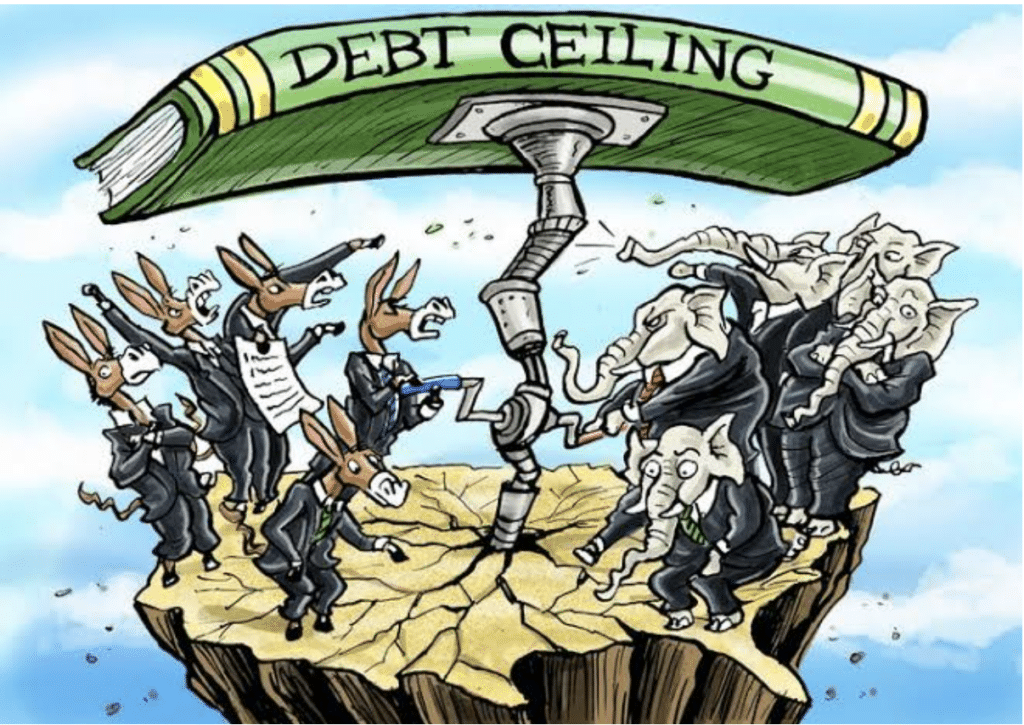

The US debt ceiling is a legal limit on how much the US government can borrow to pay for its spending. If it is not raised by Congress by June 1 2023, the US government will default on its payments for the first time in history. This would have serious consequences for the global economy and especially for the UK economy, which is already facing its longest recession ever.

In this post, we will explain what the US debt ceiling is, how it could affect the UK economy, and how to protect your portfolio from the US debt ceiling crisis.

What is the US debt ceiling and why does it matter?

The US debt ceiling was first introduced in 1917 to give the US Treasury more flexibility in managing government finances during World War I. Since then, it has been raised more than 100 times to accommodate the growing spending and borrowing needs of the US government. The current debt ceiling is set at $31.4 trillion, which is roughly equal to the total amount of debt that the US government owes to its creditors, both domestic and foreign.

The US debt ceiling matters because it ensures that the US government can pay for its obligations, such as interest on its debt, social security benefits, military salaries, tax refunds, and other bills. If the debt ceiling is not raised by Congress before it is reached, the US Treasury will run out of money and will have to choose which payments to prioritise and which to delay or skip. This would be a breach of trust and a violation of legal contracts, which could trigger legal challenges and lawsuits.

A default by the US government would also have severe implications for the financial markets and the economy. The US Treasury bonds are considered one of the safest and most liquid assets in the world, and they are widely held by investors, banks, central banks, and governments as a store of value and a benchmark for interest rates. A default would undermine the credibility and reliability of these bonds, and could cause their prices to plummet and their yields to spike. This would increase borrowing costs for the US government and other borrowers, and reduce lending and spending in the economy.

Moreover, a default by the US government would create uncertainty and panic among investors, consumers, businesses, and policymakers. Financial markets could experience increased volatility and instability, with stock prices falling and risk premiums rising. Economic activity could slow down or contract, as confidence and demand decline. A recession or even a depression could ensue, with negative effects on output, income, employment, trade, and inflation.

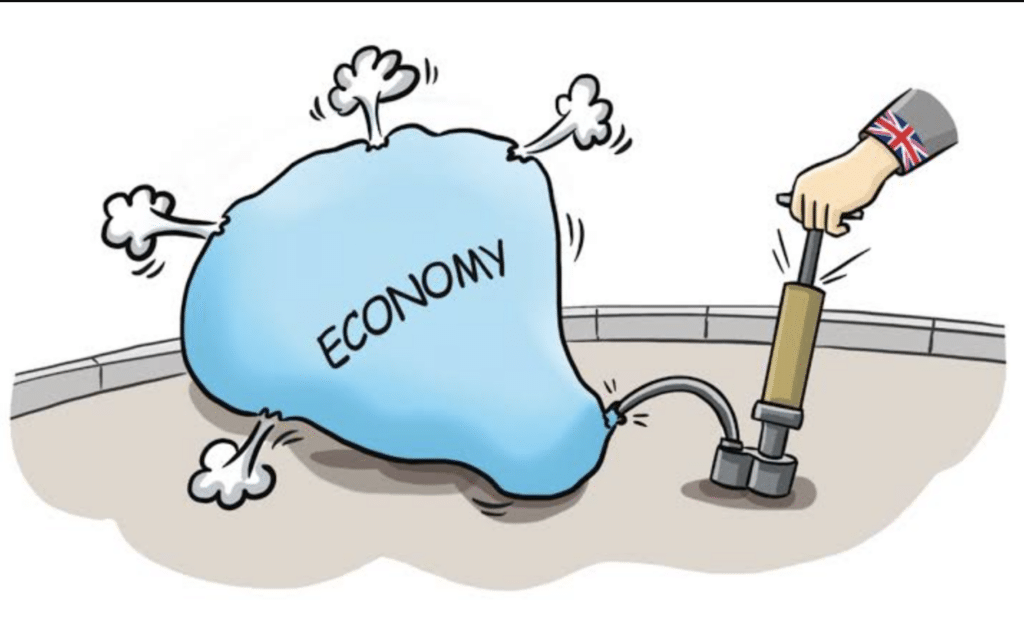

Analysing the UK Recession

The UK economy is facing a challenging year in 2023, as the cost of living crisis, high inflation and interest rates, and global supply chain disruptions weigh on growth and consumer confidence. According to the Office for Budget Responsibility (OBR), the UK will avoid going into recession in 2023 but the economy is still expected to shrink by 0.2%. This would be the weakest performance among major advanced economies, and almost as bad as Russia’s projected contraction of 1.3%.

One of the main factors behind the UK’s economic slowdown is the persistent inflationary pressure, which has reached the highest level since the early 1980s. The annual inflation rate was 8.7% in April 2023, down slightly from 10.1% in March. The surge in inflation has been driven by a combination of factors, including rising energy and food prices, higher wages, supply chain bottlenecks, and base effects from the pandemic-induced slump in 2020.

The high inflation has eroded the purchasing power of households and businesses, and forced the Bank of England to raise interest rates aggressively to curb price growth and anchor inflation expectations. The Bank has increased its key base rate from 0.1% in October 2022 to 4.5% in May 2023, and financial markets are pricing in further hikes that could take the rate to over 5.5% by the end of the year. This has pushed up the cost of borrowing for millions of households and businesses, especially those with variable-rate mortgages and loans.

The tightening of monetary policy has also put upward pressure on the value of the pound sterling, which has appreciated by about 10% against the US dollar since October 2022. While this has helped to lower the cost of imported goods and services, it has also hurt the competitiveness of UK exporters and reduced their profit margins.

Another challenge facing the UK economy is the uncertainty and disruption caused by global supply chain issues, which have affected many sectors such as manufacturing, construction, retail, and hospitality. The shortage of raw materials, components, labour, and transport capacity has led to delays, cancellations, higher costs, and lower output for many businesses. The International Monetary Fund (IMF) has warned that these problems could persist well into 2024.

The UK government has taken some steps to support the economy and mitigate the impact of the cost of living crisis, such as increasing public spending, extending some pandemic-related support schemes, and cutting some taxes. However, the IMF has cautioned against any further fiscal stimulus that could worsen the inflationary pressure and undermine fiscal sustainability. The government has also faced criticism for its handling of the pandemic and its post-Brexit trade policy.

The outlook for the UK economy remains subdued and uncertain, with significant downside risks from further inflation shocks, interest rate hikes, supply chain disruptions, and political instability. The IMF expects the UK to grow by only 1% in 2024 and 2% in 2025, well below its pre-pandemic trend. The UK will need to address its structural weaknesses and boost its productivity and competitiveness to achieve a more balanced and sustainable recovery.

How could the US debt ceiling crisis affect the UK economy?

The UK economy is closely linked to the US economy through various channels, such as trade, finance, currency, and confidence. Therefore, a US debt ceiling crisis could have significant spillover effects on the UK economy.

One of the channels is trade. The US is one of the UK’s largest trading partners, accounting for about 15% of its exports and 11% of its imports in 2020. A US debt ceiling crisis could reduce demand for UK goods and services in the US market, as well as affect UK supply chains that rely on US inputs or intermediates. This would lower UK export revenues and output growth.

Another channel is finance. The UK has substantial financial exposure to the US through direct investment, portfolio investment, banking claims, and currency reserves. According to official statistics, at the end of 2020, UK residents held about $1.7 trillion of US assets (including $0.6 trillion of US Treasury securities), while US residents held about $1.2 trillion of UK assets (including $0.2 trillion of UK government securities). A US debt ceiling crisis could cause losses or impairments on these assets due to default risk or market volatility. It could also disrupt financial flows and transactions between the two countries.

A third channel is currency. The US dollar is the world’s dominant reserve currency and international medium of exchange. The UK has a large share of its foreign exchange reserves denominated in US dollars (about 24% in 2020), as well as a significant amount of its external debt (about 38% in 2020). A US debt ceiling crisis could weaken or destabilize the value of the US dollar against other currencies, including the British pound sterling. This could affect the UK’s external position and balance of payments.

A fourth channel is confidence. The UK economy is highly dependent on consumer and business confidence, which in turn are influenced by global economic and financial conditions. A US debt ceiling crisis could erode confidence and sentiment in the UK, as well as in other countries. This could reduce spending, investment, and growth in the UK economy.

How to protect your portfolio from the US debt ceiling crisis?

The US debt ceiling crisis poses a serious threat to your portfolio, as it could affect various asset classes and sectors. Here are some strategies to protect your portfolio from the US debt ceiling crisis:

- Stay informed: Stay updated on the negotiations and developments surrounding the US debt ceiling. Understanding the potential outcomes and risks can help you make informed decisions.

- Review and diversify your portfolio: Regularly review your portfolio to ensure it is well-diversified across different asset classes, sectors, regions, and currencies. Diversification can reduce risk by spreading your investments across various assets that may respond differently to the US debt ceiling crisis.

- Focus on long-term goals: Maintain a long-term perspective and avoid making impulsive decisions based on short-term market fluctuations. Stick to your investment plan and objectives, and resist the temptation to make drastic changes to your portfolio during times of uncertainty.

- Ensure adequate cash reserves: Keep sufficient cash reserves to cover your short-term expenses and emergencies. A cash buffer can provide liquidity and security, and reduce the need to sell your assets at a loss during a market downturn.

Also consider consulting with a financial adviser who can provide guidance tailored to your circumstances. They can help you assess your risk tolerance, review your portfolio, and make adjustments if necessary.

In Summary

The US debt ceiling crisis is a serious threat to the global economy and especially to the UK economy, which is already facing its longest recession ever. The UK government and investors should prepare for the worst-case scenario and take measures to protect their interests and assets. What do you think about the US debt ceiling crisis and its impact on the UK economy? Let me know in the comments below.