Polymetal shares could soar if dividends restart, if it splits its assets, or if peace in Ukraine becomes a political reality.

Polymetal (LON: POLY) is arguably the company which would most benefit from a peace deal brokered between Russia and Ukraine.

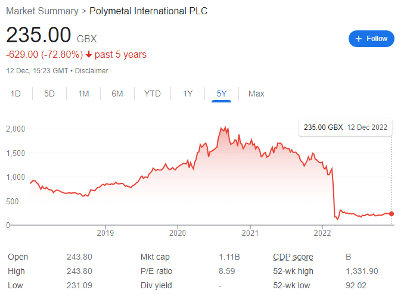

The London-Moscow dual-listed gold miner, which was struck off the FTSE 100 earlier this year, saw wild volatility after Russia’s invasion, collapsing from 1,098p the day before the invasion to just 92p by 8 March. However, it then recovered some ground by the start of April, and now changes hands for 235p apiece.

It’s worth noting that the miner was worth a record 2,028p in August 2020, coinciding with the at-the-time record gold spot price. With gold gearing up for the next bull run amid slowing central bank hawkishness and the highest amount of central bank gold-buying ever, it’s possible that a peace deal could see the company soar further than its pre-war price point.

Risk-reward overview

Polymetal was trading for 168p when I covered the company for IG in March. At the time, I described the stock as the ‘epitome of the risk-return trade-off.’ And though POLY is up circa 40% since then, I still consider further upside potential very possible.

Previously, there was no clear future for Polymetal in London: Blackrock and Norway’s Sovereign Wealth Fund were exiting, Russian-based London-listed stocks, including Evraz, were leaving at pace, and fellow Russian miner Petropavlovsk was forced into administration by sanctions. Further, board members were exiting en masse, and the stock was suffering multiple trading halts through irregular share price movements.

However, POLY stuck to its guns, arguing that it did not consider itself to be an entity owned by, or acting on behalf, or at the direction of, a ‘person connected with Russia as defined in Regulation 19A(2) of The Russia (Sanctions) (EU Exit) Regulations 2019.’ Moreover, it contended that newly imposed Russian capital controls would not have a ‘material impact.’

With the war sadly approaching a one-year anniversary, it appears that neither London nor Moscow wishes to force the miner to abandon its dual-listing: a prospect I thought likely months ago.

Q3 saw gold equivalent production rise by 7% year-over-year, though it has been forced to switch mining parts suppliers from Europe to China. This has led to inevitable logistical delays as China continues its endless cycle of lockdowns.

However, POLY promises that it should still be able to produce 1.7 million gold-equivalent ounces for the full year.

Recent developments

Polymetal is maintaining a delicate balance to keep its dual-listing status. After sanctions saw it unable to sell gold in London, most analysts speculated that it would sell its gold to Russia’s central bank. But it has refused to do so, in part due to sanctions, in part because the bank would expect a discount, and in part because this would leave the company indirectly funding the Russian war effort.

This has led to a large build-up of inventory, as well as rising debt, which stood at $2.8 billion at the end of Q2 2022. However, it has now arranged a variety of buyers across Asia, while some of the gold at its Kazakhstan mines continues to be sold directly to the country’s central bank. With inventory now falling, the company is deleveraging, and POLY hopes to get debt below $2 billion in early next year.

This could see a resumption of dividend payments to shareholders by March 2023; though this comes with the risk that London regulators will take direct aim at Polymetal’s atypical position.

Long-term investors will know that dividends stopped due to sanctions, political uncertainty, and the immediately weakened balance sheet. As it is based in Jersey, Polymetal has stopped paying out dividends due to sanctions against the Russian National Settlement Depository, with 22% of its shareholders locked into the NSD system.

But in September, POLY suggested a legal workaround to these affected shareholders to tender their shares for certificated shares. Nearly half of the company’s NSD-registered share capital has already been submitted for the proposed exchange, greatly strengthening the case for resuming dividend payments.

For context, POLY paid record dividends in FY21 after generating $2.9 billion in revenue, with gold equivalent production rising 2% year-over-year amid record prices.

Further, the risk that management could choose to sell off its Russian assets at a discount to exit the market has now dissipated, with the miner stating clearly, it is ‘no longer an option.’ Instead, it’s exploring an ‘optimal scenario,’ where it could see the ‘legal separation of assets into two different jurisdictions.’

How this structure would work remains to be seen, though it is possible that Russian assets will be dual-listed in Moscow and London, and Kazakhstan assets dual-listed in Astana and London.

Peace at last?

Though it may appear unlikely, peace between Russia and Ukraine could be coming closer.

For the first time, Putin has acknowledged that a peace deal may be needed to resolve the conflict, just days after Kremlin spokesperson Dmitry Peskov told the press the outcome of the war should be a ‘just and durable peace.’

US President Biden has said he is ‘prepared to sit down with Putin,’ to ‘see what he has in mind.’ German Chancellor Olaf Scholz recently held an hour-long phone call with Russia’s leader. Communications between CIA Director William Burns and Russian counterpart Sergei Naryshkin continue quietly in the background.

And it’s worth noting that the recent prisoner exchange between Russia and the US may not have been possible even a few weeks ago.

Further, Russia needs the backing of both India and China to continue the war. Indian PM Modi recently wrote that ‘our era need not be one of war. Indeed, it must not be one!’ And he has warned he will use his G20 presidency to ‘depoliticise the global supply of food, fertilisers and medical products,’ backing out of the annual Russia-India summit over Putin’s nuclear threats.

Meanwhile, China’s Jinping has also taken a dim view of Putin’s nuclear threats, and in talks with European Council President Charles Michel in Beijing, said that ‘solving the Ukrainian crisis through political means is in the best interest of Europe and the common interest of all countries in Eurasia. Under the current conditions, we must avoid escalation and expansion of the crisis and work for peace.’

Of course, Crimea and the Donbas remain the historical and political sticking points. Trust is at an all-time low. But as the world teeters on the brink of severe recession, global pressure to bring the conflict to a conclusion is increasing.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.