‘New tech’ shares can take time to deliver shareholder returns. But for LifeSafe, 2024 may be the catalytic year. Here’s why.

LifeSafe (LON: LIFS) shares have not had an enjoyable 2023.

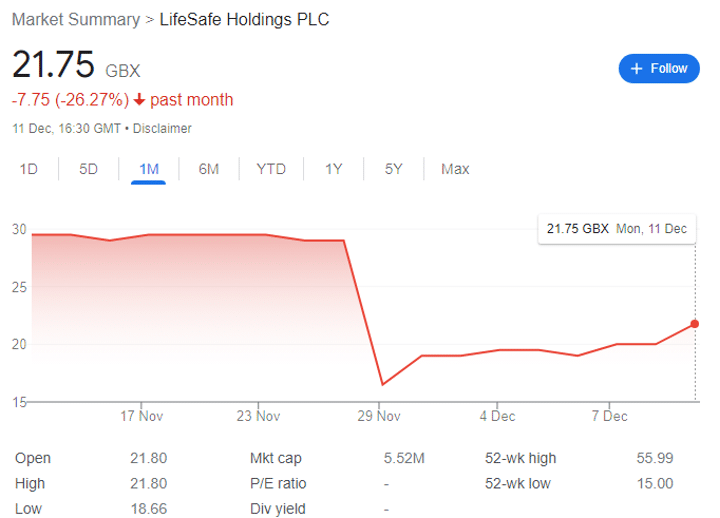

In fact, the ‘new tech’ stock launched its IPO in July 2022 and has since fallen to just 21.75p per share. Even this price point represents a recovery from the drop of late November, which saw the FTSE AIM company touch just 16.5p.

Now sporting a circa £5.5 million market capitalisation, the question for would-be investors is one of long-term investing strategy: where goes LifeSafe in 2024? And is it time to buy the dip?

Let’s dive in.

The ‘new tech’ portfolio

The regular readership here is now fairly established, so most will be aware that I hold (among various ventures) a portfolio of ‘new tech’ shares — companies with a wide protective moat composed of patented/patent pending products/services/treatments with a single trailblazing invention that solves a longstanding problem.

Within the portfolio in 2023, we have (year-to-date):

- Ondo InsurTech: +246%

- OptiBiotix: +90%

- Cizzle: +55%

- Abingdon Health: +28%

- Avacta: +11%

- Tekcapital: -58%

On Avacta and Cizzle, I sometimes categorise these as ‘new tech’ shares rather than life sciences stocks (compared to, for example, hVIVO), as the lung test and AVA6000 are essentially gamechangers in their individual spaces. On that note, Avacta’s P1A data is likely out this week – so keep a weather eye on the horizon.

TEK has been a bit of a Debbie Downer within the portfolio, but much of this disappointment is down to the weak IPO environment — when portfolio company MicroSalt launches (hopefully in 2024), the re-rate will begin. From a balance sheet perspective, the stock is already undervalued.

But when you’re chasing Ondo levels of return, you need to accept that one or two will perform poorly. C’est la vie. All you can do is sell, hold or buy more — and I’m holding. For context, have a gander at some of those shares and see what one day of trading can do.

I looked at LifeSafe earlier this year and took out a small speculative position, which is down so far. But I’m considering averaging down significantly to add it to this main portfolio basket — alongside new positions in Acuity RM and BSF Enterprises. Here’s why:

LifeSafe: the updated investment case

I’d recommend reading this initial article from late September. In fact, it’s required reading because I am not going to spend time re-covering the basics. The key point to understand is that the company has materially developed over the past few weeks, though there are some shareholder concerns to address.

For context, the trading update on 29 November shook the nerves of the LIFS investor base. As is standard in AIM, most only read the ‘bad’ news without taking into account the good bits.

For the 11 month period to that date (i.e. CY23 to date), LIFS generated ‘considerable sales growth’ in consumer channels with revenue up by a whopping 62% to £5.4 million. Of course, there is one more month to go, but December has historically been very good for the company.

LIFS described the growth as ‘extraordinary,’ and ‘achieved almost exclusively through the Group’s digital consumer channels in the UK and US,’ but there is a downside to consider. The growth is being impacted by increases in the cost of digital advertising — read Amazon advertising costs, those sponsored spots don’t come cheap — and together with increased expenses as a result of scaling, the company has spent ‘significantly more over recent months’ than previously anticipated.

The upshot is that even though revenue has scaled successfully, the company will now no longer be monthly EBITDA profitable in Q4 2023 — with full FY23 LBITDA expected to be in the range of £1.3 million to £1.5 million — with revenue up to between £5.7 million and £5.9 million.

It’s worth noting that LIFS also mentioned revenue constriction through an unexpected underperformance of a small digital marketing partner in the US compared to in 2022. This is interesting because while failing to turn profitable is a blow, revenue will not need to grow much further to become profitable.

Let’s consider: the company generated £670,000 of revenue in FY21, the lion’s share in the second half of the year. It made £4 million of revenue in FY22. And now in FY23, it’s seen revenue rise to a likely £5.8 million (with a little wiggle room).

The company operated on a 46.6% margin in 2021, which improved to 57% in 2022. Assuming continued margin growth (which has now been impacted by increased advertising costs), each Stay Safe consumer product sold is still hugely profitable — and getting to a monthly EBITDA profitable position is likely only delayed by a few months.

For perspective, the business is actively increasing even the more margin-friendly wholesale and industrial sales — which increase the revenue bottom line with substantially lower marketing/logistics costs that have been the headache in H2.

Of course, LifeSafe has implemented a cost reduction programme with a focus on ‘overheads and supply chain costs,’ but it’s also making changes to the marketing strategy.

This likely means spending less on Amazon marketing to focus on the more profitable wholesale/industrial business — but no fear, because the Stay Safe All-in-1 extinguisher will remain the most reviewed product on the site, with 2,744 reviews marking it with 4.6 stars.

It should retain the Bestseller tag regardless due to previous sales — and while there are a couple of shoddy knockoffs, when it comes to fire safety, consumers pay a premium.

Strategic Pivot

Chairman Domnic Berger advised at the time that ‘the diversification and development of new fluid variants aimed at the higher margin industrial and wholesale sectors is ahead of plan, notably in the fight against the threat of fire events with lithium-ion batteries, and in our partnerships with Wormald and QBE.’

This focus on lithium-ion batteries (I have a soft spot for lithium as you might know) is interesting as the market opportunity is essentially unlimited — and one of the key problems for the rEVolution is increased insurance costs due to battery degrading/fires. LifeSafe may have the solution, and it’s for this reason it can be included in the ‘new tech’ portfolio.

On 7 December, it launched an ‘innovative new fluid proven to prevent thermal runaway fires in high voltage battery packs.’

Christened the ‘Pre-Trauma Fluid’ (wouldn’t be my first choice, but hey-ho), it’s described as a ‘unique, non-conductive coolant fluid designed specifically to prevent thermal runaway in battery packs which can be caused by overheating, overcharging or damage.’ The solution prevents thermal runaway by reducing heat transfer in a battery pack, is completely non-toxic, and most importantly non-corrosive which marks a huge step forward.

In layman’s terms, it will stop EV fires while causing minimal damage. Interestingly, one of the key problems with early nickel-based EV batteries was the overheating problem, and this fluid may form part of the long-sought solution to make nickel-based short-range EVs more sustainable.

One risk factor — the fluid is patent pending, and while the company has had no issue getting patents thus far, patent pending and patented are not the same thing.

The fluid has been in development for 12 months in conjunction with ‘several interested parties’ including Xerotech and Reacton, but the company specifically mentioned that the fluid can either be built into a battery unit or ‘delivered by a fixed suppression system.’ In all likelihood, LIFS is therefore also working with a major auto brand to install a prototype system — and any announcement tying the company to one of the auto majors will see a share price explosion.

If you’re worried about client crossover, don’t be. Xerotech — while chasing unicorn status — is focused on, in the words of CEO and founder Barry Flannery, battery tech ‘kind of like Tesla, except it’s aimed at everything except automotive.’ These low volume, high diversity non-auto sectors include defence, rail, energy and heavy machinery sectors, which are also in need of a working suppressant.

But the key point is that the partnership agreement will ‘support the development and application methods for the deployment of LifeSafe’s PTF and Thermal Runaway Fluid to tackle battery overheating and support the cooling systems.’ Xerotech Engineering Head Tony McDonald is ‘incredibly pleased’ to have the opportunity to use the ‘unique fluids.’

The second partnership with Reacton allows the partner — which specialises in manufacturing automatic fire suppression systems — to sell the PTF and TRF as part of its global fire safety solutions. Global Certification Director Ed Chivers is also ‘delighted’ to make the fluids an ‘integral part’ of its fire safety systems worldwide.

If that’s not enough for you — on 11 December, LIFS announced the launch of another (again, patent pending) fluid, termed Wildfire Pro. Unsurprisingly, this fluid is designed to tackle wildfires, and is also non-toxic and fluorine free — a huge upgrade on current solutions as this means it poses no threat either to wildlife or to general ecosystems.

While the fluid can put out fires and keep them out (like all the range) the true value is in its potential as a pre-treatment; you can spray the fluid onto land to create a barrier that a wildfire cannot penetrate. At present, the standard strategy is often creating a fire line, by pre-emptively burning a break in vegetation to stop a fire from spreading.

This is obviously not ideal.

Wildfire is a global problem costing billions in damage — just ask Greece or California. Berger enthuses that ‘the launch of the new fluid will open up new partnership and geographic markets for the Group.’ Presumably these will be forthcoming in the new year.

Add in the worldwide legislative changes that will see many of the most popular fire extinguisher fluids banned from 2025 onwards due to their toxicity or fluorine content — including Aqueous Film Forming Foam — and you can see the investment case.

Consumer sales are rising at 62%, and industrial applications and partnerships are increasing quickly. The market seems to have missed the significance of its partnership with multi-billion-dollar market titan Wormald, in Australia and New Zealand (read the last piece). And LIFS is still on QBE Insurance Group’s Solutions Panel, as a best-in-class supplier of choice to their global client network.

At wholesale, there’s an entire insurance industry to tackle, with the Stay Safe flagship already in Screwfix shops countrywide.

The only issue is short-term financing before turning profitable during the next calendar year — alongside a tepid market, struggling with inflation, that is only just now experiencing green shoots. For context, I had previously surmised that a placing would be unlikely at the former margins/growth, but increased costs merited a £1.2 million placing in late August.

It’s unclear whether an additional fundraise will be needed given the numbers, but a small placing in the new year can’t be ruled out. On the other hand, there is the potential for current partners to consider supporting the company. And in any event, the share price slide continues to represent excellent value given the strategic progress and near-term movement from loss to profit.

As a final note, many of my favourite ‘new tech’ stocks take months/years for the market to recognise the opportunity.

This catalytic moment will come for LifeSafe too.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.