Horizonte Minerals gave investors a nasty surprise at the start of October, but the funding gap does not appear insurmountable.

I gave my initial thoughts on Horizonte’s (LON: HZM) funding problems three weeks ago, but the company has now released more detail on its current financial position in advance of the independent cost and schedule review from Reta Engenharia — likely to be published in November.

At the time, I had invested a speculative £1,000 in the stock; I’ve now upped this to £5,000 at 16p per share, though am fairly confident this is the limit of the risk I am prepared to take on a nickel miner in South America without enough money to become revenue-generative yet.

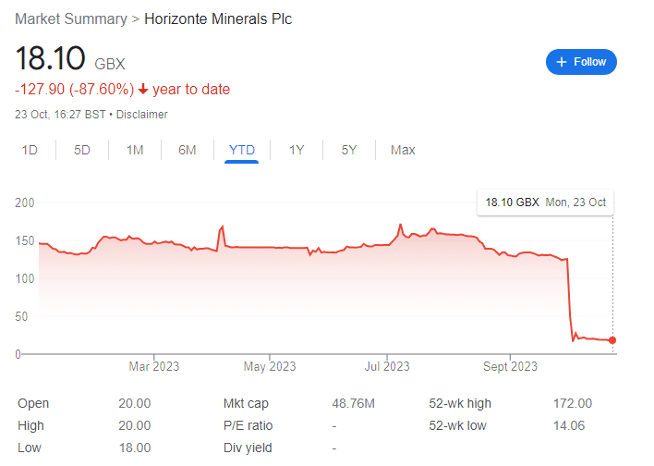

As a primer, HZM shares have been novimated since the start of the year to just 18p per share. This is exceptionally high risk, and I would not be surprised to see this investment fail. This is not financial advice.

On the other hand, the potential upside could be extraordinary.

On a side note, it was lovely to see Upland Resources shoot up today — the market needed reminding that there is a positive side to high-risk-high reward, even with the wider small cap market drifting down towards pandemic lows.

Let’s dive in.

Horizonte Minerals finances

To preface, construction remains underway, and the company now has 138,000 tonnes of ore averaging 1.92% Nickel stockpiled. And the flagships Nickel Project Line 2 Feasibility Study, which aims to double nickel production from 14,500 tonnes per annum to 29,000 tonnes per annum, should be published in mid Q4-2023.

Given that this feasibility study is to be published close to the same time as the cost review, the detective in me would suggest that it is this second arm of the project development that is causing the cost issues. Of course, the company had previously argued that this second leg would be paid for from Project Line 1 profits, so this shouldn’t be the case — but the timing seems pretty coincidental.

Regardless, CEO Jeremy Martin notes that:

‘Despite the current challenges, I am pleased to report that construction activities at the Araguaia Project continue to progress well, with a strong safety performance to date.

Notwithstanding the expected increase in capital, the Araguaia project remains a Tier 1 nickel project with lower quartile C1 cash costs, and a long mine life of 28 years producing a high grade, low impurity FeNi product. Discussions with the Company’s major shareholders and lenders to fund the project to completion are progressing.’

Of course, the million-dollar question is twofold: what will the exact funding gap look like, and will shareholders be diluted to oblivion in the process?

Here are the facts we know:

- The current capex budget is $537 million.

- The overall project capex requirement will be ‘at least 35%’ higher than this figure.

- This means at least $725 million (rounded).

- $429 million has been spent as of 30 September 2023.

- This means there is a funding gap between what has been spent so far, and first production, of ‘at least’ $296 million.

The Reta Engenharia report will be followed by a review from an independent technical adviser nominated by the ‘Senior Lenders’ (presumably to ensure the numbers are right this time) and again, investors will be informed by mid-Q4 2023. Notably, the report will meet AACEI Class I requirements, an improvement from the estimate of September 2022.

It’s worth remembering that the capex requirement for this project was already increased once before. While HZM management may be to blame, you could also argue that the lenders haven’t exactly done enough due diligence either.

But November is the month to watch. Which for HZM shareholders, will be the do-or-die month — as it’s likely a funding package will be put together shortly afterwards which will either torpedo shareholders or see them in a much better position than 90%+ down.

In terms of what exactly has changed, there’s lots of technical detail — but none of this really matters to investors until the review comes through. The key point is that the schedule delay is currently estimated at ‘around six months’ — from Q1 2024 to Q3 2024, and further, that there is ‘an associated increase in costs and working capital linked to the increased schedule duration.’

However, it’s also worth noting that the company described the shift of more Electromechanical activities into the wet season due to the delay as representing ‘a significant percentage of the cost increase given the lower productivity in the wet season and increased quantities.’ This could be interpreted as opex cost increases will be minimal — as man hours will be much lower.

Here’s some further facts, as of 30 September 2023:

- $215 million has been drawn down from the $346 million senior secured finance debt facility.

- HZM had total liquidity sources of $253 million comprised of $131 million undrawn on the Senior Debt Facility and a cash position of $122 million.

- $93 million of the cash position relates to the project to cover current construction activity and working capital which includes the full draw down on the Cost Overrun Facility of $25 million as well as the $5 million cost overrun equity. The cash balance is committed to near term capital expenditures.

- $16 million of the cash position is segregated for the development of Vermelho with the balance of $13 million spread amongst other entities for the ongoing running of the Group.

The company has $131 million of the Senior Debt Facility left over — but needs to get the lenders on board to spend it. These lenders were on-site on 4 October 2023. Again, HZM is:

‘working closely with its senior lenders and its cornerstone shareholders on a financing solution to solve the funding gap. The Company’s objective is to put in place a financing solution which will satisfy the cost to complete requirements and thereby allow the Company to continue to access its Senior Debt Facility.’

So in essence, there’s a $296 million capex funding gap — and the company has $253 million of liquidity sources, minus the $16 million for Vermelho — so $237 million. That’s a gap of $59 million ($72 million if you include the $13 million for ongoing running), not a million miles off the $52 million initial estimate I made a few weeks ago.

Okay, so there are a few additional factors to consider:

- The capex increase is expected to be ‘at least 35%’ higher, so this figure is a conservative estimate.

- The company needs to get the lenders to agree new terms to access the remaining $131 million of the debt facility — but in fairness, if they don’t agree new terms this is all moot anyway.

- This figure ignores increased opex costs for the six month delay — but as mentioned above I don’t think these would be too high, and in any event, this is six months in the scale of a 28 year LOM (at least).

The keystone investors have not sold. The senior lenders have not walked away.

I still think the new deal will be resolved favourably to investors — at least those with a 16p buy-in price.

We’ll know if I’m right next month. Of course, it’s not just HZM with a crunch Q4 to consider…

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.