Kodal Minerals could be presenting a strong bull case for 2023. Rocketing lithium prices, buyout potential and a confident CEO all star.

Kodal Minerals (LON: KOD) shares are arguably the marmite investment of the small-cap lithium world. Up 37% over the past five years to 0.29p per share, the long-term success of this penny share hides some significant volatility which has not been easy for many to ride out.

But while KOD is also down 26% over the past year, the bull case was strong when it hit 0.47p in July 2021 and remains strong now. And if a 26% annual fall is a dealbreaker, then consider the price falls of NASDAQ 100 giants like Apple, Amazon, Alphabet, Tesla, and Meta.

Kodal Minerals shares: the road so far

While KOD has been trading since late 2013, when it launched its £1 million Initial Public Offering — its market cap now £48 million — for me, history began when it applied for the mining licence to begin work at its Bougouni Lithium Project in Mali in June 2021, and then developed when the licence was granted in November 2021.

Up until this point, KOD was only a gold miner. Of course, it still operates multiple gold mines, and with gold at a near-record high, this is no bad asset to have on its books.

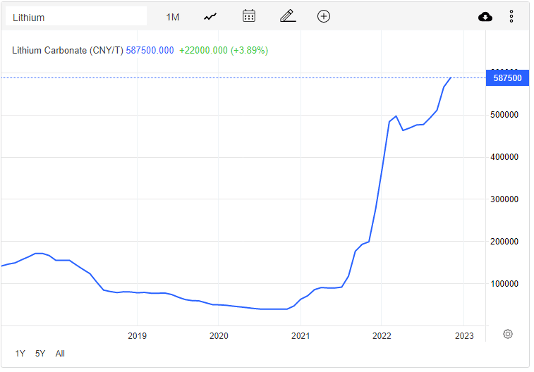

But the crown jewel remains Bougouni. Lithium prices continue to strike fresh record highs in China, where ceramics factories are now being retooled to process the precious metal. And in an unprecedented move this week, Canada has forced three Chinese companies to divest themselves of Canadian critical lithium, citing national security concerns.

CEO Bernard Aylward argues that while exporting Kodal’s lithium to China from West Africa isn’t ideal, Europe lacks the necessary processing capacity. He has ‘had discussions with people about (processing in) Europe’ but reasonably argues ‘we’d love to be thinking it’s possible, but right now it doesn’t seem that it’s ready.’

The 2023 race for lithium has been on for years, but institutional investors and the west are finally catching on. And this could make LSE-listed lithium stocks valuable equities to hold.

Kodal’s ‘Permis d’Exploitation’ is valid for an initial 12 years, with the option to renew in decade-long blocks until the resource is no longer economically viable. At the time, Aylward had argued that the permit came at a ‘great time for Kodal with the increasing global focus on battery metals and the recognition of potential supply deficits.’

The Project is expected to produce 238,000 tonnes a year when it gets fully online, with most of this product shipped to China, where spot prices have reached a record 587,500CNY/tonne. This represents a tenfold increase in lithium prices since Kodal designed its initial mine plans.

KOD shares: next steps

Revised numbers from June show that Bougouni boasts an NPV7% of $760 million, while its expected 8.5-year mine life could see total revenue exceed $2.1 billion based on an average sale price of $1,060 per tonne. And those numbers will have increased as lithium prices escalate.

Kodal expects to mine a whopping 2 million tonnes in total.

Aylward notes that ‘the window of opportunity to get Bougouni into production, to help alleviate the critical lithium shortfall expected over the coming years, is almost upon us.’ With a standard payback period of just eight months, the CEO has indicated that ‘conversations with potential partners have intensified with a view to reaching the optimum route for delivery in as short timeframe as practicable.’

One option being considered is to spend $65 million building a dense media separation (DMS) processing plant, or in layman’s terms, a quick fix.

As an alternative to the objectively better flotation plant, a DMS could come online within a year of approval and would pay for itself in just two months of mining at current lithium prices. Aylward thinks this plan could help KOD in its ‘goal of becoming the first operational lithium mine in Mali… the DMS development option provides Kodal with a near-term solution to take full advantage of the continuing buoyant lithium demand.’

KOD could then expand using the resulting cash flow.

KOD SHARES: the buyout question

But there is another possibility.

When I first covered Kodal Minerals in June 2021, there existed a tantalising possibility that the largest lithium company in the world, China’s multi-billion-dollar Ganfeng, would choose to buy out Kodal Minerals. For context, it’s no stranger to buyouts, having spent over $1 billion on Bacanora and Lithea.

But Ganfeng’s most relevant purchase is the $130 million spent on a 50% stake in the Goulamina Lithium project, to secure 455kt of spodumene over the mine’s life. This was its first investment in African lithium mining, and the holding company, Firefinch, has called the Project ‘one of the world’s highest quality lithium assets.’

Goulamina and Bougouni are literally geographically adjacent claims, and arguably, Ganfeng could be waiting for proof of profitability at either Project to swoop in and conduct a buyout at an early stage.

A further, though tangential connection is in Kodal’s strategic investor and potential offtake partner, Suay Chin International Pte Ltd, which is indirectly controlled by Zhejiang Kanglongda Special Protection Technology Co Ltd.

Zhejiang is a Shanghai-listed company, which acquired Jiangxi Tiancheng Lithium Industry Co Ltd on 6 September 2022, which specialises in extracting lithium sulphate solution. It’s also signed a strategic agreement with Askari Metals, which has been looking to develop its Australian lithium assets.

It’s a complex puzzle with many moving pieces.

But in summary, the CEO remains confident, enthusing that ‘the stars are aligning for Kodal and I whole-heartedly believe that 2023 will prove to be transformational for our business.’

The bull case looks good to me.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.