The small cap market could recover sharply in 2024. At least, that’s the theory.

Welcome back after the break! Are you ready to invest your hard earned cash or ill-gotten gains into small cap shares, in pursuit of ridiculous returns? You’re in the right place. While risks continue to abound, there has been a marked change in the investor and institutional emotional environment.

I’m not talking about New Year resolutions (mine is to run 3 miles a day, every day). No, I’m talking about the fact that investor fear is rapidly being replaced by greed — or FOMO — and the markets are going to improve as a result.

Let’s dive in.

The macroeconomic picture

The Bank of England hiked the base rate from 0.1% to 0.25% in December 2021. In August 2023, they hiked it to a (hopefully) final 5.25% — and most analysts think rate cuts will start up from as soon as March 2024. With CPI inflation still nearly double the 2% target (and history suggests it could start rising again), these rate cuts in my view may not happen until H2.

A big part of making any predictions is the unexpected. While post-pandemic inflation and energy price rises (alongside the subsequent rate hikes) were essentially inevitable given two years of global economic shutdown, the Ukraine War, Silicon Valley Bank, and Israel-Hamas were Black Swans that were not predicted.

The most recent escalation in the Middle East has essentially seen transit through the Red Sea cease — and you’re only one more Black Swan away from resurgent inflation.

Central banks will want to be sure that cuts are the right choice because the likes of Powell and Bailey have been (rightfully) mercilessly mocked for their post-pandemic incompetence.

On the other hand, the soft landing may be a pipe dream. The economy contracted by 0.3% in October and the Insolvency Service has reported that corporate bankruptcies are at their highest since the Global Financial Crisis. Perhaps cuts can’t come soon enough.

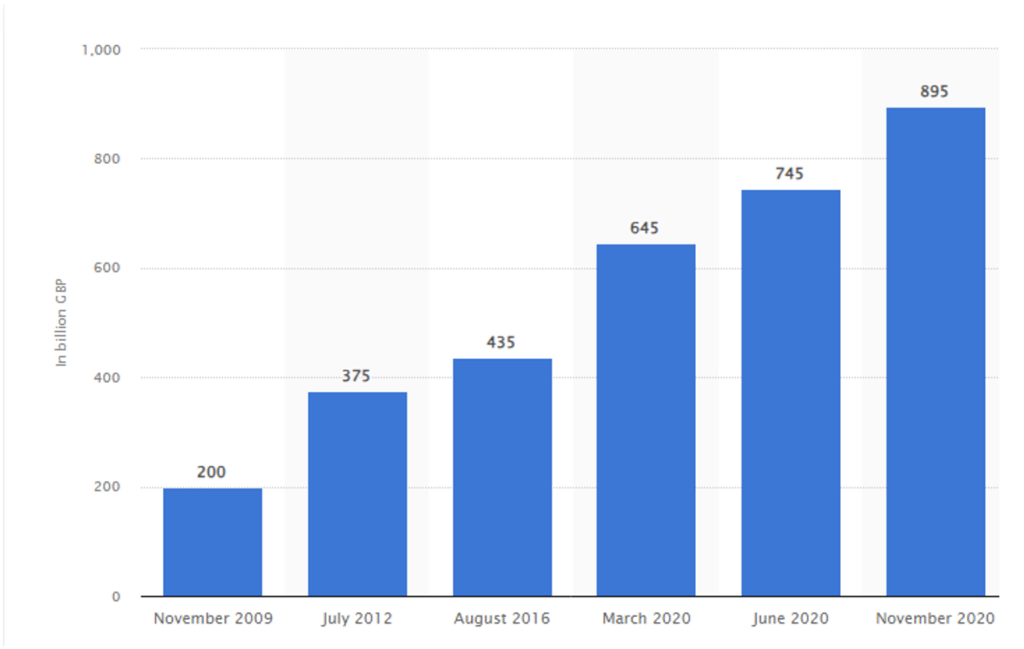

Over a longer view, the UK is attempting to unwind its £895 billion of Quantitative Easing — and this has just as much of an effect on cash as interest rates, even if less well reported.

Stateside, the picture remains unclear. The NASDAQ 100 has rocketed by more than 50% over the past year, compared to global average growth of 20% when using the MSCI All Country World Index, and the 25% growth of the S&P 500.

For context, the FTSE 100 grew by a meagre 3.8% last year. This looks bad — but then, 2022 saw the NASDAQ lose a third of its value while the FTSE rose slightly. Investors looking at the AI bubble (yes, it’s a bubble) might take a gander at Apple’s first day of trading in 2024 — a substantial drop and a downgrade from Barclays.

The tech rally may already be over. And then there’s the US debt position to consider — at some point, the deficit will become unmanageable — the country’s debt has increased to over $34 trillion, with nearly half of this figure ($15 trillion) built up since 2016. This might be why the US became the largest oil producer in the world last year — it will need cheap energy to even attempt to balance the books.

As an aside, my top blue chip pick for 2024 (covered in depth elsewhere) is Disney. I bought shares at $83 and consider the brand power far more valuable than the current $160 billion market capitalisation. The company simply needs to recognise that its job is to entertain, stay out of the culture wars, and then the stock will resurge.

My blue chip picks for 2023 were Rolls-Royce and Meta Platforms — when heritage companies with an overwhelmingly dominant market position get cheap, the value is superb.

But if rates are starting to fall and the US indices look a bit risky given the outperformance in 2023, where to look? You might think gold, and yes gold performed superlatively in 2023. The problem is that there is an effective ceiling on gold’s price — central banks have been buying the yellow stuff at a record pace over the past couple of years — but will sell should the metal spike too high.

Cash is clearly popular — indeed, many of the private equity firms I moonlight for are actively complaining that there aren’t enough good opportunities when the high-rate environment makes low risk double-digit returns viable. But if mortgage rates are falling, then so too will risk-free returns — and cash then needs to be put to work.

The small cap market is now an attractive choice. Consider FTSE AIM — the index collapsed to 674 points in October last year but has since recovered to 755 points. This reflects the reality — small UK companies are cheap as chips, and the various buyouts of companies including Hotel Chocolat at huge premiums suggest significant capital gains are to be made.

And if there’s risk at the larger end of the market, and returns are falling in cash, then my best guess is that 2024 will be a good year to get into quality small caps.

As a caveat, cash is now king. Again. If a company has an excellent product/management team etc, but little in the bank, you need to remain aware that raising cash is still expensive. Conversely, when a company lets you know that they are capitalised for at least a year, this should hold some significance.

In terms of the mining and biotech sectors specifically: biotech investors will be in for a good year. As noted above, private equity is sitting on massive war chests — and the pharmaceutical titans have also been splashing the cash over the past few months. Consider the $10 billion AbbVie buyout of ImmunoGen, for starters. The big boys have cash, and the minnows are comparatively inexpensive.

Junior resource companies should also start to benefit from a loosening monetary environment, especially when HNW investors start to take positions and the TR1s begin flooding in. I suspect this will be weighted towards the second half of the year — because many HNWs locked in their cash in fixed rate one-year accounts around August 2023 as rates peaked — and therefore will have money to spend from late Q3 2024 onwards as account restrictions ease.

Lithium investors will have to hold their nerve through the current pricing weakness — an artificial construct of Chinese planning, and poor investment bank supply estimates. Copper investors will see the metal spike in 2024 — see Anglo American’s woes

(though I think a buyout is imminent) and the generic supply gap.

Graphite could go either way; China has sent the mineral southwards but ex-China sources due to the export ban are becoming more attractive. See also: titanium and tungsten.

Perhaps the most interesting conundrum to consider is wider investor awareness of the Lassonde Curve. You’ve all seen the chart — which essentially suggests buying and selling shares at different points in the development of an asset. The problem is that investors now know about the Curve, so will this disrupt its efficacy? Perhaps.

But overall, I suspect 2024 will be an excellent year for the small cap sector. Opportunities abound — and I will cover them all for you.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.