Incanthera has broken a clinical barrier in skincare. Its range is about to enter the real world.

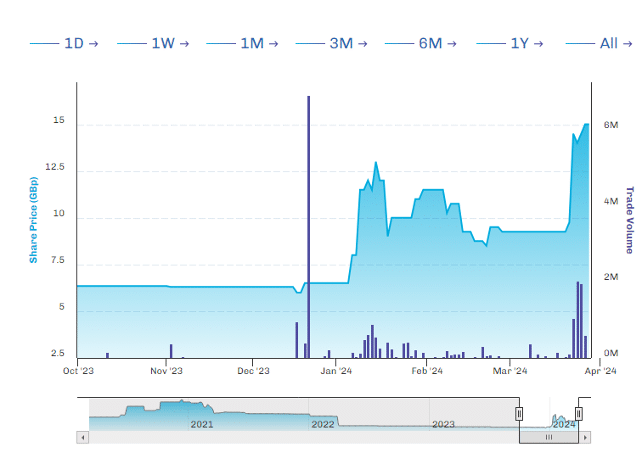

Incanthera (AQSE: INC) shares are currently changing hands for 15p apiece, more than doubling since the start of the year. This is a growth stock which has been on my radar for a while, ever since the market ignored an excellent update in December 2023.

Of course, Incanthera has a market capitalisation of roughly £11.7 million — and a full 2p spread of over 14%. The AQSE market is also unregulated (though for fairness, it’s not like the NOMADs or FCA seem to be doing anything to regulate AIM). And growth stocks are dealing with a higher rate environment in a pretty unforgiving market.

But as growth picks go, Incanthera has made several leaps forward recently.

Let’s dive in.

Incanthera shares: start with the product

It amazes me just how often investors start with the financials, the deals, and the management. Yes, these are important factors, but I always start with the product and/or service. What is it that Incanthera has that other companies do not — and is what they have going to be enough to generate sustainable profits?

Ondo InsurTech, Optibiotix, MicroSalt, and Abingdon Health (for example) have all passed this product test — each have a unique product that has an obvious demand.

Incanthera has developed a way of delivering B3 (and other compounds but B3 is the important one) directly into skin cells to enhance skin health and repair and protect the organ. These Skin+CELL products are being targeted at the high-end cosmetic market, with a focus on anti-aging and protective creams.

While I am not an expert in skincare (I find water works wonders), judging by the staggering assortment of creams, gels ointments and potions in my bathroom, women are prepared to pay for new products which work. And also, some that don’t.

But the global skincare market was estimated to be $135.8 billion in 2022 and is expected to grow at a CAGR of 4.7% through to 2030. The good news is that demand is there, and growing, and you only need to have one decent product that represents an advance on the status quo to take a slice of the pie.

Incanthera notes that independent studies show its tech is:

‘uniquely effective in delivering Bioactive B3 below the dermal barrier, energising the living cells of the skin to maintain natural health and protection… Skin + CELL’s complementary range of products are based on advanced, clinically designed, formulation concentrates which combine leading edge pharmaceutical enhancement technology with selected prestige cosmetic ingredients to give an effective product which gives a silky emollience in use and leaves the skin visibly radiant, energised and protected.’

I can literally hear the future TV advert.

Of course, while delivering B3 directly into the skin is unique, would-be investors might be pondering whether the cream actually delivers an improved result over cheaper competitors. For example, Futura Medical’s Eroxon gel is apparently clinically proven and yet customer reviews on Boots are less than encouraging.

I’m not just picking on Eroxon — what works in a lab, or in pre-launch customer research, does not always transcribe into the harsh reality of the retail world. The bottom line is that success is going to hinge on customers buying the creams on offer, reviewing them positively, passing on the message to friends and then buying more.

This means Incanthera’s creams can’t just be better, they have to be measurably better, and viewed as better value for money, for consumers — who judge by their appearance in the mirror rather than corporate excel spreadsheets.

There’s also the marketing to consider; it can’t just be an improved offering, but it needs to be marketed at a specific segment of the population with significant excess capital, and whether INC can do this effectively is not in my wheelhouse to comment on.

At this stage in the story, there is no way to know how customers will react — but what is clear is that there is a clear moat between Incanthera’s offerings and its rivals — and at the very least, the customers they are targeting will be tempted to try them out.

Incanthera’s deal

In December, Incanthera announced an oversubscribed institutional-led subscription for £1 million to fund launch orders and working capital, with an 11% premium (a rarity in this market).

It’s not hard to see why the stock commanded a premium. INC inked a commercial deal with Marionnaud for the launch of Skin+CELL. Marionnaud is a subsidiary of CK Hutchison which also owns AS Watson, the global market leader in health and beauty worldwide, with 16,100 shops and 5.3 billion customers.

The deal is that the skincare range will be available exclusively at Marionnaud’s shops in Switzerland and Austria from Q2 2024, with a full roll out across Europe thereafter. The company is also planning a rollout in Asia, and it notes that it expects the product launch will ‘generate significant revenues and profitability for Incanthera, in 2024 and beyond.’

To meet initial launch orders, it’s manufacturing 25,000 units, with this task subcontracted to Frike Cosmetic AG, which already produces skincare products for dozens of global brands.

CEO Dr Simon Ward considers that deal as ‘is recognition of Incanthera’s expertise in formulation and delivery technologies in skincare,’ while Chairman Tim McCarthy enthuses that the announcement marked ‘a huge milestone for Incanthera. A truly transformational moment for the Company and for our longstanding and very supportive shareholders.’

The Chair also thanked longstanding investors for their patience — the company was founded as a University of Bradford spin-off back in 2010, and while it has launched several products in that time, including UV cream Sol, the reality is that this launch may be the meal ticket investors have been waiting for.

Marionnaud Switzerland and Austria MD Emilio Leon is ‘are very excited to bring this into Marionnaud as part of our exclusive luxury skincare range.’ This may just be the start.

Where next for Incanthera?

On 25 March, the company gave investors a solid commercial update — Skin+CELL will be launched in circa 100 Marionnaud shops in Switzerland and Austria, before being rolled out into their remaining 1,100 European locations and then into Asia from Q1 2025.

Here’s the company figures:

- The first order will generate £2 million of revenue and has doubled in size to 50,000 units. The enlarged order is on track for delivery in this quarter, and Marionnaud expects ‘strong demand’ from customers.

- The second order is expected to be 250,000 units, improving gross margin and net revenue via economies of scale — yielding projected revenue of £10 million AND PROFITABILITY for the full year to 31 March 2025.

- The business expects that revenues will grow to £33 million in the full year to 31 March 2026.

The company has also announced a new product in the range, a Skin+CELL eye serum, which will be included in the initial launch alongside the face, hand and body serums already scheduled. McCarthy looks ‘forward to fulfilling the first order and updating the market further on the operational roll out across European stores.’

The bottom line

Stanford Capital Partners has created a research note with all sorts of wonderful financial projections — I have written several similar notes, but the reality is that Incanthera will be made or broken in 2024. Marionnaud’s order increase signals confidence, and the business is operating in a premium segment of the market where perhaps the normal rules do not apply.

And the products are unique.

Perhaps the only question left to ask is on expansion. While the business expects to be profitable in this new financial year, expansion costs money and it will likely need to raise more funds through 2024.

Given strong institutional support at a premium in December, this should not be an issue — and given the exclusivity agreement, I can see Marionnaud fronting some capex at favourable terms to increase production at Frike Cosmetic AG should the launch go as planned.

And for investors? The share price may have doubled but is now off its recent high. If you wait for retail figures, including reorder rates, you may risk missing the boat.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.