Extending mortgage terms is putting a plaster over a gaping wound. The housing correction is happening.

Fresh from spending a year calling inflation transitory, the Bank of England has once again come up with a cunning plan with regards to monetary policy.

With CPI inflation at 7.9% — hailed as the second coming but still nearly quadruple the official target — the markets have collectively decided to put fears of a 7% base rate peak on the backburner, and now consider that a peak of 5.75% will be sufficient to quell inflation.

Of course, economic predictions and crystal balls should be viewed with similar levels of healthy suspicion. OBR estimates, Bank of England opinions, economist views alike — the OBR forecasted in November that the UK’s GDP would shrink by 1.4% in 2023. The Bank thought that there would be a two-year long recession, and most economists thought that the base rate would peak at around 3% for the majority of 2022.

And another winter is coming, with mortgage, rent and energy costs still comparatively sky-high. Centrica CEO Chris O’Shea has again warned that there may not be enough gas storage, and recent energy price reversals may themselves reverse.

But two news items caught my eye last week — excluding yet more flip-flopping in the North Sea. On that note, Sunak’s plan to grant virtually unlimited exploration licences isn’t going to do much if those fields won’t be allowed to be developed under Labour. Again, some joined-up thinking might be nice.

But here’s the two pieces that grabbed my attention:

40 year mortgages

To start with, the government is now actively considering allowing first time buyers who cannot afford to take out a mortgage under the current terms to borrow though a 40-year fixed rate term. This would differ from the current situation where you might take out a 30 year mortgage, with a fixed term of two to five years, and then remortgage, as the interest rate would be fixed for the entire 40 year term.

Of course, there are plenty of problems with this. To start with, moving would become a much larger hassle. Paying off lump sums after your fixed rate ends would stop happening. People locked into a low 40 year rate would never move, freezing the market akin to what is happening in the US right now. And the Bank of England would be weakened, as fewer mortgagees would be affected by future monetary policy shifts.

But the real problem is that at present, Moneyfacts considers that FTBs need to be able to afford the average standard variable rate plus 1%, which overall currently stands at 7.67%.

Here’s some context to this: The average UK house price was £286,000 in May 2023, which is £6,000 higher than 12 months ago, but £7,000 below the recent peak in September 2022.

A £286,000 house with a 10% deposit at £28,600, with a 6% interest rate, currently leaves a monthly mortgage payment of £1,659. This is clearly not sustainable, and the government’s plan is to attempt to prop up the Ponzi scheme rather than let it correct. Andrew Griffith, economic secretary to the Treasury, has formally told the Telegraph that he is ‘definitely interested’ in copying similar schemes in the Netherlands and Denmark — noting that there would be no stress of payments rising.

But here’s the thing. First Time Buyers can’t buy houses because the prices need to crash. Once again attempting to subsidise demand, rather than build a few million homes, will simply see prices rise higher, making it even harder for anybody to get on the ladder. And by allowing this group and others to get cheaper financing, it takes some of the bite out of rate rises, weakening their effect on inflation.

Research from Schroders analyst Duncan Lamont already shows that the average house price costs nine times average earnings — and that the last time homes were this expensive relative to earnings was in 1876 — the same year that Alexander Graham Bell won his patent for the telephone.

Given that the word ‘mortgage’ is derived from the French for ‘death pledge,’ it could be that the government plans to get new mortgagees to pay off mortgages just as they are about to die. For perspective, new graduates are facing the 9% student tax for 40 years already, and the average FTB age currently stands at 34. A 40 year mortgage takes this person to 74, and the average life expectancy stands at 81 — with a mortgagee will be paying tens of thousands of pounds in additional interest.

By comparison, a generation ago, the standard was a 25 year mortgage with no student loan. It will be impossible to save for private pensions — and if rates fall, you will suffer from higher mortgage repayments with no flexibility.

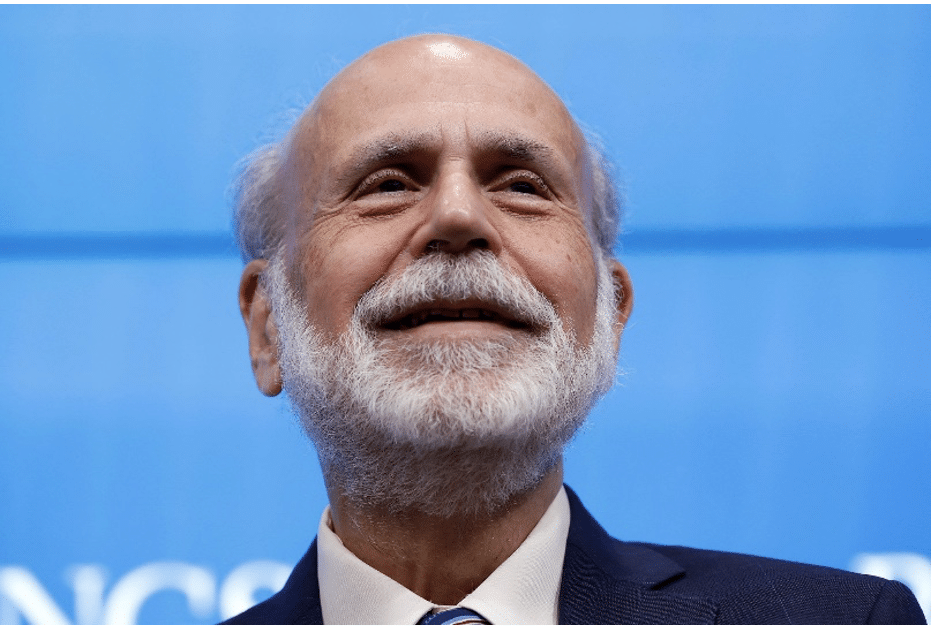

Ben Bernanke special

However, to stop poor economic forecasting in the future, the Bank of England has appointed former US Federal Reserve Chair, and chief money printer, Ben Bernanke, to lead a review designed to ‘develop and strengthen the Bank’s support for the Monetary Policy Committee’s (MPC’s) approach to forecasting and monetary policy making in times of uncertainty.’

With a straight face, Governor Andrew Bailey called Bernanke ‘a renowned and award winning economist whose distinguished career makes him the ideal person to lead this review.’ The former Reserve Chair was given a Nobel Prize in economics after almost destroying the world’s economy in the 2008 Global Financial Crisis — but apparently, there’s nobody better qualified.

I’m sure the review will go swimmingly.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.