High risk, high reward investing in small cap shares is not for everyone. What does this typical warning actually mean?

First up, this is not advice. This is simply an insight into my investing philosophy.

Again, for clarity, not advice — DYOR.

As I spend much of my time covering FTSE AIM and similar small cap shares here on Investing Strategy, I tend to include a generic threat warning:

High risk, high reward.

At its most basic, this is hopefully fairly self-explanatory: you are accepting there is a good chance you will lose some or all of your investment in return for the prospects of significant profits.

Specifically, these potential rewards are far better than you will get with a more conservative strategy. If you invest £10,000 into a decent S&P 500 tracker, or FTSE 100 tracker, or perhaps a reliable dividend stock like Legal & General, then over the long term you are very likely to get solid returns of at least 7% per year — often slightly more.

If you go for the conservative figure of 7%, then it would take almost exactly 10 years with compound interest to double this initial investment amount to £20,000. If you go down a slightly riskier route and invest in a handful of NASDAQ growth stocks like Tesla or Apple, you might get higher returns, but with the risk of greater volatility, despite their blue chip status.

For context, Apple — the largest company in the world — was worth $2 trillion in January and is worth $2.75 trillion today. To put this another way, investing in NASDAQ blue chips is riskier but the potential rewards are higher.

On this note, it’s important to be careful with historical bias when it comes to index investing. I’ve covered the FTSE 100 misconceptions elsewhere, but a common error is to think that the S&P 500 is a better choice than the Dow Jones. This is simply a mistake of youth.

Between:

- 1903-1940 — DJI outperformed SP500

- 1941-1985 — SP500 outperformed DJI

- 1986-2008 — DJI outperformed SP500

- 2009-2023 — SP500 outperformed DJI

These big cyclical changes are hard to keep in mind for investors who only really got started over the past few years — but with monetary policy tightening, the Dow may well be coming back into fashion.

And then you come to AIM shares, and specifically those I tend to focus on in the mining and biotech sectors. These are the ultimate reflection of the extreme edges of the risk-reward-ratio; a decent clinical trial result or drilling campaign can see shares re-rate to 5x, 10x, and occasionally even 20x your initial investment. But failure usually results in share price collapse — and most operations do indeed fail.

This is why I advocate for some diversification alongside a wider defensive strategy. Note, this is what works for me, and everybody’s financial situation is different.

As an overview, the initial basics are to:

- pay off all debt (excluding the mortgage).

- build up an emergency fund to cover six months of basic living expenses.

- invest regularly in index trackers or blue chips within your SIPP.

- contribute regularly to your children’s JISAs.

- buy a little gold/crypto.

Once you are at the stage where you have this level of financial security, it can be much easier to tolerate volatile, high risk penny shares.

There are several caveats though:

1. Leveraged trading is for the wealthy. To get to a point where it makes sense, you need to max out your ISA and SIPP for the truly excellent tax advantages, and then set aside some income to live off. For most, this means you need to earn at least £150kpa to make trading using CFDs or spread betting worthwhile. Even if you manage to turn a profit — circa 70% of accounts lose money — and it’s then taxed as well.

2. Timing the buying and selling of AIM shares using technical analysis is not as accurate as it might appear, and sensitivity to RNS announcements (positive or negative) means that trying to sell the top and buy the dip regularly usually ends with you losing money. Of course, I always aim to buy shares at the bottom, but once I’m in, I view myself as a part business owner rather than a speculator.

3. Diversification is important when you’re investing in high risk, high reward companies. However, it’s also true that investing in too many shares limits the effect of good news on your portfolio. I like to keep a portfolio of about 15-20 core holdings, backed up by an additional 10 speculative smaller ‘bets’ that I plan to average up over time. The key thing is that one poor RNS shouldn’t be able to crash your entire portfolio, keep you up at night, or reaching for the phone at 6.58am every morning.

4. If it’s in the headlines, you’re usually too late. The chances are that waiting until after the ‘big’ announcement means you have lost the opportunity. As an example, I missed the initial run-ups of Upland Resources and OptiBiotix. I cannot cover or analyse every single share and jumping in from FOMO rather than because of a researched decision is just gambling. This doesn’t mean that a company is a bad investment after a re-rate, simply that it is often no longer ‘deep value.’

5. Long-term winning at high-risk AIM investing requires patience and fearlessness in equal measure.

Some examples of my long-term investments:

PREM — invested 0.03p, current 0.44p, recent high 1p.

MARU — invested 2.5p, current 14.1p, recent high 15.5p.

AVCT — invested 52p, current 100p, recent high 185p.

BOIL — invested 0.09p, current 0.09p, recent high 0.25p.

I’m not going to go through every single share, but the overarching principle is that I’m here for unreasonable returns over multi-year time frames. If I just wanted to double my initial investment, it would be easier to go to a casino and bet it all on black — with returns potentially of 100% at nearly 50:50 odds and tax free.

Buy and hold

When I say multi-year timeframes, I mean this not just in terms of the ‘buy and hold’ mentality, but also in terms of psychological resilience. If you look at the four companies above, then the progress made over the past year is significant — PREM is on the verge of production, MARU is going after a JORC Resource at its flagship, AVCT is near the end of the critical Phase 1B trial of AVA6000, and BOIL has a CPR for Chuditch.

If you get shaken by a 20% drop one day, or euphoric about a 30% share price rise, then this AIM strategy isn’t for you. Because these kinds of price movements don’t matter to long-term investors; instead, what should be exciting is the improved underlying business case that underpins the rise.

If you sell the 20% down, you just lost money. And if you sell the 30% rise, you will never see the kind of returns that investors like me are chasing. You need to accept that some portfolio companies will fail — with the idea being that the winners more than outweigh the losers. The exception to this rule is where there is a clear change to the investment case — a CEO resigns, a mining licence is lost, etc.

But if you want more than the 7-10% on offer with an index tracker, you need to sweat for it. And if you’re chasing 1,000% returns, it can get — to put it mildly — a little stressful. If this sounds unappealing, or you’ve been burnt by the weak sentiment of 2023, there’s no shame in sticking to the blue chips.

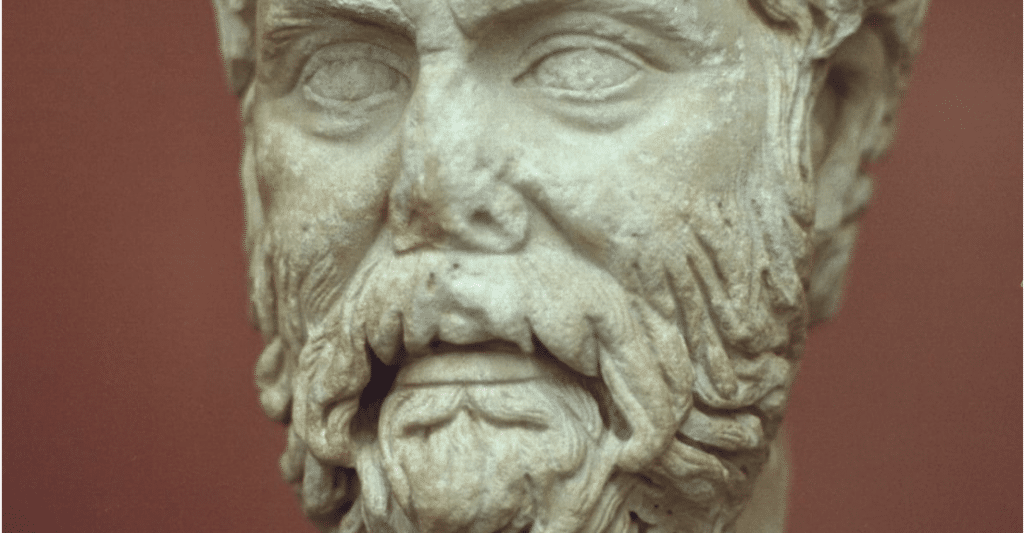

If you still want to play the AIM game, it’s best to adopt the ataraxia of Pyrrho.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Thanks for your assessment Charles, very helpful to a novice investor like myself.

Have invested in couple of good, bad and indifferent stocks and think your analysis is spot on, good advice to any novice or wanna be investor.

Thanks again.

Hi Robert,

Glad to hear it.

As my social media profile has grown, I think it’s important to highlight that I’m targeting a specific kind of return which comes with elevated risks. This requires a building a financially resilient base and also the temperament to hold through the swings. A big part of this is the mental toll – if you get stressed about the down days, or are investing with money you can’t afford to lose, it’s probably not worth it. But the rewards are far, far better than elsewhere.

Thanks again.