2023 has hopefully seen off the bottom of the small cap market. In 2024, fortune favours the brave!

I was going to spend my last article of the year considering why Shanta Gold has chosen to accept an offer far below what the company seems to be worth. FWIW, boards tend to have more information than investors, so there may be a subsurface reason — but instead, I think I’d prefer to spread some Christmas cheer.

I have my two year old on my left knee and my five year old on the right. The ten year old is playing Fortnite on the screen next to me and their mother lounging on the sofa reading a book with a glass of wine in hand. Nobody is sick.

Some things are worth more than money.

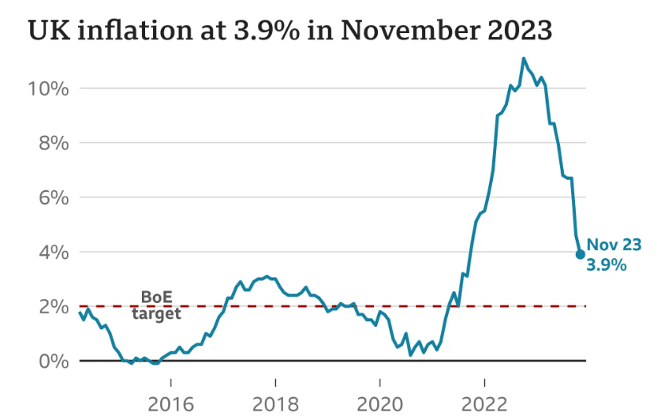

CPI inflation has fallen by more than expected; to just 3.9% in November. Now, of course, this is still nearly double the official 3% Bank of England target. And the economy contracted (unexpectedly) in October, by 0.3% — after growing by 0.2% in September. And in November, the Insolvency Service released data showing that company insolvencies are at their highest level since 2009.

So we’re very much not out of the woods yet. And after constant black swans — the pandemic, the Ukraine War, the inflation crisis, the energy crisis, the rates crisis, the crypto winter, the Truss mini-budget, Silicon Valley Bank & Credit Suisse, the Israel-Hamas War…

It’s — in my personal view — hard to relax entirely about the wider macroeconomic environment.

The UK government (the BoE is independent in the same way as a three year old let loose in the local park) magicked £895 billion of bonds in the form of Quantitative Easing out of thin air between 2009 and 2021. They then spent billions more on the pandemic — with states worldwide shutting down vast swathes of the economy for over two years.

This all highlights my strongly held view (not advice) that investors should diversify and build up financial resilience. Apportion circa 50% of your excess income into a SIPP, tracking a diversified index. I prefer the S&P 500, though a world index or even the FTSE 100 can be better choices dependent on your risk tolerance/how close you are to retirement.

Then you need 5% into specific gold coins (CGT-free), 5% into crypto, and then the remainder into a diversified small cap portfolio through an ISA. Pay off all debts first, build an emergency fund, and away you go! But in all seriousness, if 2023 has taught investors anything, it’s that piling into one stock is perhaps not the best investing strategy — and it pays to know that I am investing from a position of financial strength.

Back to the macro.

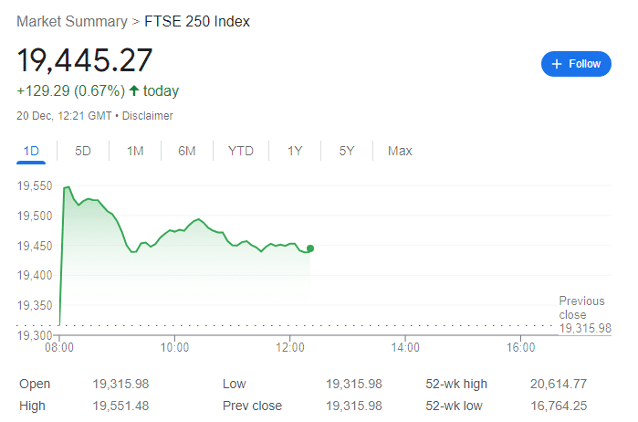

Economists the world over are really starting to believe in the longed-for ‘soft landing.’ But they aren’t really sure, and perhaps the best UK metric to highlight their uncertainty is the FTSE 250 — which is almost exclusively composed of domestically focused stocks and is therefore a decent barometer of UK economic confidence.

The index started the year at 19,134 points, rose sharply to 20,615 points in early February, and then fell to 16,783 points by late October. It’s now at 19,450 points — up 1.7% year-to-date, but by an amount that could easily be wiped out by 1 January 2024. In other words, analysts and investors are sitting on the fence, and honestly, who can blame them?

Every other black swan — by their nature — was unpredicted. Right now, traders are pricing in 125bps of rate cuts in 2024. This may be optimistic.

But in the small cap world, green shoots are definitely emerging.

The FTSE AIM market hit 670 points in late October 2023, but has now recovered to 749 points. For perspective, the bottom of the market during the pandemic flash crash on 20 March 2020 was circa 624 points. There is clearly more space to recover, and you can see this is actual, real world company movements.

In the junior resource sector, mining companies are actually — SHOCK HORROR — doing some drilling or at the very least planning to. After a year of cost-conscious activity, companies are actively engaging in expensive drill programmes. You can name them yourselves, but if companies are drilling, it signifies confidence that the market will support further development at reasonable prices.

Meanwhile, the biotechs are on notice for buyouts. Avacta, Cizzle, Poolbeg, hVIVO and Hemogenyx are all strong acquisition targets in my view — you can read all about them in pieces over the year. But UK valuations are cheap as chips, and private equity war chests have never been larger. Literally, they’re at record highs — and the pharma giants will also want to muscle in.

If rates start to fall and inflation stays contained, then the HNW investors and institutions are going to come roaring back. Investors taking positions today could be well rewarded, and all it takes is a little bravery. In 2023, you were swimming upstream — in 2024, you’re surfing with the tide.

Counterintuitively, this could make 2024 a year where it makes sense to invest in medium risk, medium reward companies. If you were investing in 2023, then every small cap stock was going to slowly fall in value as money leaked out of the market — so it made sense to go for the riskiest companies (or stay out of the markets altogether).

Because if you’re forgoing a guaranteed 6.2% NS&I return, then you’ve got to go for gold.

2024 may be a time for a more measured strategy. Consider Sovereign Metals, Amaroq Minerals, Kodal Minerals, Greatland Gold, ARC Minerals, Golden Metal — where the upside is now strong, the investment case is compelling, but the risk is mitigated through various channels.

Of course, I will still cover the riskier segment of the market. HARL is still waiting for UKEF funding and a sale of Islandmagee. BOIL is still waiting for a JV or sale. PREM is entering Q1 like it’s hit the wall on the 26th mile of the marathon —out of shares to raise, but with cash to last until production or quasi-collapse in March. These are all long-term plays using risk money; all three could still deliver lifechanging rewards, and all three could fail.

But times, they are a changing.

In the end analysis:

Happy Christmas!

Happy Christmas to the Twitterati and the Telegrampers! Happy Christmas to my clients new and old! Happy Christmas to mining companies who release RNSs vague enough to keep the soothsayers in business. Happy Christmas to biotechs delivering world-changing news to a market with a MEH attitude.

And I’ll even wish a Happy Christmas to investors who only think about reward and never about risk. And also to those intellectually challenged individuals who can’t interpret sarcasm.

On a final note, I do have one more comment to make going into the new year, and it’s about the way you use social media to convey your opinions. I can tank the hits — it’s part and parcel of sticking my neck out with an educated opinion. I enjoy most of the heckling, and actually view the feedback on social media as important to avoid any echo chambers. Remember, this site is about high risk, high reward.

But what I can’t stand is the abuse being hurled at company boards, and in particular, the CEOs. Without naming names, some of them do deserve it. Challenge them.

But many have spent the past couple of years navigating extremely choppy waters with limited financing and only a series of increasingly difficult choices — any of which will anger various shareholders. Many are working 90 hour weeks for limited reward and while they are stewards of your money, they’re also human too.

Here’s to an exceptional 2024 and a Happy New year!

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.