Launching its London IPO later this year, Neo Energy Metals could be the best uranium opportunity of 2023. Chairman Jason Brewer gives his insight.

Over the past few weeks, I have covered the bull case for uranium in detail — and also set out the investment case for majority-state-owned Kazatomprom, which is responsible for more than 40% of the world’s primary uranium production.

Now it’s time to start focusing on the small caps. As usual, my favourites are on the London market, with deposits in relatively safe jurisdictions in Africa. This is somewhat of a problem, because unlike lithium, copper, nickel, graphite, and REEs, there are very few decent opportunities that fit this description.

In fact, there’s only one I care to mention. And it’s not even listed yet. But that’s fine, because getting in on the ground floor is where the profit is at.

Regular readers will recall that I covered Marula Mining in early December when the AQSE-listed stock was trading for 2.45p per share. Despite some volatility, the stock is changing hands for 12.5p right now, an increase of over 400% — and further rises could be coming as it progresses towards its much-anticipated AIM IPO.

MARU CEO Jason Brewer is also Chair of Neo Energy Metals, a uranium explorer with a promising South African project — who has kindly answered my many questions to help me write up this piece.

Before I get into the details, I want to be clear — this is not investing advice, and almost all mining small caps are speculative to some degree.

Neo Energy Metals: Henkries project in depth

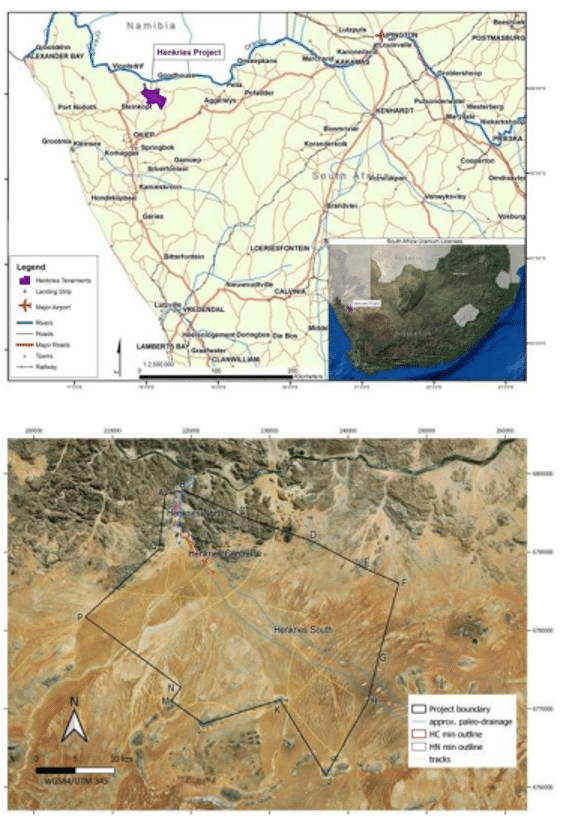

Neo’s key project is the Henkries Project in South Africa — where Anglo American completed a feasibility study in the 1970s. The titan let the project go, even after $30 million of expenditure, including 9,693m of drilling and over 700 holes, largely due to the collapse of uranium prices in 1979.

But Anglo’s loss is Neo’s gain.

The JORC resource is a high-quality 4.7 Mlbs U3O8 at 399 ppm, with Neo owning a 70% economic interest through a holding company structure. The other 30% is owned by Wavecrest Proprietary Capital — an entity owned by Raziya Bongani, who among other senior positions is the director of Petregaz, the largest independent LPG distributor in South Africa.

There are several advantages that Henkries boasts over other potential projects, with Brewer enthusing that ‘the most exciting thing… is the clear pathway to bring this project into production.’

In addition, the Chair notes that Henkries:

- is ‘one of the advanced and near term, low-cost uranium project around that is capable of an accelerated development and production timetable’

- ‘benefits from excellent infrastructure with road, power and water all available at the project site’

- has a ‘key differentiating factor’ in the ‘style of uranium mineralisation where it is hosted in soft, very shallow paleochannel sediments’

- has ‘uranium mineralisation largely at surface and within 8m of surface…at Henkries Central almost 80% of the uranium in a continuous layer 3.6km long and up to 1.1km wide and up to 8m thick’

- boasts ‘the previous Positive Feasibility Study that was completed by Anglo American, and which included mining of 211 pits, bulk metallurgical sampling and operation of a pilot plant that had a throughput of 50kgs dry ore/hr and operated continuously for 3 months’

- has a ‘nature of the mineralisation lends itself towards a very low cost’

An updated feasibility study is currently underway, representing an ‘update of a previous positive feasibility study and the completion of additional shallow drilling aim at a 5-fold increase in resources.’

Henkries Project: next steps

Neo’s investor presentation notes that £2.5 million in equity funding will be needed to bring the project to a production decision.

Brewer thinks there is ‘significant value’ compared to competitors, highlighting that ‘Henkries has a very simple mining method, favourable processing route and high recoveries and low capital and low operating costs – there really isn’t too many projects like this about.’

Interestingly, he argues that many competitors, for example ‘other North American uranium companies,’ have ‘projects with uranium mineralisation interested down at depths of 100s of metres and is much lower grades and requires major capital investment.’

This is a fair point, though it’s probably fair to argue that US or Canadian miners benefit from more stringent regulatory oversight and political stability compared to South Africa.

For perspective, recent problems including Eskom and Cloete Murray’s murder have reintroduced the jitters to investors — though Brewer defends the jurisdiction, noting that while it has ‘challenges…its mining sector is one of the most established and skilled in the world…the regulatory environment… is robust, proven and I believe provides a good base for investment.’

It’s worth noting that the company had originally planned to launch its London listing in 2022, though this has been delayed, most likely to later in 2023. The Chair points out that ‘things rightly take time to get to a company listed… we worked through all the regulatory requirements with the FCA and find ourselves on the cusp of now listing Neo on the Standard List of the London Stock Exchange.’

I’d like to note that this regulatory oversight is why I like my African miners to be listed in London — while the small-cap market sometimes gets a bad rep for regulatory oversight, it is in reality not easy to get listed. Investor protections are fairly strong.

In the longer-term, only 10% of the license has been explored thus far, and Brewer notes that ‘the potential to make new discoveries and significantly increase resources is there and clear to see.’

Henkries South remains the area with ‘the most significant potential to increase overall project resources,’ though ‘immediate resource upside will also come from Henkries North where resources have only been defined on just 3 of the 6 identified zones of uranium mineralisation.’

Leadership team

While Jason is slightly cagey when asked about uranium’s price trajectory — and to be fair nobody has a crystal ball — he thinks like I do: ‘Uranium has not had the massive upward trajectory as we have seen in lithium, or graphite prices… the upward trend is there and with that comes a need to secure a long term and low costs producer.’

As an investor in Marula, I was concerned that he might be stretching himself too thin in his dual roles, though he argues that while he remains the ‘Duracell Bunny’ at MARU (his words not mine), the day-to-day work at Neo is being handled by CEO Sean Heathcote, who is ‘there to project manage this through to production.’

Heathcote and Brewer have known each other since the Stone Age — and the CEO boasts over three decades of experience in the mining and exploration industry across Africa. During his career, Heathcote has completed a whopping 50 feasibility studies — including ‘delivering the Definitive Feasibility Study for the Langer Heinrich Uranium Project in Namibia and the Kayalekera Uranium Project in Malawi as well as the subsequent EPCM contract for Phase 1 of Langer Heinrich.’

These are not small projects.

Closing comments

When it comes to small cap mining stocks, there is always an element of risk. However, uranium explorers are undervalued, the uranium price may be set for a lithium-like rise, and Neo Energy Metals has an exceptional project run by a team of competent people.

When the IPO comes, I’ll be first in the queue.

This article — including all answers provided by Chair Jason Brewer, has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Q&A with Chair Jason Brewer

1. Where do you see the uranium price going after years of underinvestment? Do you agree that nuclear as a share of global power generation will increase over the next decade from its circa 10% now?

Clearly, I’m a uranium bull – I’m a commodity bull and anything related to this green transition and need for more efficient energy generation and storage.

Uranium has not had the massive upward trajectory as we have seen in lithium, or graphite prices and probably in part due to the incredible long lead time for these new uranium power generation facilities to come online, but the upward trend is there and with that comes a need to secure a long term and low costs producer – such as Neo will be at Henkries.

The uranium price and outlook continue to remain positive, and you are a far more qualified person to talk to that. Myself, I just look at securing a quality project that is very quickly able to be part of these discussions and be in a position to contribute through an accelerated production timeline.

2. Are you concerned about corruption in South Africa? Some strides have been made but the situation at Eskom and recent murder of Cloete Murray have worried external investors.

I am very comfortable operating in South Africa and of course like many countries around the world it has its challenges, but to be fair to South Africa, its mining sector is one of the most established and skilled in the world and the opportunities that still exist are one of the key reasons as to why I am keen to operate and expand my own activities in the country.

The regulatory environment for the mining sector and throughout the country for that mind is robust, proven and is I believe provides a good base for investment.

Challenges such as the current Eskom power situation is a challenge of course and actually leads us to seek longer term more sustainable / green power solutions such as solar and clearly, we are well down the path with that.

3. You operate as CEO at Marula Mining as well as Chair at Neo Energy Metals. How do the two roles differ — are you less ‘hands-on’ at Neo? Are you taking on too much at once, given the early stage of both companies?

As Executive Chairman of Neo, clearly, I will be doing all I can to make it a success. I’ve been working with the team at Gathoni Muchai Investments and with our advisors for over 18 months now to get this listed on the London Stock Exchange and that work is not going to slow down.

Marula is very different to Neo; in that I am CEO at Marula and have a very growing team around me and also have the support now of our new major shareholder in Q Global Commodities. At Marula I am very much that “Duracell Bunny” and certainly not looking to slow down anytime soon.

At Neo we are where Marula was several months ago, however I get the benefit of working with a very capable CEO that I’ve appointed and who will be focused on updating the previous Anglo Feasibility Study and getting all the technical aspects addressed as part of his day to day role – essentially Sean is there to project manage this through to production and I’m there to support him in my executive chairman role and provide more of the corporate level and support and market interaction to allow him to rally focus on getting this to a very quick mien decision.

I think we are a very good combination, and it will really allow each of us to focus on our respective strengths at Neo and importantly allow me to maintain my focus on Marula.

4. What makes the Henkries Project so exciting? The JORC resource is 4.7 Mlbs U3O8 at 399 ppm — how does this compare to similar projects elsewhere? Do you know when an updated feasibility study may be completed?

The most exciting thing I find about the Henkries Project is the clear pathway to bring this project into production. It has all the attributes of being a very significant project and has benefited from some first-class work by Anglo including the feasibility study.

The presentation really does set out some of the key points which includes:

– it’s one of the advanced and near term, low-cost uranium project around that is capable of an accelerated development and production timetable

– it also benefits from excellent infrastructure with road, power and water all available at the project site

– there has been over US$30m of historical exploration, drilling, test-pitting and mining, metallurgical test work and pilot plant work and feasibility study completed by Anglo American, Niger Uranium and Namakwa Uranium

A key differentiating factor is the style of uranium mineralisation where it is hosted in soft, very shallow paleochannel sediments – this is not the hard rock uranium projects located next door in Namibia for example.

The uranium channel extends for 37km on the license area and two deposits, Henkries Central and Henkries North have been defined along just a 12km section of the paleochannel.

The uranium mineralisation is largely at surface and within 8m of surface, the at Henkries Central almost 80% of the uranium in a continuous layer 3.6km long and up to 1.1km wide and up to 8 m thick.

One of the other exciting things about Henkries is the work that went into the previous Positive Feasibility Study that was completed by Anglo American, and which included mining of 211 pits, bulk metallurgical sampling and operation of a pilot plant that had a throughput of 50kgs dry ore/hr and operated continuously for 3 months.

The nature of the mineralisation lends itself towards a very low cost.

In addition, the high-grade areas also make this a great project ▪ 4.1m at 668ppm U3O8 ▪ 3.3m at 827ppm U3O8 ▪ 2.4m at 1,703ppm U3O8 ▪ 2.0m at 2,131ppm U3O8 ▪ 4.0m at 1,033ppm U3O8 ▪ 2.4m at 1,703ppm U3O8 ▪ 4.0m at 1,265ppm U3O8 ▪ 2.1m at 1,071ppm U3O8

5. Neo owns 70% of Henkries — who owns the other 30%?

Neo will hold the 70% interest in the Henkries Project through the acquisition of two intermediary holding companies, namely Mayflower Energy Metals Limited (“MEML”) and Neo Uranium Africa Proprietary Limited (“NURSA”). MEML owns 100% of the share capital of NURSA, and NURSA will hold the shares in Desert Star Trading 130 Proprietary Limited (“Desert Star”), a company registered in the Republic of South Africa with Registration Number 200501474307 and the legal and beneficial owner of a uranium prospecting right NC30/5/1/1/2/11918 in the Northern Cape of the Republic of South Africa commonly known as the Henkries Uranium Project (“Henkries”)

The 30% shareholder in Desert Star is Wavecrest Proprietary Capital Limited (“Wavecrest”), a company registered in the Republic of South Africa and who hold their interest in accordance with South Africa’s Broad Based Black Economic Empowerment legislation.

Wavecrest is a company owned by Mr Raziya Bongani, He is currently the director of Petregaz, a liquefied petroleum gas (LPG) aggregator, and the largest independent LPG distributor in South Africa. Additionally, he maintains senior operational roles at a number of other natural resource companies.

Mr Raziya founded Rwenzori Rare Metals, a rare earth mine based in Uganda. The company established and is continuing to actively develop a significant ion absorption clay deposit at Makuutu, Uganda, which is currently thought to rank amongst the largest ionic clay deposits (key sources of highly prized magnetic, heavy rare earths) outside China.

Rwenzori Rare Metals is majority owned by Ionic Rare Earths Limited, which is listed on the Australian Stock Exchange (ASX). Finally, Mr Raziya also founded the largest independent shareholder of Burgan Cape terminals, a refined petroleum product storage facility situated in the port of Cape Town.

Mr Raziya is active in Broad- Based Black Economic Empowerment (B-BBEE) concerns, and acts as an adviser on B-BBEE compliance to a number of companies involved in natural resource extraction.(B-BBEE) requirements are the company’s

6. Anglo American, Niger Uranium and Namakwa Uranium together completed circa $30 million of work at the site, and Anglo even completed a feasibility study. Why would this titan let a promising project go — was it just weak uranium prices in the late 1970s?

The Anglo American work was really quite special and as you would expect done to a very thorough level and with a significant amount of capita spent on it. It was based on 9,693m of drilling and over 700 holes and of course the test-pitting and mining, metallurgical test work and pilot plant work.

Anglo’s decision to pull back from the project was largely driven by the major fall in the uranium price in 1979.

7. I note that the CEO is Sean Heathcote, who among many achievements was an operations manager at Anglo American in Johannesburg for over two years in the 1990s. Has he had any previous contact with this project in this former role?

I’ve known Sean since we were playing rugby at the Royal School of Mines together and I guess I’ve always been looking for an opportunity to work with him. I’ve followed closely what he’s been doing over the years and also bumped into him when I was in South Africa and when he was working with a number of the major mine and project development companies.

Sean’s has over 31 years’ experience in the mining and exploration industry and importantly all in Africa across a broad range of commodities including uranium. You’re right in that he held operations management positions Anglo American and he was also at at BHP Billiton too. His 16 years of executive management and directorships experience in the project development companies of Fluor, Murray & Roberts Engineering Solutions, GRD Minproc and Sedgman in over 30 countries in Africa though is why I believe he will be a such a great asset for Neo.

During this time, he participated in the development of over 100 mineral projects, including completing 50 Feasibility Studies. Whilst at GRD Minproc he played a leading role in securing and delivering the Definitive Feasibility Study for the Langer Heinrich Uranium Project in Namibia and the Kayalekera Uranium Project in Malawi as well as the subsequent EPCM contract for Phase 1 of Langer Heinrich.

8. Your presentation on the site notes that £2.5 million in equity funding will be needed to bring the project just to a production decision. Do you think the risk-reward trade-off is favourable compared to other listings — say on the ASX or TSE?

I think when investors look at the advantages that Henkries has over other earlier stage and pre-production projects they will see significant value in the company.

These include amongst other things:

– the high-grade uranium mineralisation at Henkries relative to other established and operating open-pit uranium deposits

– the uranium mineralisation is at surface and mostly within 8m of the surface

– the deposit has good continuity with mineralisation at Henkries Central a continuous sheet 3.6km long and up to 1.1km wide

– at its thickest the mineralisation is 7-8 m thick but typically 2-3m thick

– the uranium mineralised material is visually very distinctive and is contained with 3 main ore types: green sand, carbonaceous clay and diatomaceous earth

With all the mineralisation at exceptionally shallow depths, and being soft and free-dig material, and with the pilot scale test-work achieving 85% recovery, Henkries has a very simple mining method, favourable processing route and high recoveries and low capital and low operating costs – there really isn’t too many projects like this about.

So when it comes to comparison to other North American uranium companies which have projects with uranium mineralisation interested down at depths of 100s of metres and is much lower grades and requires major capital investment and incurs significant mining and processing routes determined, then I do believe that Henkries is we’ll placed compared to its peers.

The costs to get this through to a decision to mine are relatively low and will be secured upfront thus reducing any further major dilution.

IOr is essentially an update of a previous positive feasibility study and the completion of additional shallow drilling aim at a 5-fold increase in resources.

9. Only 10% of the license has been explored. How prospective is the remaining 90% in your view? An educated guess?

The exploration upside at Henkries is substantial and as you’ve pointed out the existing Henkries Central and Henkries North deposits occupy less than 10% of the prospective area.

The potential to make new discoveries and significantly increase resources is there and clear to see.

The granted Prospecting Right in place over the Henkries Uranium Project extending over a total area of 743km2 and probably the main exploration upside is at Henkries South, which extends over 25km of the total 37km of the paleochannel which hosts the uranium throughout the license area.

Henkries South is to the southeast on the on rights area and there is clear indications from previous survey work of the potential that exists there and we will clearly be focusing on this as part of the post listing exploration activities and we are firmly of the opinion that this has the most significant potential to increase overall project resources.

Immediate resource upside will also come from Henkries North where resources have only been defined on just 3 of the 6 identified zones of uranium mineralisation and where Exploration Targets have been set out for the other 3 zones.

Additional drilling and assays of a substantial number of existing unsampled drillholes will also assist in further resource increase and upgrade. Another major opportunity is from deeper drilling – most drilling less than 20m in depth and there has already been a deeper zone of uranium from a deeper (25-35m) layer that was intersected in some holes and where most holes stopped short of this zone.

10. You originally planned to launch your London listing in Q4 2022? Why the delay — is MARU’s upcoming AIM listing the current priority?

The listing of Neo on the LSE was originally scheduled for much earlier in 2022, however there is no doubt that things rightly take time to get to a company listed and especially when you embark on a reverse takeover as well.

There was a considerable amount of work to do in terms of tidying up Stranger Holdings balance sheet and working with its creditors, however we have worked through this and we worked through all the regulatory requirements with the FCA and find ourselves on the cusp of now listing Neo on the Standard List of the London Stock Exchange, and that was a key part of the strategy to get that listing – the pedigree of that listing and being London’s only real uranium mine developer is something I believe will be a major attraction and benefit for the company.

Excellent article Charles, great deal and very clearly written. Gives me confidence to take a position in NEO when the opportunity arises. It will be interesting to follow the equity raise journey to a hopefully successful conclusion.