase (on care and maintenance since 2015) which contained a total combined resource of >16Mt @ 2.2% Cu & 1.2g/t Au. It also boasts the Hope-Gorob-Vendome deposit cluster, and African Pioneer’s Ongombo and Ongeama Projects adjacent to Otjihase mine.

- The Central African Copperbelt is widely regarded as the largest and most prolific sediment-hosted copper province on the planet — and African Pioneer has a 100% interest in five large-scale exploration licences, four of them in the western extension of the Copperbelt, covering 2,366.3 square kilometres centred around the town of Mwinilunga.

Specifically, LEL27771 lies just 10 kilometres from the Luamata copper-cobalt deposit which has been subject to recent pilot-scale mining. Some of theSE licences were covered by reconnaissance exploration by majors, including Anglo American and MinMetals, but little follow-up was undertaken.

Recent updates

16 February saw African Pioneer release an update on key operations within the Central African Copperbelt. To start with, you need the basic details on the long-standing option agreement with First Quantum:

- During the initial 18 month option period First Quantum has the right but not the obligation to spend US500,000 on each of the exploration licences 27767-HQ-LEL, 27768-HQ-LEL, 27770-HQ-LEL, and 27771-HQ-LEL. At this stage First Quantum will not have earned any shares in subsidiary African Pioneer Zambia, just the right to proceed to take one or more of the properties into the First Earn In Period by issuing an Option Exercise Notice.

- During the First Earn In Period, First Quantum then has 2 years when it has the right but not the obligation to prepare a Technical Report in respect of the Zambian Projects demonstrating an Indicated Mineral Resource of at least 300,000 tonnes of contained copper. First Quantum is to fund the Technical Report. Once the Technical Report is issued First Quantum has the right to be issued shares equal to a 51% shareholding in African Pioneer Zambia. This will also trigger the Second Earn-In Period.

- In the Second Earn-In Period, First Quantum shall have the right but not the obligation to complete all necessary mining, metallurgical and development studies to establish a mine at the Property and make a public announcement that it intends to proceed towards commercial development of a Mine on the Property. First Quantum is to fund all costs related to the Decision to Mine. Once First Quantum announces a Decision to Mine it has the right to be issued shares in African Pioneer Zambia to increase their 51% shareholding in African Pioneer Zambia to 75%.

The update saw the business note that under First Quantum Minerals’ option agreement with the company’s 80% owned subsidiary, African Pioneer Zambia:

- First Quantum has delivered a notice to exercise their option over the two licences subject to the Option Agreement, which had not previously been exercised, on top of the first two already exercised (one remains outside of the agreement). This is a good sign.

- These newly option exercised exploration licences are 27770-HQ-LEL and 27768-HQ-LEL. As announced on 26 October 2023, options over licences 27767-HQ – LEL and 27771-HQ – LEL have already been exercised. These licences are located less than 100km from First Quantum’s Sentinel copper mine.

- The first earn-in period during which First Quantum has to prepare a Technical Report demonstrating an Indicated mineral resource of at least 300,000 tonnes of contained copper for First Quantum to earn a 51% shareholding in African Pioneer Zambia has been extended to 28 February 2026.

In other words, FQM wants to explore more, and wants more time on the ground without being rushed.

Executive Chairman Colin Bird noted that ‘the initial period under the Option Agreement has been extremely successful for both First Quantum and AFP with the Western Foreland and Kamoa-style mineralising environment being established as well as near surface mineralisation in the fold- and thrust domain further to the east on some of our licences.’

For clarity, First Quantum have not yet earned a shareholding in African Pioneer Zambia — and the First Earn In Period can be further extended by 12 months if First Quantum incur $2 million of expenditure towards preparing the Technical Report which will include expenditure in excess of the Qualifying Expenditure of US$500,000 per Exercised Licence already incurred by First Quantum to give them the right to exercise the Exercised Licences.

It’s well worth mentioning that Bird, who among other ventures founded Jubilee Metals, founded and floated Kiwara which discovered copper in northwest Zambia — and was sold to First Quantum within 30 months of being formed, for $260 million.

Ongombo copper-gold project

The 7 February update on 85%-owned Ongombo was largely an update on Permitting and Ore Processing test work. The project is located within Exclusive Prospecting Licence EPL 5772, just 40 kilometres northeast of capital city Windhoek, Namibia.

The good news is that EPL 5772 has just been renewed for two years, and the awaited Environmental and Social Impact Assessment (ESIA) is at an advanced stage of completion. And Mining Licence 240 was granted to AFP on 10 August 2022 for 20 years, covering a portion of EPL 5772 and approximately one third of the open pit resource. An extension to the Mining License was submitted on 6 September 2022, to encompass the wider Resource Area.

African Pioneer is now completing the permitting process by way of the near-term submission of an Environmental and Social Impact Assessment (ESIA) and the Environmental Management Plan (EMP).

For context, Ongombo now has an Independent updated total (gross) Indicated Mineral Resource Estimate (MRE) of 5.7Mt at 1.1% Cu Equivalent (CuEq), 0.94% Cu and 0.23g/t Au and a substantial Inferred underground potential Resources of 23Mt at 1.1% CuEq, 0.95% Cu and 0.24g/t Au — this was announced almost a year ago.

I’ve covered the difference between an indicated and inferred MRE in depth here.

Encouragingly, expenditure thus far of approximately $480,000 on direct drilling costs ahead of the Mineral Resource update represents a unit resource development cost for the additional announced 100,000 tonnes of contained copper metal was approximately $4.8 per tonne of contained metal.

The company is now in ‘advanced discussions’ with ‘multiple parties’ on project level funding of the project. I’d argue this asset is the most likely to be developed first — and it’s key to consider what this might look like.

On funding, I’d say that a company with a £4.2 million market cap is not going to be able to build a working mine through dilution, so a partner with deep pockets will be necessary. But perhaps not too deep.

Bird notes that as the wider resource includes 930 Kt at 0.57% Cu and 0.19g/t Au open pit potential resource:

‘potential for a ‘starter’ mine using low-cost open-pit methods. We plan to combine XRT with laser dry sorting technology to separate ore from waste and generate a high-grade concentrate for transport to an in-country processing plant for final separation before metal recovery. We are now sequencing the primary development infrastructure and the process flowsheet. As we advance towards the completion of the ESIA we expect to soon be in a position to move towards project implementation and the completion of development financing.’

Here’s some key facts:

- the location and design of marginal ore and dry tailings storage areas have been identified within the ESIA.

- low water demand and modern XRT sorters and gravity concentrators have been shown to be amenable by Steinert (Germany’s competent engineers). Laser tests confirmed the potential to differentiate between ore and waste with induction sensor tests returning the required response to distinguish waste and ore fractions.

- AFP intends to use XRT sorting to initially process crushed ore for transportation to an external flotation plant, where the copper and gold will be recovered into concentrates for export for final smelting. This hugle reduces potential capex and is only possible due to how close the asset is to infrastructure.

- In parallel, with metal recovery testwork, Addison Mining Services has indicated significant increases in resources with further scope for another meaningful increase in the project’s CuEq grade, contingent upon follow-up work to test gold content in the East/Ost Shoots.

- AFP has approved a short drill programme to twin some historic Goldfields Namibia holes to assess potential content. Goldfields Namibia often did not assay for gold but in some of their drill holes in areas of East/Ost Shoots that were assayed for gold they returned values ranging from 9.6g/t Au over 0.17m to 0.12g/t Au over 1.1m.

- AFP has engaged the services of a highly experienced mining engineer with a career in narrow orebody exploitation in African projects, to plan how to optimise both the mining methodology most suited to the narrow orebody, and the primary development required to ensure access to sufficient ore to maintain production.

Botswana review

Sandfire Resources was previously exploring AFP’s Botswana licences within the Kalahari Copperbelt, but while this is old news, Sandfire has notified the Company that it will not be exercising its option under its Option Agreement.

AFP is awaiting an expenditure report from Sandfire for the option period so it can review Sandfire’s Exploration Commitment which was to fund $1 million on the Included Licences within the Option Period with 60% of the Exploration Commitment to be on drilling and assay costs.

If the Exploration Commitment is not spent, any shortfall will be paid by Sandfire to African Pioneer. And Sandfire has confirmed that they will provide Exploration Information that it holds in relation to the Licences.

It’s not all bad news — while the exploration on the licences did not indicate prospectivity for a large scale mining operation, the AFP Board believes that there is prospectivity for a smaller to medium sized mining operation within the range of 5,000 to 10,000 tonnes of contained copper per annum.

In other words, very profitable for smaller scale miners but simply not large enough to interest a company the size of Sandfire.

In addition, all the Company’s Botswana prospecting licences are being reviewed by an external geological consultant with specific expertise of Botswana copper geology and further work will be based on recommendations generated by the review.

Management and finances

Executive Chairman is Colin Bird — 40 years of experience and has significant experience working in Zambia and Botswana since the 1970s. Colin Bird founded and floated Jubilee Metals, is Chairman and CEO of Galileo Resources, Chairman at Xtract Resources Plc, and Executive Chairman of Bezant Resources.

As noted above and most importantly, Bird founded and floated Kiwara, which discovered copper in northwest Zambia. The company was sold for $260million to First Quantum.

Finance Director is Raju Samtani, who was previously finance director of Kiwara and has decades of experience, including three years as Group Financial Controller at marketing services agency WTS Group, where he was appointed by the Virgin Group to oversee their investment in the WTS Group.

Business Development Director is Christian Cordier, who has worked with many major international mining houses over the years, including in investments in listed companies in the United Kingdom, Australia and Southern Africa as well as private mining operations. He has ‘extensive experience in sourcing natural resource projects and nurturing them through the value curve.’

In terms of finances, half-year results to 30 June 2023 saw AFP lose £301,000 after tax, slightly up on the prior comparable period. It held £390,000 at period end, though raised funds in June 2023 to the tune of £790,000 including a £140,000 directors subscription to start drilling at Ongombo and exploration in the Kalahari Copperbelt.

And the company recorded the net asset value of assets at £5.24 million — which is possibly an underestimate now copper is hitting the headlines.

It’s worth noting this raise was at 2.25p, with Bird enthusing that ‘we are confident that we can increase the overall value of the project by some further general drilling aimed at further copper additions, but more importantly the east shoot can be brought earlier into the mine plan by further judicious drilling to define both overall quantum and gold content, which was not defined in the past.’

The bottom line

African Pioneer has:

- Various licences prospective for copper across Botswana, Zambia and Nambia

- An option agreement with First Quantum covering four licences in Zambia, to whom the Chair has previously sold a copper asset for $260 million

- The highly developed Ongombo project with advanced project funding discussions ongoing in Namibia

- The proven ability to negotiate agreements with multiple majors

- the potential for small scale mining at the Botswana licences

- a bull market for copper

- dozens of operators looking for exploratory copper assets across Africa, leaving its £5.24 million NAV arguably underpriced

Yes, this is not a Jubilee Metals, even if Bird founded that as well. But as an exploratory option in Zambian copper with large potential upside, it’s top tier.

And an update is due.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.