Made Tech shares could be a promising long term buy for position investors with a basic understanding of the numbers.

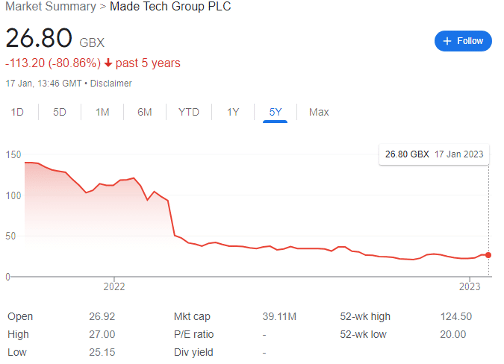

Made Tech (LON: MTEC) has not exactly put forth a stellar performance since launching its IPO in September 2021, falling from 122p at launch to just 27p today.

To be fair to the FTSE AIM tech stock, this share price nosedive has partially been due to unlucky timing; tech stocks rely on ultraloose monetary policy to achieve rapid growth, and interest rates started rising weeks after launch. Like many of my favourite FTSE AIM stocks, its prospects are diminished by external events rather than its own failures.

And now may be time to take a speculative position.

MTEC shares: investment case for 2023

Made Tech operates within the digital, data and tech space, exclusively focused on providing services to the UK public sector. With 478 employees on the books, the company plans to be central to the country’s digital transformation, with a fast-expanding client base including the DVLA, HMRC, and MoJ.

Indeed, half of the six highest spending government departments are now in its client books, and this could make onboarding the rest only a matter of time.

In FY22 results, reported in September, the company saw organic revenue growth increase by a whopping 100%, with CAGR increasing to 97% across the past four years.

Revenue came in at £29.3 million, and for context, the company currently sports a sub-£40 million market cap.

With the IPO raising £15 million, the company won 12 new clients in the financial year, including its largest ever contract with NHS Digital worth £19 million over two years. FY23 has begun with £13.3 million of new contracts secured and an annualised run rate of £40 million as of August 2022.

CEO Rory MacDonald argues that FY22 was ‘a landmark year in the history of Made Tech and I am hugely proud of everything that the business has achieved. We have made strong operational and strategic progress…the digital transformation market is substantial and growing and Made Tech is well positioned to capitalise on the opportunity.’

Key contracts

Three key contracts make Made Tech shares potentially undervalued.

The first was signed in February 2022; a two-year £37.5 million NHS Digital contract to be delivered jointly between the company and consortium partner Answer Digital. MTEC expects to receive half the contract value in revenue, worth £18.75 million. MacDonald notes that this was ‘our first major contract within Health & Social Care…we look forward to delivering this contract and to growing our services to this key Health and Social Care market.’

The second was signed in July 2022, where MTEC announced a Met Office contract worth £7 million over a two-year period, to act as the department’s Digital Services Partner. It’s currently actively working on ‘problem-solving digital, data and technology solutions, which enhance and expand the organisation’s consumer-facing digital services offering.’

Chris Frost, Head of Digital Services at the Met Office, enthuses that he is ‘delighted to be working with Made Tech. The team’s expertise and capabilities shone through in their proposal, aligning with the Met Office’s vision for delivering exceptional digital services for our citizens.’

The third, which came after full-year results were announced and is therefore in addition to the previous good news, came in November. After formerly winning a one-year contract with the Home Office in May 2021 worth a total of £6 million, Made Tech has now been awarded a new contract worth £10 million with a six-month extension option worth a further £2 million. The CEO believes that the renewal demonstrates the Home Office’s ‘confidence in our ability to deliver digital technology and our growing reputation within the market.’

It’s worth bearing in mind that the NHS, Met Office, and Home Office are three clients where security and privacy are absolutely paramount; confidence at this level of government means further growth is almost inevitable. As digitisation accelerates, Made Tech will be on an approved supplier list — whether official or not.

And for long-term investors, the annualised revenue run rate is equivalent to its market cap. It’s hard to see how this isn’t an excellent buy. The only question is when to buy in; shares could be picked up for 21p at the start of the year, and it may be worth waiting for a retrace closer to this level.

Of course, this could mean missing the re-rate when the next big contract comes through. And it does create another RNS to watch out for on my ever-increasing FTSE AIM watchlist.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.