Mkango Resources has multiple attractive qualities, but its flagship Songwe Hill Rare Earths Project in Malawi is the near-term catalyst to watch.

As the world moves towards electrification, there is going to be a critical minerals shortage. This is an inescapable fact that I, and many, many others, have covered in depth over the past few years.

A second inescapable fact is that many of the largest heritage mining sites are running dry. There is huge consolidation in the mining sector underway, and this is being catalysed by the mining supercycle —despite widespread fears of a global recession, commodity prices remain elevated compared to historical norms.

And a third inescapable fact — and apologies if this is getting repetitive — is that much of the global supply of critical minerals is being controlled and shepherded towards China. The west does seem to be waking up to this, and there will likely soon be a struggle to control the remaining critical minerals deposits. Talented individuals with the gift of foresight who have set up companies and then bought out the rights to these globally significant deposits will soon have a choice of buyers, and those smart enough to back those companies — *cough* — will also benefit.

Of course, the lithium and copper gaps are already well-known. Graphite prices could well be next to shoot up, and I have covered some of the best small cap prospects for these three minerals both here and elsewhere — MARU, BRES, GROC, TGR, PREM, KOD et al are all long term holds.

But there is a gap in my portfolio for an equally important company, Mkango Resources (LON: MKA), which focuses predominantly on rare earth elements.

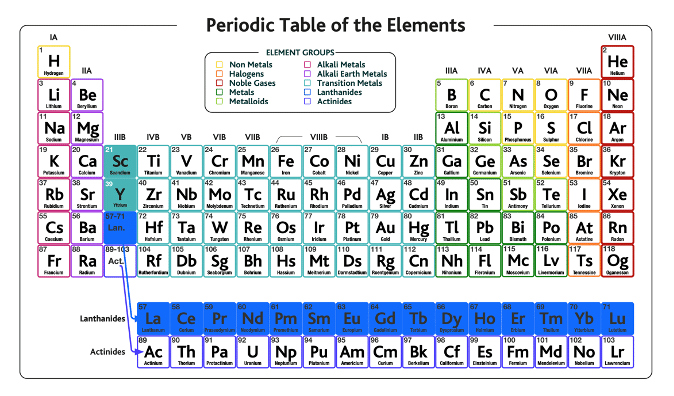

What are rare earth elements?

If you don’t know what lithium, copper, or graphite is, there is no hope for you. However, rare earth elements are mildly esoteric, and it is not unreasonable to provide a brief summary. And while not advice, investors may wish to read up on the minerals in depth before making any investing decisions.

Rare earth elements, often shortened to REEs, rare earths or even just ‘rares,’ are a group of 17 virtually indistinguishable silvery white soft heavy metals. Like lithium, they aren’t actually particularly rare, but their geochemical properties mean they are rarely found in a concentrated-enough deposit to make them economically feasible to mine.

As usual, China is ahead of the curve, having flooded the global market with low price rare earths during the 1980s, forcing many non-Chinese companies invested in the sector either out of business, or to cut their losses by diversifying away. With demand set to reach 315,000 tons by 2030, the country has a dominant hold on the market — a depressingly familiar tale — with an estimated 60% of global production and 85% of global processing capacity.

Rare Earths are used in across a vast array of industrial applications, including electronics, batteries, lasers, ceramics, catalysts, clean energy, automotives, defence, and aerospace. Their most important function, accounting for circa a third of all rare earths mined globally, is in the manufacture of permanent magnets.

These magnets, in various forms, are used in over 90% of EVs — including permanent magnet traction motors alongside micromotors, sensors, and speakers. Mkango cites Adamas Intelligence research that the rise in EV sales will ‘fuel a 275% increase in demand for rare earths used in passenger EV traction motors between 2019 and 2025, and a further 124% increase in demand between 2025 and 2030.’

Indeed, demand may already be exceeding supply with historically accumulated inventories now depleting fast.

For reference, falling supply amid rising demand is economics 101.

Mkango Resources: solid portfolio addition

Mkango Resources (LON: MKA) shares struck a record 37.5p in mid-November 2021, but have since fallen to just 13p. Most recently on 13 February, the company issued a share placement, raising £3.5 million from 28 million new shares at a discount 12.5p each.

CEO William Dawes argues that he was ‘very pleased to welcome new institutional and private investors to the shareholder base…this positions the Company for some major upcoming milestones…to capitalise on its early mover advantage in rare earth magnet recycling with potential for near term production.’

In addition, MKA has signed definitive agreements with ESG-focused CoTec Holdings, whereby CoTec has invested £2 million into Mkango. The parties have entered into a convertible loan agreement providing for a two-year, £2 million secured convertible loan with 5% interest, convertible into Mkango shares at 27p each. And these agreements will form the basis of US-based opportunities in the rare earths technology space.

Mkango also has various exploratory projects and is putting prep work into a rare earth separation plant in Poland together with partner Pulawy. There’s also its 42% (option to increase to 48%) shareholding in rare earth magnet recycler HyProMag, which is preparing to establish recycling facilities at Tyseley Energy Park in Birmingham. It’s also planning to build a 100tpa rare earth magnet recycling facility in Germany, slated to start production in 2024.

As a caveat, there is far more detail to Mkango’s ambitions and technical terms with partners than is possible to cover here. But while these potential developments could add serious value over the longer term, I am currently intrigued by a potential short-term catalyst.

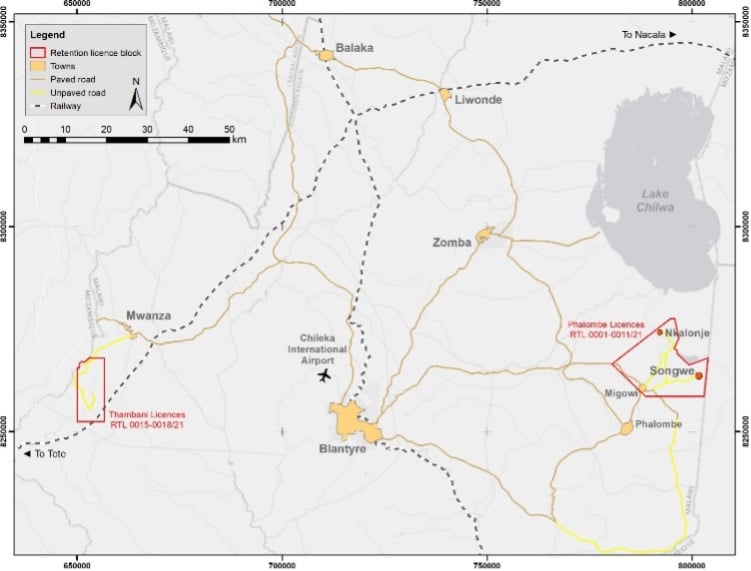

Catalyst to watch

That’s the flagship Songwe Hill Rare Earths Project in Malawi, which for the sake of brevity is a world-class deposit. The project’s definitive feasibility study estimated a post-tax net present value (NPV) of $559 million, with post-tax life-of-operations nominal cash flow of $2.1 billion, and with upfront capex costs of $311 million. As the study was published in July 2022, it’s reasonable to assume that these capex costs may have risen with inflation.

Songwe has already received approval of its Environment, Social and Health Impact Assessment (ESHIA) last month, and recently announced it is ‘continuing to advance discussions with potential lenders and strategic investors.’

Importantly, MKA noted that it has an ‘initial focus on stand-alone development of Songwe to produce a mixed rare earth carbonate – next milestone is MDA (mine development agreement) approval, which is a key step towards project financing and development.’ Assuming the MDA were to be approved, the last formality would then be applying for a mining licence to begin production.

Here’s the rub. Mkango has a market cap well under £40 million. It simply does not have the cash to develop this asset, even assuming the $311 million capex costs have remained static. And it can’t raise this kind of money without enraging current shareholders.

This is a similar story playing out all over Africa. Small cap western companies have secured quality deposits, but do not have access to the cash to develop them — and upon receiving a mining licence, simply wait for partner offers to come out of the woodworks.

For MKA, when the mining licence is granted one of two things could happen. Either a strategic investor — most likely Chinese — will come on board, which would see the company able to access a large portion of the $559 million NPV.

Or Songwe will be sold entirely, with the proceeds to be fed into MKA’s opportunities across its exploratory projects, and rare earths plants in the UK, Germany, Poland, and the US.

And then the share price goes up.

At least, that’s the theory.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.