Untangling the financial mess — £1,000 down the drain or shrewd speculative bet? It gets complicated.

A couple of days ago I released an article highlighting the importance of diversification within a portfolio, in response to my Twitter (X) poll where almost 50% of respondents said they only had one stock in their portfolio. For those of you who are still in this position, I would ask that you read that piece and consider the new financial position that HZM investors now find themselves in.

I was not in Horizonte Minerals for a variety of reasons; I don’t like investing in South American mining, where projects come with the valuation of a Tier 1 jurisdiction without the typical regulatory protections. I also dislike nickel investing, preferring lithium, copper, gold, and graphite.

But most importantly, I come to the FTSE AIM market to buy high risk. high reward shares — and up until this week, HZM was considered by the market to be about as safe as a junior resource small cap can be. Indeed, I know many investors who held large positions in their SIPPs. All I have is sympathy for those who lost money — we have all been there.

But going forward there are some really important lessons:

Diversify — Just because you think a stock is bullet-proof does not mean it is.

Financing — Just because a company appears well-financed does not mean it is.

Drilling — Just because a resource is indicated does not mean it is perfectly measured. Curveballs come up every time, and the only question is how expensive they are to resolve.

Broker Notes — are not unbiased and should be used as sources of information rather than God-given fact.

But whether investors like it or not, HZM has now become a high risk, high reward FTSE AIM mining share — or in other words, it’s time to breakdown what’s actually happened and see whether huge profits are there for the taking.

As a precursor, I invested £1,000 at 16p per share yesterday evening just before close. I won’t be putting more in until there’s more certainty and readily accept that cash may be lost soon. On the other hand, the money came from top slicing my new position in Oxford Biodynamics which I took out at the start of the week — so psychologically I think of this as a ‘free bet.’

Probably not a professional outlook, but there’s a reason why I’m a freelancer.

One other thing — other high risk exploratory miners — PREM, KOD, ALL, GGP, AMRQ etc will likely all go on sale this week as investor fear deepens. This could present a buying opportunity.

Let’s dive in.

Horizonte Minerals: what’s going on?

First things first. This is not financial advice.

As I’m aware that this post will likely attract a different type of reader to my standard following, it’s important to understand that I’m chasing high-risk returns of 1,000%+ over multi-year timeframes. This is very much not for people looking for safe, dependable returns and there’s a good chance you will lose your money.

HZM investors who thought some AIM shares are safe — sorry, but you’re in my house now. Welcome, and if you still haven’t sold, read on.

Let’s start with the share price chart.

To begin with, HZM shares were trading for less than 90p less than a year ago — then rose to 172p by 7 July 2023. Even forgetting the collapse this week, the stock had drifted to 125.5p by the end of September (a fall of some 27%).

Thereafter, the fateful RNS on 2 October saw the stock collapse by a further 87% to 16p per share (my buy-in price), before recovering to 20.5p. At present, this leaves investors down 91% since the July peak, and even more from the record high. I won’t do the maths — it’s just depressing.

But my instinct was to buy at that 16p low — as I feel like suspension is likely incoming and the chance to buy shares will be gone soon.

Let’s actually read through the keynotes of the RNS:

HZM has ‘has made good progress in completing the final detailed engineering and construction design for Line 1 of its 100%-owned Araguaia Nickel Project.’

So far, so good.

Then it gets a little lairy. The company now thinks that the overall capex to bring the project to production needs to increase by ‘at least 35%,’ while production is being delayed to Q3 2024.

Happily, the actual project seems to be progressing. These are exact quotes:

- construction work on site continues to progress well.

- all key engineering drawings issued for construction.

- Ore stockpiling activities commenced last quarter, and ROM build-up is progressing to schedule.

- The rotary dryer is now in place, with all shells aligned for final welding.

- Construction of the 126km, 230kV transmission line is well advanced, with all pylons erected and 118km of conductor cable installed.

- Construction of the water storage reservoir is also well advanced, with the initial sections of the water abstraction pipeline positioned and foundations poured for the river abstraction pump station.

Indeed, CEO Jeremy Martin (who’s probably had better weeks) enthused that ‘we continue to make solid progress with construction at Araguaia Line 1 and are confident that the Project is now significantly de-risked given the near finalisation of detailed engineering and procurement, together with the detailed review of the costs to project completion, ensuring successful delivery.’

Fighting talk from a man who perhaps misjudged the size of the market reaction. The company noted that in order to de-risk the operation, it’s had to make various changes to the original plans and is also having to cope with ‘selected suppliers who have not been able to deliver to the project timeframe, which has added further cost pressures.’

The business is now waiting for independent mining contractor Reta Engenharia to undertake a comprehensive review of these additional expenses, with the results due in Q4 2023. Further, the original Feasibility Study on Araguaia Line 2 also remains on track to be published in Q4 2023.

The company took the opportunity to remind investors that the combined production of Araguaia Lines 1 and 2 is expected to be 29,000 tonnes per annum.

If Nickel is trading for $18,500/tonne at present, that’s potentially $536,500,000 of revenue a year starting in Q3 2024 — as soon as 1 July 2024. HZM just needs to get from where it is now to that profitability inflection point.

Regarding this, the RNS notes that ‘the Company continues to have strong support from its major partners. The Company is working on a plan with its various financial institutions together with the cornerstone shareholders for a financing solution to complete construction.’ And Martin notes ‘the strong support provided by both local stakeholders and cornerstone shareholders, as we work towards a financing solution to complete construction.’

Horizonte’s Flagship

Before we get to the financing, it’s important to check whether the juice is worse the squeeze.

Spoiler: it is.

I’m going to ignore Vermelho — if HZM digs itself out of its hole, I’ll do a comprehensive review in the future. In August 2019 — long before Tesla, the EV revolution, western critical minerals concerns, or the nickel resurgence took centre stage, the CEO told investors that:

‘The Base Case and the Stage 2 Expansion Case for the Araguaia Feasibility Study use US$14,000 nickel; however, based on the recent nickel price of $16,000, the project NPV on the Stage 2 Expansion Case is approximately $1 billion with an IRR of 30% generating free cash flow of US$3.5 billion.’

Araguaia is the clear flagship — with a whopping 28-year mine life generating free cash flows after tax of $1.6 billion and returning an IRR of over 20% on what was then supposed to be a $443 million initial capex cost. The company also clearly thought the 28-year-LOM was conservative, and the feasibility study included the option to increase production from 14,500tpa of nickel to 29,000tpa.

This would leave it with a 26-year mine life, generating cash flows after taxation of US$2.6 billion, with an estimated NPV of US$741 million and an IRR of 23.8% – using the base case nickel price forecast of $14,000/t. Best of all, the plan was and remains to finance this upgrade through cash flow leaving the upfront capex costs the same.

With the resource upgraded significantly in August 2019, the company announced it was sitting on one of the ‘world’s largest inventory of undeveloped nickel and cobalt resources globally.’

I won’t go into grades, but suffice to say, this was not an understatement. Araguaia is still 100%-owned by the company and is extremely valuable.

Clearing the financial picture

There are a few things to start with before delving into the figures. First, the company was tweeting out sexy corporate videos as recently as 28 September. This leaves four possibilities:

- either management knew about the problems, and hid them from investors;

- or management didn’t know about the problems;

- or management knew but thought the market reaction would be better;

- or management knew and decided to create a sunk cost problem for their partners.

Regardless, this is not a good look. However, I think some forbearance can be assigned to the CEO et al when you actually consider the full picture. As a caveat, I am new to this stock and piecing together the various financing has not been easy. If there are any errors, please get in touch and I will happily amend.

Let’s consider how Araguaia is being financed. As noted above, Line 2 is planned to be financed from cashflow from Line 1, so let’s have a look at just Line 1:

The entire project budget came in at $537 million. If we now need to up this by at least 35%, the minimum capex cost will come in at $724.95 million — let’s round this up to $725 million.

We know from the Q2 2023 quarter update that $329 million has been spent so far on construction, and at the time the company considered that 65% of the overall construction and 53% of the physical construction was complete at the end of June 2023.

HZM had liquidity and funding sources of $344 million as of 30 June 2023. As recently as 3 August 2023, Martin was ‘targeting first metal in Q1 2024…with the progress made to date, we remain confident in our ability to deliver our world-class project in a safe and responsible manner.’

If $329 million has been spent so far, and it has access to $344 million as well, HZM can get up to $673 million. With the new capex figure standing at $725 million, then the company is only short a piffling $52 million (+subsistence costs such as management salaries — let’s ignore those for a moment).

This should not be enough to tank the share price.

There is a strong argument to be made that HZM’s partners, having already effectively spent $329 million to get half a mine, are essentially going to be forced to finance the funding gap. Of course, this will not be on great terms for Horizonte — but it’s hard to see how terms could be worse than a 90%+ share price decline.

The company should have suspended itself from trading, done a deal, and then come back. But it’s not like there was no warning: the Going Concern statement from the Interim Results (which usually come with generic risk warnings), stated that:

‘There exists a risk that the senior debt facility is not able to be drawn due to unforeseen circumstances or noncompliance with any conditions precedent which may or may not be within the control of the Group…

…a number of risks still exist around escalation costs linked to several of the major construction packages (these include labour, materials, and productivity). This could result in future drawdowns on the senior debt facility not being permitted and require the Group to pursue alternative sources of funding to meet its commitments.

As the project moves into operational ramp-up phase there are a number of risk areas around commissioning the RKEF process plant. If any of these ramp-up risks exceed the pre-production funding allocated to the unit areas, there will be a requirement for additional funding.

As a number of these factors are outside of the Group’s control, a material uncertainty exists which may cast significant doubt about the Group’s continued ability to operate as a going concern and its ability to realise its assets and discharge its liabilities in the normal course of business.’

This is not the standard generic risk warning and investors should have paid attention to it.

Now, let’s turn to an alternative possibility — that Glencore is engaging in typical Glencore activity. Remember, this is a company that seems to be facing more lawsuits than grains of sand on the beach and is not alien to getting junior partners into weak positions before taking advantage.

But before we go down that particular rabbit hole, it’s key to be clear about how the project is being financed. This involves rewinding to 16 March 2022 (excluding minor points):

Senior Debt Facility, comprised of:

- Commercial senior facility of $200,000,000 provided by Senior Lenders (BNP Paribas, BNP Paribas Fortis, ING Capital LLC, ING Bank N.V., Natixis, New York Branch, Société Générale and Swedish Export Credit Corporation). In two tranches and guaranteed by EKF and Finnerva.

- ECA facility of $74,562,000 guaranteed by EKF

- ECA facility of $71,638,000 guaranteed by Finnvera

Cost Overrun Facility, comprised of:

- $25 million, interest 13% pa, secured to the senior debt facility and provided by Orion

Convertible Loan Notes, comprised of:

- $65 million, likely fully drawn down and provided by Orion and La Mancha (horrendous interest rates)

Equity Fundraise, comprised of:

- Circa $70 million form La Mancha in newly issued shares

- $50 million from Orion in newly issued shares

- $75 million standard placing in the UK and Canada

- $7 million Cornerstone subscription with Glencore

Now this is critical — at the same time as this funding was agreed, Araguaia Niquel Metais Ltd (a subsidiary of Horizonte), entered into a conditional ten year offtake agreement with Glencore for 100% of the nickel produced at Araguaia.

This offtake agreement was a ‘key requirement of the Lenders and significantly de-risks future cash flows from the Project. The Offtake Agreement is conditional upon, among other things, the completion of the Glencore Subscription and the entry by Glencore into a direct agreement with the Lenders in relation to typical intercreditor matters.’

I believe there was also an $8 million placing for the average joe, and then in October 2022, HZM raised another $80 million.

Now again, I’m new to the stock, but let’s add that all up. In rough figures, that’s $200m + $74.5m + $71.6m + $25m + $65m + $70m + $50m + $75m + $7m + $8m +$80m = $726.1 million.

That’s $1.6 million more than the increased capex figure — so a question long-term holders might have is this: if the cash position stands at $344 million and spending at the project accounts for $329 million, where’s the rest of the cash gone?

That’s over $50 million, a bit much for working capital.

Again, this is just my maths — if I’ve missed something please let me know.

Now we can consider Glencore’s position, the volume over the past two days, and the entire issued share capital.

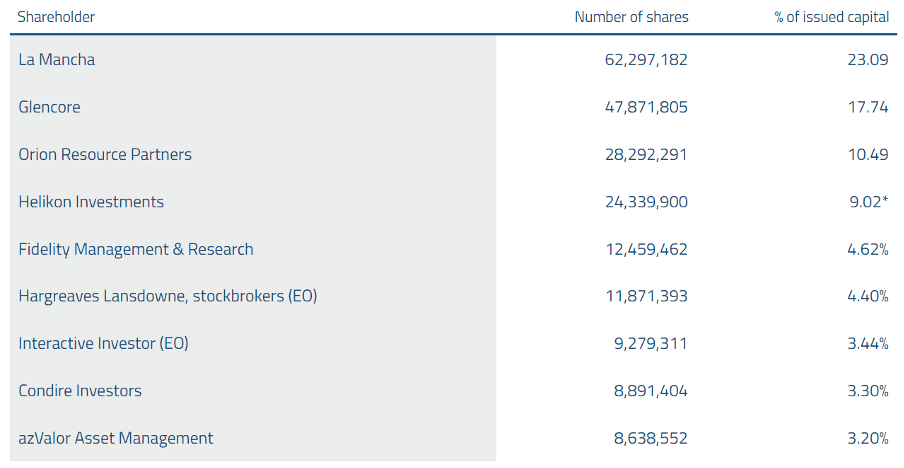

There are close to 270 million shares in HZM in total. 52% are not in public hands, and Glencore holds (or held?) nearly 48 million according to most recent company data. The share volume on Tuesday was circa 23.5 million shares, with a similar number on Monday. Most of these were clearly sells.

If an institutional investor is selling up, it could be La Mancha, Glencore, or Orion. But La Mancha and Orion have no incentive to tank their own investment unless they have decided the additional investment makes the project unviable (it doesn’t).

That leaves Glencore as the only viable seller with the shareholding to make this happen — or it’s retail panicking. This seems unlikely but stranger things have happened. The second question is this: why would Glencore sell up? To my knowledge, HZM retains 100% ownership of the project, has a small funding gap, and I would imagine that as is standard in the industry, GLEN must retain its shareholding to keep offtake rights.

GLEN might think that it can crash HZM into oblivion, but as PREM shareholders have shown, this doesn’t always go the way of the senior partner. And if HZM collapsed, the mine could be sold to any operator.

The only other possibility is that another funding partner is distressed and is running scared, or that HZM’s financial situation is worse than it’s letting on at present. How much has inflation hit its cost estimates?

But regardless, a speculative £1,000 and there’s still a good chance funding will be sorted soon. Pint at the Winchester…

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Good breakdown but the “at least 35%” is the problem. Your figures are tight with 35%

Agreed, but I have to go with that figure until the Reta Engenharia review reports back in a few weeks. Even if you go up to 50%, the gap doesn’t seem too bad.

You write exceptionally well Charles. Great insightful piece.

Thanks Noel – though I’m always learning.

The other 50m went on imminent A2 DFS and Vermelho DFS for next year . Your sums have also left off ramp up opex needed before cash starts to flow in. The new funding requirement will likely be $200-250m. Also whenever the company has said ‘at least’ in the past it has always shot low. I don’t believe Glencore, La Mancha or Orion will have sold in the last few days, but Helikon and Fidelity may have done plus a lot of angry retail investors. That stock dump would have been enough to hit the volume seen.

Personally I think the drop started as a retail panic, followed quickly by spooked institutions, and then the wild west shit show really kicked off.

Another way to look at the valuation is through the assets vs liabilities, if they can’t raise the cash because of the equity cash what could the whole lot go for. NPV calcs are now different, but asset values are probably not a mile out. Check the last balance sheet.

Hi Pete, thanks for the comment.

Agreed RE Fidelity/Helikon – as shown by the TR1 today, but the key thing is that retail is selling off and not the lending institutions or GLEN.

Assets v liabilities – we do know that a lot of the debt comes up for repayment in Q1, so if this can’t be postponed/rearranged, it’s game over regardless.

Total funding required – $50m in the A2 DFS and Vermelho DFS makes sense – though I’d argue that increased opex costs won’t be close to what you think. Production was originally meant to start in Q1 2024 and has been delayed to Q3 2024; that could be as little as three months.

The review will lay it all out in black and white – but my overall argument is that whatever deal comes out of this mess, HZM still owns 100% of the asset and it will get mined eventually given the sunk cost. While the new deal will not be great for HZM, it will be a lot better than a 90%+ SP loss.

Having said all of that, there’s a reason why I only invested a very small amount. Feedback like yours very welcome – thank you (and if you’re in, good luck)