GGP shares are now fully financed to production at its flagship 30%-owned Haverion project, which is set to deliver feasibility study results early in the new year.

Greatland Gold (LON: GGP) is a London-listed mining developer and explorer focused on precious and base metals in Australia. While the miner has interests across six projects scattered throughout Western Australia and Tasmania, its flagship is the world-class Haverion Project in the Paterson region of Western Australia, initially discovered in 2018.

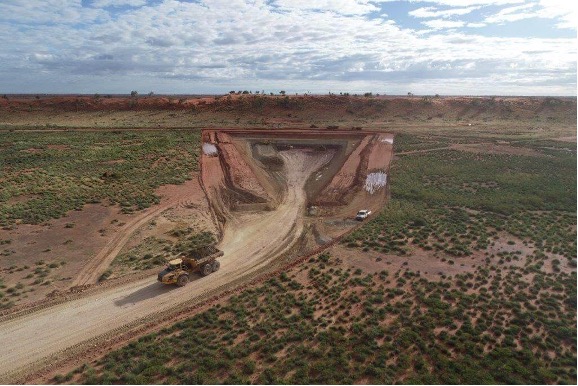

Under development through its Joint Venture (JV) with Newcrest Mining, Australia’s largest gold producer, the Haverion project is ideally located just 45km from Newcrest’s existing Telfer gold and copper mine. This means that the two companies are able to develop Haverion using Telfer’s existing infrastructure, including its processing plant, which will significantly reduce the needed capex.

So far, so good.

At this point, it’s worth noting the standard advantages and drawbacks associated with this type of investment. Newcrest is an AU$17.7 billion giant, which gives it significant power in negotiations with Greatland, if not legally, then at least practically.

On the plus side, Australia is a fully developed country with dozens of exceptional gold deposits and a trusted legal system. For context, the Fraser Institute 2021 Annual Survey of Mining Companies ranked Western Australia as the best jurisdiction out of 84 worldwide based on mining investment attractiveness during the year.

Regardless, GGP maintains many of the usual hallmarks of penny mining stocks, despite being too large to qualify for the technical definition. It sports highly volatile shares and an undeveloped asset which is yet to generate any revenue. Further, the feasibility study on Haverion has not yet concluded, and Greatland has conducted multiple share placements over the past couple of years.

For perspective, it issued 82 million new shares in 2021 to bring in circa £18 million in cash. And as an explorer without a revenue-generator online, it lost £28 million in the same year.

And while GGP shares remain 290% up compared to pre-pandemic levels, the miner has also fallen by 80% from its record 37.35p in December 2020 to 7.50p today. Understandably, investors who bought in at less than 2p a few years ago and are still holding may be feeling mixed emotions.

I note this volatility both for GGP’s potential and as a note of caution: all FTSE AIM shares are subject to an element of investor bias, which often sharpens on social media. Even excellent opportunities are not risk-free.

However, the investment case is starting to crystallize. Haverion will soon be producing gold and copper: two hard commodities surfing at near-record highs.

Moreover, gold is expected to outperform during the global recession as the trusted real-asset inflationary hedge. Q3 saw central banks purchase 399 tons of gold, the most ever in a single quarter, and 160 tons more than the previous record of Q3 2018. And the year-to-date total of gold bought by central banks is 673 tonnes, more than any year since the Vietnam War.

I’ve covered the prospects for copper here, but for context, the world’s largest producer Codelco has already warned that there could be an eight-million tonne shortage by 2032.

Haverion: the road so far

Newcrest assumed management of the JV in May 2019, and owns a 70% interest, with GGP the junior partner at 30%. A small-scale, though promising, stage 1 pre-feasibility study (PFS) was conducted in October 2021.

But the gears started shifting in March 2022, when GGP announced a ‘substantial increase to the Resource and Reserve announced in the maiden PFS.’ Haverion’s resource estimate was increased by 50% to a massive 6.5 million ounces of gold equivalent and 218 kilotons of copper, with an 86% conversion of resource to reserve.

Investors are now patiently waiting for the results of the feasibility study which has been ‘extended beyond the December 2022 quarter to allow further time to maximise value and de-risk the project.’

With further optimisation work underway, the miner has promised that ‘a further update will be provided as value enhancing options are assessed.’ And as 250,000 metres of drilling are now complete, Managing Director Shaun Day enthuses that the ‘outstanding results… provides increasing confidence of the project being delivered on schedule.’

Risk-reward trade-off

As of 30 June 2022, GGP stood in a reasonable financial position, having secured a total of £11.9 million of funding for the full financial year. However, this was nowhere close to enough to fund the miner through to production. Therefore, in August 2022, it raised an additional £29.7 million through a further share placing priced at a 15.5% discount.

Then in September 2022, it executed a debt commitment letter with a syndicate of leading international banks worth £130 million at favourable interest terms. Near-simultaneously, it secured an equity investment by Wyloo Metals, comprised of an initial strategic equity subscription of £35 million plus the option to acquire up to an additional £35 million of Greatland shares at 10p per share.

Most recently, on 11 November, it conducted yet another placing, creating an additional circa 13.4 million shares to ‘pay financial advisory service fees to a third party for advice in respect of the Havieron 5% option process which culminated in Greatland retaining 30% ownership of Havieron.’

Under the original terms of the JV, Newcrest had the option to acquire an extra 5% of Haverion at ‘fair market value.’ With this process concluded, GGP becomes even further de-risked for new investors, with the board noting that ‘this outcome delivers substantial medium and long-term value to Greatland.’

This is because, by my calculations, GGP is now fully capitalised to Haverion production, significantly reducing the risk compared to the potential investor rewards.

And despite reducing their price target from 22p to 18p to reflect the dilution, Berenberg Bank analysts argue that GGP has recently ‘materially strengthened its board with (new) appointments…Mark Barnaba is deputy chair of Fortescue Metals and will join as non-executive chair, while Elizabeth Gaines was CEO of Fortescue and will join as a non-executive director and deputy chair, and James Wilson was previously president of BHP’s iron ore division.’

Better still, the connection with Fortescue doesn’t stop there. Wyloo is a subsidiary of Tattarang, the holding company of Andrew Forrest, the founder and executive chair of Fortescue and the wealthiest man in Australia. And Wyloo now holds 8.6% of GGP shares.

Overall Berenberg thinks ‘the board appointments, debt and investment by Wyloo as material as they bring in a heavyweight partner and put in place a comprehensive funding package.’

It’s hard to disagree. Of course, GGP is a volatile stock, with a history of diluting loyal shareholders. But when the feasibility study reports back in Q1, a fundamental re-rate could be in the offing.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.