Keep an eye out for Atlantic Lithium, Marula Mining, Savannah Resources, Bradda Head, and Firering. Any one could be next.

While I disapprove of trying to find the next FTSE AIM share to spike, it’s hard to resist the temptation that comes with looking for quick profits. Premier African Minerals’ and Kodal Minerals’ bull runs have been several years in the making for me, and while I will continue to hold these shares, I suspect that the stratospheric rises in the thousands of percent are over.

Buyouts are coming down the track in my view, and retail investors will be powerless to stop them.

I believe that taking a longer-term view is essential for chasing down high-risk exceptional returns, so believe that copper, graphite, and uranium small caps are the best place to look, if you want ridiculous returns over a multi-year time frame and can stomach the likely paper losses in the short term.

However, London does still boast a small number of lithium miners that could become the next ‘hot lithium AIM stock’ — with decent returns for those with a reasonably voracious appetite for risk.

This may even be a self-fulfilling prophecy — like the thunderbolt that made the Flash, thousands looking for the next rocket may be the ones to light the fuse.

The next hot lithium AIM stock?

1. Atlantic Lithium (LON: ALL)

Atlantic Lithium’s crown jewel is its Ghanian Ewoyaa Project, a huge lithium pegmatite mine which will most likely become West Africa’s first lithium-producing mine. Ewoyaa is fully funded to production by strategic investor and lithium titan Piedmont — to the tune of $102 million.

Its Mineral Resource Estimate currently stands at 35.3Mt at 1.25% Li2O, and the company expects life-of-mine revenue to exceed US$4.84 billion, with a post-tax NPV of US$1.33 billion.

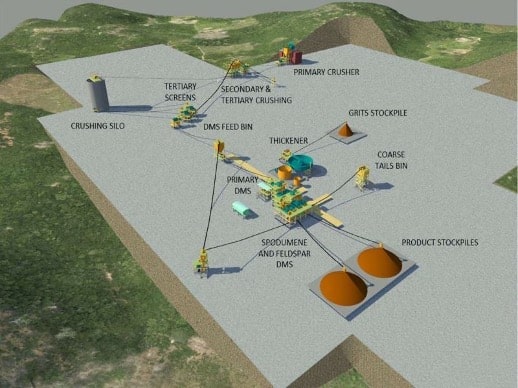

ALL is planning to build a 2Mtpa DMS plant with capacity to produce 255,000tpa of lithium spodumene concentrate, and has its definitive feasibility study due this quarter. The only dark spot is Blue Orca’s short attack in early March — while allegations have been refuted in full, it’s continuing to have an anchoring effect on the stock.

2. Marula Mining (AQSE: MARU)

Marula Mining plans to launch its AIM IPO in the near future. While the company boasts various projects concerning copper, graphite, and REEs, the flagship is undoubtedly the 100%-owned Blesberg Lithium Project — where Southern Jade Resources Pty Limited, a South African-based subsidiary of global commodity group Traxys SARL, recently advanced $5 million against first sales from existing stockpiles — which have commenced.

MARU also benefits from strategic investment from Q Global Commodities Group, whose CEO billionaire Quinton van der Burgh believes that ‘Marula has potential, and we intend to assist the Company in meeting its growth targets.’

Q Global will subscribe for up to £3.75 million through the issue of up to 100,000,000 new ordinary shares across five equal traches of equity investment, and van der Burgh is to be appointed as Marula’s Chairman.

3. Savannah Resources (LON: SAV)

I have held Savannah Resources shares for as long as PREM, making both investments on the same day. While PREM has delivered, SAV shares have essentially been on a long road to nowhere — but I think this company will eventually re-rate.

And I’m a patient person.

Savannah, in my view, will emerge as a key player in Europe’s lithium supply chain, as it owns the Barroso Lithium Project in Portugal, the continent’s most significant resource of hard rock spodumene lithium.

The company was awarded a 30-year mining lease in 2006 and a 3-block mining lease application. And it thinks that the Project will support sufficient lithium production to power 500,000 EV battery packs every year.

4. Bradda Head (LON: BHL)

Bradda Head owns multiple projects across the USA covering the main three types of lithium deposit — hard rock, brine, and sedimentary. All projects are 100%-owned and located close to existing infrastructure and potential end-use clients.

The legal ramifications of the Inflation Reduction Act together with increased Sino-US tensions could serve to see US EV manufacturers pay a premium for US-based supply, and continued quality results will likely see nearby strategic JV partners come on board soon.

And down 56% over the past year, it’s a great entry point for long-term investors.

5. Firering Strategic Minerals (LON: FRG)

Firering shares spiked in early November 2022 before crashing back to earth by the start of this year. Having spiked again this month, investors may be hoping for a similar rocket.

The explorer’s flagship is the 90%-owned Atex Lithium-Tantalum Project in the Côte d’Ivoire — a country which is relatively politically stable and also underexplored compared to other African nations.

CEO Yuval Cohen (not the Jazz musician) enthuses that ‘the Atex project has the potential to become a significant lithium resource in West Africa…the quality and potential of Atex was recognised by Ricca who is earning into the project and supporting us in fast tracking the project to Definitive Feasibility Study.’

While shares remain relatively depressed, now could be the time to buy in.

But like all FTSE AIM shares, there can be no guarantees.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.