Suppose you’re looking to invest in a speculative investment. In that case, you may need to know: what speculative investment is, who speculators are, features characterising speculators, factors affecting this kind of investments, why people invest in speculative investments, the strategies, the pros and cons, and if you should invest in speculative investments. This guide will help you learn about the basic principles of speculation.

Concise Overview:

- Speculative investments are an investment with high levels of risk

- Speculators predict events, movements, and trends of the world in probabilities and possibilities, not absolutes

- Speculative investments are for investors who can tolerate the high risks associated with them

Introduction

Investing in properties like real estate, bonds, stocks, cryptocurrencies, and other assets is a great way to build wealth. Though, most of these investments come with a certain degree of risk because there’s always the chance that the investment could lose or gain value. When an investment comes with such a risk factor, it’s considered speculative.

Speculative investment is usually short-term, whereby investors want to make a quick profit and leave the investment. When it involves a long-term investment, the goal is to make money over a more extended time. You’ll need to be patient and wait for your investments to pay off.

Primarily, investors who have a tolerance to risk are the ones who make speculative investments because of their high volatility. In this guide, you’ll understand, in total, speculative investment, such as: who are speculators — their types and features, factors affecting speculative investment, why people invest in speculative investment and its types, strategies for investing in speculative investment, the pros and cons of speculative investment and should investors invest in it.

What Is Speculative Investment?

Speculative investments are investments that carry high levels of risk and offer high potential returns which are less guaranteed. These investments are usually associated with volatile markets and can result in significant losses if not managed properly. Speculative investments include stocks, bonds, futures contracts and options, real estate, and commodities (gold, silver, palm oil, etc.).

Speculative investments are not for everyone, so it’s essential to understand the risks involved before making investment decisions. They can be great for long-term speculators who have a high tolerance for risk and are willing to accept short-term losses in exchange for potential long-term gains. Speculative investments are part of a well-thought-out investment portfolio for speculators who think it’s right for them.

Who Are Speculators?

Speculators think about the world in probabilities and possibilities, not absolutes. They try to predict events, movements, and trends before they happen so that they can benefit from their knowledge. They use this information to make profitable investments in the stock market or other markets.

Speculators are usually more interested in short-term gains than long-term growth, which can lead to severe losses if they need to be more careful. However, speculators can be some of the most successful investors in the world. The key to their success is their ability to think outside the box and see opportunities others miss.

Types Of Speculators

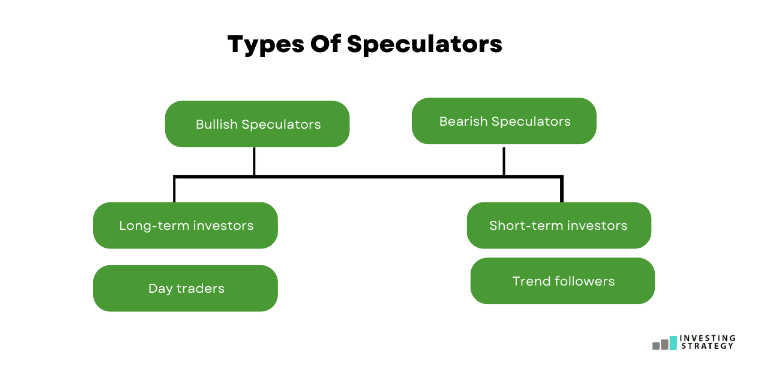

Not all speculators are the same. They differ in preferences, tastes, risk length, and investment focus. But we can categorise every speculator into two, such as:

- Bullish Speculators

Bullish speculators believe the price of an asset will increase in the future, and they bet on it by buying now. They hope that their investment will become more valuable in the future as demand increases and supply decreases.

Bullish speculators can be divided into two subcategories: long-term investors and day traders.

- Long-term investors hold their positions for many months or even years.

- Day traders try to make quick profits within one trading session.

- Bearish Speculators

Bearish speculators believe the price of an asset will decrease in the future. They bet on it by selling now, hoping their investment will become more valuable as demand decreases and supply increases.

Bearish speculators can be divided into two subcategories: short-term investors and trend followers.

- Short-term investors hold their positions for one day or a few days.

- Trend followers try to make quick profits within one trading session.

Features Of Speculators

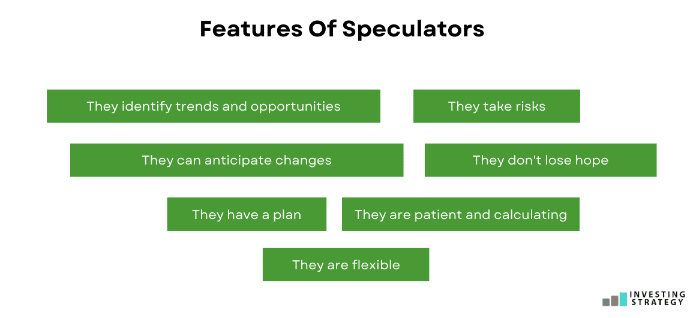

Some things are common among speculators — the features they share and the characteristics that make them. These features are:

- They identify trends and opportunities: They have an eye for identifying trends and opportunities. They can spot the potential in something yet to come and act on it before anyone else.

- They take risks: They’re willing to take risks and understand that risk is a part of investing, even if the outcome is uncertain. They believe in their ability to make the right decision and act on it confidently. They can handle the ups and downs of the market because they know that’s how you make money.

- They don’t lose hope: They don’t lose hope. They understand that the market is volatile and that there will be times when things don’t go their way. But they know it will eventually pay off if they keep doing the right thing.

- They have a plan: They have a plan and stick with it. They don’t allow themselves to get caught up in the hype of the moment or let their emotions dictate their decision-making process. They stay focused on what they’re trying to achieve and how they will get there.

- They are flexible: They are flexible. They know that the market is constantly changing, and they need to adapt to it. They understand that what works today may not work tomorrow, so they don’t get too attached to any one strategy or approach.

- They can anticipate changes: They can anticipate changes in the market and adapt their strategies accordingly. They don’t just react when things don’t go as planned; they anticipate how things could go wrong so they can be prepared for them before it happens.

- They are patient and calculating: They are patient and calculating. They only jump into something after thinking it through first. They are willing to take risks, but only when they know that those risks will pay off in the end.

Factors Affecting Speculative Investment

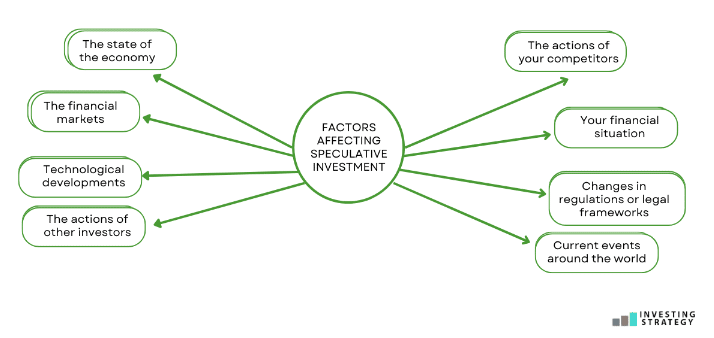

Speculative investment isn’t immune to the interplay of demand and supply. Many factors can affect it, and the most important ones include the following:

- The state of the economy: The state of the economy can significantly impact speculative investment. If the economy is in good shape and growing, investors will likely take risks with their money. However, they tend to be more conservative with their investments if there is a recession or other signs of economic instability.

- The financial markets: The financial markets can also affect speculative investment strategies. A sudden drop in prices for an asset class, such as real estate or gold, can cause speculators to reassess their positions and pull out of them before they lose any more money.

- Technological developments: The development of new technologies can also affect speculative investment strategies. For example, the introduction of computers and other forms of electronic communication has made it easier for investors to access information about different markets, including those closed during certain hours or days. This allows speculators to take advantage of opportunities wherever they arise around the world.

- The actions of other investors: Successful investors can significantly impact the market with their speculative investment strategies. For example, if an investor buys up a large number of shares in a particular company, other investors may follow suit. This can cause the price to rise and make it more attractive for other speculators to buy into the stock market.

- The actions of your competitors: The actions of your competitors can also significantly impact your speculative investment strategies. If an investor notices that one of their competitors is making money from a particular strategy and decides to mimic it, this can cause the stock price to rise even higher.

- Your financial situation: Your financial situation can significantly impact your speculative investment strategies. If you are desperate for money, this may cause you to make rash decisions that could lead to significant losses in the stock market.

- Changes in regulations or legal frameworks: Changes in regulations or legal frameworks can also significantly impact your speculative investment strategies. For example, if the SEC announces that it’ll be cracking down on particular trading activity, it could cause investors to panic and sell their stocks to avoid penalties.

- Current events around the world: Current events worldwide can significantly impact your speculative investment strategies. For example, an outbreak of a disease like Covid-19 could cause investors to panic and sell their stocks to avoid being affected by the disease. If this happens in a country you are investing in, it may cause you to lose money.

Why Do People Invest in Speculative Investments?

People invest in speculative investments because they’re looking for a high return on their investment. Speculators also use speculative investments to hedge against future market declines. For example, if you’re worried that the stock market will crash soon and want to protect some of your assets, you could invest in gold or silver. If the market crashes, you can sell those metals for cash and use them to buy back into stocks at a lower price.

There are two main types of speculative investments:

- Long-Term Speculation

This is where you invest in an asset you hope will increase in value over time. For example, if you bought shares in a company that you believe has the potential to grow and earn profits, this would be considered long-term speculation.

- Short-Term Speculation

This investment involves buying stocks or other assets to sell quickly for a profit. For example, if you believe that the price of gold will rise, you could buy shares in a mining company or buy physical gold itself. Once the price rose, you could sell your gold for a profit.

Strategies for Speculative Investments

As a speculative investor, your goal is to earn above-average returns. This means that you need to be able to identify opportunities that other investors don’t see and then take advantage of them before others do. By using a combination of technical analysis and fundamental analysis, you can find these opportunities faster than others.The market is volatile, so to invest in speculative assets, it is crucial to have a clear strategy for how to do so. Each one has its risks and rewards. Here are some trading strategies that you can use when investing in speculative investments:

- Buy and Hold

This involves buying an asset and holding onto it until the price rises enough for you to sell at a profit. For example, if you bought one thousand dollars worth of gold today and waited two years before selling, you would profit from the price increase. The key to this strategy is to hold onto your assets for a long enough time to allow them to appreciate.

- Invest in Low-Risk Assets

This involves investing in assets that are unlikely to lose value. For example, if you bought a bond that the government issued, then you’d be unlikely to lose money from this investment because governments never go bankrupt. A good rule of thumb is that the lower the risk of an investment, the lower its return will be.

- Diversify Your Portfolio

Investing in a wide range of assets is the best way to diversify your portfolio. This means that you should spread your investments across several different assets. Diversification will protect you from losing everything if one investment goes wrong. You can diversify by investing in different companies or industries and buying stocks from various countries worldwide.

- Use Limit Orders

A limit order is buying or selling a security at a specific price. A limit order can be used by investors who want to buy or sell a stock at a certain price but don’t want to pay more than that price (or accept less). This type of investment strategy can help you avoid paying more than market value for investment and ensure you get the best possible deal.

- Try Speculative Scalping

Scalping is a short-term market trading strategy that involves the buying and selling of assets very quickly to take advantage of small price fluctuations. The trader tries to profit by buying at a low price and then selling at a higher price. Scalping traders typically use technical analysis tools such as charts to identify possible entry and exit points for their trades.

The Pros and Cons of Speculative Investment

Understanding the merits and demerits can also serve as an insightful trading tip. If you’re considering making this type of investment, here are some pros and cons.

The Pros

- More potential for higher returns: Ceteris paribus, the higher the risk, the more profits you make when your investment pays off. In other words, if you believe in a company’s long-term potential and invest in it at the right time, you could make more money than if you invested in less risky security.

- Learn about different types of investments: Speculative investments are also a good way to learn about other types of securities and how they work. You’ll learn what factors affect their value, how far in advance you should buy them, and more. For example, if you’re interested in investing in real estate one day, buying shares in a Real Estate Investment Trust (REIT) may help give you an idea of what goes into that type of investment.

- Potential to make short-term gains: Speculative investments can be a good option if you’re looking for a way to make money quickly. While these investments don’t have the same long-term potential as other types of securities, they are often easier to buy and sell quickly. If you want to turn your money into cash quickly, speculating may be your best investment.

- Provide attractive tax benefits: Some speculative investments can provide attractive tax benefits. You can use these benefits to lower the amount you owe in taxes yearly or even make a profit you wouldn’t otherwise have.

The Cons

- Higher risk level: One of the most significant downsides to speculative investments is that they come with a much higher risk level. These types of investments, like crypto-currency, are more volatile than other types of investments and can quickly lose value if there is a sudden change in the market. While this makes them more exciting, it also means that you need to be prepared for things to go wrong.

- Difficult to liquidate in an emergency: Another disadvantage of speculating is that it can take time to liquidate your holdings quickly. This is especially true if you’re dealing with illiquid assets like real estate or collectables, which are hard to sell on short notice when you need cash. In addition, many speculative investments provide different returns than diversified portfolios, including stocks and bonds.

- Lower returns than diversified portfolios: Also, the disadvantage of speculating is that it doesn’t offer higher returns than a diversified portfolio. Most speculators rely heavily on leverage and shorting to boost their profits. While these strategies can be profitable in the long run, they also reduce your potential gains during bull markets since you have less money invested when prices rise quickly.

- Speculating can be addictive: Another major con of speculative investment is that it can be addictive. It’s easy to get hooked on the rush you get from seeing your money grow, which can lead to over-speculation. If you’re not careful, you can start taking bigger and bigger risks with your investments, which could have serious consequences if things go south.

Should I Invest In Speculative Investment?

The answer to this question is: it depends. If you have a high-risk tolerance and can afford the potential loss of your investment capital, then yes. Speculative investments are designed to offer a potentially higher return, but they are typically more volatile than safer investments as they carry more risk.

If you have a low-risk tolerance and are looking for a more conservative investment strategy, then probably not. Consider your investment goals before making any investment decision. You should also avoid speculative investments if you don’t have enough money to invest in this type of investment.

So, if you’re ready to take the risk of investing in speculative investment, the key is to understand how the investment works and what it does. If you don’t have a firm grasp of what the company or fund does, then you should probably steer clear—speculative investments are not for beginners.

This article has been prepared for information purposes only. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.